Embark on the journey of Armando, a lettuce producer, as he navigates the world of agriculture with FACES by his side. Witness how their support has helped him overcome obstacles and achieve success in his rural entrepreneurship endavors.

Embark on the journey of Armando, a lettuce producer, as he navigates the world of agriculture with FACES by his side. Witness how their support has helped him overcome obstacles and achieve success in his rural entrepreneurship endavors.

In the dynamic economic landscape of Azerbaijan, the story of ART RIGHT LLC stands out as a testament to AccessBank’s commitment to fostering entrepreneurship. Gurbanov Tariyel, the founder of ART RIGHT LLC, embarked on his journey with AccessBank on September 14, 2017. At that time, Tariyel was involved in food sales with his father, and started with a modest business capital of AZN 15,000.

Abishov Razim Husan, a valued customer of AccessBank CJSC’s Barda branch, resides in Gapanli village, Tartar region, where he manages a family-run animal breeding business with his three sons. Facing challenges in obtaining funding from other banks due to the front-line location of his village, Abishov turned to AccessBank in 2011 for support in expanding his household.

#Movingmoneytomeaning

We are pleased to announce that we provided a loan to Golomt Bank in Mongolia an exciting and innovative business focused bank.

We are excited to be working with FINANCIERA EL COMERCIO from Paraguay and Moving Money to Meaning together.

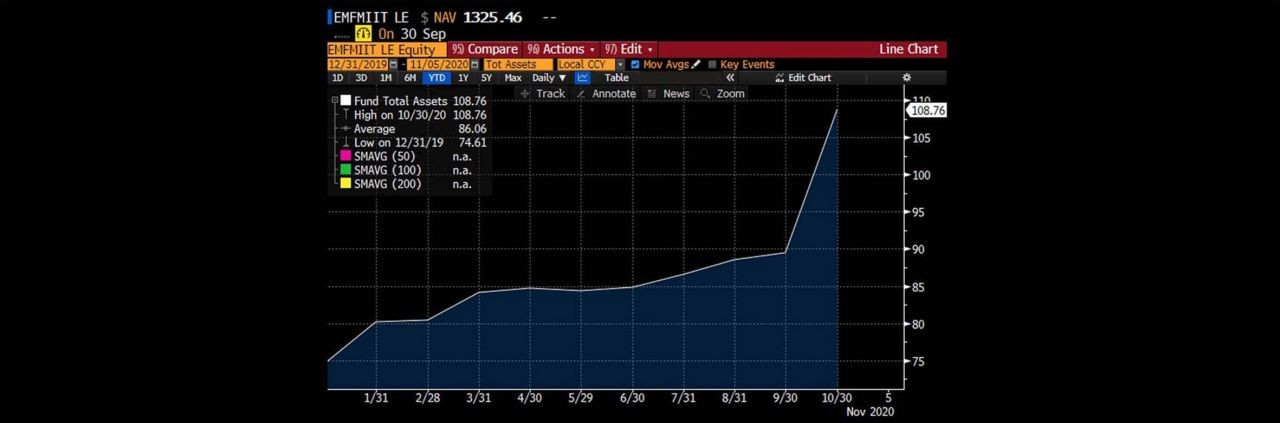

Yes we can, and we DID! Despite the global pandemic, Enabling Qapital has been able to grow the EMF Microfinance Fund assets under management above USD 100mm.

Das Zürcher Mikrofinanz-Startup Enabling Qapital erhält Geld von führenden Organisationen für einen Fonds, der bessere Lebensumstände in Afrika und CO2-Reduktionen erwirken soll.

We are very pleased to announce the African Development Bank Group’s and European Commission’s commitments of catalytic first-loss capital into SPARK+ Africa, a first-of-its-kind impact fund investing debt and equity in companies throughout the clean cooking value chain across Sub-Saharan Africa (SSA).

Almost 30 years ago, María Cristina Estrada established her business with a tiny venue located at a small marketplace in Nicaragua. Starting with 6 pineapples, 6 melons, 50 bananas and 6 watermelons she dreamed of someday growing her business into a large store. In order to do so, she acquired loans from Financiera FAMA, a microfinance institution that had operations near her business. Maria was able to establish a good credit history with FAMA. She was repaying the loans on time, which made for a very successful long-term relationship between the two.

Enabled by her first loan through ASA PAKISTAN, Mehwish Muhammad Ashraf started a small business with the purchase of a sewing machine in 2016.

OUR PARTNER-MFI SUMAC

In 2020 Enabling Qapital provided USD 1.5mn to Sumac, a microfinance bank based in Kenya. The bank specializes in providing finance to both individuals and companies in the MSME segment by offering a variety of financial services. They have a large clientele within the agribusiness sector, who can profit from the Kilimo Biashara (agribusiness) loans. Through those, Sumac can disburse loans of up to ~USD 3,000 within 48 hours. Sumac also offers customers the Kawi loan product, targeting the provision of clean energy solutions to its customers.

