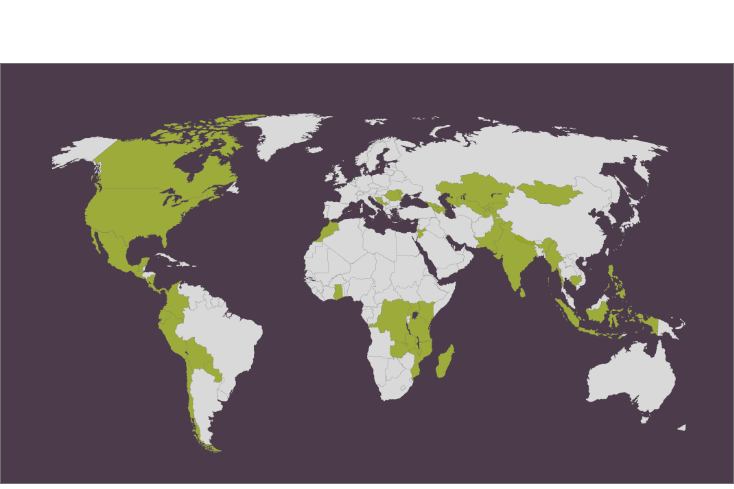

Enabling Qapital Ltd. (EQ) is a leading Impact Investment Advisory Company dedicated to a world where investments provide a financial and social return.

Following the objective to have a positive economic, social, and environmental impact.

EQ currently advises USD 700M in Assets within Microfinance and Access to Energy / Clean Cooking.

EQ has over 50 team members speaking more than 21 languages and representing 12 countries..

Enabling Qapital is moving money to meaning.