Our Commitment to Sustainability and Impact

Responsible investing isn't just a choice – it's our core mission

Our Commitment to Sustainability and Impact

Responsible investing isn't just a choice – it's our core mission

Discover how we integrate sustainability, ESG principles, and responsible investing to create lasting positive change for people and the planet.

Explore our vision, strategy, and actions that drive meaningful impact.

Vision: A world where investment empowers people and embraces the planet.

Mission: Moving money to meaning.

Values: Good Governance and Servant Leadership.

Sustainability principles is deeply engrained in our core corporate values of servant leadership and good governance.

This commitment goes beyond compliance and serves as a pillar of integrity in our decision-making process and strategy definition.

Serving each other: Every staff member of the Enabling Qapital family is responsible for delivering and accepting honest, transparent, and frequent feedback to foster a culture of innovation and professional growth.

Serving our partners: Each staff member is encouraged to build respectful relationships with all stakeholders - both internal and external - and to put their needs at the center of their work.

Serving as an example: We are committed to living up to the same standards it holds its investees to. We are always open to feedback and suggestions from our portfolio companies. By serving as an example, we encourage employees, investees, investors, and partners to follow good governance practices and educate them about social and environmental risks and their mitigation.

Serving the planet: Enabling Qapital is dedicated to continuously innovating towards developing more products and services that address environmental risks.

We recognize the need to ensure we ‘walk the talk’ and live up to our values and guiding principles. This involves integrating sustainability standards into our operations, monitoring our environmental footprint, refining our social performance management, and strengthening internal governance practices. Following this, we apply our values to explore issues in emerging countries, identifying those which investments can address, and creating products to tackle them.

We are dedicated to integrating ESG standards into our operations, with a strong focus on environmental stewardship.

We continuously work to minimize our carbon footprint, enhance operational efficiency, and promote sustainable practices across our organization. Here are some of our key initiatives:

Our people are our greatest asset. Our commitment to creating an inclusive, empowering, and supportive workplace is reflected in our HR guiding principles.

To bring these principles to life, we've implemented a comprehensive framework that spans three key areas:

Training & Development: Leadership programs focus on goal setting, communication, and emotional intelligence.

Health & Well-being: Regular health sessions and wellness support.

ESG Training: Promoting responsible business practices through ESG education.

High-Performance Culture: Fostering collaboration and excellence.

Safety & Security: Commitment to safety extends beyond the office.

Flexible Work Schedules: Hybrid schedules for optimal productivity and work-life balance.

HR Automation: Efficient, data-driven HR processes.

Anti-Harassment Training: Ensuring a respectful and inclusive workplace.

Positive Relations: Grievance and open-door policies support a healthy workplace.

Staff Retention: Strong culture and satisfaction drive high retention rates.

Long-term Commitment: Many team members, including those with 15+ years of collaboration, have followed senior leadership from previous roles, showcasing trust and shared vision.

At EQ, we uphold rigorous governance standards that are integral to our commitment to sustainability and responsible investment practices. Our governance framework encompasses B Corp certification, dedicated sustainability initiatives, and active board oversight, ensuring transparency and accountability in all our operations.

Board Oversight and Sustainability

Our Board of Directors provides rigorous oversight, integrating sustainability into strategic decisions and ensuring accountability through regular updates and reporting.

Dedicated Sustainability Department

Established in 2024, our Sustainability department enhances our ESG efforts, ensuring integration throughout our operations and investments.

Gender Equity Commitment

We conduct comprehensive gender lens assessments internally and externally, driving inclusive practices across recruitment, investments, and partnerships.

Servant Leadership Philosophy

Rooted in servant leadership, our governance fosters transparency, collaboration, and innovation, driving positive social and environmental impact.

B Corp Certification

We are proud to be B Corp certified, reflecting our commitment to high governance and social responsibility standards across Governance, Workers, Community, Environment, and Customers.

UN PRI Signatory

As signatories of the UN Principles for Responsible Investment (PRI), we uphold principles that align our investments with sustainable development goals.

