2023 - 2024 in review

All numbers in this report are as of the end of December 2023, unless otherwise stated

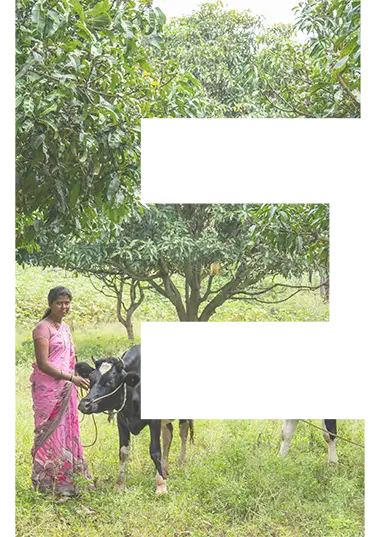

Enabling Qapital’s (EQ) mission and vision is to move money to meaning in a world where investments empower people and embrace the planet. At EQ, we are committed to creating a more equitable and sustainable world through our active involvement in financial inclusion and access to clean cooking.

In this Sustainability Report, we provide a comprehensive overview of our efforts and achievements in the past year and our continued dedication to embracing environmental, social,and governance (ESG) principles and making a positive impact on the global community.

With a commitment to good governance and servant leadership, we made progress in enhancing internal systems and practices, aligning values with actions. This includes upgrading our ESG evaluation tools and implementing a structured ESG data collection framework that maps quantitative key performance indicators (KPIs) to the United Nations (UN) Sustainable Development Goals (SDGs).

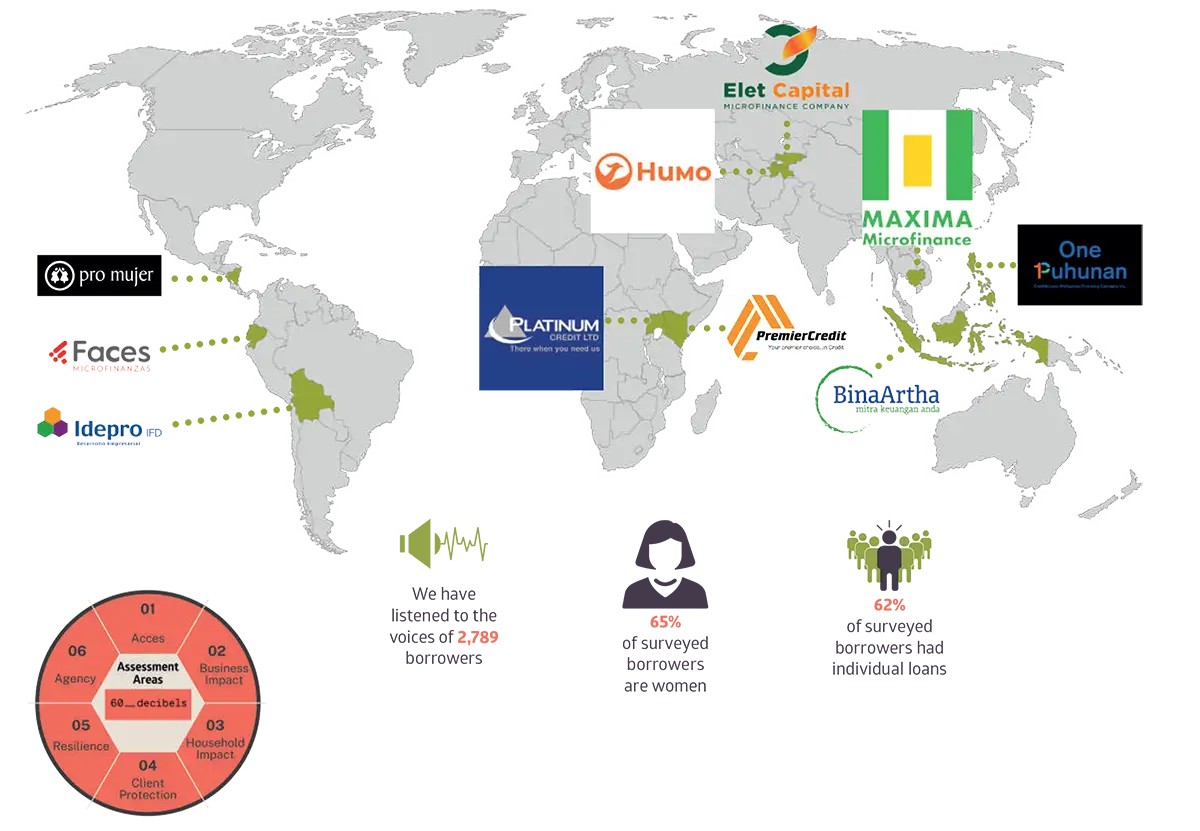

Furthermore, we offered ESG specific training to the entire team and worked with investees to improve their own governance and ESG related frameworks. Additionally, we hired an external consultant to conduct a thorough assessment and audit of both our internal and external practices from a gender lens perspective. We have also teamed up with impact evaluation consultant 60 Decibels to conduct an in-depth study of the impact of microfinance.

Throughout 2023 we continued to adhere to the demanding requirements outlined in Article 9 of the Sustainable Finance Disclosure Regulation (SFDR). Operating in emerging countries where regulatory frameworks are still evolving presented distinct challenges, especially when collaborating with institutions of diverse sizes and varying data collection capacities. However, we approached these challenges as catalysts for change, seizing the opportunity to broaden awareness among our investees. To achieve this, we organized a webinar introducing the SFDR disclosure requirements and engaged our locally based investment team members to collaborate actively with investees, facilitating comprehension and implementation. Looking ahead, our vision involves an expansion of initiatives to nurture awareness and collaboration, with the goal of enhancing the reporting capacity of our investees.

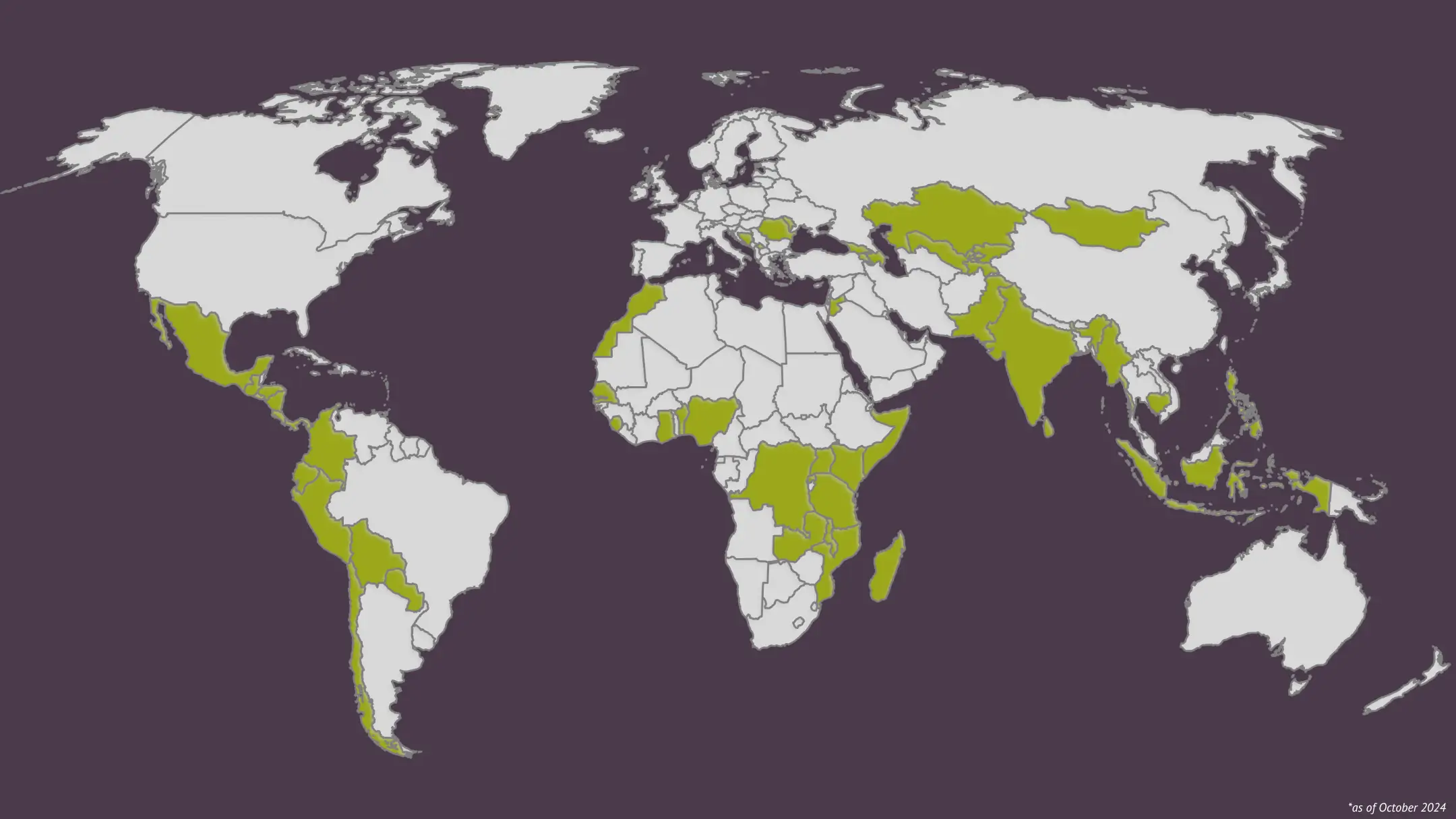

At EQ, we now manage approximately USD 700 million investments in companies committed to promoting positive change in a responsible and sustainable way in developing and emerging countries, including early-stage companies as we attempt to increase their visibility among investors and disseminate best practices for greater impact. In the financial inclusion sector, as of end of December 2023, our partners include 145 financial institutions that collectively strive to empower and realize the aspirations of over 18 million micro, small and medium entrepreneurs. In 2023, our portfolio companies facilitated access to clean cooking solutions for 14.5 million end-users, extending health benefits to their households as well as reducing carbon emissions and decreasing deforestation.

In 2024, we have taken a significant step forward by establishing a dedicated Sustainability Department and have added Sustainability expertise to the Board with two new Independent Board Members joining our Board of Directors.

Above all, the focus remains on creating positive change and sustainable returns. All of this is only possible thanks to our investors, partners, investees, and our global team. Thank you all for being part of this journey. Let’s continue to move money to meaning together!

Chuck Olson - Xavier Pierluca - Christoph Dreher - Kazim Mohamed Ali - Remo Oswald - Roger Müller

MOVING MONEY TO MEANING

USD 700M AUM

>145

Financial Institutions & Companies in the Clean Cooking Sector

48

Countries

>18

Million Borrowers

70%

Women

>55

Rural Borrowers

GOVERNANCE

EQ Board & Executive Management

EQ’S NEWEST STEWARDS OF CHANGE

MEET OUR NEW BOARD MEMBERS

TEAM MEMBERS

57 Team Members Globally

41% Women

59%Men

14

Nationalities

21

Languages

16

New Hires

13

Promotions

+ 91%

Retention

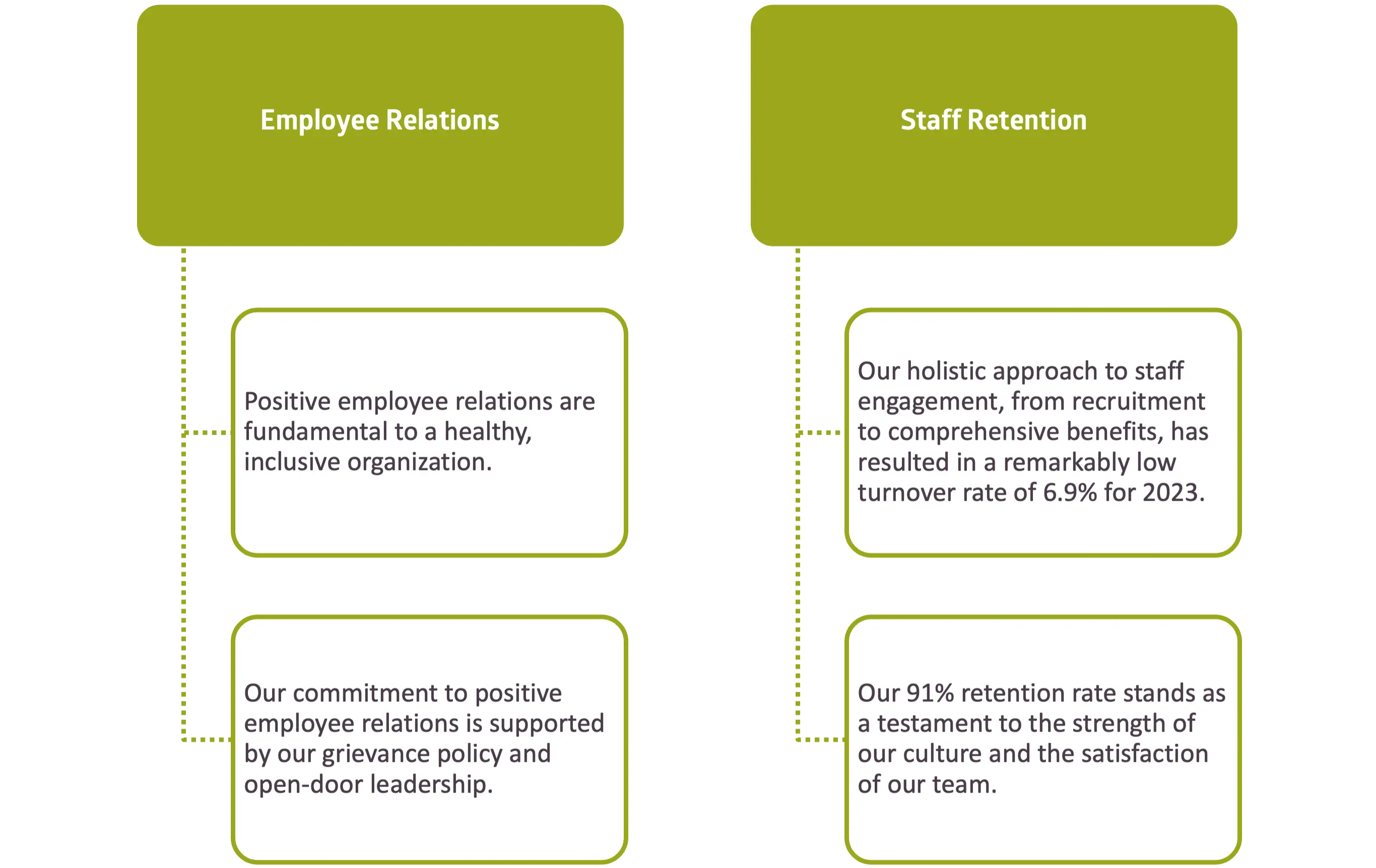

A HOLISTIC FRAMEWOK

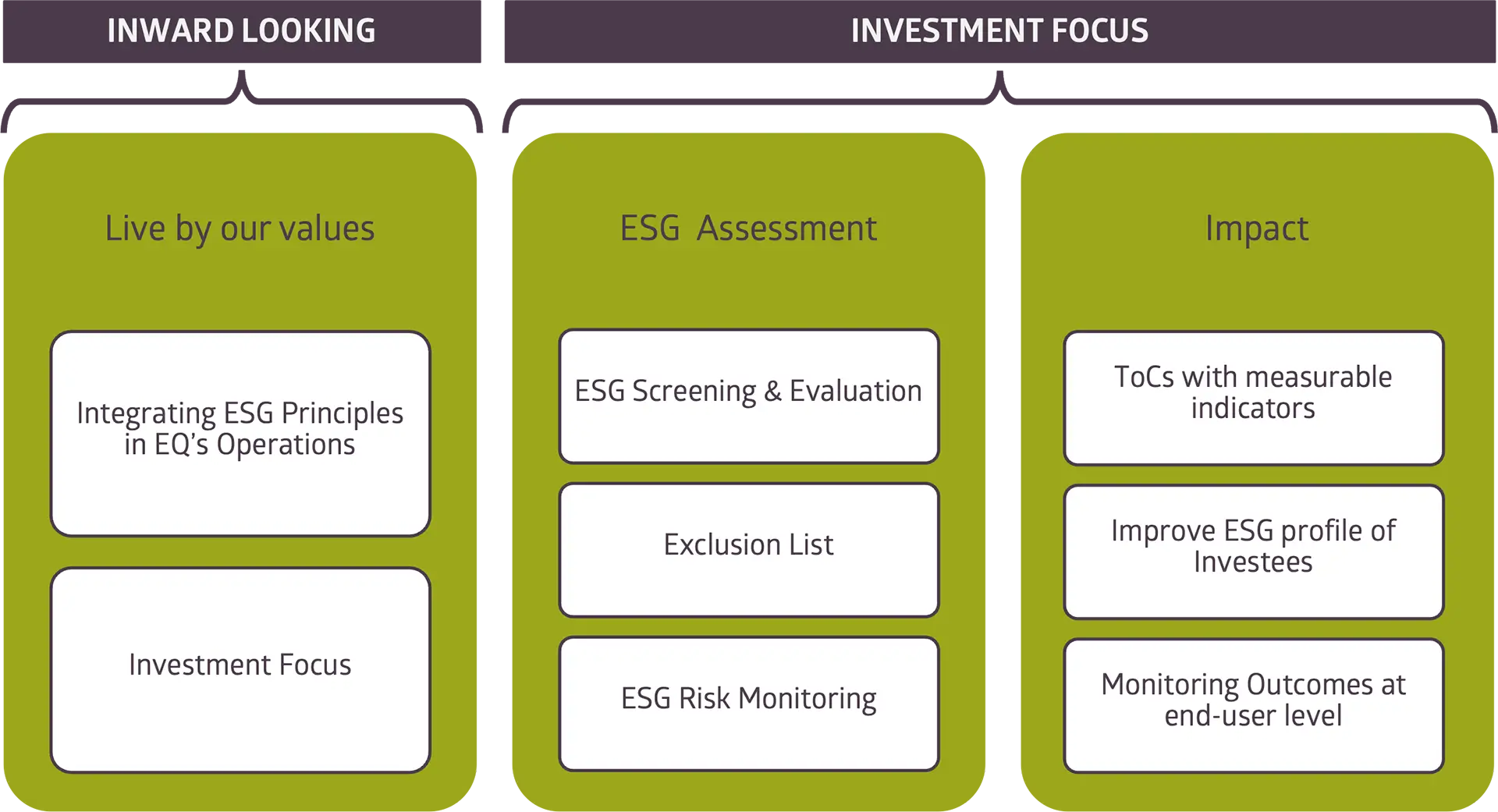

Welcome to EQ’s sustainability strategy. With a focus on internal excellence and external impact, we’re shaping a future where responsible investing isn’t just a choice – it’s our core mission.

