Over 480,000 micro-entrepreneurs

reached as of Dec 2025

Over 480,000 micro-entrepreneurs

reached as of Dec 2025

The EMF Microfinance Fund was founded in 2008. Since its inception, it has been a pure private debt fund, investing in Microfinance Institutions (MFIs) in emerging and frontier markets. All the currencies are systematically hedged. This allows investors to obtain stable, uncorrelated, and attractive financial returns while fostering financial inclusion.

This pure debt fund offers investors a capital preservation and growth strategy with a target return of 2-3% above Libor/SOFR. In order to manage the investment risk, the Fund diversifies across a large number of countries, a broad range of MFIs, and a strong blend of maturities, to achieve liquidity for investors.

Enabling Qapital has a team across all continents with strong investment expertise and a state-of-the-art underwriting process as well as risk management.

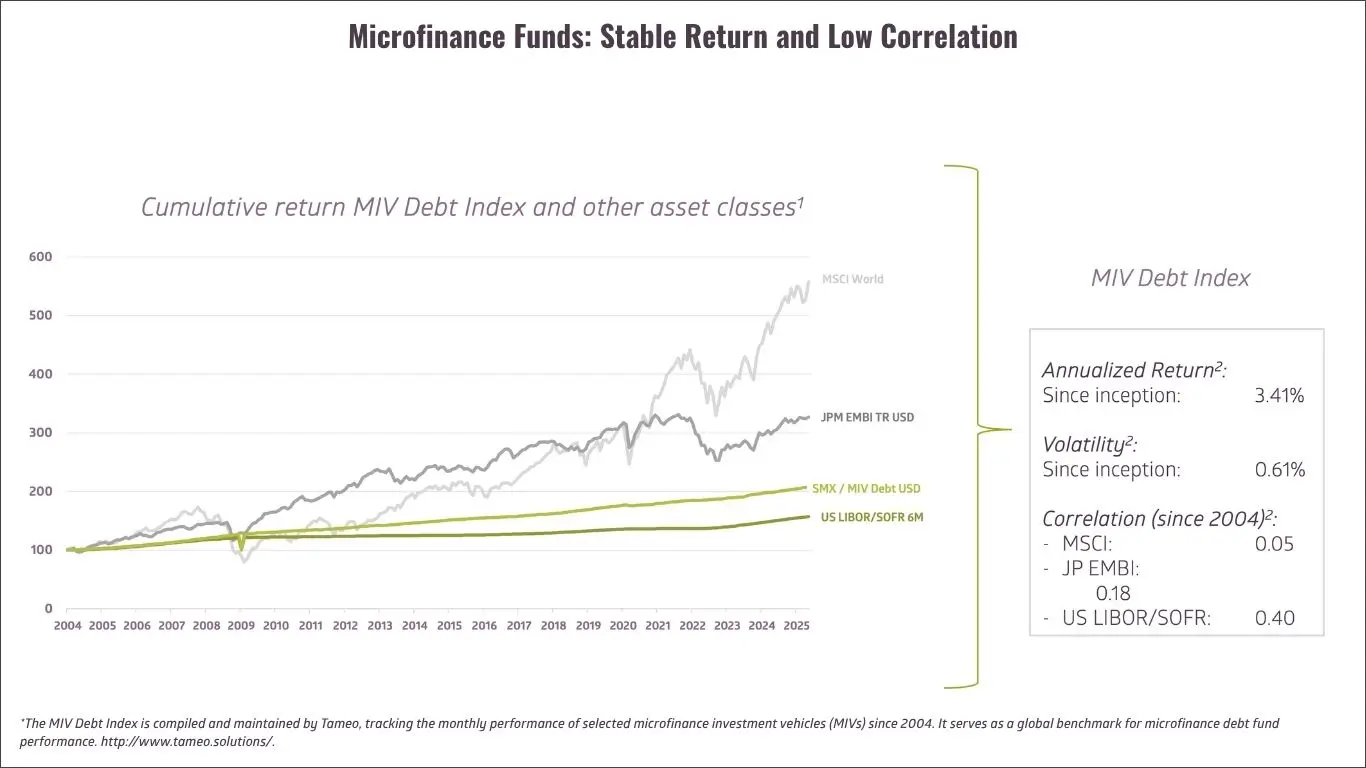

Microfinance’s appeal as a diversifier in institutional portfolios stems from its consistently low correlation with mainstream financial markets. Since 2004, the MIV Debt Index has shown correlations of just 0.04 with MSCI World, 0.18 with JP EMBI, and 0.35 with US LIBOR/SOFR

But what drives this disconnect?