We integrate environmental, social, and governance (ESG) factors into our investment strategies. This commitment enhances transparency, promotes sustainable financial practices, and underscores our mission to deliver value through responsible investment decisions. We strive for positive outcomes by measuring impact at both the investee and end-borrower levels, ensuring tangible effects of our investments. While we prioritize evaluating systems and practices at the investee level to manage risks efficiently, we are mindful of the resource-intensive nature of measuring impact directly at the end-borrower level. This balanced approach allows us to strengthen positive outcomes effectively.

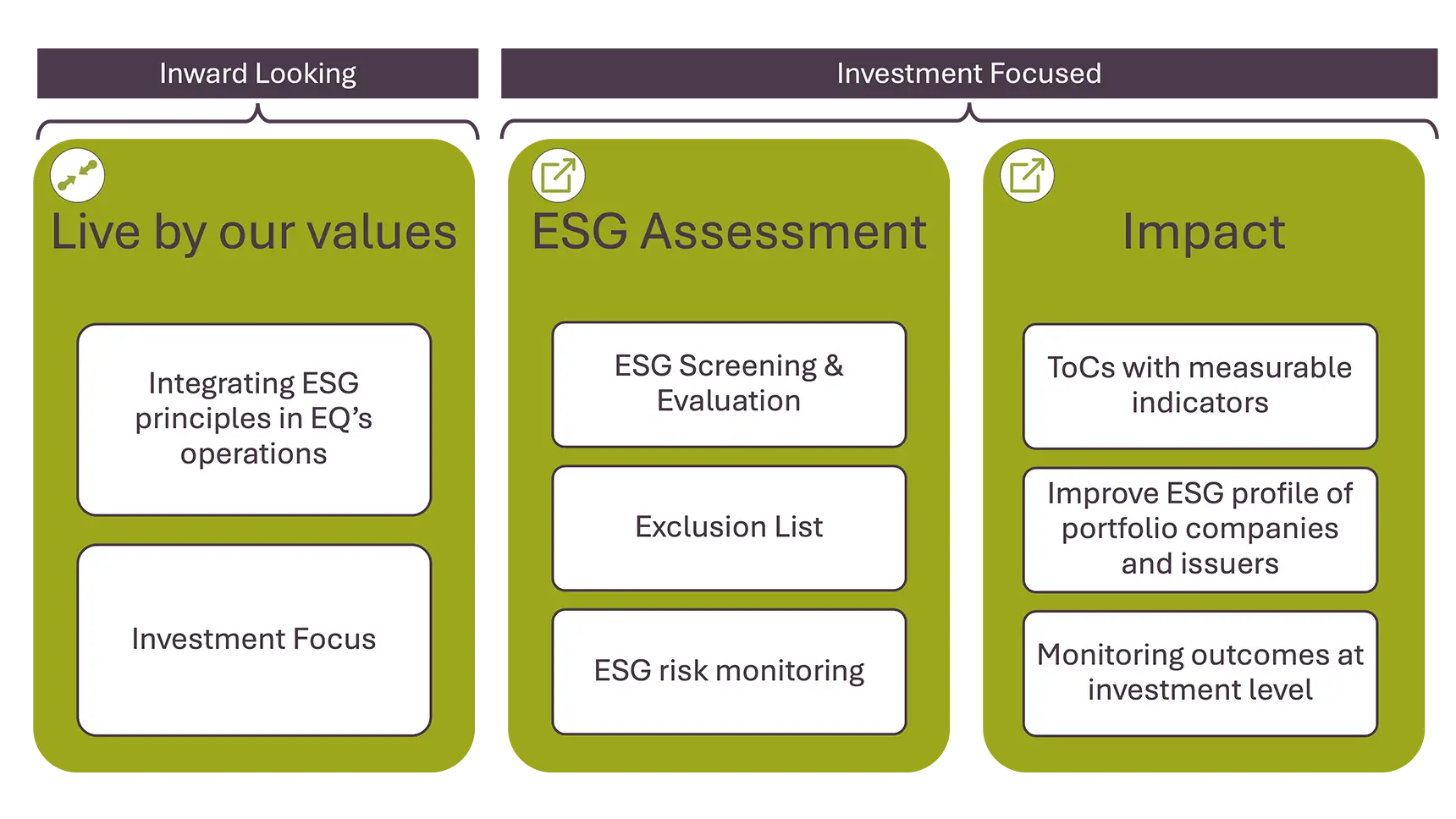

We take a holistic approach when it comes to integrating ESG and impact considerations throughout our investment decision-making and monitoring processes. This comprehensive strategy ensures sustainability and ethical standards are embedded at every stage.

We screen potential investments for their ESG profiles to ensure alignment with our sustainability and ethical standards. This involves excluding companies on our exclusion list and those known for unethical practices or poor client protection. We support companies with developing ESG systems if they demonstrate a commitment to improvement.

Additionally, we conduct comprehensive KYC (Know-Your-Customer) assessments on key personnel and stakeholders both at the beginning of our relationship and during regular reviews.

Our investment decisions are guided by a comprehensive due diligence process that evaluates potential investments on operational, financial, ESG (Environmental, Social, and Governance), and impact factors. This ensures a holistic assessment of each opportunity.

ESG assessments are integral to our investment decision process. These assessments, alongside credit ratings, are reviewed by our Investment Committee. We may adjust deal terms to encourage improved ESG performance or incorporate specific covenants into agreements to ensure compliance with our ESG standards.

We continuously monitor the ESG and impact performance of our investees throughout the investment cycle. Regular updates from our investees help us maintain transparency and accountability in our reporting to stakeholders.

Explore our Theory of Change (ToC), a strategic framework guiding our commitment to building a sustainable future. At EQ, we believe in empowering communities and preserving our planet through purposeful investments. By actively enhancing Environmental, Social, and Governance (ESG) practices among our investees, we strive to align global standards with local impact. Our approach focuses on fostering long-term value and measurable outcomes, ensuring accountability and continuous improvement. Join us as we drive positive change, leveraging investments to create a resilient and prosperous world for generations to come.