OUR SUSTAINABILITY STRATEGY

INTERNAL EXCELLENCE - EXTERNAL IMPACT

Our commitment to sustainability principles is deeply engrained in our core corporate values of servant leadership and good governance. This commitment goes beyond compliance and serves as a pillar of integrity in our decision-making process and strategy definition. It is a living dedication to balancing profit with purpose as we actively pursue our mission of “moving money to meaning” in a world where investments empower people and embrace the planet.

Our Sustainability framework is built upon three pillars that guide our commitment to internal improvement andresponsible investing.

Firstly, we prioritize internal initiatives. This involves integrating sustainability standards into our operations, monitoringour environmental footprint, refining our social performance management, and strengthening internalgovernance practices. Following this, we apply our values to explore issues in emerging countries, identifying those which investments can address, and creating products to tackle them. Presently, we offer two established investment products and are deeply committed to researching and designing new ones to broaden the scope for enabling impactful investments.

Secondly, we focus on our investments and products. We actively manage the risks associated with our investments by prohibiting certain activities and by conducting ESG evaluations of each investee.

The three pillars of our sustainability Strategy

Thirdly, we strive for positive outcomes and emphasize measuring our impact. We assess outcomes at the investee and end-borrower levels to gauge the tangible effects of our investments.

We also aim to measure impact at the level of the end-borrower, but we are mindful of the resource-intensive nature of this exercise.

To balance this, we prioritize evaluating systems and practices at the investee level. This approach helps us monitor our risks and strengthen positive outcomes.

Through these pillars, we aim not only to generate long-term value but also to make a positive contribution to society and the environment. At EQ, we are always keeping in mind that ESG is a journey and not a destination.

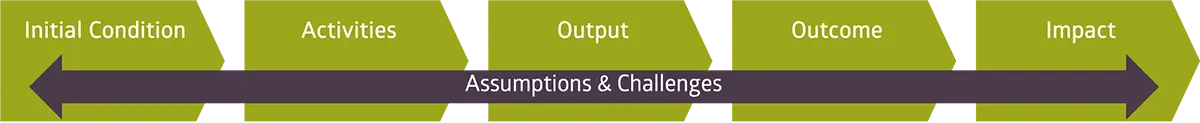

Sustainability Strategy Implementation Framework

The diagram above illustrates the implementation of our sustainability strategy within our daily business operations. At the core of our approach is our Theory of Change (ToC), which outlines our mission and vision, driving our actions forward.

Ourfull ToC is presented in our Impact section. Our ToC is supported by our action plan, key performance indicators (KPIs), and targets. These elements guide our product development and inform the structure of our investment focus. Each investment product is tailored to specific criteria, with minimum requirements outlined at each level. For more information on our ESG Evaluation process, refer to Chapter 2.

Furthermore, we ensure transparency and accountability by continuously monitoring our performance and reporting progress to investors, regulators, team members, and all relevant external parties. This commitment ensures we remain on track to achieve our sustainability goals.

LIVING BY OUR VALUES

INWARD LOOKING DIMENSION OF OUR SUSTAINABILITY STRATEGY

IMPLEMENTING ESG IN OPERATIONS & PRODUCTS

OVERVIEW OF OUR INTERNAL ESG INITIATIVES

This section goes into detail about how EQ starts within to integrate ESG Standards in our operations and introduces our investment products.

CHAMPIONING ENVIRONMENTAL RESPONSIBILITY

One Step at a Time Towards a Greener Future

At EQ, we acknowledge the imperative to address environmental challenges inherent in our operations, particularly those associated with air travel.

Conducting thorough due diligence and implementing vigilant monitoring are integral components of our fiduciary responsibility to investors. These practices enable us to establish close connections with our investees and partners and stay abreast of market trends across various regions. Concurrently, we maintain a keen awareness of our carbon footprint and are actively working to offset the CO2 emissions resulting from these flights. We are continuously seeking ways to enhance the efficiency of our field visits, with a primary focus on minimizing our environmental impact while maximizing on-site and regional resources.

Beyond our organizational efforts to manage our operational impact, we recognize the transformative power of individual actions in fostering environmental change. From the onboarding stage onward, our staff is encouraged to establish resolutions aimed at adopting more sustainable and eco-friendly practices. This commitment extends to sharing these initiatives with the broader team and fostering a collaborative approach to environmental responsibility.

In our belief that every small action contributes to meaningful change, we are pleased to highlight some inspiring initiatives undertaken by our team members, underscoring our collective commitment to sustainability.

OUR EARTH DAY INITIATIVES

EVERYDAY ENVIRONMENTAL EXCELLENCE

ENVIRONMENTAL

CRAFTING SUSTAINABILITY STORIES

COMMUTE FOR A CAUSE: SMALL STEPS, BIG CHANGES

Meet Chuck Olson, Remo Oswald, and Spring Lonneker, EQ’s pioneers in sustainable commuting. Chuck, Board Member & Executive Management, as well as Remo, Executive Management, embrace cycling as their primary mode of commuting, leading by example and reducing emissions. Spring Lonneker from our Business Development Team advocates for public transportation, showcasing the diverse ways individuals can contribute to a sustainable future.

SOLAR POWER: LEADERSHIP IN SUSTAINABLE PRACTICES

Board Member, as well as Kilonzo Mbwele, Head of Portfolio Management & Investment Solutions, have embarked on a journey to harness solar power at home. Installing smart sockets and solar water heaters, they not only reduce energy costs but also align their personal choices with our commitment to sustainability, setting a precedent for environmentally conscious practices.

Silvia Spear, Senior Advisor, takes the lead in our “Eco-Champion” series by incorporating solar panels into her home. Silvia’s story exemplifies the practicality and benefits of renewable energy.

These initiatives showcase EQ’s dedication to solar power, encouraging employees and stakeholders alike to adopt eco friendly practices. Together, these leaders contribute to a collective effort towards a greener and more sustainable future.

COMMITMENT TO SUPPORTING LOCAL BUSINESSES

EQ’s Marketing Manager, Marine Lacoudree, champions local businesses by prioritizing local and seasonal products. From grocery shopping to supporting artisans at farmers’ markets and craft fairs, Marine’s commitment highlights the impact of individual choices on communities and the environment.

RECYCLING REVOLUTION: MR. GREEN’S CATALYST FOR CHANGE

Executive Management, Roger Muller’s journey from a student lifestyle to sustainability continues with Mr. Green. His commitment to recycling, supported by Mr. Green’s “Reduce, Reuse, Recycle” program, exemplifies the transformative impact of sustainable practices on an individual’s life and broader environmental goals. Embracing his role at EQ, Roger integrates sustainable principles into his daily activities, fostering a culture of environmental awareness within the organization.

LAND CONSERVATION IN PAKISTAN: KARACHI TEAM EFFORT

The Karachi team exemplifies responsible land use by actively participating in land conservation at Deosai National Park in Pakistan. Their commitment aligns with EQ’s broader dedication to preserving natural resources and contributing to the well-being of local ecosystems.

A GREEN EARTH DAY GESTURE FOR CHILDREN’S WELL-BEING

Our Nairobi team, in a heartwarming Earth Day effort, revisits the Children of Paradise Orphanage Home. Continuing their support, the team donates Mimi Moto pellet stoves. These clean cooking solutions not only provide warmth but also promote eco-friendly cooking by burning compressed biomass pellets, significantly reducing indoor air pollution and minimizing the environmental impact associated with traditional cooking methods. This initiative reflects our commitment to corporate social responsibility, bringing sustainable and efficient technologies to positively impact lives and the environment

"On a journey of eco-responsibility:

Repurpose, Reuse, Recycle"

SOCIAL

HR GUIDING PRINCIPLES

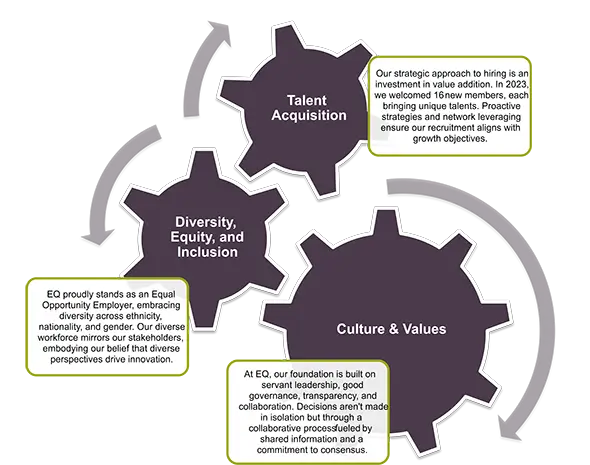

Promoting an Inclusive and Diverse Workplace for Success

HR BEST PRACTICES

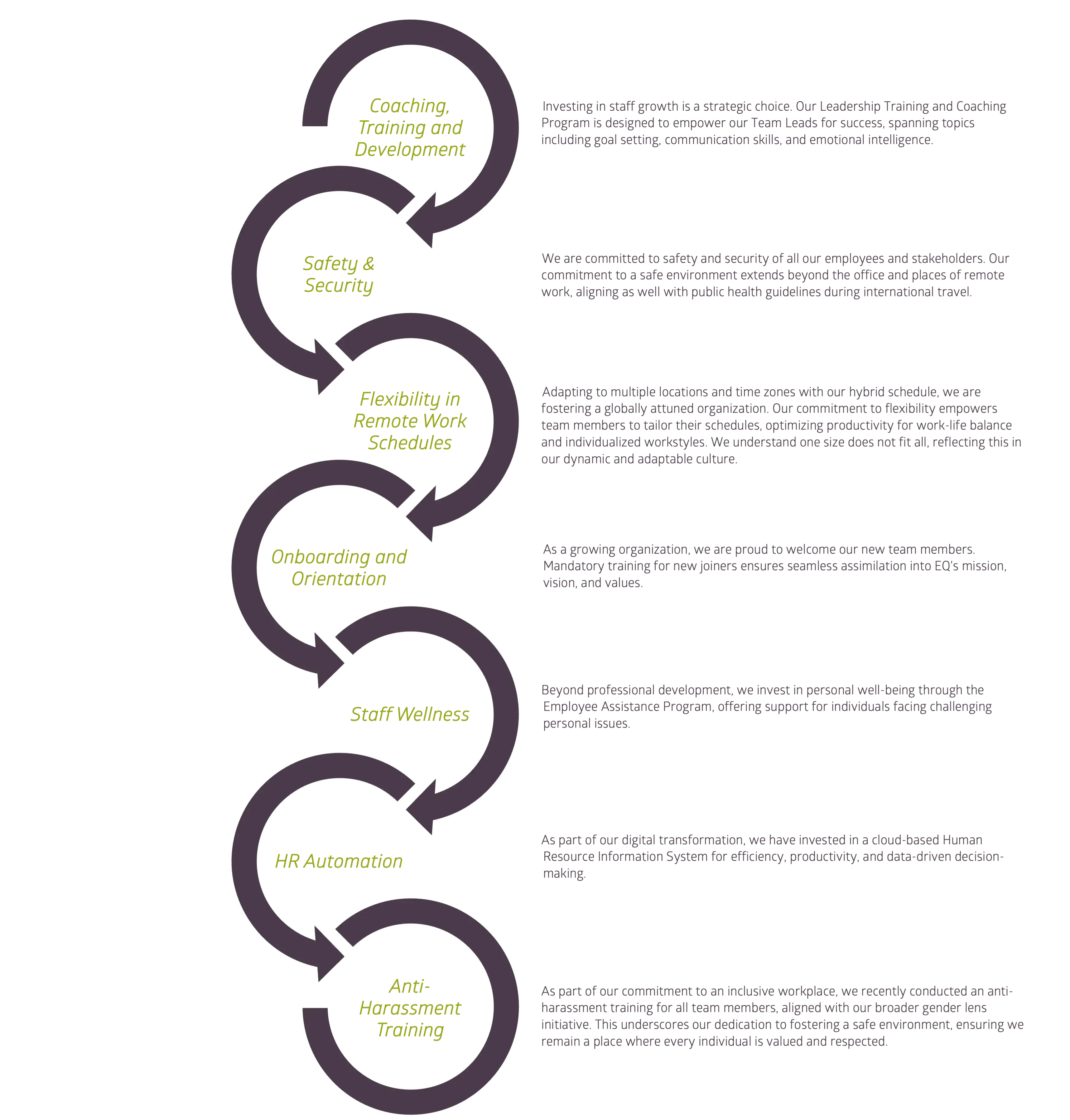

Development Initiatives Overview:

- Scholarship Program: Our Scholarship Policy supports academic and technical development, benefiting three deserving beneficiaries in 2023. Congratulations to our scholars for their milestone achievements.

- Quarterly Health Training: We prioritize the holistic well being of our team, including their health. To support this commitment, we conduct quarterly training sessions covering topics such as nutrition and mental health.

- ESG Training: As part of incorporating ESG across the organization, we share informative videos on ESG principles. ESG training and education foster a shared understanding both internally and externally, contributing to a responsible and resilient business environment.

- High-performance Team: Our internal performance tool drives a high-performance team known for communication, collaboration, and consistent delivery. In 2023, we celebrated 13 promotions, highlighting our commitment to talent development.

"This report is not just a reflection of the past year, it's a roadmap for the exciting journey ahead.

Together, we have shaped a workplace where impact is not just a goal but a shared reality."

OUR TEAM IS OUR GREATEST STRENGTH

A UNIFIED FORCE DRIVING SUCCESS

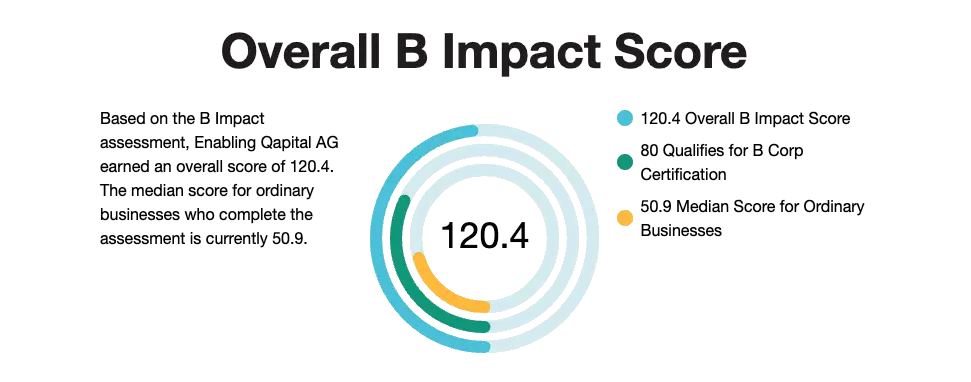

B-CORP CERTIFICATION

A Continuous Commitment to Responsible Governance

Attaining B-Corp certification in 2022 marked a pivotal moment for EQ, signifying our dedication to elevated governance and social responsibility standards. We scored 120.4 out of 200, while a minimum score of 80 is required for the certification. This achievement represents more than a mere certification—it’s a commitment to ensuring a positive impact on all stakeholders.

As a company, our journey towards sustainability is dynamic and evolving. While our initial certification is a significant achievement, we understand that the path towards responsible governance is ongoing. We have integrated B-Corp principles in our corporate governance documents to demonstrate our commitment to continually revisit and enhance our policies and procedures in alignment with B-Corp’s rigorous standards.

Additionally, our B Impact scores, measured against benchmarks, reflect our dedication to consistently moving money to meaning with purpose and upholding our core principles. Through this proactive approach, we aim not only to uphold our B Corp certification, but also to improve our score, demonstrating our dedication to sustainable business practices and ethical governance.

Enhancing Sustainability Governance with a Dedicated Department

In 2024, we took a significant step forward by establishing a dedicated Sustainability Department. This move enhanced our commitment to ESG principles and impact, and complemented the ongoing efforts of the Sustainability Working Group, a Management level body responsible for final decisions on sustainability matters at EQ.

The newly created Sustainability department includes representatives from the Investment Team, ensuring a direct connection to the real needs and concerns of our investees and end-borrowers. Aligning strategically across departments enables us to integrate sustainability throughout our operations. The allocation of resources to run a dedicated Sustainability Department underscores our Management’s strong commitment to effectively implementing our sustainability strategy.

Our Board of Directors provides vigilant oversight, diligently monitoring compliance with the sustainability framework. The Board receives quarterly updates, offering insights into completed projects and outlining the next steps in our sustainability journey.