🌍 Local Economies, Global Independence

Microfinance institutions (MFIs) operate in fragmented, informal economies that are largely decoupled from global capital flows. Their borrowers - often micro-entrepreneurs in rural or underserved areas - are influenced more by local agricultural cycles or community-level commerce than by global interest rates or equity markets

🏦 Non-Market-Based Lending Models

Unlike traditional financial instruments, microfinance loans are not priced off benchmark indices or traded in secondary markets. This structural independence shields them from the volatility and herd behavior that characterize public markets

📊 Idiosyncratic Risk Profiles

The risks in microfinance - such as weather shocks, local political shifts, or borrower-level defaults - are highly idiosyncratic and geographically dispersed. This makes them statistically uncorrelated with systemic risks that affect equities or sovereign bonds

🧭 Mission-Aligned, Long-Term Capital

Microfinance is often funded by Pension Funds, impact investors and development finance institutions with long-term horizons and low redemption pressure. This patient capital base reduces the likelihood of procyclical behavior during market stress

📉 Empirical Evidence Across Cycles

Studies like the one by Krauss & Walter (NYU Stern) confirm that microfinance returns show very low exposure to global and domestic market movements, reinforcing its role as a distinct asset class.

Microfinance has consistently demonstrated low volatility across economic cycles, and this is not by chance. Here’s why:

🔒 Structural Insulation from Global Markets

Microfinance institutions (MFIs) operate primarily in local economies, often serving clients in rural or underserved regions. Their performance is more closely tied to domestic consumption and informal economic activity than to global capital markets. This geographic and economic insulation results in very low correlation with traditional asset classes - just 0.04 with MSCI World and 0.18 with JP EMBI, according to the MIV Debt Index.

🏦 Diversified and Fragmented Loan Portfolios

MFIs typically issue small, short-term loans to a broad base of borrowers. This diversification across thousands of micro-entrepreneurs reduces concentration risk and cushions against localized defaults. The result: volatility as low as 0.32% in some institutional share classes.

📈 Stable Demand and Counter-Cyclicality

Demand for microfinance tends to remain stable - or even increase - during downturns, as traditional credit sources dry up. This counter-cyclicality helps maintain consistent cash flows and portfolio performance, even during crises like the global financial crisis, COVID-19, or regional currency collapses.

🛡️ Strong Risk Management and Local Knowledge

MFIs often have deep community ties and robust underwriting practices tailored to informal economies. Their ability to assess creditworthiness without relying on conventional credit scores contributes to low default rates and stable returns.

🌍 Mission-Driven Capital and Long-Term Orientation

A significant portion of microfinance capital comes from Pension Funds, impact investors and development finance institutions. These investors are typically long-term oriented and less reactive to short-term market noise, which further stabilizes the asset class.

