SUSTAINABILITY REPORT 2025

All numbers in this report are as of the end of December 2024, unless otherwise stated

Guided BY OUR VISION

Dear Partners and Investors,

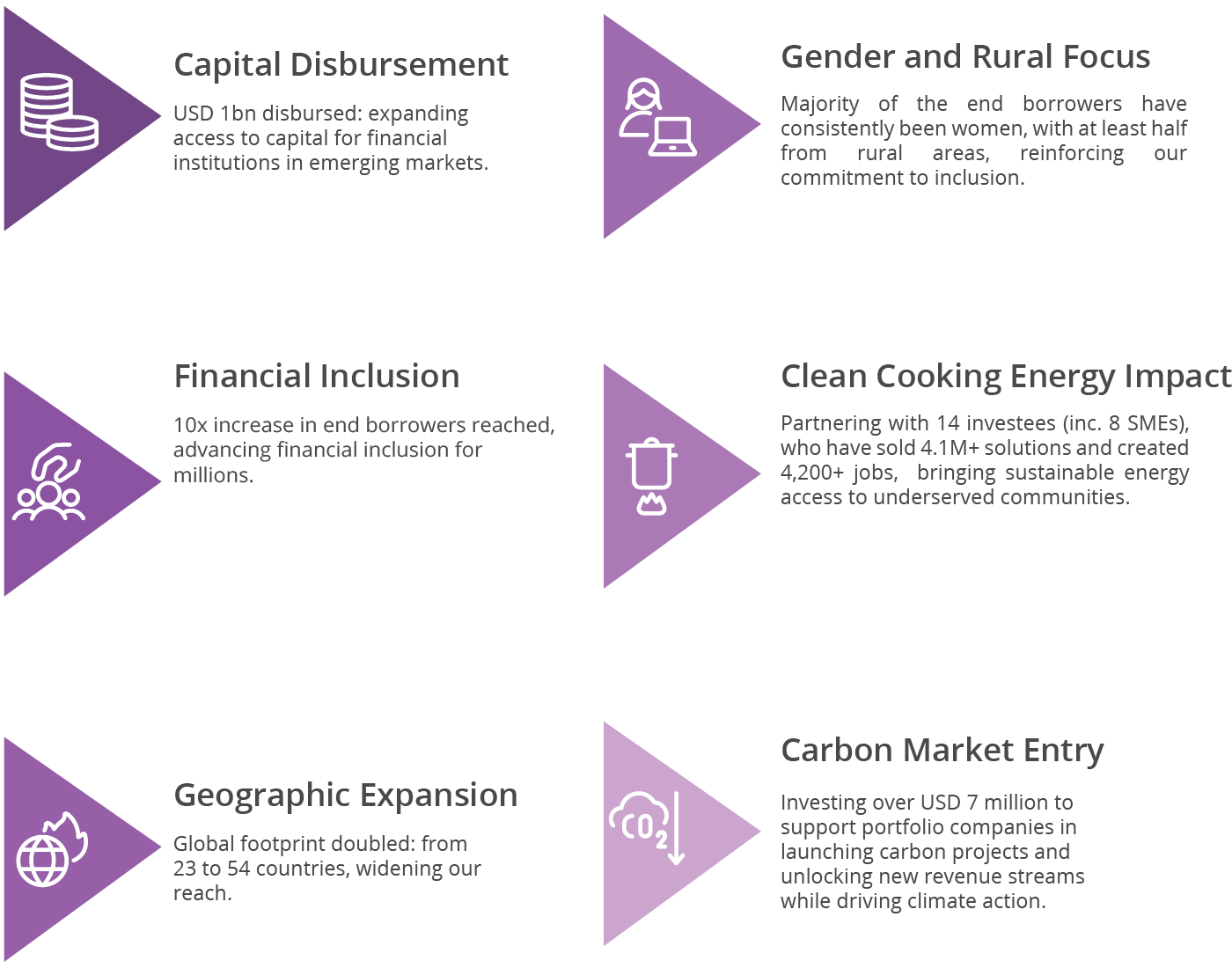

In 2024 Enabling Qapital (EQ) strengthened its dedication to its mission to moving money to meaning, striving for a more equitable, sustainable world through both financial inclusion and clean cooking solutions. The 2025 Sustainability Report highlights our progress in deepening environmental, social, and governance (ESG) practices, strengthening collaborations with investees, and delivering meaningful impact in the communities we serve.