SUSTAINABILITY on the Board Agenda

Insights from Our New Independent Board Member, Laura Aarnio

As the cornerstone of our governance structure, the Board of Directors plays a pivotal role in guiding EQ’s sustainability initiatives. In an exclusive interview, Laura Aarnio, one of our new independent board members sheds light on the board’s strategic approach to sustainability and its impact on our EQ’s long-term success.

Why is it crucial for the board to include members with expertise in environmental and social issues?

The Board of Directors plays a pivotal role in steering a company and its strategic direction. Board members with expertise in environmental and social issues are better equipped to ask the right questions from management about their sustainability principles and how they are incorporated into a company’s strategy and operations. Moreover, with such expertise, the board is more effective in overseeing measurement of KPIs and reporting of progress.

How do you perceive the role of environmental and social expertise within the governance structure?

I believe that a company’s culture is set by its leadership team. When the board and management see value creation in sustainability and understand its implications on risk as well as on its various stakeholders, the organization takes a more long- term approach in setting strategy and operational standards. This eventually will reflect in the company’s long-term competitive positioning and performance.

Enabling Qapital has very robust governance, sustainability and risk management processes, which I believe are the core reason for its strong and stable returns. Similarly Enabling Qapital sets high governance and sustainability standards for its investees, recognizing the impact of such standards on the underlying value of the investment. Good management frameworks not only reduce risk, but they also generate efficiencies and enhance productivity as well as allow for faster adaptation to change.

How can the board encourage the integration of environmental and social considerations into day-to day business operations?

Our role as board members is to ensure that Enabling Qapital’s management team continues to focus on operational excellence with its robust policies and procedures together with its strong risk management culture. As board members we need to be prepared to initiate and drive sustainability agendas that define clear governance, leadership and accountability on environmental and social issues and incorporate measurement capabilities for relevant KPIs. When we, as a board, understand the implications of such issues to value creation and the resilience of operations, we are best equipped to support management in developing quality investment strategies with sustainable returns.

Our Continued Commitment to Gender Equity

As part of our commitment to upholding our values, we have enlisted the expertise of external consultants to conduct a thorough assessment and audit of both our internal and external practices from a gender lens perspective. Assessing such practices enables us to carefully examine the implications of our actions in terms of gender. In collaboration with EA Consultants, an external consulting party, we have launched an extensive initiative examining our practices across fundraising, internal human resource management, and financial investments through a gender lens.

Internally, our introspection led to a holistic assessment of our recruitment, selection, and retention strategies. This process prompted updates in our recruiting practices, internal communication, and grievance policies, fostering a more inclusive workplace that goes beyond gender boundaries. On the investment side, our due diligence, risk analysis, and investment monitoring processes were scrutinized for their impact on gender outcomes. Working alongside EA Consultants, we identified actionable areas for improvement in evaluating our investees against a gender lens. This underscores our commitment to global initiatives such as the 2X Challenge launched at the G7 Summit in 2018. With investments totaling USD 16.3 billion strategically allocated, the 2X Challenge aims to bolster women’s quality employment, advance financial inclusion, provide targeted enterprise support, and facilitate access to leadership opportunities.

According to the UN, closing the gender gap in women’s access to financial products and services could unlock an impressive USD 330 billion in global annual revenue. As a result, gender lens investing stands not only as a socially responsible choice but also as a strategically sound approach for creating a better world.

Introducing Our Exciting Collaboration:

The Gender Equity Study

As we concluded the assessment phase in 2023, we are alreadyunderway implementing recommendations internally to improve gender outcomes, and our collaboration with EA Consultants continues. Looking ahead, we are excited to announce a strategic partnership with the School of International and Public Affairs (SIPA) program at Columbia University. This collaboration will enable us to design effective support and technical assistance for investees committed to advancing gender equity.

INVESTMENT FOCUS

Financial Inclusion

Financial inclusion is key for development and has been identified as an important enabler of SDGs contributing to poverty reduction, economic growth, job creation, women’s empowerment, reduction of inequalities, and improvement in health, well-being, and education. By enabling access to capital and other financial services for low-income individuals and micro, small, and medium-sized enterprises (MSMEs) traditionally excluded or underserved by the banking sector, microfinance has significantly contributed to financial inclusion in developing and emerging markets.

Despite progress, the 2021 Global Findex estimates that some 1.4 billion adults globally remain unbanked. Those unbanked are more commonly women, poorer, less educated, and living in rural areas in developing and emerging markets. The International Finance Corporation (IFC) also estimates that USD 5.2 trillion financing gap for formal MSMEs and of USD 2.9 trillion for informal MSMEs.

At EQ, we remain committed to filling these gaps by providing debt financing to financial institutions engaged in microfinance and MSME lending in developing and emerging markets. In line with our corporate values, we also remain committed to tracking and disclosing impact results to our investors and stakeholders.

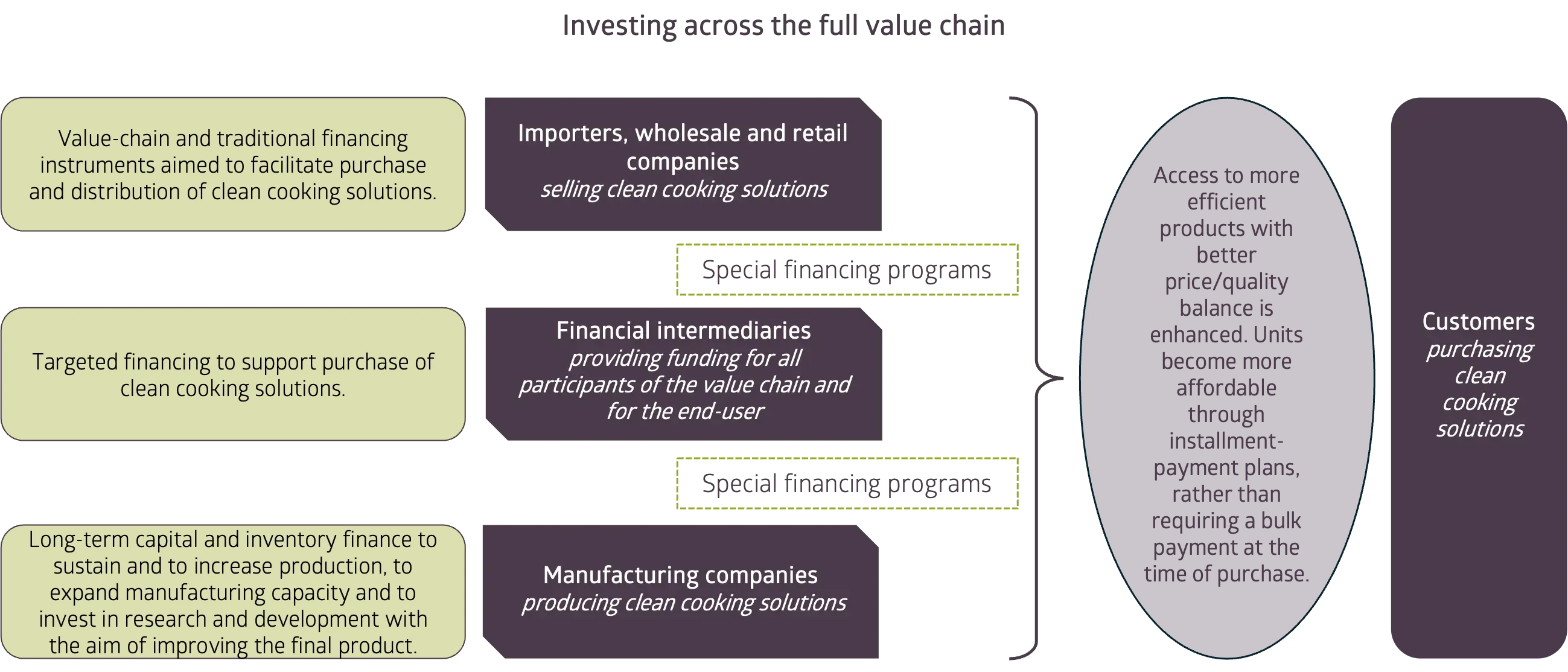

Clean Cooking, a key component of Access to Energy

Cooking is the key household energy use in Africa, where 2 to 3 cubic meters of wood is consumed per household per year for cooking, on average. This implies that cooking is 10 to 100 times more consumptive than any other household energy use in Africa.

According to the World Health Organization, 2.3 billion people worldwide lack access to clean cooking facilities, relying instead on more traditional fuels like solid biomass, kerosene, or coal as their primary cooking fuel. 40%, or roughly 920 million, live in Sub-Saharan Africa. WHO further reports that household air pollution, mostly from cooking smoke, is linked to over 3.2. million premature deaths per year. Traditional cooking fuels also contribute to Africa’s total greenhouse gas emissions and are responsible for the majority of forest loss.

In the past, progress on access to clean and modern cooking solutions has been very limited compared to electricity access.

Starting from 2022, we have been providing investments to companies across clean cooking supply chains, offering debt and quasi-equity financing to companies that manufacture, distribute, and finance cooking fuels and appliances in Africa.

ESG

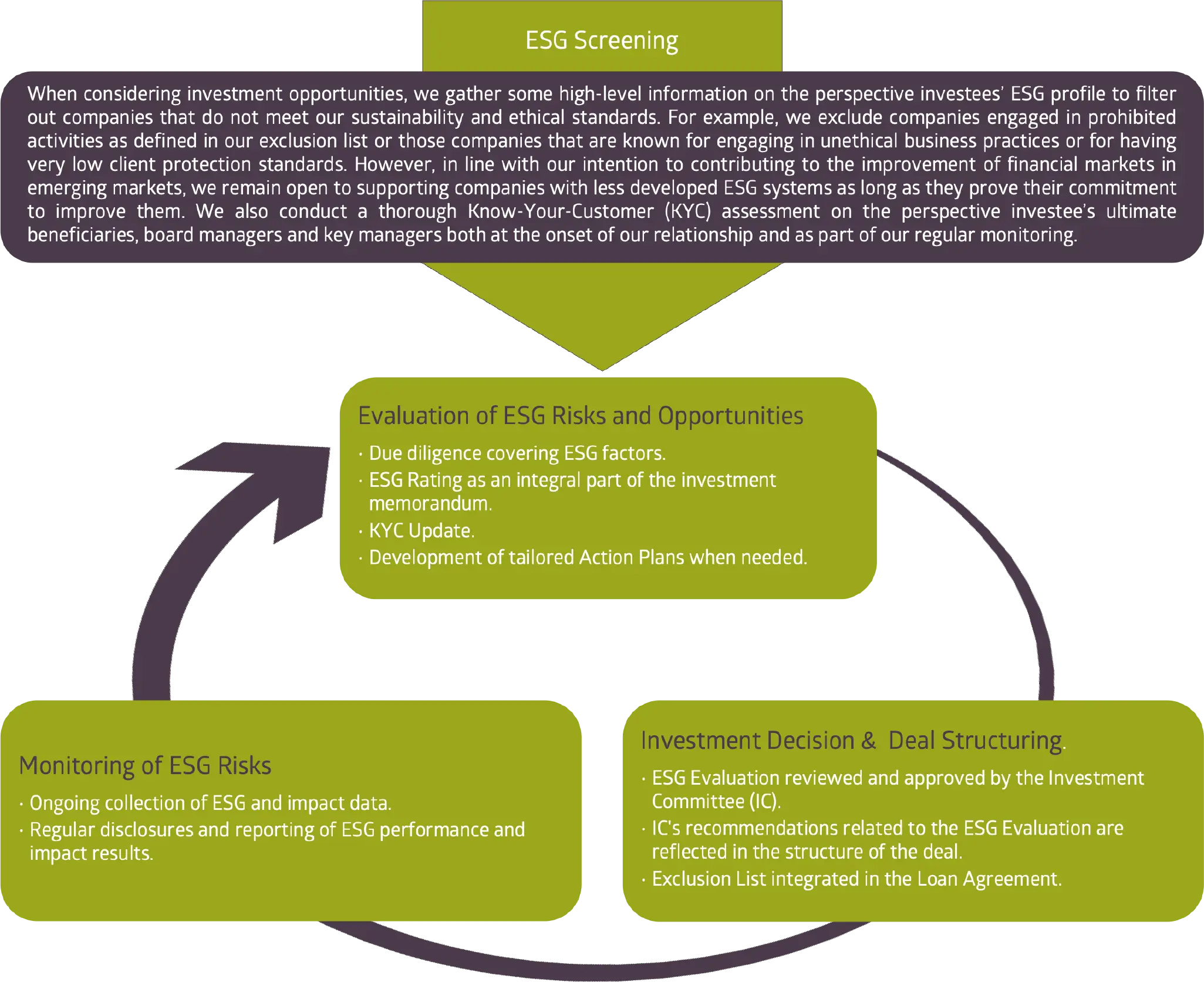

ASSESSING ESG RISKS IN OUR INVESTMENTS

INVESTMENT FOCUSED DIMENSION OF OUR SUSTAINABILITY STRATEGY

ESG EVALUATION FRAMEWORK

INTEGRATING ESG INTO OUR INVESTMENT DECISION-MAKING

Aiming to create a resilient and sustainable portfolio, we take a holistic approach when it comes to integrating ESG and impact considerations in our investment decision-making and monitoring processes. In this chapter, we will describe how we assess and monitor ESG risks as well as how we track impact.

To be true to our commitment to sustainable and responsible investing, we put social, environmental and governance considerations at the center of all our investment decisions.

1. Evaluation of ESG risks and opportunities. Every investment decision is backed by a thorough due diligence process during which we assess and score perspective investees not only against operational and financial criteria but also against ESG and impact factors as defined in each of the product’s proprietary evaluation tools. We also periodically update our KYC assessments to account for potential changes in ultimate beneficiaries, board members, or management within our investee companies.

2. Investment decision & deal structuring. ESG ratings / Environmental and Social Management System (ESMS) assessments are an integral part of the investment package sent to the respective Investment Committee, which is responsible for approving them along with the credit ratings. In case of lower ESG performance compared to the standards and internal benchmark, the Investment Committee might alter terms and conditions of the deal to encourage investees to improve or include covenants in the Loan Agreement when feasible. For non-financial institutions, the findings of the ESG due diligence may inform an action plan that investees have a binding obligation to implement during the tenor of our financing. All our investees also have a binding obligation to not engage in the categorically prohibited activities detailed in the exclusion list integrated in the loan agreement, under the risk of having the loan recalled.

3. Monitoring and Disclosure of ESG risks. The investee’s ESG and impact performance is regularly reassessed throughout the investment cycle as part of the standard monitoring process. Along with operational and financial data, our investees also regularly share ESG and impact data that feed our reporting to external stakeholders, which reflects our commitment to transparency and accountability.

ESG Evaluation Tool: Exploring the Practical Application of ESG Evaluation in Financal Inclusion

At EQ, we firmly believe that staff commitment and training are vital components of an effective ESG Framework. To achieve this, we incorporate the ESG framework into our induction program, ensuring that every newly hired staff member, regardless of their role, gains a good understanding of our sustainability principles and practices.

Furthermore, we prioritize ongoing education and awareness by conducting annual refresher sessions. Recognizing the importance of continuous improvement, we expanded our training efforts last year to include internally and externally designed specialized sessions tailored to the needs of specific teams, such as the investment team. These sessions covered essential topics like client protection principles and introduced advanced concepts like ESG rating methodologies. By soliciting feedback from participants, we continuously refine our training programs to ensure they remain relevant and impactful.

The ESG Rating Tool has been developed internally and utilized since the inception of our operations.

Building upon our experience with the tool and in line with the evolution of the ESG framework at our company, we undertook a significant initiative to upgrade our tool in 2023. For example, we expanded the factors related to environmental issues to reflect their increased relevance in the sector and integrated the updated standards for client protection as well as the environmental and social dimensions of corporate governance. In the analysis of results, we incorporated the indicators related to the SDGs targeted for the financial inclusion investment product, aiming to reward investees aligned with our ToC.

The tool underwent a rollout process, beginning with backtesting on a sample of existing investees from various regions. Subsequently, the results were reviewed with the Investment Team to assess the tool’s overall usability and the clarity of its rating descriptions. After incorporating feedback into the tool, we tested it on new investees and launched it for use for all investees.

We plan to conduct annual reviews to evaluate its effectiveness.

The ESG Rating Tool has been developed internally and utilized since the inception of our operations.

Building upon our experience with the tool and in line with the evolution of the ESG framework at our company, we undertook a significant initiative to upgrade our tool in 2023. For example, we expanded the factors related to environmental issues to reflect their increased relevance in the sector and integrated the updated standards for client protection as well as the environmental and social dimensions of corporate governance. In the analysis of results, we incorporated the indicators related to the SDGs targeted for the financial inclusion investment product, aiming to reward investees aligned with our ToC.

The tool underwent a rollout process, beginning with backtesting on a sample of existing investees from various regions. Subsequently, the results were reviewed with the Investment Team to assess the tool’s overall usability and the clarity of its rating descriptions. After incorporating feedback into the tool, we tested it on new investees and launched it for use for all investees.

We plan to conduct annual reviews to evaluate its effectiveness.

DIALOGUE ON SFDR

While the ESG framework has always been ingrained in our organizational DNA, it’s crucial to ensure that our framework aligns with regulatory standards and evolves accordingly.

Our funds are fully aligned with the Article 9 requirements of the Sustainable Finance Disclosure Regulation (SFDR). Introduced as part of the European Union’sconcerted effort to address environmental and social concerns within financial markets, SFDR Article 9 mandates transparency and disclosure regarding sustainability matters. Enacted to mitigate greenwashing and enhance investor confidence, this regulation compels financial market participants to integrate sustainability considerations into their investment decision-making processes.