At EQ, we're committed to creating lasting impact through strategic investments. Our approach is guided by three key elements: a robust Theory of Change (ToC), a focus on improving our investees' ESG profiles, and rigorous outcome monitoring. These interconnected strategies ensure that our investments not only generate financial returns but also drive meaningful social and environmental progress. Explore below to learn how we're turning our vision into reality:

To guide us in our overarching vision to create a world where investments empower people and embrace the planet , we utilize Theories of Change (ToC). This strategic framework helps us understand how and why a desired change is expected to happen in a particular context.

Our Theory of Change (ToC) is a comprehensive tool that outlines activities, outputs, outcomes, and assumptions, providing a clear path to achieving desired impacts. By incorporating measurable indicators, our ToC ensures accountability and fosters continuous improvement, enhancing our programs and maximizing social and environmental impacts. This approach promotes ongoing learning and effective positive change.

To guide us in our overarching vision to create a world where investments empower people and embrace the planet , we utilize Theories of Change (ToC). This strategic framework helps us understand how and why a desired change is expected to happen in a particular context.

Our Theory of Change (ToC) is a comprehensive tool that outlines activities, outputs, outcomes, and assumptions, providing a clear path to achieving desired impacts. By incorporating measurable indicators, our ToC ensures accountability and fosters continuous improvement, enhancing our programs and maximizing social and environmental impacts. This approach promotes ongoing learning and effective positive change.

We have defined clear and measurable targets and use them to monitor the implementation of our ToC and its relevance. To track the achievement of these targets, we directly collect data from our investees through various channels.

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

7, rue Robert Stümper,

2557 Luxembourg

Luxembourg

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

16, rue Robert Stümper,

2557 Luxembourg

Luxembourg

© 2026 Enabling Qapital Ltd - Privacy Statement - Disclaimer and Terms & Conditions - Contact - Website Management by Magiris