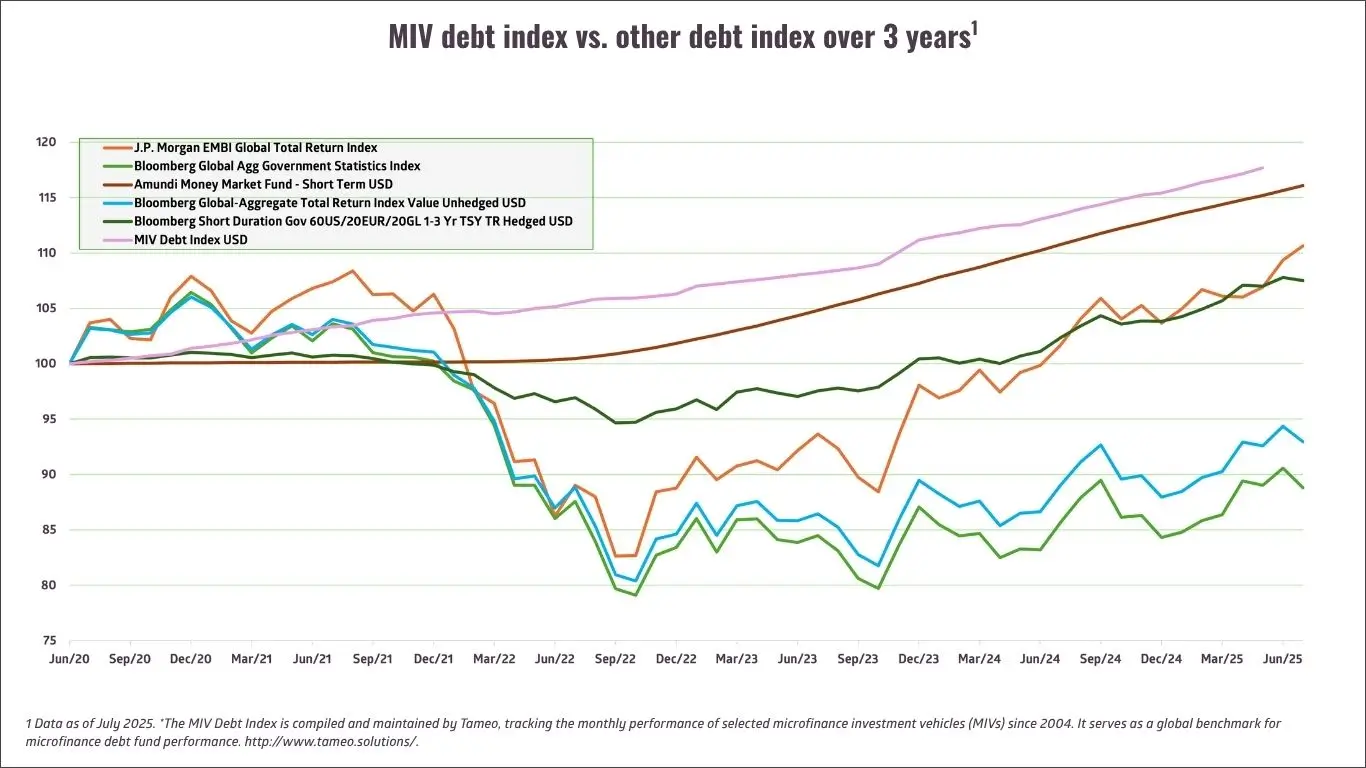

In a world where traditional fixed-income yields remain compressed - especially in CHF and EUR - investors are once again turning to microfinance for its attractive spread and resilience.

📊 Spread Above Risk-Free Rates

Microfinance investments have historically delivered a spread of over 2% above the risk-free rate - and that premium is back in 2025, across CHF, EUR, and USD investments!

With global interest rates stabilizing after a period of aggressive tightening, microfinance portfolios are benefiting from solid fundamentals and disciplined pricing.

💡 Liquidity Premium and Local Market Dynamics

The spread also reflects a liquidity premium and the idiosyncratic nature of local lending markets. MFIs often operate in regions where traditional capital is scarce, allowing for pricing that reflects both risk and impact

🌍 Impact Without Compromise

Beyond yield, microfinance continues to deliver on its promise of financial inclusion, supporting entrepreneurs and small businesses in underserved communities. Investors benefit from stable returns and measurable impact - a rare combination in today’s markets.

The EMF Microfinance Fund fosters financial inclusion and shared prosperity. Microfinance institutions provide loans and increasingly savings, insurance and related products to low-income groups.

The fund’s focus on supporting financially sound, impact-focused local financial intermediaries enables the population of entrepreneurs to create and grow income-generating activities and to break out of poverty. Expanding access to financial services for these customers promotes resilience, business growth, and helps generate and secure sustainable employment. This is key to unlocking the potential to deliver large-scale growth in formal employment within developing countries, leading to poverty reduction at scale over the long term.

The EMF Microfinance Fund supports microfinance institutions in expanding their outreach, improving the quality and appropriateness of their financial services, and encourage the development of new products such as savings, insurance and payment services.