Board Member and Executive Management Christoph Dreher possesses extensive expertise in navigating regulatory frameworks within the context of impact investments. He is regularly invited to participate in events such as the LuxFlag Sustainable Investment Week, where he leads discussion panels on sustainable finance. In the following discussion, Christoph addresses questions posed by the CMS Funds Group in Luxembourg on how the fund sector has been affected by SFDR9.

What is the main difficulty faced with the implementation of SFDR to an impact fund (especially investing in micro finance)?

The introduction of the SFDR represents a significant stride towards equipping stakeholders with standardized and comparable ESG information. However, navigating the complexities of this regulation is not without challenges. The challenges inherent in SFDR9’s reporting mandates are extensive and specific, presenting a formidable task for impact funds due to the granularity of data required. The biggest and most relevant challenge is data availability to meet regulatory requirements.

Securing accurate ESG data in a timely and dependable manner will, especially in the initial stages, pose complexities. This is primarily because such information has not traditionally been as accessible or subject to the stringent checks that financial data undergoes. The difficulties in data accessibility also come from the nature of private credit borrowers themselves.

Given they are often smaller-scale, non-listed companies, there have been some constraints to estimate the scope and the quality of data available to the lenders. In many instances, data providers find it challenging to furnish precise estimates for alternative assets that align with SFDR specifications. Additionally, data collection in emerging countries has its own set of unique challenges.

Microfinance, with its context-centric nature, exemplifies the challenges of numerically representing impact. Crafting a framework for impact investing is essential to navigate these complexities. As a result of these challenges, measurement standards for social and governance indicators need further development. Furthermore, due to the nuanced and intricate nature of some indicators, especially those related to Principle Adverse Impact (PAI), there’s often a need to resort to proxy measures, which might not always capture the full essence of the indicator in question.

How to address the reporting requirement and data collection?

Two years ago, Enabling Qapital (EQ) identified one of the pivotal challenges in private debt: data sourcing. When investing in microfinance institutions, which often resemble small to mid-cap companies, accessing managerial insights can prove more challenging than it is for equity investments. Moreover, many of these institutions might not internally track the kind of data mandated by regulations. To counteract this, we adopted a proactive approach. We dispatched questionnaires to our portfolio companies well in advance – aware that setting up robust reporting mechanisms might take them a year or more. The rationale was simple: it’s always better to start early.

Our initial foray, however, wasn’t without its challenges. The preliminary round revealed that sourcing certain data points was a complex task, and many microfinance institutions (MFIs) faced difficulties in establishing comprehensive reporting. Additionally, there were instances of discrepancies in understanding the regulatory definitions, resulting in data that required meticulous quality checks. This feedback was instrumental in refining our data collection tools. Our revised questionnaires were better tailored to the realities on the ground. Simultaneously, we began exploring data modelling as a complementary approach for cases where direct data remained elusive. For instance, models became instrumental in approximating the carbon footprint of companies based on size, loan portfolio, and sector specifics. Collaborating with the Impact Institute and Joint Impact Model bolstered our efforts in this direction.

Another dimension to this challenge is the stipulation of Article 9 funds. Such funds must evidence their investments in entities driving tangible environmental and/or social impacts. This becomes particularly challenging for microfinance funds, especially with the current ambiguity surrounding the social taxonomy, which, disappointingly, has faced delays without a defined roadmap.

However, proving “impact” is a cornerstone for Article 9 funds. Recognizing this, EQ has meticulously crafted a Theory of Change (TOC) for each product in our portfolio, ensuring our commitment to genuine impact remains transparent and demonstrable. To foster a more standardized approach, collaboration within associations is pivotal. By banding together, industry participants can champion market standards that are harmonized and resonate with the ethos of SFDR. Such collaborative efforts will be crucial in the coming years as we seek to refine and evolve the framework in harmony with the spirit of SFDR.

Do you think that SFDR is suitable for impact funds (especially investing in microfinance) and if not, what should be changed in the SFDR requirements in that respect?

SFDR emerged primarily as an instrument to counter greenwashing and social washing, a phenomenon where investments are misleadingly portrayed as environmentally friendly and socially responsible without genuine sustainable impact. Its foundational intent was not to serve as a definitive stamp of sustainable authenticity. Rather, SFDR aimed to ensure that investment managers marketing ESG-friendly funds were transparent about their offerings. This transparency would equip investors with the requisite information, allowing them to discern genuine sustainable investments from mere marketing facades and thereby make informed decisions.

However, the industry’s response has been intriguingly divergent from the SFDR’s foundational intent. A notable section of institutional investors has co-opted the SFDR as a sort of labelling mechanism. This seems to be driven by the convenience it offers in fund selection. That is definitely one part, that in my mind is not very useful for the industry and also does not do justice to microfinance funds. The definition of “impact” is currently being used in an inflationary way. The differences between the various frameworks the providers use highlight the clear challenges in defining impact investing.

Microfinance funds also face a distinct set of challenges in this evolving ecosystem. The absence of a comprehensive social taxonomy poses significant hurdles, especially when defining and demonstrating their unique focus of impact. And of course, as mentioned above, a recurring concern is the data challenge. Many reporting requirements mandate data that either doesn’t exist or is challenging to obtain, especially from companies in emerging markets. Ensuring the reliability and authenticity of such data further compounds the challenge.

Lastly, it’s prudent to anticipate evolutions in the SFDR9 landscape. Presently, the regulatory emphasis seems to be pivoting towards the tangible demonstration of impact. As I would say the journey is still in its nascent stage, and it underscores the importance of staying agile and responsive to such shifts, ensuring that our approach remains both compliant and effective in reflecting true ESG impacts.

Acknowledgment: With sincere appreciation to CMS law firm for sparking this conversation. Their expertise in legal matters concerning finance, coupled

with our collaborative effort, has facilitated an exchange of insights and expertise crucial for addressing the challenges posed by the Sustainable Finance

Disclosure Regulation (SFDR). Watch the interview: https://cms.law/en/int/insight/sustainable-investment/funds-esg-client-interviews

IMPACT

MEASURING OUTCOMES AND IMPACT

INVESTMENT FOCUSED DIMENSION OF OUR SUSTAINABILITY STRATEGY

EMPOWERING IMPACT INVESTMENT

THE TOC APPROACH

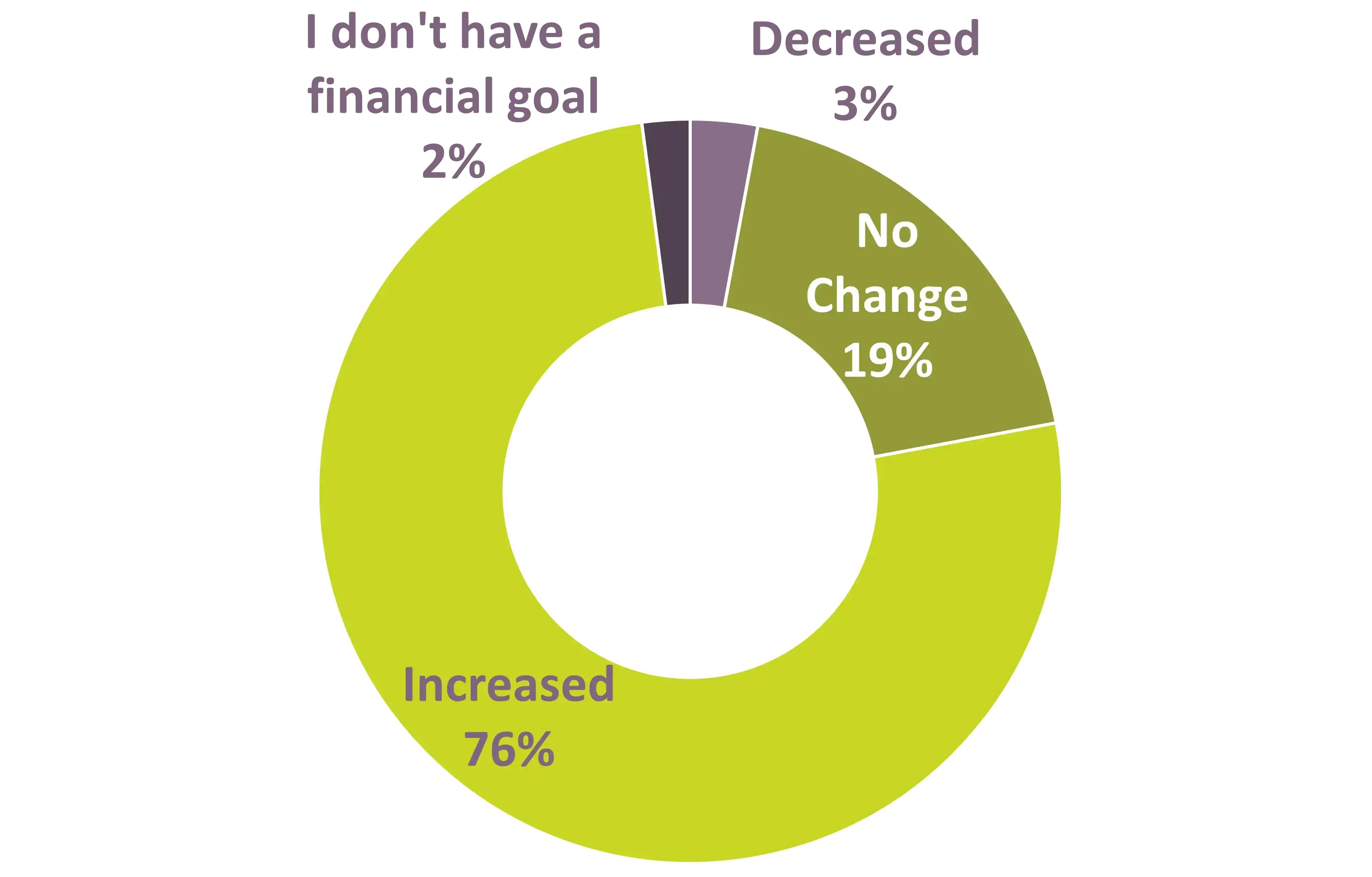

EQ was established with a clear mission and vision in mind: move money to meaning in a world where investments empower people and embrace the planet. But how can we be intentional in targeting positive outputs and outcomes in our investment areas? How do we know whether our investments contribute to the achievement of the SDGs and when to make strategic changes if they don’t?

Starting from these questions, we have adopted a powerful tool known as a Theory of Change or ToC to guide our sustainability strategy. A ToC serves as a narrative framework that delineates our approach to addressing targeted issues. While the components of a theory of change may vary, it typically includes several key elements. Firstly, it articulates the specific issues or challenges that our investment strategy seeks to address. Secondly, it outlines the activities or interventions we will undertake to confront these issues. Thirdly, it maps out the immediate outputs as well as outcomes and long-term desired impact we aim to achieve through our efforts. Lastly, it transparently presents the assumptions underlying our strategy and acknowledges potential challenges in its implementation. Below, we have provided a graphical representation of the elements utilized in our ToC to facilitate a clearer understanding of our approach.

At EQ, we have adhered to the best practices by collaboratively developing our ToCs in partnership with various teams across the company. One ToC pertains to the company level, illustrating our overarching approach to articulating our vision and mission, managing internal ESG risks and guiding our investment strategies. Additionally, we have a customized ToC for each specific investment product, ensuring alignment with our objectives. These theories align with the UN SDGs to serve as our long-term impact targets.

We have defined clear and measurable targets and use them to monitor the implementation of our ToC and its relevance. To track the achievement of these targets, we directly collect data from our investees through various channels. We rely on our original and follow-up ESG Ratings, which are derived from the investee’s data and the findings of our Investment Team. Additionally, we conduct monthly monitoring and annual performance reviews. In addition to this investee data, we also gather borrower stories to gain qualitative insights into the impact of our investments. Furthermore, we actively explore methods to monitor the impact of our investments on end-users with external parties as described in the next pages.

In this section, we will present our ToC at the EQ level and segments of theories of change relevant to each investment area. For the complete ToCs, please refer to the annex to the report. Furthermore, we will demonstrate examples of how our investments in financial inclusion and clean cooking contribute to achieving several SDGs.

EQ'S ToC

EQ strives to support all SDGs with its products

FINANCIAL INCLUSION

OVERVIEW OF TOC FOR FINANCIAL INCLUSION

Problem Addressed:

- Financial Inclusion Gap: Approximately 1.4 billion adults, particularly women, rural populations, and young people, remain unbanked.

- MSME Financing Needs: 41% of MSMEs in developing countries have unmet financing needs, with a finance gap of around $5 trillion.

- Climate Change Impact: Developing countries, most affected by climate change, face challenges, including agricultural households bearing the entire financial burden of weather-related disasters.

- Investment Alignment with SDGs: Investors seeking opportunities to contribute to the achievement of Sustainable Development Goals (SDGs).

Who Benefits:

- Individuals and Households: Access to financial and non-financial services, improved housing, education, healthcare, and energy-efficient solutions.

- Financial Institutions (FIs): Improved visibility, ESG compliance, and access to funding for providing services to underserved populations.

- Enterprises: Enhanced sustainability, job creation, economic development, and implementation of green solutions.

- Inclusive Finance Fund: Resilient and constant growth, attracting more capital to support investees in emerging markets.

How Big is the Impact:

- Immediate Impact: Access to financial and non-financial services for vulnerable populations, improved visibility for FIs, and innovative financial solutions for risk mitigation.

- Medium to Long-Term Impact: Resilience to economic shocks, job creation, economic development, improved living conditions, and growth of the inclusive finance fund.

Contribution to Impact:

- Financial Support: Offering senior or subordinated debt in local and foreign currencies to FIs, supporting growth and access to financial services.

- ESG Integration: Promoting the adoption of ESG principles and SDGs, ensuring the importance of gender-diverse teams and other sustainability factors.

- Innovative Solutions: Partnering with international stakeholders to offer innovative solutions supporting the achievement of SDGs.

- Investment Management: Structuring, marketing, managing, and investing debt in inclusive finance in emerging countries.

Challenges:

- Data Collection: FIs may lack resources or capacity to collect and report data required for monitoring medium and long-term goals.

- ESG Implementation: Underserved populations and enterprises may lack capacity and resources to fully implement ESG principles, and strict standards may increase inequality in access to financial services.

- imited Data Availability: Limited availability of public data on outputs and outcomes for benchmarking and comparison of results.

CLEAN COOKING

OVERVIEW OF TOC FOR CLEAN COOKING

Problem Addressed:

Addressing the widespread issue of inadequate access to clean and modern cooking solutions in Sub-Saharan Africa.

- Access to Clean Cooking Solutions: 900 million people lack access to clean and modern cooking solutions.

- Social, Environmental, and Economic Costs: Over $300 Billion per year in costs imposed on individuals and society.

- Health Impact: 700,000 premature deaths per year resulting from household air pollution.

- Fragmented Sector: The cooking energy sector is fragmented, with many small and unprofitable companies.

- Financial Barriers: Companies and consumers lack financial resources for R&D, raw materials, inventory, and upfront costs associated with adopting clean cooking technologies.

Who Benefits:

- Individuals: A larger number of individuals will be able to purchase and adopt clean and modern cooking solutions.

- Companies: The fund supports growth in various sectors, leading to increased revenue and financial sustainability.

- Society: Better and more affordable products are developed, improving lives and creating social and environmental impacts.

- Governments: Enhanced ability to meet climate goals through fuel efficiency and fuel switching.

How Big is the Impact:

- Immediate Impact: Reduction in household air pollution, burns, and physical ailments due to improved cooking solutions.

- Environmental Impact: Reduction in GHG emissions, deforestation, and forest degradation.

- Social Impact: Improved health, employment opportunities for women, and decreased vulnerability to climate change.

- Economic Impact: Reduction in poverty due to decreased expenditures on cooking fuels.

Contribution to Impact:

- Financial Support: Providing capital through short-term debt facilities, long-term mezzanine facilities, and grants.

- Strategic Investments: Making strategic acquisitions to complement organic growth.

- Technical Assistance: Offering technical assistance to enhance the impact of investments.

- Environmental & Social Due Diligence: Ensuring alignment with E&S best practices.

