In Madagascar – home to 30 million people and some of the world's most unique biodiversity – small business owners face a common challenge: access to capital.

Growing Madagascar's Economy - One Business at a Time

Traditional banks often consider micro and informal entrepreneurs too risky or too small to serve, leaving many without the financing they need to start or grow.

At Enabling Qapital, we seek out financial institutions that are creating tangible economic opportunities for small business owners. SIPEM is one of those institutions.

A Local Financial Institution with a Long-Term Vision

Founded in 1990, SIPEM (Société d'Investissement pour la Promotion des Entreprises à Madagascar) began as a venture capital initiative between a local Malagasy business association (APEM) and French development finance partner SIDI. Over time, SIPEM evolved from an investment company into a licensed financial institution in 2004, and by 2014 became a full commercial bank focused on financing micro, small, and medium-sized enterprises (MSMEs) – especially those operating informally or outside major financial centers.

Today, SIPEM operates 29 branches across Madagascar, serving over 7,300 customers with a $31.9 million loan portfolio. Its mission is straightforward: "Support Malagasy business clients, in urban and peri-urban areas, by offering them financial products and services necessary for their development."

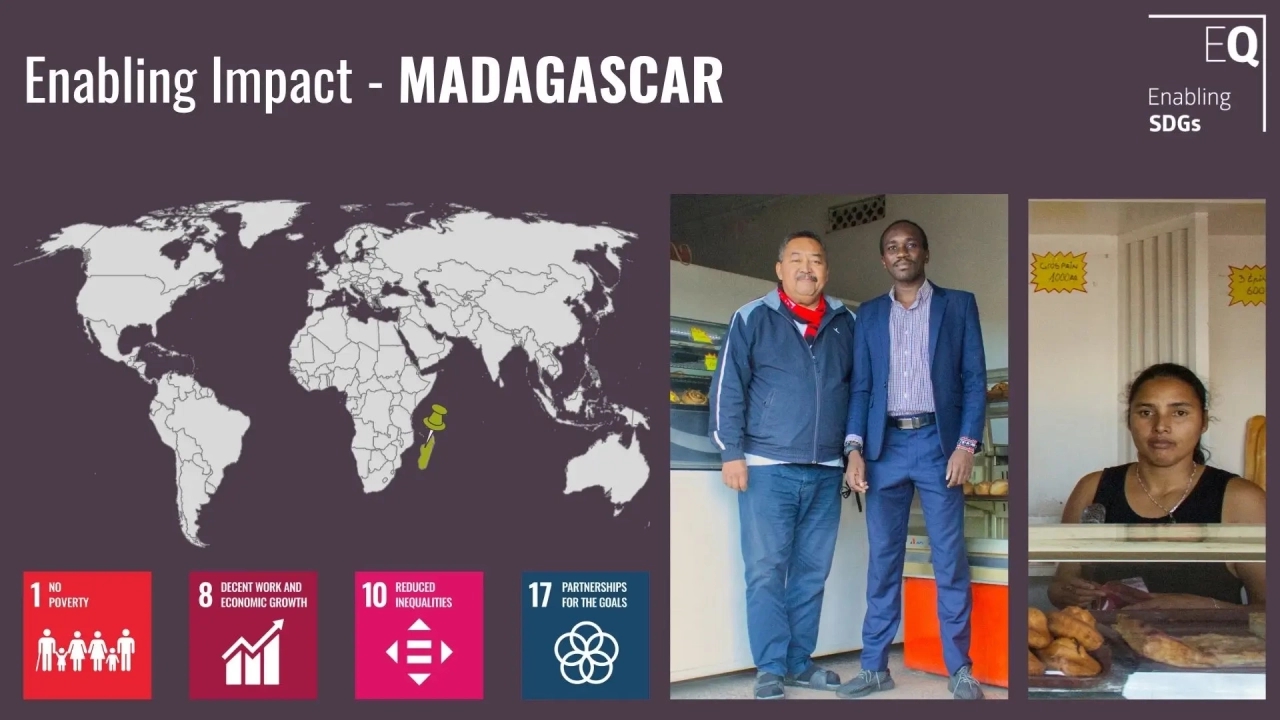

Client Example: A Bakery with a Bigger Vision

Twelve years ago, Lucien Mac had one bakery and a business plan. He needed a small loan to open a dedicated bread shop in Antananarivo. Traditional banks weren't interested – but SIPEM was.

His first loan of $4,600 (MGA 20 million) gave him the foundation he needed. Since then, he's built a long-term relationship with the bank, accessing a total of $46,000 (MGA 200 million) over six credit cycles. SIPEM's fast processing times and approachable staff made it a practical choice as his business expanded.

Today, Boulangeries Trois Épis has four locations – three in the capital and one in Mananjary province. Lucien now employs 60 people, offering steady jobs in both urban and coastal regions.

Delivering on the SDGs

Lucien's story is just one example of how accessible finance supports Madagascar's economic development. Through its ongoing support for small entrepreneurs, SIPEM contributes directly to the following UN Sustainable Development Goals:

SDG 1 – No Poverty: Steady income for Lucien and his employees, enabled by access to working capital.

SDG 8 – Decent Work and Economic Growth: 60 jobs created by one small business; thousands more across SIPEM's broader MSME portfolio.

SDG 10 – Reduced Inequalities: Financing for informal businesses often excluded by traditional banks.

SDG 17 – Partnerships for the Goals: A long-term collaboration between local and international actors that continues to support inclusive finance.

By the Numbers

- 29 branches nationwide

- $31.9 million active loan portfolio

- 7,300+ clients served

- 60 jobs created by one bakery

- 12 years of partnership with a single entrepreneur

Why It Matters

SIPEM doesn't just issue loans. It fills a financing gap that helps local businesses grow, hire, and contribute to their communities. For entrepreneurs like Lucien Mac, that support translates directly into job creation and local economic development – one bakery at a time.