Over the past year, we broadened our ESG activities, refining evaluation and monitoring frameworks for greater transparency while aligning with the United Nations (UN) Sustainable Development Goals (SDGs). Continuous ESG training for our team and consistent engagement with investees have helped reinforce good governance structures and foster resilience in emerging markets. We also worked with expert consultants to sharpen our focus on gender lens investing, reinforcing our commitment to inclusivity and equity.

challenges into opportunities for raising awareness around sustainable practices. By maintaining open dialogues with investees, we introduced improved disclosures, promoted robust data-sharing protocols, and will roll out additional initiatives in 2025 to help institutions surpass required ESG standards.

We continued navigating the evolving requirements of Article 9 of the Sustainable Finance Disclosure Regulation (SFDR), turning these regulatory During this period, EQ reached new milestones in managing approximately USD 700 million across a growing portfolio of responsible companies. Our efforts in financial inclusion expanded outreach to millions of micro, small, and medium entrepreneurs, helping them achieve business success and a higher quality of life. We also scaled clean cooking investments, reducing health risks for families while mitigating carbon emissions and deforestation.

In 2024, we strengthened our Sustainability Department and added expertise to the Team, ensuring that sustainability informs every decision we make. Looking ahead, we extend our gratitude to everyone who shares our vision – our investors, partners, investees, and the global EQ team – for demonstrating that financial returns and positive impact can thrive together. Let us continue moving money to meaning, building a more inclusive, sustainable tomorrow.

Creating OPPORTUNITIES

The commitment of our partners and investors continues to prove that financial returns and positive change go hand in hand. Thank you for being part of this journey!

