Enabling Qapital Ltd. (EQ) is a FINMA-regulated, leading Swiss impact asset manager dedicated to a world where investments generate financial, social, environmental, and economic returns.

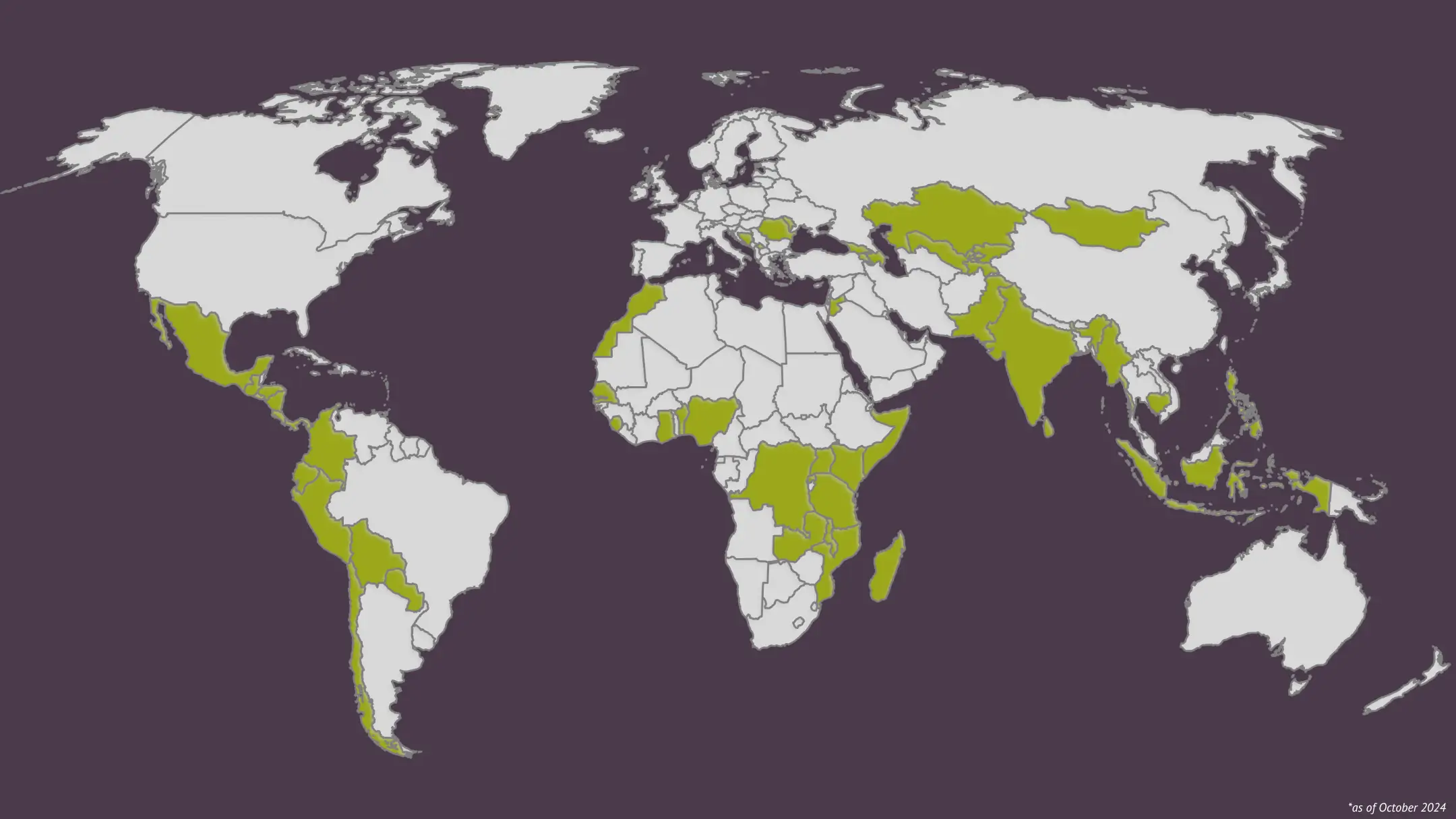

EQ currently manages USD 800 million in assets across Microfinance (Private Debt), Access to Energy / Clean Cooking, and listed emerging market bonds.

The team consists of over 65 members, speaking more than 21 languages and representing 14 nationalities.

Enabling Qapital is moving money to meaning.