MRS LUCIA RICO SUCCESS STORY

Growing up with her two siblings in the town of Trento in the rural province of Agusan del Sur in the south of the Philippines, Mrs. Lucia always dreamt of running her own business. She started her business with a tiny stall to sell her handmade baskets and figures made from rattan palms. After struggling with bankruptcy in 2015, she moved her business and began to look for capital. This was only the start of a long and hard journey for this microentrepreneur to fulfill her dreams and be independent.

The company Freshpro, which was established in 2016 initially delivered fresh products from different localities to urban areas in Nairobi. In 2018, they transitioned to dairy processing by setting up a bigger facility in Githunguri (Kiambu County, Kenya). The company began operations in 2019 and expanded its presence shortly afterwards to four cities: Keringet, Chogoria, Embu and Njoro.

Muhammad Saleh is the owner of a small staple food store in Karachi, Pakistan. A few years ago he was introduced to the possibilities of expanding his business through a visit from a Loan Officer of the Microfinance Institution (MFI) ASA Pakistan.

Today we want to share the inspiring story from Maryam, one of the many impressive MicroEntrepreneurs in Pakistan.

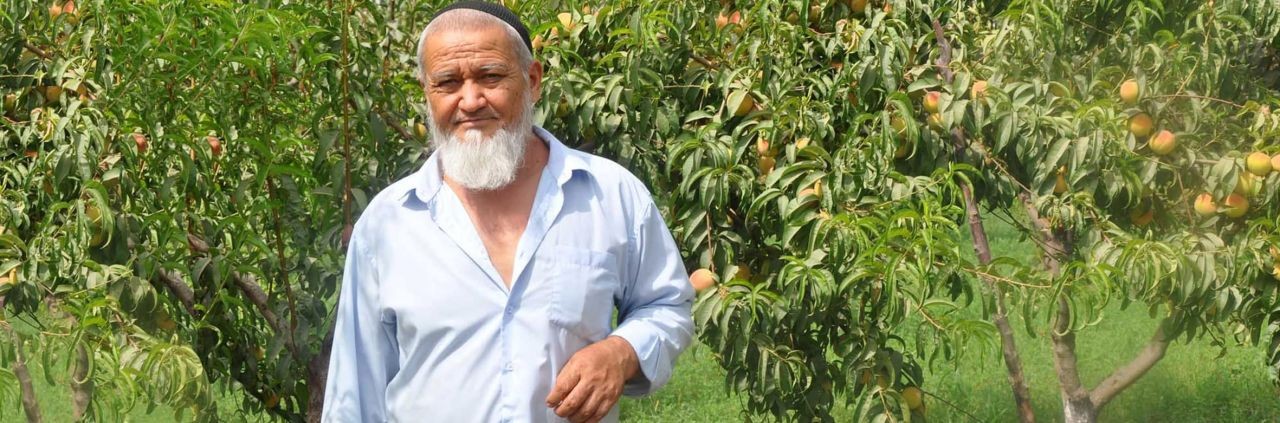

Rustam Buriev started his farming business many years ago.

In 2013 he applied for his first loan at Finca Tajikistan, with the purpose to help finance the expansion of his garden.

The enlargement was much needed for him to be able to grow more fruits, rice and wheat.

Subsequently he managed to grow his business and payback the loan amount.

Rustam decided to apply for a second loan and even a third one, which enabled him to also purchase livestock and thereby grow his farm further.

Spark+ has made its first investment in BURN to Accelerate its Multi-Country Expansion across Africa.

Current fertilizer shortage and rising energy prices: How small farmers produce renewable energy and organic fertilizer

Imagine a world in which women had the same access to financial services as men. Financial services are a critical part of economic development and can have a huge impact on the lives of women and their families. Yet far too many women around the world are shut out of the financial system.

Gopal is an Indian businessman who specializes in the art of weaving, a skill that he learned from his late father. His life changed when his friend referred him to one of the MFI’s in our EMF Microfinance fund in India. Watch the video below to get a first-hand account of his experience since borrowing the loan, as well as his plans for the future.

Introduction :The Middle East (ME) and North Africa are among the regions with the lowest microfinance presence worldwide. Additionally, women and those living in rural communities are disproportionately affected by financial exclusion.

Monitoring the outcomes of our investments is essential to ensure that we are achieving our social mission and goals and can measure our impact. At the portfolio level, we carefully select financial institutions by integrating the assessment of environmental, social, and governance (ESG) risks in the investment decision-making process. However, we also recognize the importance of assessing whether our investees contribute to generating positive change in the lives of their clients and households.

The East of Georgia is strongly involved in agriculture, thanks to its nutrient-rich soil. Additionally, agricultural practices are often deeply intervened with family history. This is also the case for Nino. Thirty years ago, his father decided to purchase land and start a family business in the agro-business.

In the ever-evolving finance landscape, our commitment to “Moving Money to Meaning” propels us to invest strategically, to drive impact on both financial and social fronts. Acknowledging the significance of ensuring gender equity, we are applying a gender lens to our internal processes and investments, taking steps to foster a more inclusive global financial ecosystem.

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Place du Grand-Mézel 1,

1204 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

16, rue Robert Stümper,

2557 Luxembourg

Luxembourg

© 2024 Enabling Qapital Ltd - Privacy Statement - Disclaimer and Terms & Conditions - Contact - Design Magiris