Financial Inclusion & Investment Reach

End Borrower Impact & Inclusion

Clean Energy & Sustainability

Global Reach & Expansion

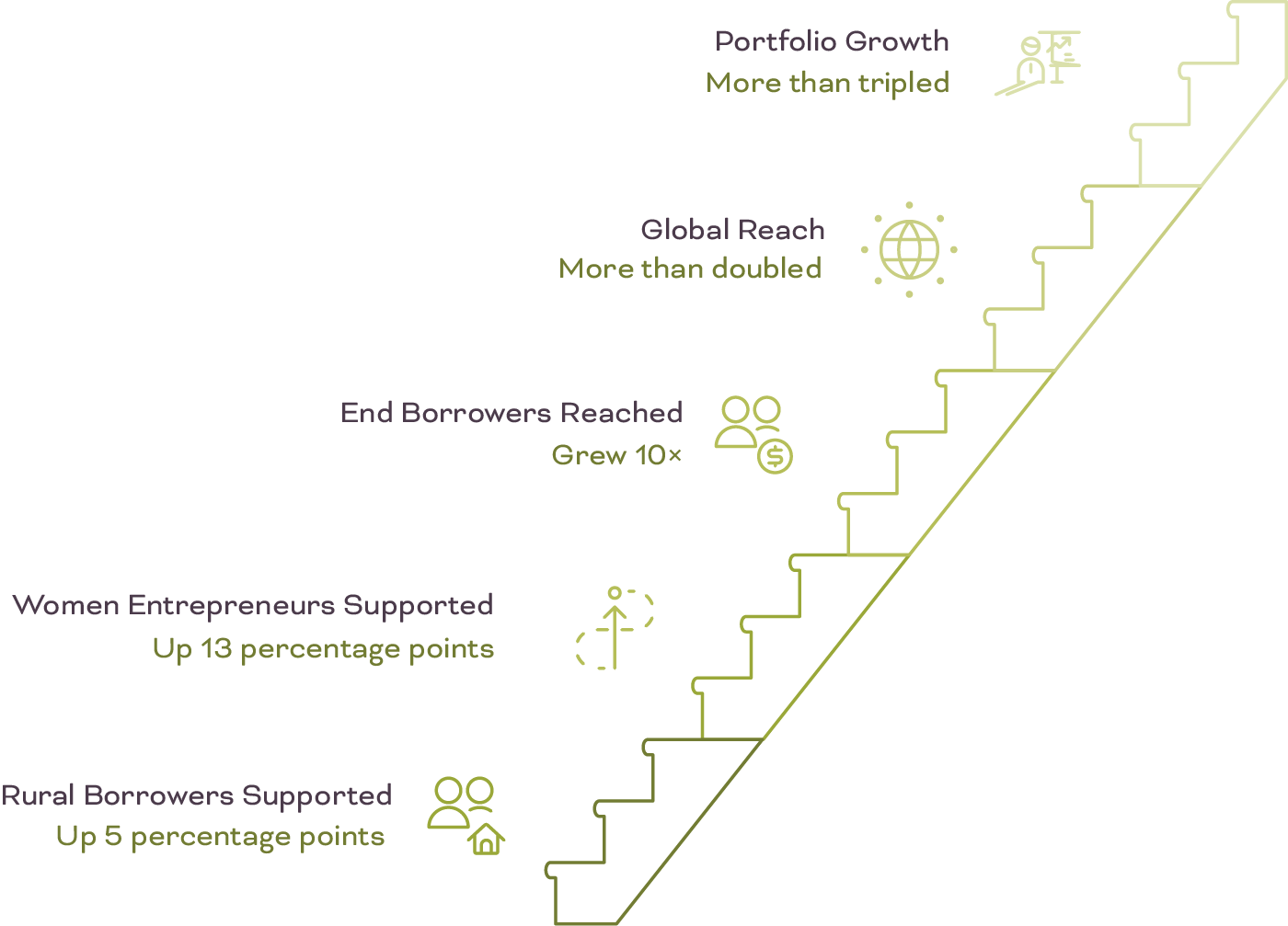

We are grateful to our investors and partners who have joined our mission since early 2020. With your support, we’ve grown our investments in emerging markets from USD 80 million to USD 700 million, moving money to meaning – creating a world where investments empower people and embrace the planet.

EQ's Growing Impact

Carbon Market Entry: +USD 7M Investment to Launch Projects and Drive Climate Action

DRIVEN By Commitment

In 2024, EQ continued its journey towards a world where investments empower people and embrace the planet. Sustainability is not a static goal – it is a continuous process of learning, adapting, and leading by example. While challenges persist, we firmly believe that meaningful change is possible, and we remain committed to driving it forward.

