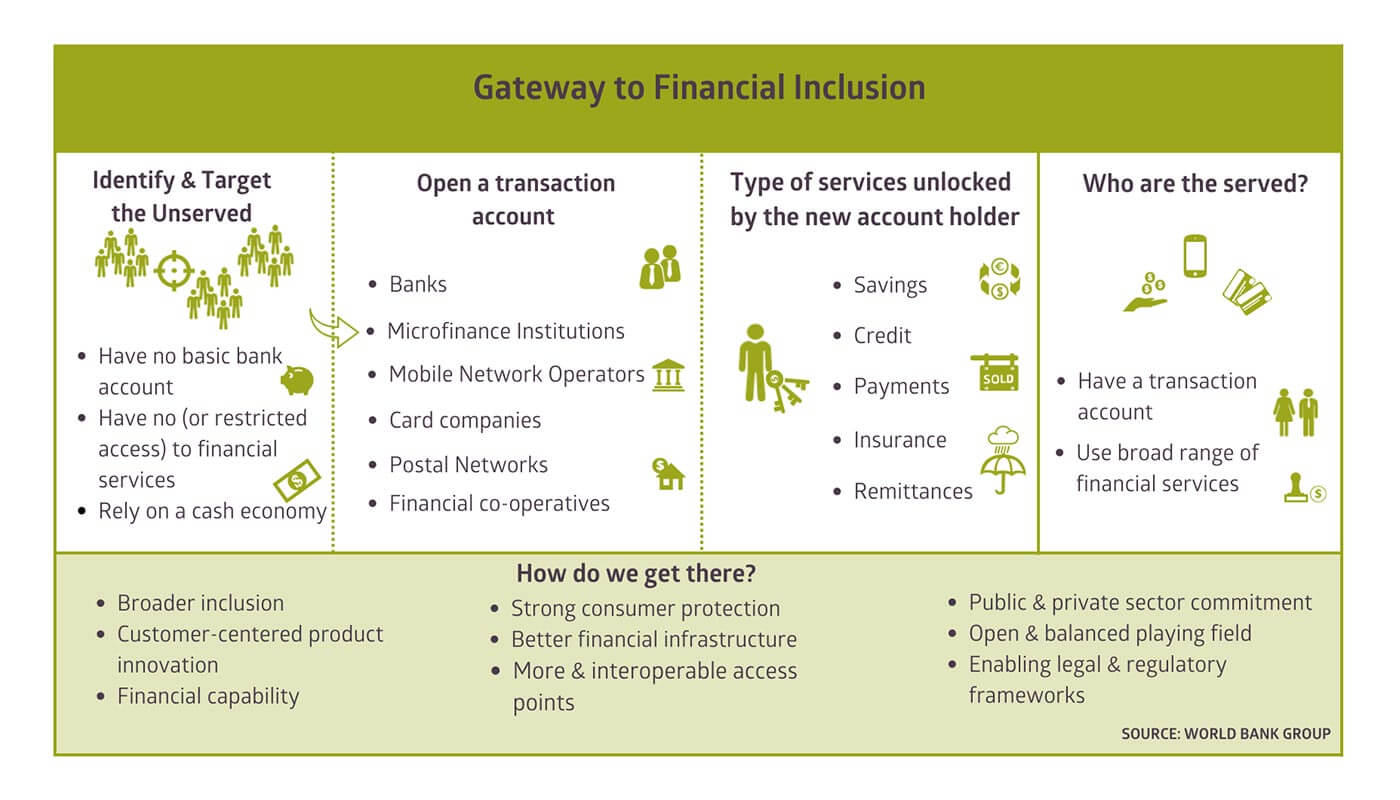

Daily life is made easier by having access to money, which also helps families and businesses prepare for everything from long-term goals to unexpected emergencies. Having access to a transaction account is the first step toward greater financial inclusion because it enables people to keep money and send and receive payments.

A transaction account acts as a doorway to other financial services.

It opens up opportunities for account holders to access credit, insurance, and investment products that can help them achieve financial stability and growth.

Account holders are more likely to use additional financial services like credit and insurance to launch and grow enterprises, invest in their health and/or education, manage risk, and recover from financial setbacks, all of which can enhance their overall quality of life.