SDG PERFORMANCE UPDATE

MEASURING OUR CONTRIBUTION TO THE UN SDGS

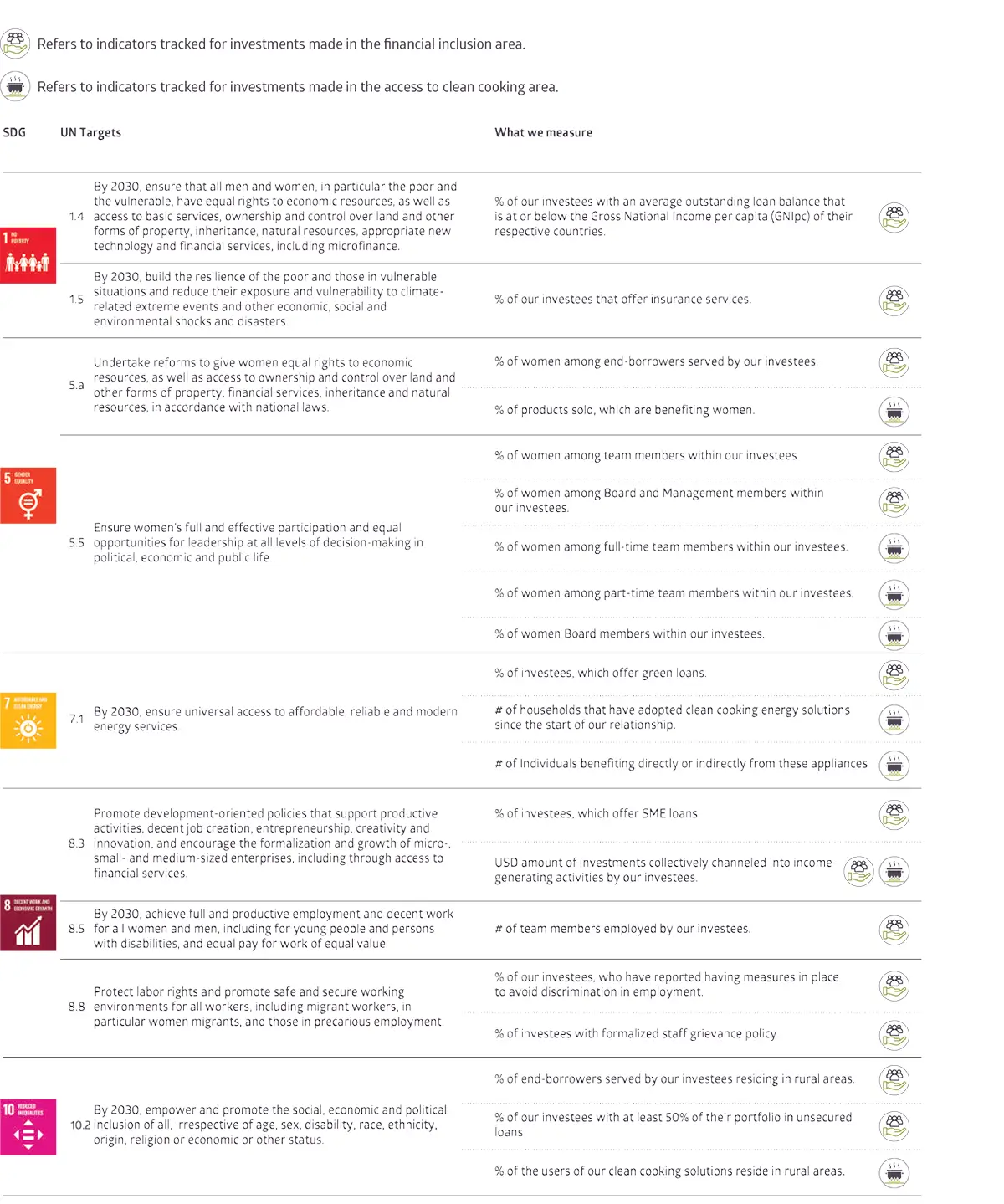

In this section, we show how financial inclusion and access to clean cooking contribute to selected UN SDGs. For this report we focus on five SDGs we target, with plans to address additional SDGs in future social media, website publications, and reports.

We begin with an overview of internal statistics mapped to the UN SDGs and their targets. The table on the right shows metrics we track internally in each of our investment areas.

In addition to internal data, we are consistently exploring opportunities to understand the impacts these services have on the lives of endborrowers and end-users. Given that our investments in access to clean cooking are still at an early stage, in 2023 we decided to prioritize the financial inclusion sector and participated in the 60 Decibels Microfinance Index. The forthcoming section will present an overview of the 60 Decibels initiative, highlighting our investee sample, the profiles of surveyed borrowers, and the various dimensions of their lives explored through the survey questions. Then, we guide you through each SDG displayed in the table, explaining how our metrics align with UN targets. We present our internal data, survey results, and borrower stories to illustrate our impact.

MAPPING INDICATORS TO SDGs

USING INTERNAL STATISTICS

PARTNERING WITH 60 DECIBELS

HOW EQ APPROACHES INVESTMENTS

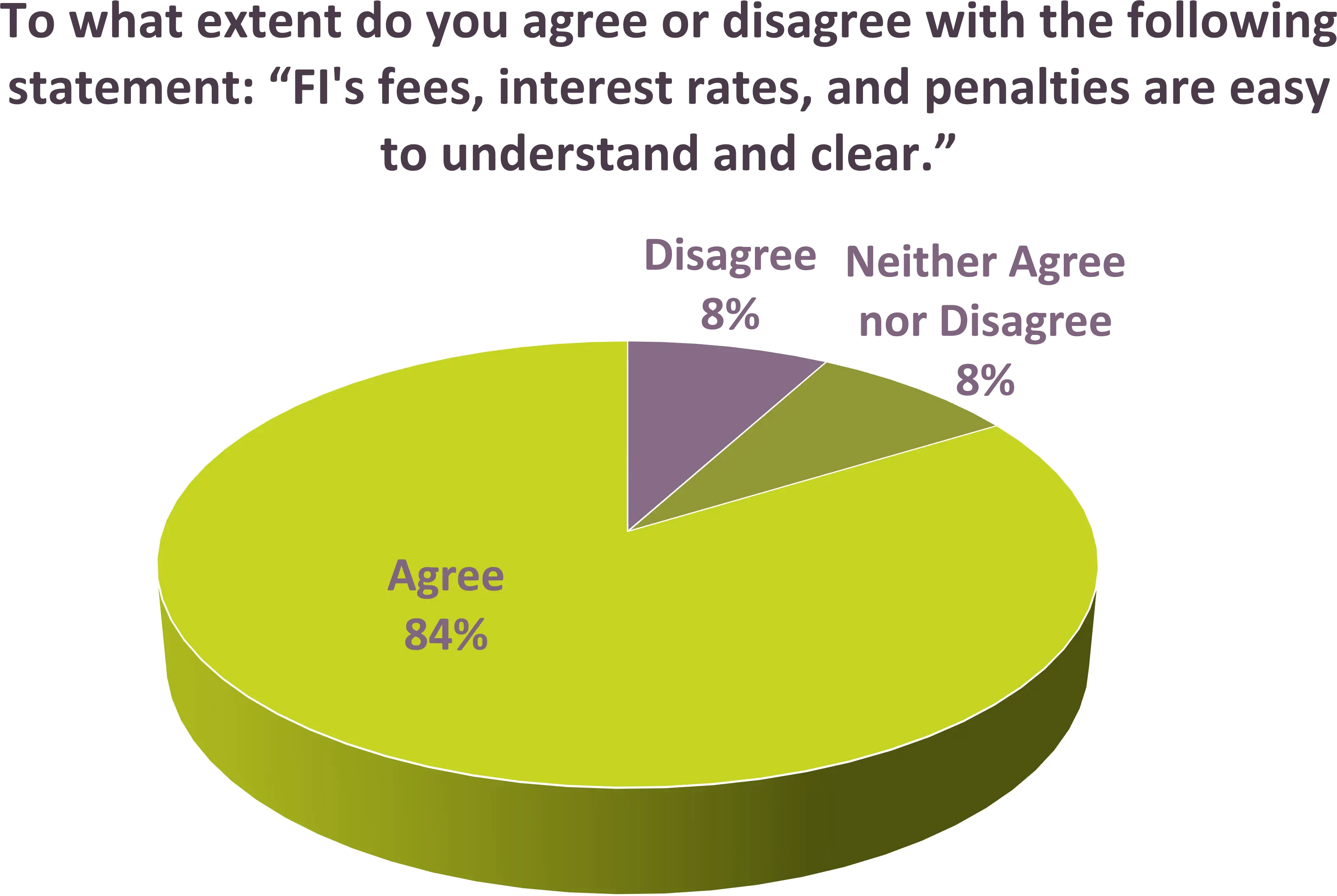

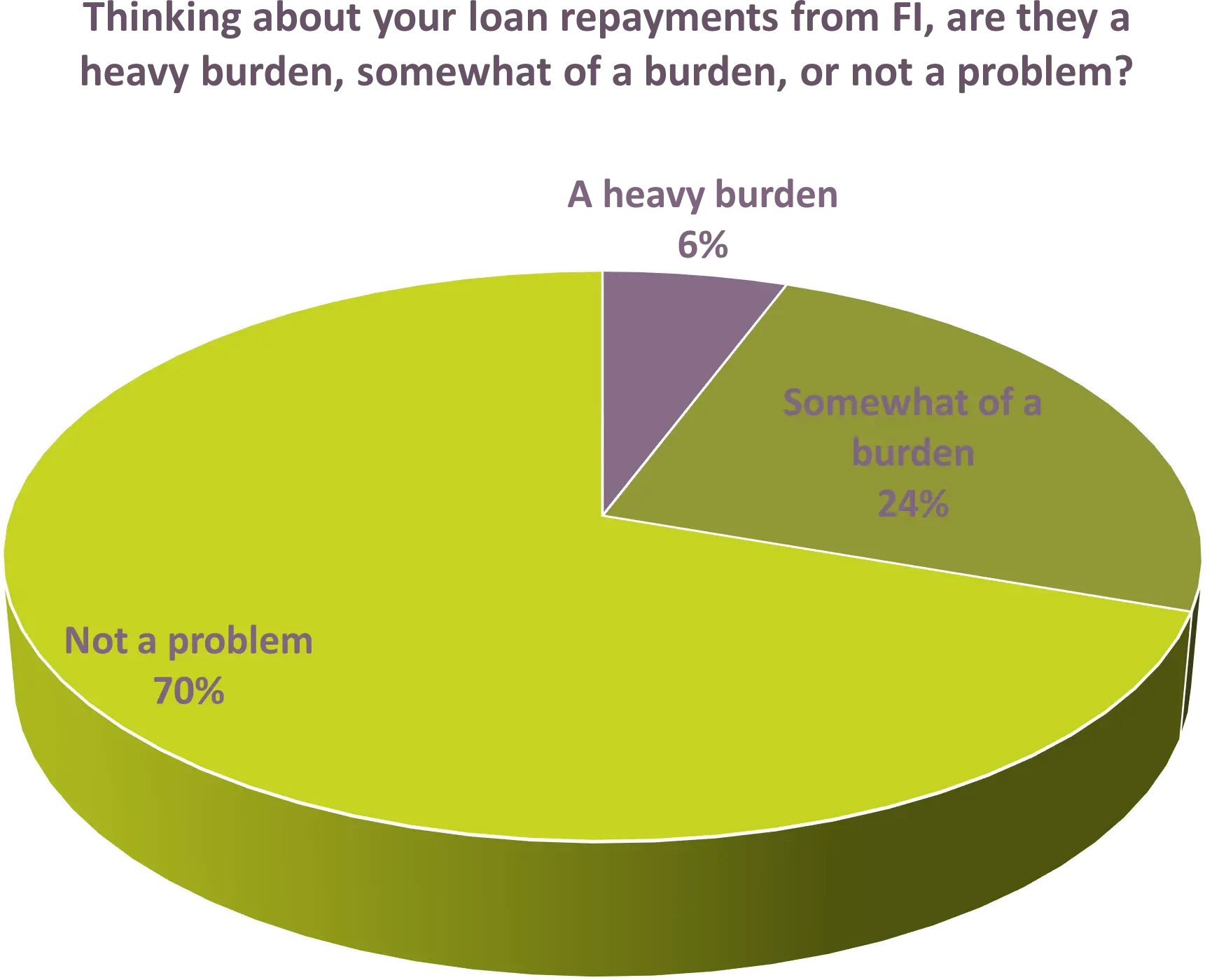

The 60 Decibels initiative specializes in providing impact data for the financial inclusion industry, driven entirely by the voices of borrowers. Despite the presence of certain methodological challenges in ensuring an unbiased sample selection and the potential limitations of surveys conducted via phone, participation in the Index provided valuable insights into whether our investments are leading to positive social outcomes for borrowers across various dimensions including business and quality of life. In the next section, we demonstrate how the survey results relate to the SDGs we track. Presented below are details on the 60 Decibels sample.

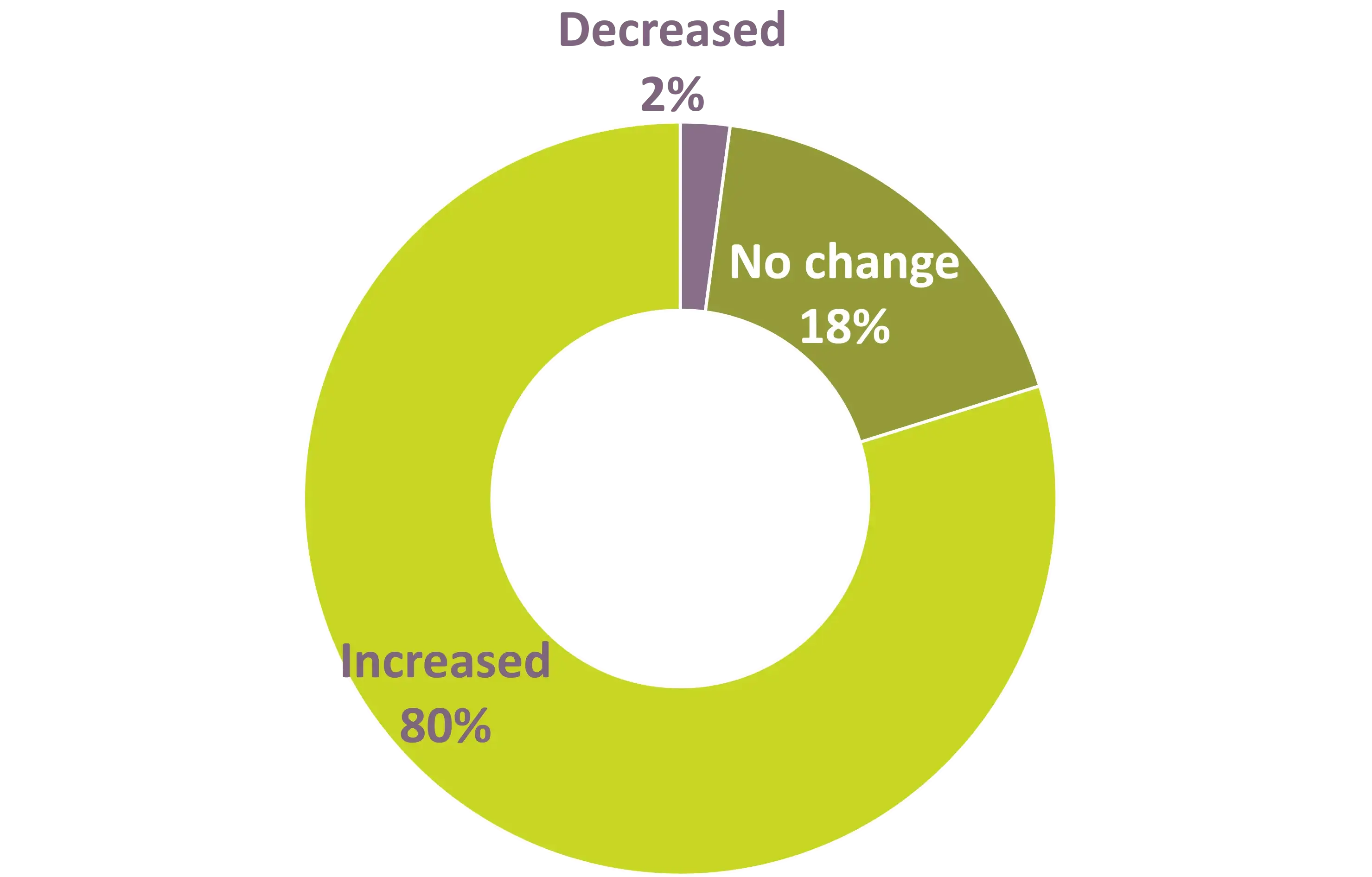

We have aligned specific survey questions with the UN SDGs we track to evaluate our impact on end-borrowers. We transparently present borrowers’ opinions regarding changes in their lives attributed to the MFI. To enhance visual clarity, we’ve simplified the five-answer scale used by 60 Decibels to a three-answer scale.

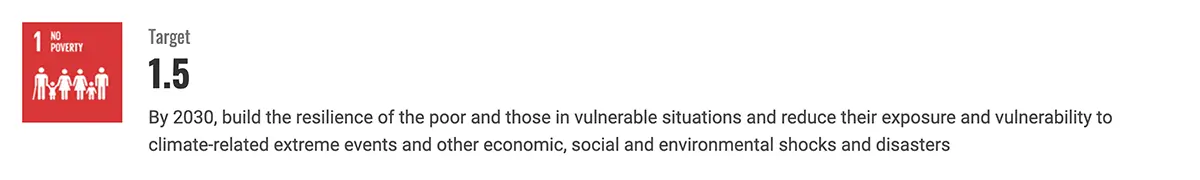

SDG 1

End poverty in all its forms everywhere

We strategically invest in diverse entities within the financial inclusion sector, addressing the financing needs of underserved populations and businesses. To ensure alignment with SDG 1, we monitor our impact by tracking the proportion of our investees offering microfinance loans, as per Target 1.4. We recognize that the size of microloans varies significantly across countries, depending on the economic scale and we have established a measurement methodology accordingly. We use gross national income (GNI) per capita as our benchmark and track investees whose average loan size does not exceed 250% of the GNI per capita. This approach ensures a contextualized assessment of our investments channeled to microfinance institutions, which are primary champions of filling in financial gaps of low-income population.

The analysis of the average outstanding loan size of our investees shows that over 60% of our investees offer loans at or below GNI per capita, which would be small loans in their respective economies and would translate to slightly over USD 1,200 in the Kyrgyz Republic or USD 2,000 in Paraguay.

Over 60% of our clients extend loans at or below their country’s Gross National Income per capita

![]()

Financial resilience embodies an individual’s capability to confront and overcome financial shocks encountered throughout life’s journey. Resilience building is notably more challenging for low-income population groups. Typically, these groups lack savings, access to insurance, or the ability to rely on their social networks for support. Moreover, systemic challenges such as inadequate infrastructure and limited access to essential services exacerbate their vulnerabilities further.

66% of the financial institutions we collaborate with provide insurance services enabling access to insurance services for 13,200,000 borrowers

![]()

Internally, we track how we enable access to insurance through our investments.

Insurance serves as a core instrument in building resilience against financial shocks, yet its availability remains limited in emerging countries. Consequently, the population lacks awareness of how to effectively utilize insurance for financial planning.