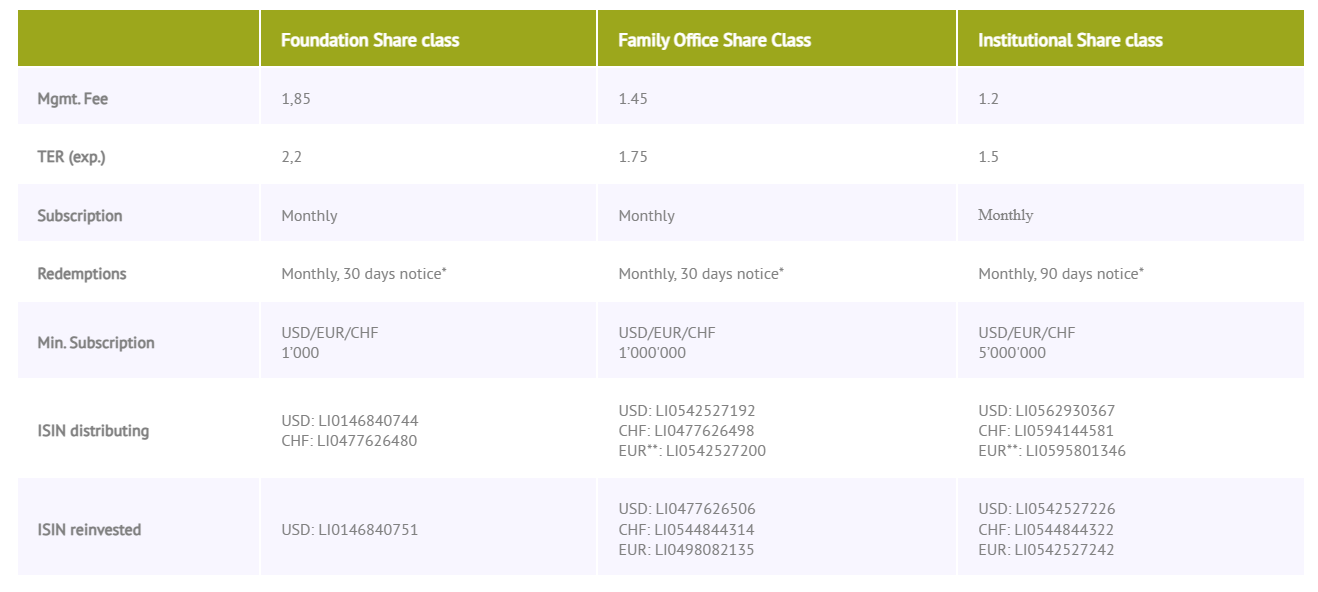

*Each investor may redeem not more than 1% of Sub-Fund’s NAV (last available NAV). If more than 1% of Sub-Fund’s NAV are redeemed, a redemption period with 90 days notice is applied.

**Share class will be opend for subscriptions at client’s request.

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

7, rue Robert Stümper,

2557 Luxembourg

Luxembourg

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

16, rue Robert Stümper,

2557 Luxembourg

Luxembourg

© 2026 Enabling Qapital Ltd - Privacy Statement - Disclaimer and Terms & Conditions - Contact - Website Management by Magiris

You are likely to be an Institutional Client if you are:

an entity required, under the laws of the jurisdiction in which you carry on business, to be authorized or regulated to operate in the financial markets (which includes but is not limited to financial intermediaries such as: banks, investment firms, broker dealers, insurance companies, insurance intermediaries, funds, pension funds or management companies);

a large undertaking (the term ‘undertaking’ includes corporates, partnerships and unincorporated associations);

a national government, central bank, international or supranational institution;

a regional government, sub-national organization or state-owned agency that manages public debt; or

an institutional investor whose main activity is to invest in financial instruments, which includes entities dedicated to the securitization of assets or other financing transactions.

The term Institutional Client in particular covers professional clients in terms of MiFID and AIFMD or equivalent rules outside the EU, certain investors deemed to be professional investors based on local law (such as “well informed investors” in Luxembourg).