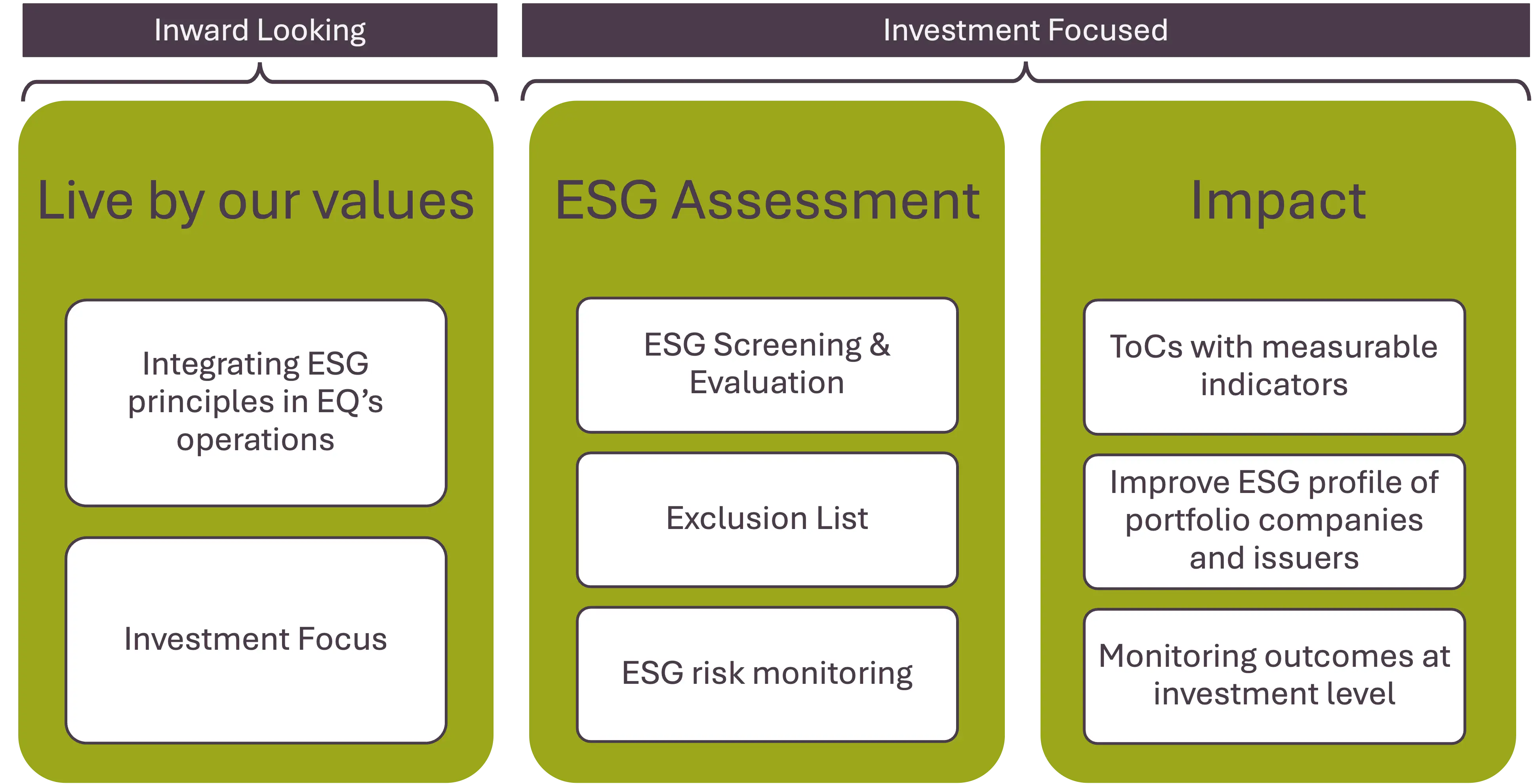

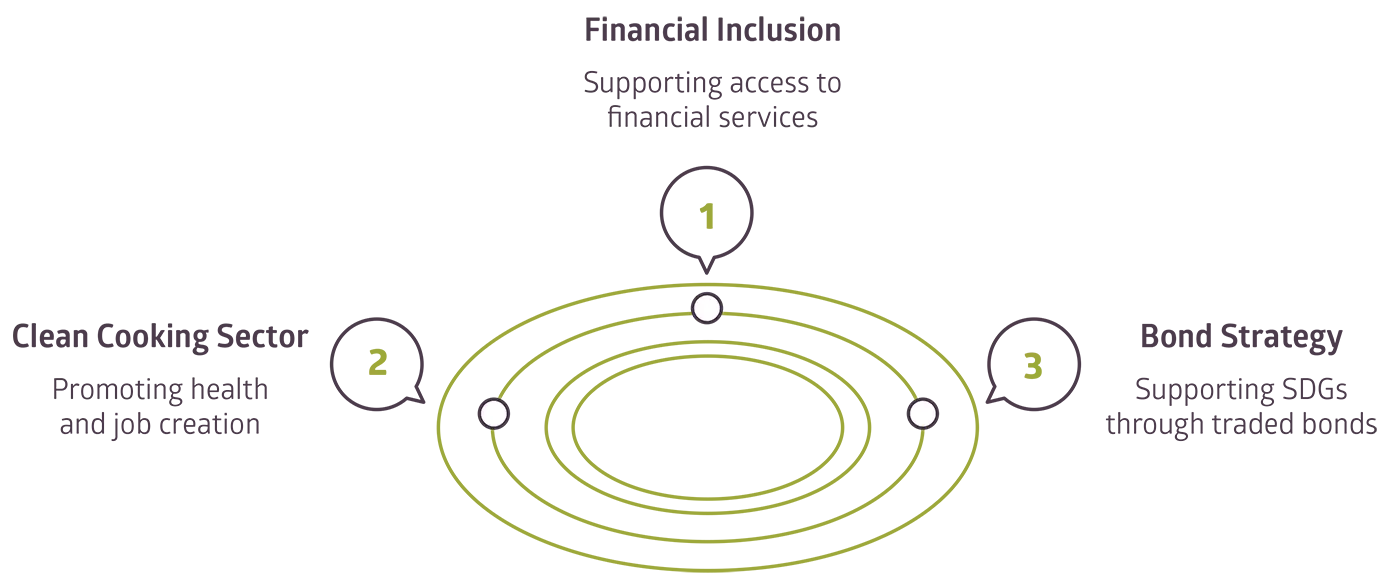

A Three-Pillar Approach to Sustainability

EQ’s sustainability strategy is built on three interconnected pillars that guide our commitment to responsible investing and internal excellence. These pillars ensure that we uphold ESG principles, actively manage investment risks, and drive measurable impact.

❶ Living by Our Values - Walking the Talk

At EQ, sustainability is not just a concept – it is deeply ingrained in the way we operate and lead. Servant leadership has been at the heart of our company since its founding and continues to shape our actions today. We believe that true leadership is about taking responsibility, leading by example, and continuously striving for improvement. Before we ask our investees to meet high sustainability standards, we ensure that we uphold these principles ourselves.

In 2024, we remained committed to this philosophy, expanding our sustainability efforts across all levels of our organization. We strengthened our internal governance, refined our HR practices, and improved the way we track our environmental footprint in business travel. But our sustainability journey does not stop with internal progress – it extends outward, guiding how we invest and the impact we strive to achieve.

At EQ, our formula for sustainable investments is simple: ESG + Impact

This means we do not only identify and mitigate ESG risks but also actively seek opportunities to improve sustainability practices and create positive change.

❷ ESG Assessment

From the very beginning – since EQ’s inception – it has been a core principle that no investment is made without undergoing an ESG assessment. This is not just a checkbox exercise; it is a fundamental part of our investment approach.

Every investment product at EQ integrates ESG assessment tools, ensuring that sustainability considerations are embedded into our decision-making. Of course, these tools are tailored to the nature of each investment, whether active or passive, and adjusted to the industry and context in which we invest. However, one thing remains consistent: the assessment will always be there.