Financial institutions authorized by regulators to offer insurance play a crucial role in addressing this gap. They provide a range of relevant insurance services, including micro-insurance and traditional options such as car and real estate coverage, as well as agricultural, credit-health, or credit-life insurance. Additionally, these institutions serve as primary educators for borrowers, introducing them to the concept of insurance and explaining its functionalities. This educational aspect is essential for increasing awareness and understanding among borrowers about the benefits of insurance and its role in financial protection.

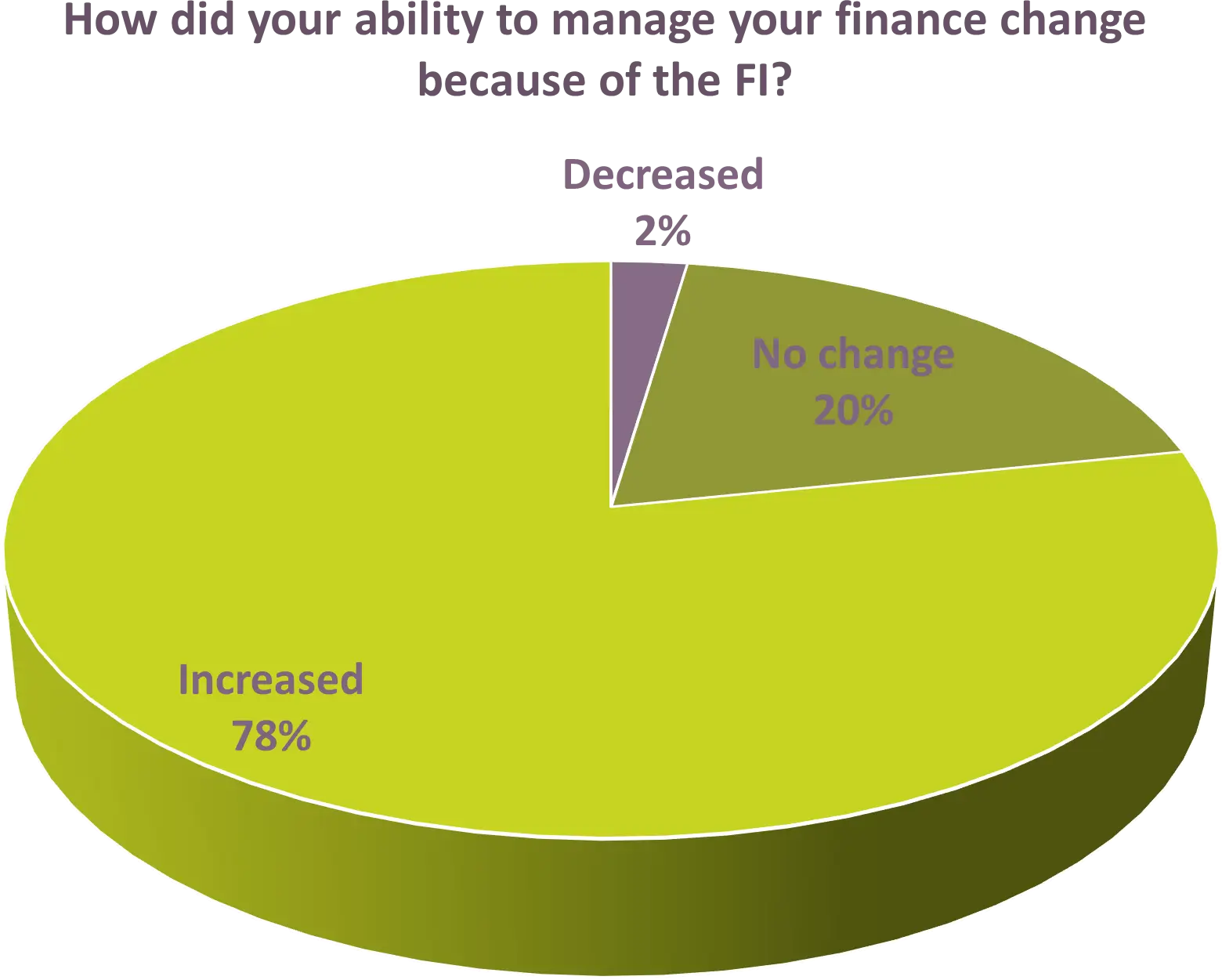

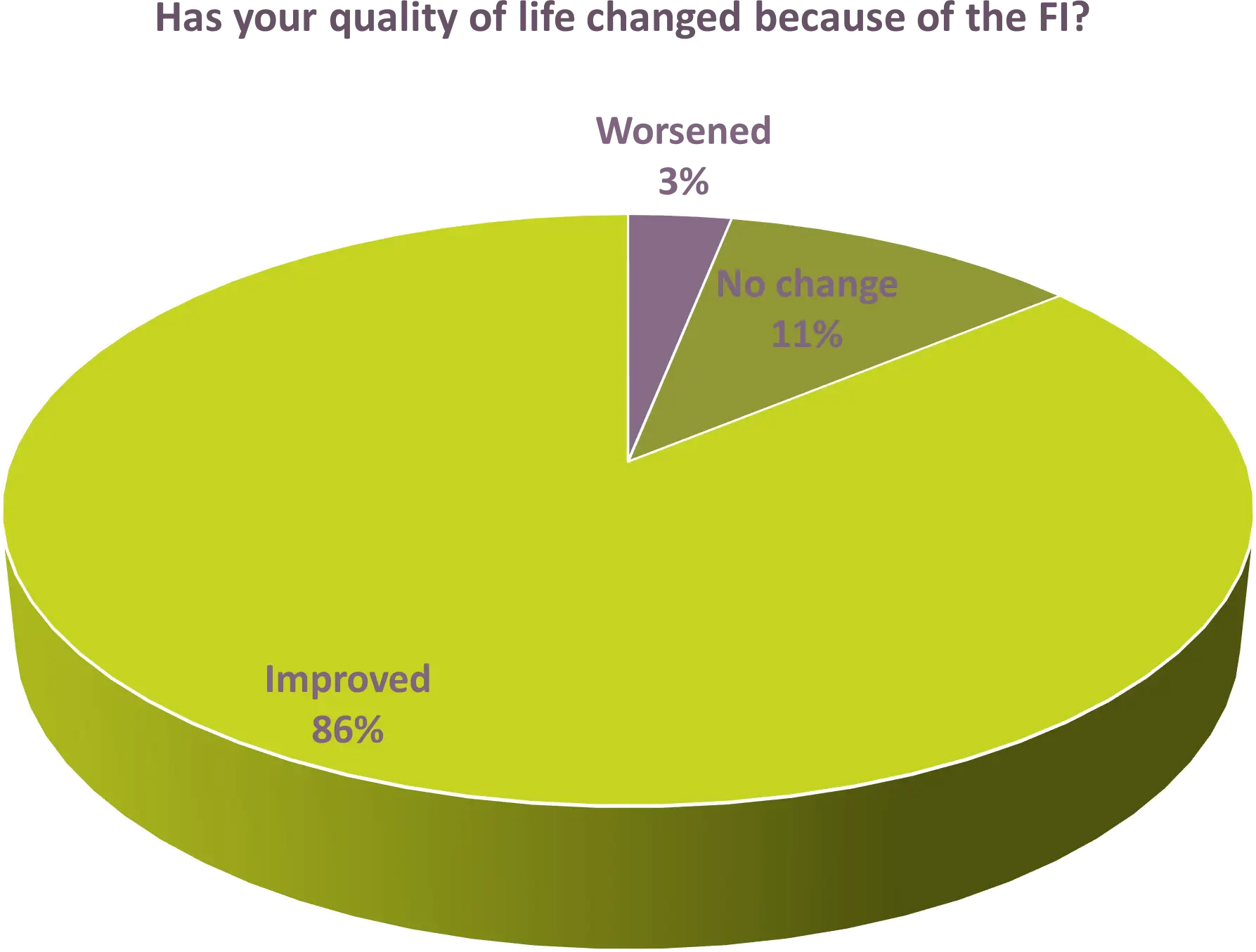

Financial inclusion plays a crucial role in resilience building, not only through the provision of insurance services but also by offering opportunities to mitigate shocks, diversify revenue sources, and improve the ability to make savings. Below, we showcase the impact of financial inclusion on resilience from the perspective of borrowers, using specific questions from the 60 Decibels survey. Later on, you will find a borrower story illustrating how cooperation with the financial institution has helped diversify her revenue base, which also positively contributes to the resilience of the lowincome population against financial shocks.

![]()

Financial inclusion enhances resilience by improving borrowers’ financial planning skills and providing immediate funding for various needs. Financial institutions often offer the first loan to underbanked populations, guiding borrowers through income and expense tracking and emphasizing the importance of insurance, savings and financial discipline. Additionally, they provide diverse loan products to help borrowers cope with business and financial shocks, such as funding for crop replacement after natural disasters or seasonal inventory purchases for shops. These initiatives empower borrowers to navigate challenges effectively and build financial resilience. During the 60 Decibels survey, a prevailing majority of borrowers (78%) said that their ability to manage finance has either slightly or very much improved in the course of cooperation with their financial institution. Of importance is that there was even a higher share of women reporting this positive change (82% of women vs 71% of men).

![]()

The large majority of respondents reported experiencing positive changes in the quality of their lives as a result of their collaboration with the financial institution.

When I needed additional venture capital to increase the stock of my selling items during peak season (religious holiday and new year eve), Bina Artha Loans were extremely helpful. As a resutl, I may have exceeded my income sales because my inventory is sufficient to meet high demand and could use the money for my monthly household saving and next tier (yearly) on business investment.

![]()

Financial institutions play a crucial role in enhancing borrowers’ ability to save through various means, including financial literacy training, positively impacting the diversification and amount of their income, and offering easier ways to save.

While traditional banks offer savings services, low-income populations often struggle to benefit from them due to barriers such as inability to meet minimum balance requirements, inability to afford account fees, or feeling intimidated by traditional banking processes. In contrast, microfinance institutions that provide savings services bridge this gap by keeping minimum initial deposit requirements low and simplifying the savings process by offering both lending and savings services in one place. The results from the 60 Decibels survey corroborate this, with over half (62%) of respondents reporting a positive impact of their collaboration with the financial institution on their ability to save.

![]()

![]()

In recent years, countries worldwide have experienced significant shocks such as the COVID-19 pandemic, geopolitical conflicts, and high inflation rates. Emerging countries are disproportionately affected by these shocks as they face higher relative levels of risk and economic impact. Moreover, the effects are not experienced equally by the affected population. Poor and low-income people suffer more, in relative terms, the adverse effects of these shocks than the average population.

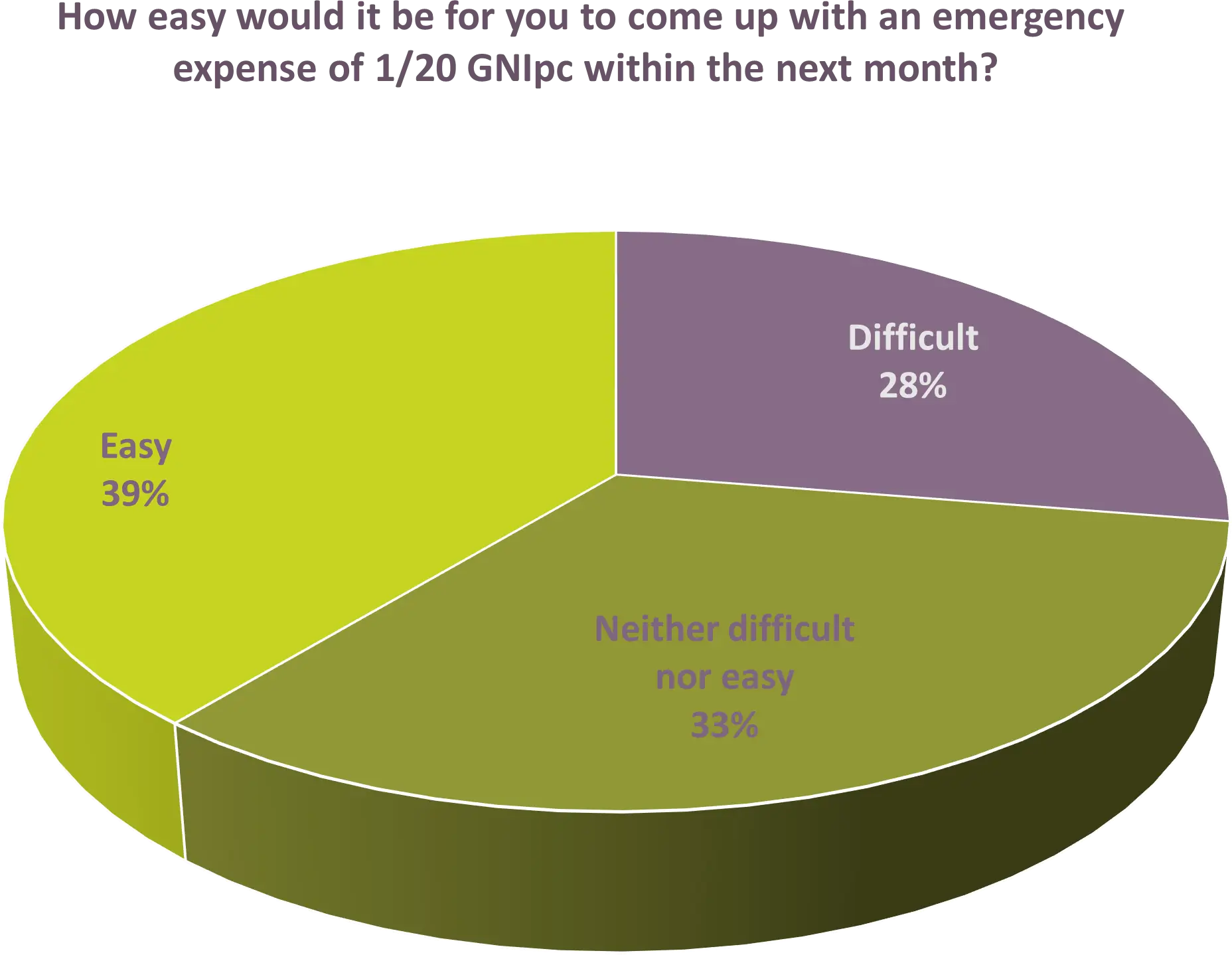

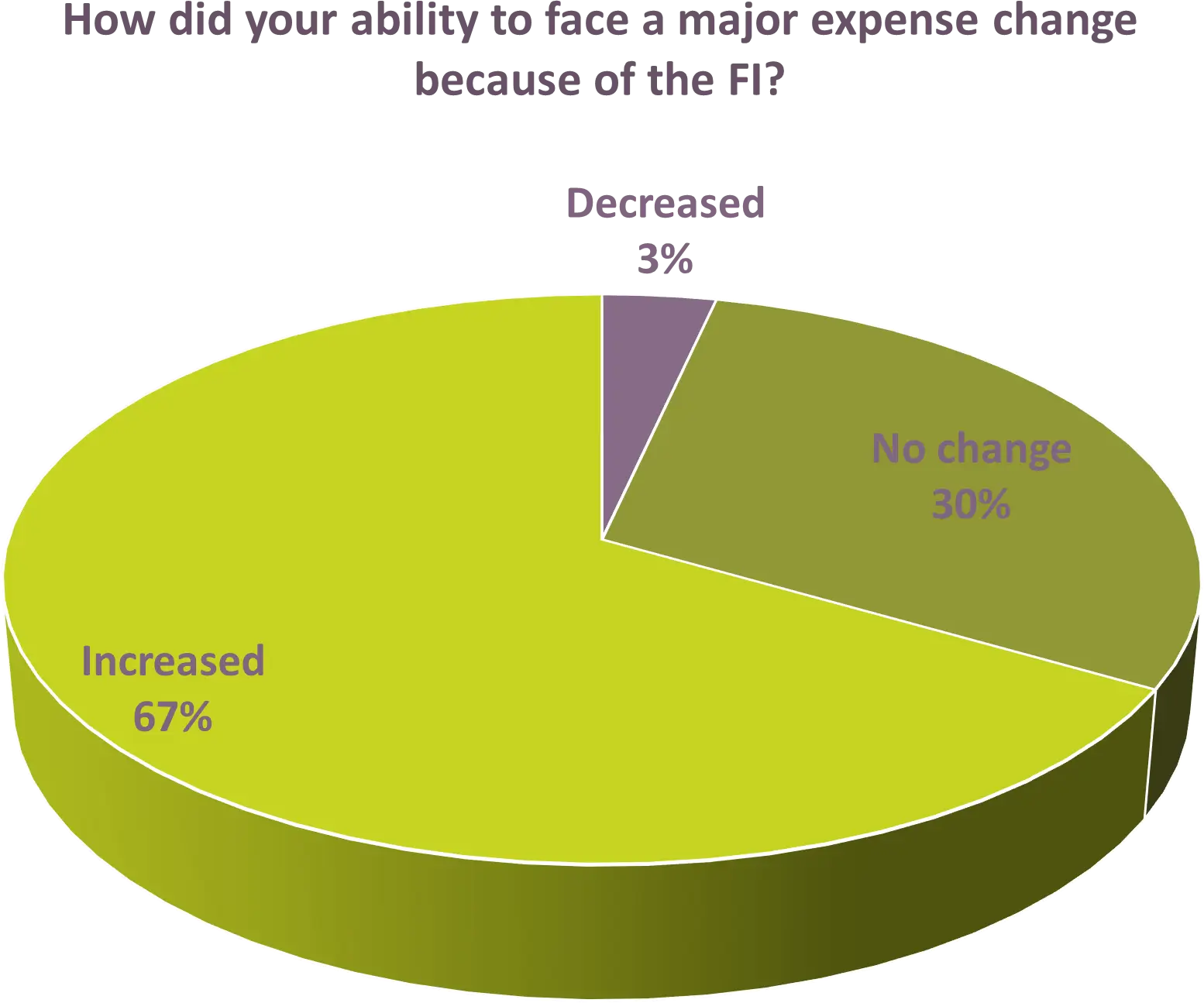

Despite these major shocks, it was encouraging to see that over 70% of borrowers reported being able to cover emergency expenses, with 41% finding it easy to do so.

The majority of borrowers (67%) reported a positive impact of their cooperation with the MFI on their ability to cover emergency expenses. Further analysis revealed that among the 27% who found covering emergency expenses challenging in the next month, 50% reported an improvement in their ability to meet such expenses. This indicates a positive trend and suggests progress in building resilience among these borrowers. However, it is clear that additional time and effort will be necessary to assist these borrowers in establishing a safety cushion.

Geographical Essentials

- Country: Kenya

- Capital: Nairobi

- Population: 55,830,306* (*as of Friday, March 1, 2024, based on Worldometer elaboration of the latest United Nations data).

- Kenya population is equivalent to 0.68% of the total world population*.

- Kenya ranks number 26 in the list of countries (and dependencies) by population.

- 30.7 % of the population is urban*

- The median age in Kenya is 19.6 years

- GNI per capita: 2,170 (data source: World Bank, 2022)

- Language: Swahili and English

- Currency: Kenyan Shilling

Financial Institution Spotlight

- Name: Yehu Microfinance Services Limited

- Founding year: 1998

- Mission: Empowering rural communities through access to innovative, affordable, and sustainable financial solutions in a socially responsible manner.

- Target client: small business

- Branches: 16

- Number of borrowers: 38,324

- 81% of Rural Borrowers

- 73% of Women Borrowers

- Asset size (USD): 13,836,152

- Average Loan size (USD): 152

Anna began her journey with Yehu in 2018 with a modest loan of KES 30,000 / USD 300 for a small business. Through successful cooperation, she gained eligibility for larger loans, nearly tripling her borrowing in 2019 and further expanding in 2020 with investments in livestock and land. Subsequent loans facilitated ventures into a motorbike business and M-PESA registration—a mobile phone-based money transfer and microfinancing service. Her latest loan amounted to KES 150,000 / USD 1,340. Anna’s story highlights how access to even a small loan can empower borrowers to steadily increase their income and diversify revenue streams, ultimately enhancing their resilience.

SDG 5

Achieve gender equality and empower all women and girls

Another outcome of our investments is supporting companies that often serve as the first formal employers for recent female graduates entering the financial sector. As impact investors, we encourage these companies to demonstrate responsible staff treatment and to offer training, equitable career development opportunities, and avenues for growth for their employees.

Staff

41%

39%

of women among team members or within our investees

46%

of part-time team members of our investees are women

Ownership & Decision Making

23%

27%

of Board members are women within our investees

23%

of Top Management Members are women within our investees

21%

of all shareholders are womens

![]()

7 out of 10 of our end-borrowers served by our investees are women. Our investees collectively provide access to financial services to over 10,000,000 women

Financial inclusion holds significant potential for advancing SDG 5, as access to financial services fosters the development of women entrepreneurship, improves quality of life, and facilitates swift access to funding for health, education, and other essential needs. Access to funding not only promotes economic independence for women but also contributes to their social empowerment by enhancing self-confidence and providing opportunities for greater participation in household decision-making.

![]()

89% of products sold by our investees are benefiting women

Clean cooking solutions primarily target women, aiming to mitigate the health risks they face by offering cooking stoves that emit fewer harmful emissions. These solutions also seek to enhance women’s quality of life by providing more efficient stoves that cook faster, thereby freeing up their time.

Furthermore, continuous innovation in clean cooking technology aims to increase energy efficiency, leading to additional cost savings for women and their households.

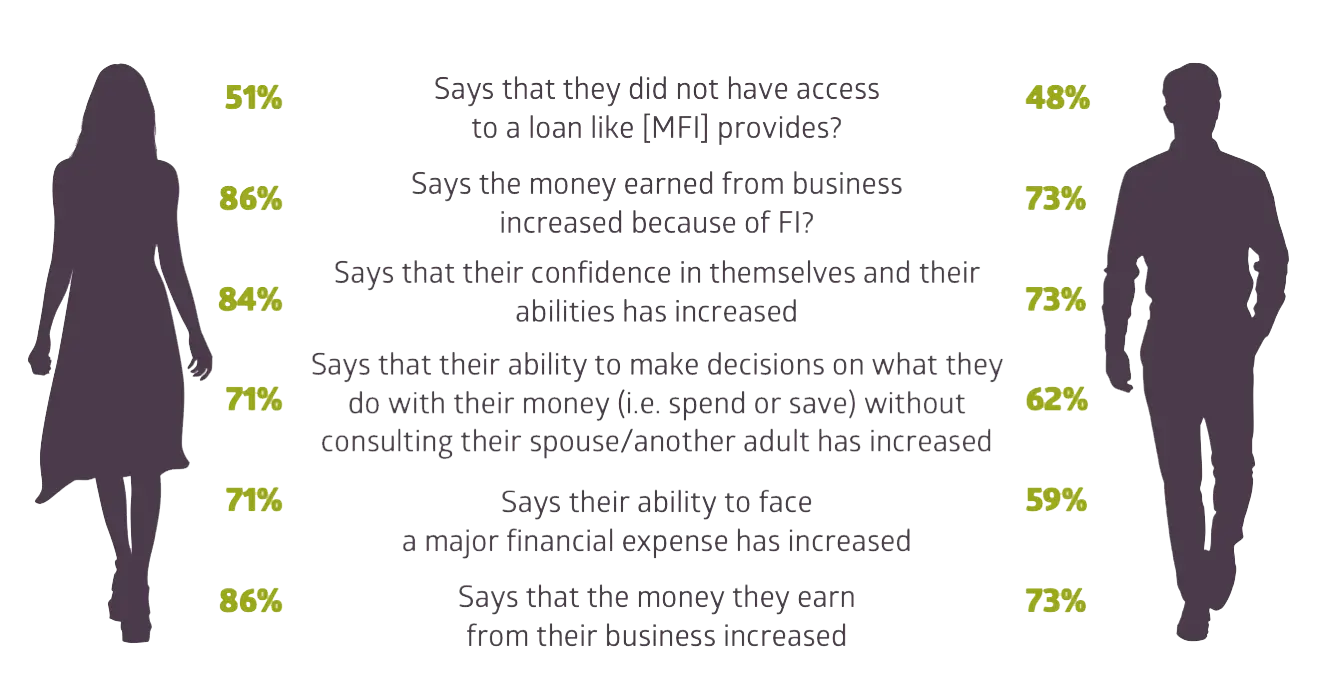

Below, we show the impact of loans on the lives of borrowers from a gender perspective. To achieve this, we analyzed the differences in the share of women and men making positive references to changes in their lives as a result of cooperation with the financial institution. Presented below are some of the analyzed areas that either exhibited significant differences between genders or were not covered in the SDGs later on. Next, we present a borrower story that offers further illustration of how financial inclusion contributes to women’s empowerment.

60 Decibels data suggest that both men and women borrowers attribute positive changes in their lives to their collaboration with financial partners. It’s worth noting that a slightly larger proportion of women borrowers indicated they had lower access to loans similar to those provided by their Microfinance Institutions before. This difference might explain why there’s a higher proportion of women experiencing a more positive impact from these loans, as women had lower access to such resources before. The data also suggests that women benefit not only economically but also socially, gaining greater autonomy in managing their finances and growing more confident in their abilities.

These findings underscore the importance of ongoing efforts to ensure financial inclusion and support women entrepreneurship. Recognizing the transformative potential of empowering women through access to small loans, we can foster greater economic and social empowerment for women globally.

Geographical Essentials

- Country: Indonesia

- Capital: Jakarta

- Population: 279,259,648* (*as of Friday, Apr 4, 2024, based on Worldometer elaboration of the latest United Nations data).

- Indonesia population is equivalent to 3.45% of the total world population*.

- Indonesia ranks number 4 in the list of countries (and dependencies) by population.

- 59.1 % of the population is urban*

- The median age in Indonesia is 29.9 years

- GNI per capita: 4,580 (data source: World Bank, 2022)

- Language: Indonesian

- Currency: Indonesian Rupiah

Financial Institution Spotlight

- Name: Esta Dana Ventura (EDV)

- Established: 2014

- Mission: Striving for three pillars. Society (Empowering community entrepreneurship to enhance SMEs, fostering welfare, Employees (Ensuring job stability and self-development for improved welfare and quality of life), Shareholders (Securing a strong return on investment to sustain future business continuity).

- Target client: micro and small women entrepreneurs

- Branches: 215

- Number of borrowers: 327,189

- % of Rural Borrowers: 83%

- % of Women Borrowers: 91%

- Asset size (USD): 95,803,108, Average Loan size (USD): 266

In a village in Gunung Sindur, West Java, Mrs. Nuridah, often called Mrs. Nur, and her husband Pak Mahmud faced a challenge when he lost his job in 2022. They had to provide for their family and support their daughter who was about to enter university.

Without giving up, Mrs. Nur decided to utilize her knitting skills to open a knitting bagmaking business after getting a business capital loan and attending training from Esta Dana Ventura.Mrs. Nur’s knitting bag business not only provides additional income for the family, but also empowers other women in their village. With a focus on quality and unique designs, Mrs. Nur’s bags are the center of attention in the village. Mrs. Nur is also active in social interactions in her community, bringing attention to women who feel undervalued in the household.

The success of Mrs. Nur’s business boosted her confidence, and she became involved in family decision-making. The full support of Mr. Mahmud confirms the importance of Mrs. Nur’s role in managing their household and family. Her story inspires other women in the village to contribute to the family economy and decision-making, bringing positive impact to their communities.

SDG 7

Ensure access to affordable, reliable, sustainable and modern energy for all

According to World Health Organization (WHO), over 920 million people in Africa, or approximately 75% of the population, lack access to modern and reliable cooking energy infrastructure and are forced to purchase or gather unhealthy and polluting cooking fuels such as fuelwood, charcoal and kerosene. These fuels are either unaffordable, with some households spending 20-30% of their incomes on charcoal according to data from Local Governments Sustainability Africa, or time consuming, with women spending up to 5 hours per day that could otherwise be used productively.

Through our investments in access to clean cooking, we aim to alleviate these burdens by financing actors across the value chain from production to distribution to retail and consumer finance. This approach enables us to achieve systemic impacts and synergies, reducing production costs via economies of scale, extended geographic coverage in distribution, and enhanced affordability for customers.

Through our investments, we are scaling up the adoption of LPG, biofuels, electric appliances, household-level biogas digesters, and improved efficiency biomass cookstoves. Appliances produced, sold, or financed by our portfolio companies slow forest degradation and deforestation, reduce carbon emissions, save customers money, and empower women. Our partners dedicate meaningful resources towards building research and development capabilities to innovate more user-adapted cooking fuels and appliances, while ensuring affordability for their target customer segments.

2.9 million households have adopted clean cooking energy solutions since the start of our relationships with our portfolio companies. 14.5 million individuals benefit directly or indirectly from these appliances as a result of improved health, cost savings, and time savings for them and members of their households.

Our investees working in the financial inclusion area join efforts of the overall financial sector in financing green initiatives. These includes disbursement of energy-efficient loans such as financing purchase of renewable energy loans (solar panels, small-scale wind turbines, biogas digesters), purchase of clean cooking solutions, energy-efficient stoves, lighting and appliances, as well as sustainable agriculture practices.

50%

of our investees offer green loans

Nearly 40%

of our investees offer loans for access to renewable and affordable energy

36%

of our investees offer loans for hybrid vehicles

Geographical Essentials

- Country: Kenya

- Capital: Nairobi

- Population: 55,830,306* (*as of Friday, March 1, 2024, based on Worldometer elaboration of the latest United Nations data).

- Kenya population is equivalent to 0.68% of the total world population*.

- Kenya ranks number 26 in the list of countries (and dependencies) by population.

- 30.7 % of the population is urban*

- The median age in Kenya is 19.6 years

- GNI per capita: 2,170 (data source: World Bank, 2022)

- Language: Swahili and English

- Currency: Kenyan Shilling

Financial Institution Spotlight

- Name: Sumac Microfinance Bank

- Established: 2002

- Mission: To provide financial solutions that transform businesses and livelihoods and impact lives.

- Target client: Underbanked and low-income populations

- Branches: 5

- Number of borrowers: 2,458

- % of Rural Borrowers: 64%

- % of Women Borrowers: 28%

- Asset size (USD): 21,031,374

- Average Loan size (USD): 3,794

This is an example of how our investments create systemic change:

Mr. Mwai’s retirement marked the beginning of a new chapter: starting with just three cows, he relied on an agribusiness loan from Sumac Microfinance Bank to expand to eight cows, resulting in a daily milk production of 40 liters, and a flock of 100 chickens to enhance the diversity and productivity of his farm in rural Kenya.

In addition to offering agricultural loans, Sumac’s staff informed Mr. Mwai about ways to further optimize his farm’s efficiency, such as converting organic waste into biogas. Recognizing the potential benefits, Mr. Mwai secured a loan of approximately 2,000 USD to acquire a biodigester. Two years later, the biodigester purchased with the loan continues to supply renewable biogas for cooking and powering various household appliances. Moreover, it generates organic fertilizer, enriching the soil and boosting crop yields. Mr. Mwai’s initial investment in the biodigester not only provides access to energy and fertilizer but also translates into substantial monthly savings, ranging between 50 and 70 USD.

SDG 8

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all

Collectively our investees employ over 125,000 staff

By extending debt facilities and investing in financial service providers as well as in companies engaged in the clean cooking value chain, EQ also supports their own expansion and development and ultimately their own job creation capacity.

Over 95% of our investees have reported to have measures in place to avoid discrimination in regard to employment

By extending debt facilities and investing in financial service providers as well as in companies engaged in the clean cooking value chain, EQ also supports their own expansion and development and ultimately their own job creation capacity.

Over 89% of our investees maintain staff grievance policy

As an impact investor, we encourage our investees to promote safe and secure working environments for all workers and keep a mechanism in place for staff to submit complaints. We have begun collecting information about the availability of policies promoting equal opportunities among our investees, and we will include this data in our next report.

We are also pleased to report that none of our investees have been sanctioned for violating the UN Global Compact Principles, affirming our commitment to investing in organizations that uphold ethical and sustainable practices.

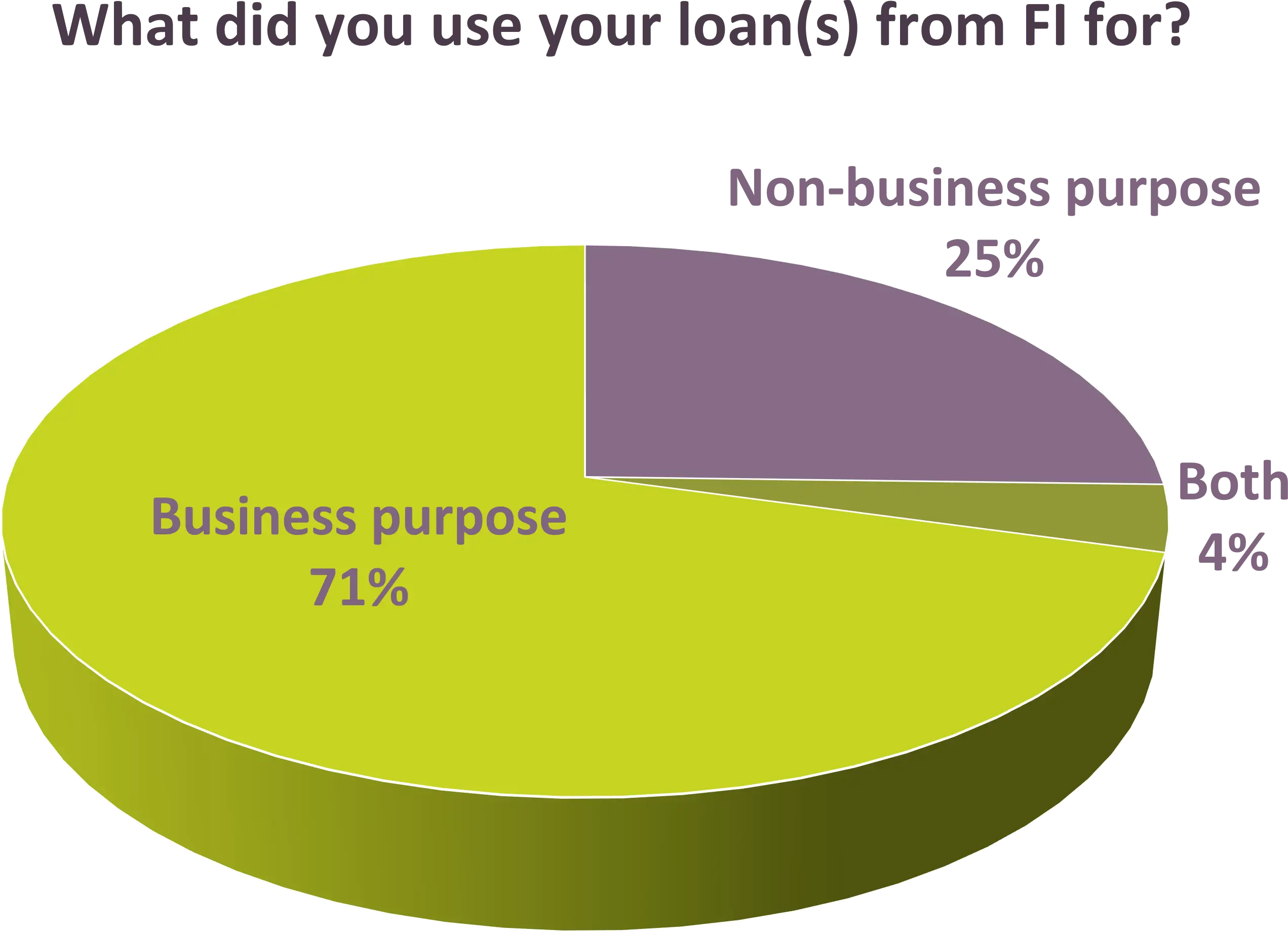

The core ambition of SDG 8 is to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. Investments in financial inclusion contribute to this SDG by providing access to credit mostly for income-generating and productive purposes to marginalized groups and underserved micro, small and medium entrepreneurs. Financial inclusion fosters entrepreneurship, job creation, and economic growth among all segments of society.