Our ESG evaluation starts at the country, sector and industry levels – some fundamental issues are simply not considered for investment. But our responsibility doesn’t stop at the initial screening. Once an investment is made, EQ continuously monitors key ESG risks across our portfolio, ensuring that sustainability remains a priority throughout the investment lifecycle.

❸ Impact

Our final pillar focuses on impact. Here, we start with intentionality, ensuring that our investments are guided by a Theory of Change (ToC). We design our products with the goal of enabling positive outcomes – for example, when we invest in financial inclusion, we aim to expand access to finance for underserved communities.

To ensure we stay on track, we assess our ToC progress annually, using well-defined indicators to measure impact. Beyond our own products, we collaborate with portfolio companies to strengthen their ESG profiles and support them in enhancing their sustainability practices. At the same time, we remain mindful that impact measurement can be resource intensive.

To ease the cost burden on end borrowers, we leverage public data sources to supplement our internal research, allowing us to gather meaningful insights while maintaining efficiency.

Sustainability as a Continuous Commitment

At EQ, sustainability is more than a strategy - it is a commitment that shapes every decision we make. By integrating ESG principles, managing risks responsibly, and striving for measurable impact, we ensure that our investments contribute to a more inclusive and sustainable world.

While challenges will continue to evolve, so will our approach. We remain dedicated to learning, improving, and leading by example - because responsible investing is not just about what we do today, but about building a better future for generations to come.

LEADING By Example

Our sustainability approach starts from within. We believe credibility in responsible investing stems not only from what we finance, but also from how we operate. Before expecting our investees to meet ESG and impact standards, we ensure those same principles guide our own practices – from reducing our environmental footprint and fostering an inclusive workplace to upholding strong governance. For us, sustainability goes beyond compliance; it’s about living our mission every day and translating it into meaningful action across our portfolio. The following sections explore how we apply ESG principles internally under our first strategic theme: Living by Our Values.