Similarly, investments in clean cooking technologies and energy can boost productivity by reducing the time needed in collecting firewood or otherfuels and reducing health risks, especially for women and girls who are primarily responsible for cooking. In addition, our investments in clean cooking companies support formal employment generation capacity for women.

As an impact investor, we also promote fair labor practices, including ensuring compliance with labor laws, providing fair wages, offering benefits such as health insurance and paid leave, and fostering a safe and healthy work environment for employees.

Collectively, our investees extend USD 28,080,120,801 for income-generating activities

83% of our investees offer SME loans

One of the core premises of our investments is that they are primarily made to support income-generating and productive purposes, thereby allowing borrowers to expand their businesses, or start new ones.

The borrowers surveyed by 60 Decibels also support this as 3 out of 4 of them reported having used at least part of the loan for productive purposes.

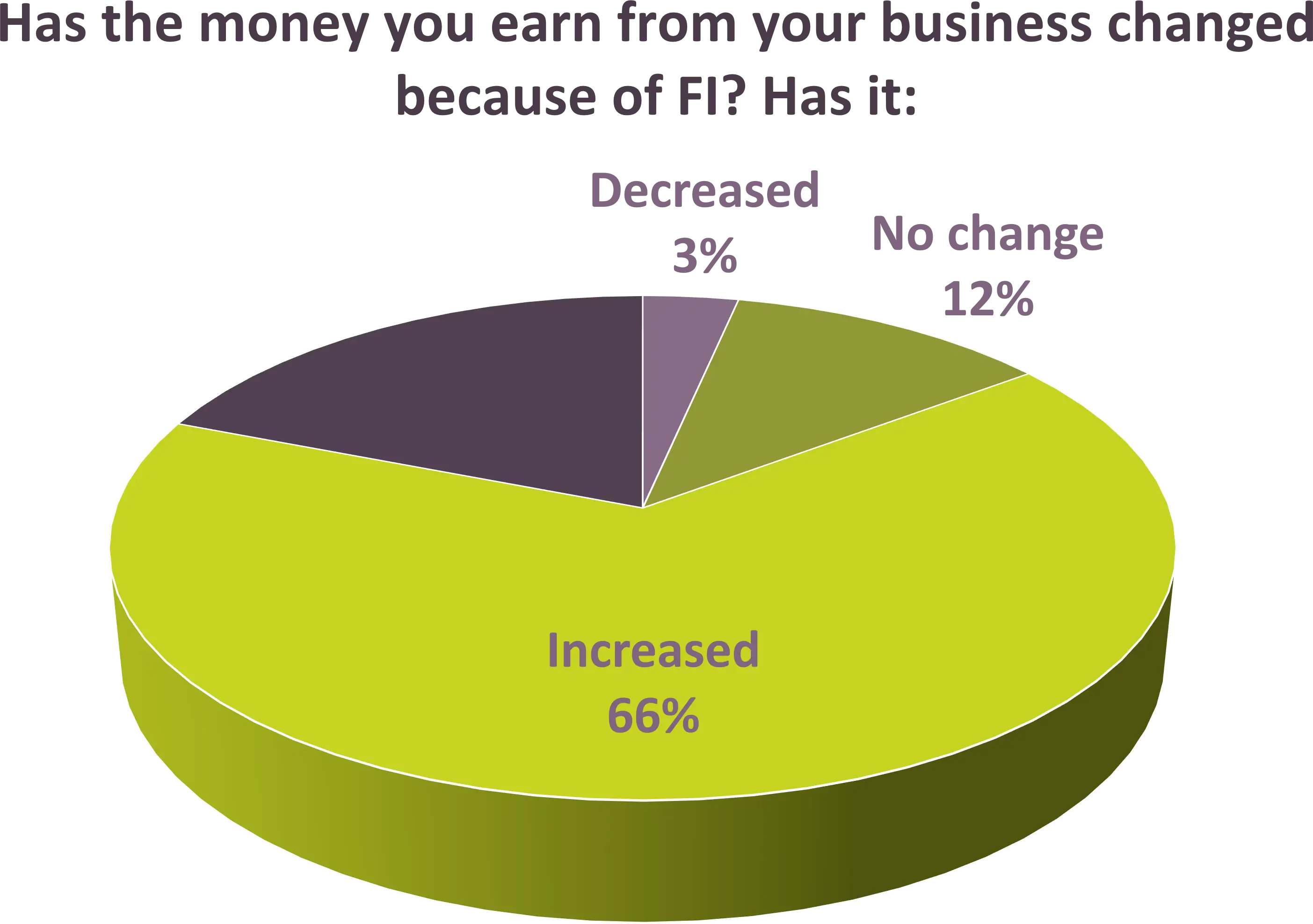

60 Decibels data show that the majority of respondents who accessed a loan experienced a positive change in terms of increased business income.

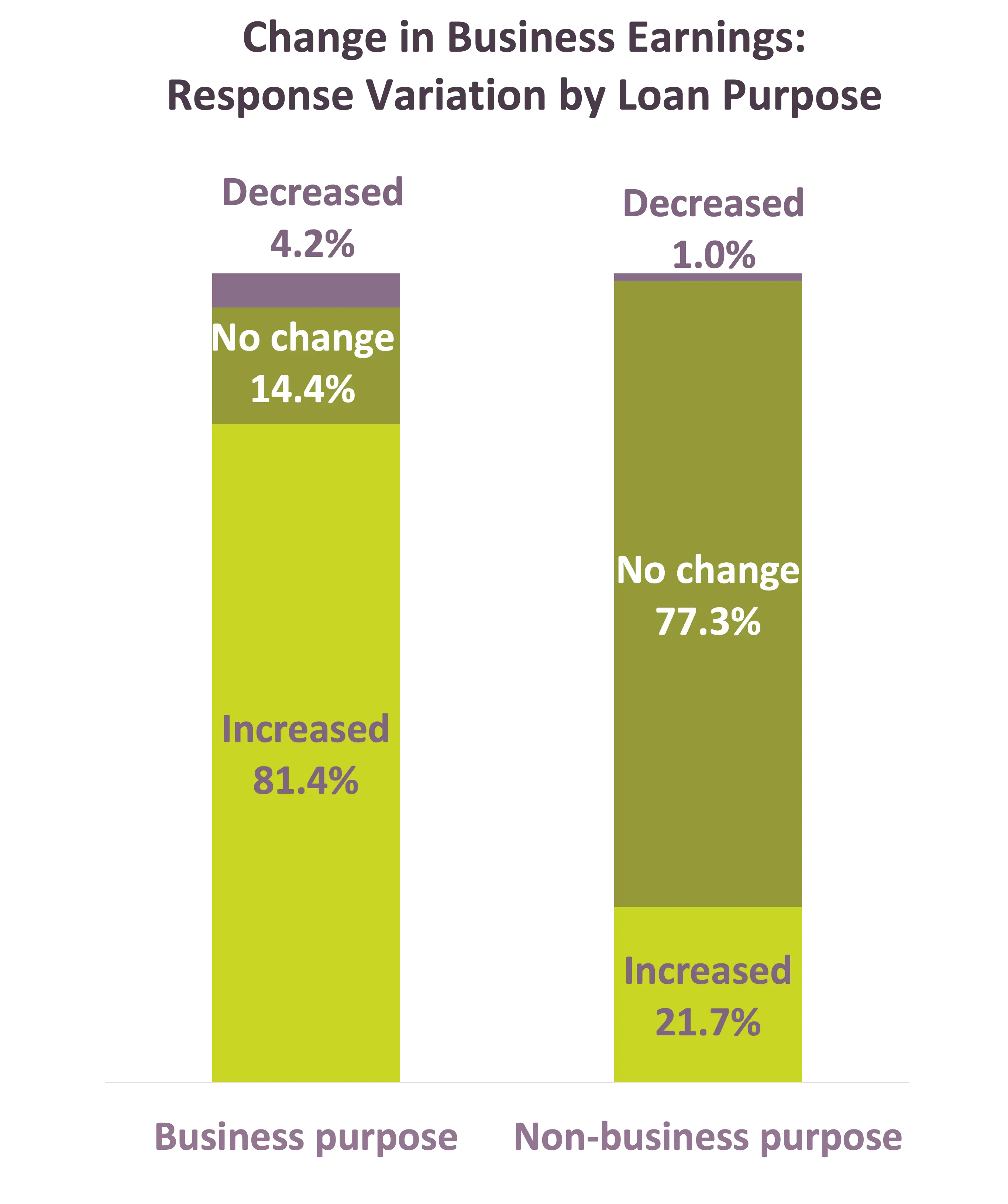

Respondents who used at least part of the loan for business purposes are four times more likely to report an increase in business income compared to respondents who used the loan for non-business purposes also as the latter mostly reported not having a business. Borrowers using at least part of the loan for business purposes also eported an increased ability to manage finances as well as a decrease in the time spent worrying about finances.

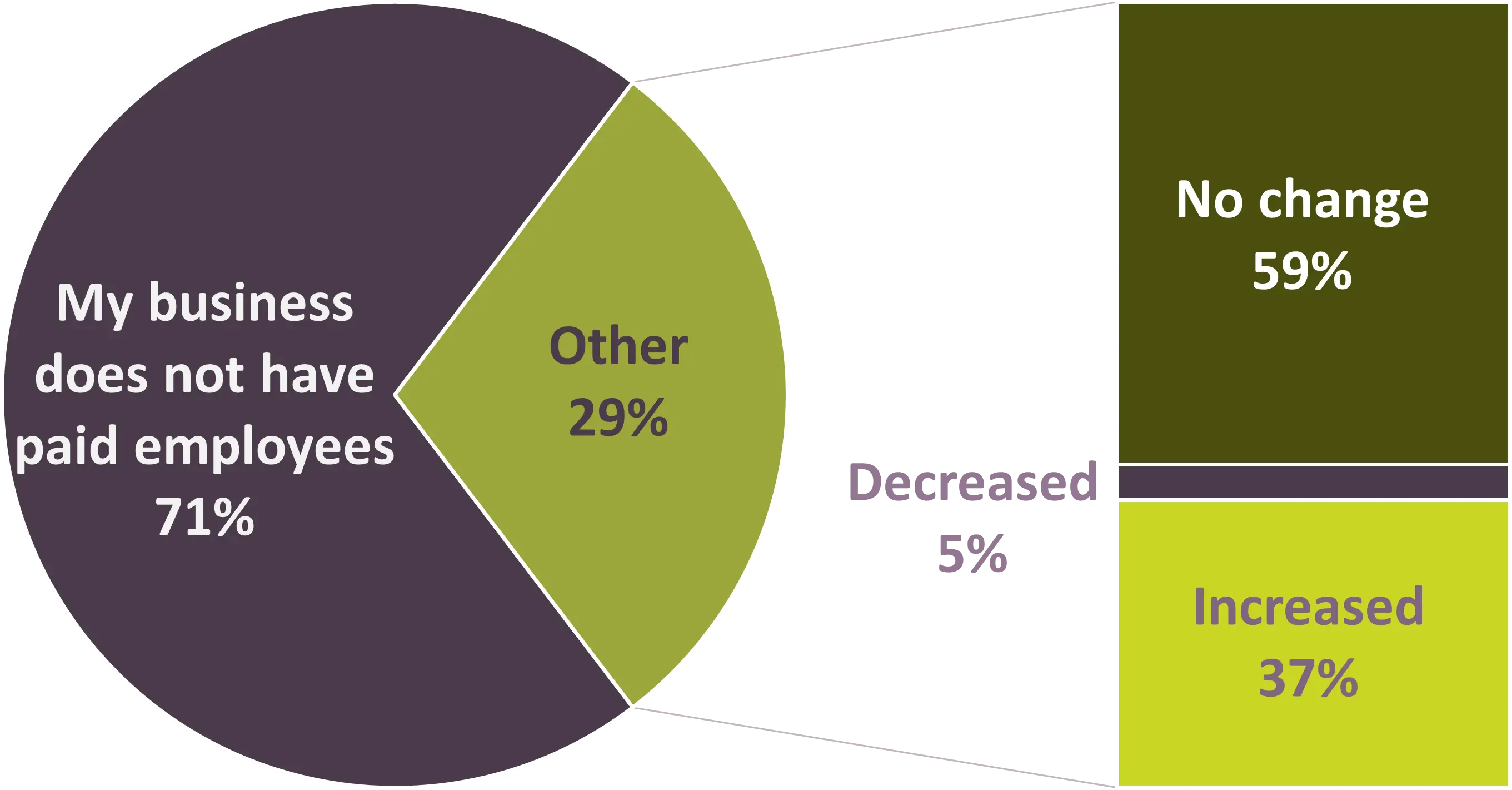

60 Decibels data show that 7 out of 10 respondents do not have paid employees for their businesses, which reflects how our investees typically target micro and small businesses often managed by a small team or sole proprietors who may be supported by other household members. Micro and small businesses require small investments and are often more accessible to individuals with limited resources and from diverse backgrounds, including women and marginalized groups. Micro and small businesses play a vital role in providing livelihoods to low-income households, especially in emerging markets’ local economies where formal employment opportunities may be scarce or not accessible.

Given the nature of these businesses and the fact that not all micro entrepreneurs aim to increase the size of their business by adding employees, 60 Decibels results show smaller improvements in terms of employment generation compared to the improvements in terms of business income. Looking at employment changes for the 30% of borrowers that have paid employees, one third have increased their number of employees because of their loan, 5% have decreased their number of employees, and the remainder have not changed their number of employees.

Geographical Essentials

- Country: Ecuador

- Capital: Quito

- Population: 18,318,042* (*as of Wednesday, March 6, 2024, based on Worldometer elaboration of the latest United Nations data).

- Ecuador population is equivalent to 0.23% of the total world population.

- Ecuador ranks number 68 in the list of countries (and dependencies) by population.

- 64.2 % of the population is urban

- The median age in Ecuador is 28.3 years

- GNI per capita: 6,300 (data source: World Bank, 2022)

- Language: Spanish

- Currency: United States Dollar

Financial Institution Spotlight

- Name: Produbanco

- Established: 1978

- Mission: To drive banking that builds relationships and offers products and services to our communities, helping them overcome cultural, economic, personal, or geographical barriers.

- Target client: SMEs

- Branches: 128

- Number of borrowers: 334,390

- % of Rural Borrowers: 0%

- % of Women Borrowers: 44%

- Asset size (USD): 7,493,799,623

- Average Loan size (USD): 12,124

For over three decades, Galapagos Flores has bloomed as a key player in Ecuador’s flower market, exporting top-tier roses worldwide while supported by a strong partnership with Produbanco. Starting with just 5 hectares, Galapagos Flores has grown to an impressive 23 hectares, with 17 dedicated to cultivation. Their roses are sold in markets across the United States, Canada, South America, Europe, and Russia.

Produbanco’s credit line has been crucial for Galapagos Flores’ expansion, funding investments in infrastructure, improving post-harvest facilities, and promoting sustainable practices.

The introduction of green credit has provided lower interest rates, thanks to earned certifications. This not only benefits the environment but also supports robust labor policies, ensuring the well-being of Galapagos Flores’ workforce - a key factor in their success.

Galapagos Flores also contributes to preserving local communities connected to their flower-sourcing environments. Their global recognition showcases regional talent and promotes economic inclusivity.

As Galapagos Flores continues to grow, their commitment to entrepreneurship, innovation, and sustainability remains steadfast. With Produbanco as their trusted partner, they are poised to lead economic growth while prioritizing societal and environmental well-being.

SDG 10

Reduce inequality within and among countries

Our investments in access to clean cooking are driven by the goal of ensuring equal access to more energy-efficient and less harmful solutions for all population groups.

39 %of the users of clean cooking solutions reside in rural areas

Similarly, investments in financial inclusion play an important role in advancing this broader agenda. By addressing barriers to accessing financial services – especially for marginalized and more vulnerable groups such as women, low-income individuals, minorities and those living in rural areas – financial inclusion contributes to reducing income inequalities and promoting inclusive economic growth.

What are the barriers in accessing financial services?

There are several barriers marginalized groups face in accessing formal financial services. These include geographical accessibility barriers due to the lower banking penetration in rural areas or disadvantaged communities. Individuals lacking access to financial services might also have limited understanding of the benefits and risks of financial products and services, leading to hesitancy in using them especially if they are not tailored to their needs in terms for example of amount, repayment schedule, cumbersome documentation, and excessive guarantee requirements. Marginalized groups might also not feel fully empowered to engage with a bank and banks may perceive them as high risk due to their lack of previous credit history or the limited availability of assets to pledge as loan collateral.

Barriers in accessing financial services hamper the individuals’ capacity to fully participate in the economy, which ultimately can contribute to social inequalities and exclusion.

How does financial inclusion break down these barriers?