Starting from ENVIRONMENT

We view environmental responsibility as both the right thing to do and a driver of long-term value. We start with internal engagement, encouraging our team to act as responsible global citizens. During our last EQ Week, teams presented ideas to enhance internal sustainability. The winning project – a sustainable welcome kit for new employees – was selected by peers and will be rolled out in 2025, demonstrating how small, tangible actions can build a shared culture of sustainability.

We have also implemented a range of practical measures – such as using energy-efficient lighting and recycled paper wherever feasible (including the very pages of this report). We focus on feasible actions that allow us to contribute meaningfully within the constraints of our operational context.

One such area is business travel. While we recognize its environmental footprint, travel remains essential to our work. In-person due diligence is key to risk management and fulfilling our fiduciary duty. To balance operational needs with responsibility, we improved flight-emissions tracking and raised staff awareness. We also conducted a thorough review to ensure that all flights taken as part of EQ’s operations are accurately captured.

We strive to mitigate our environmental impact by purchasing carbon credits, with the aim of progressively reducing the net effect of our emissions over time. To achieve this, we prefer to collaborate with one of our portfolio companies active in the clean cooking or access-to-energy sectors. These investees have undergone thorough due diligence and are subject to regular monitoring, giving us confidence in the quality and credibility of the carbon credits they can offer.

In the past, we have purchased carbon credits from Burn Manufacturing, a Kenyan enterprise that produces clean cooking stoves. We continue seeking high-quality providers to maintain this practice, support carbon markets in emerging economies, and channel climate finance beyond developed regions.

INVESTING in Our People

A conversation with Rodgers Opere

Human Resource Manager

At EQ, we don’t just invest in financial assets – we invest in our people. With a global team of over 65 professionals working across 15+ countries, our strength lies in diversity, collaboration, and shared purpose. But investing in people requires time, effort, and resources. Why does EQ prioritize this so much? We sat down with Rodgers Opere to discuss our people-first approach and how it contributes to our success.

EQ invests significantly in employee development, travel, and well-being. Some might argue that these resources could be directed elsewhere – why is this level of investment in people truly necessary?

Some might see talent investment as an expense, but we see it as a long-term strategic advantage. Our work in impact investing is complex – it requires professionals who are not only highly skilled but also deeply engaged in our mission. Investing in employee development, well-being, and team cohesion translates into higher productivity, stronger decision-making, and lower turnover.

Consider our scholarship program, which provides up to USD 20,000 per employee for advanced education. Some may question the cost, but better-trained employees make better investment decisions, which benefits the entire organization. Similarly, investing in work-life balance and well-being ensures that our employees are motivated, resilient, and equipped to perform at their best.

EQ operates globally with a diverse, remote workforce – how do you keep employees connected and engaged?

Is it really worth the effort to organize in-person events instead of relying solely on digital collaboration?

While digital tools keep us connected, real relationships are built face-to-face. EQ Week is designed to bridge the gap created by remote work, fostering trust, collaboration, and a shared sense of purpose. In 2022, we brought our team together in Nairobi, where we have a branch, and in 2024, we gathered in Switzerland. These events have led to stronger teamwork, faster decision-making, and a deeper cultural connection across our global offices.

We carefully manage costs, which is why EQ Week is strategically planned rather than held annually. The return on investment is clear – employees leave these gatherings more aligned, engaged, and motivated to drive impact.

Diversity and inclusion are key themes in today’s workplace. How does EQ approach these topics, and what challenges do you face?

Diversity has been at the core of EQ since its creation. Our team representatives span across 15 countries and speak 21 languages, ensuring that our investment decisions reflect both local expertise and global perspectives. Diversity isn’t just a goal for us – it’s a strength we’ve built into our foundation.

On gender equity, we are proud that 40% of our team members are women, including representatives in regions where opportunities for women in finance remain limited. Female representation in management stands at 42%, while board representation has increased to 60% in 2025. We’ve strengthened gender-disaggregated data analysis across the employment cycle, a major step for a company of our size. To further promote equity, we offer four months of fully paid maternity leave with flexible and reduced working hours for nursing mothers, paternity leave, and have adopted a company-wide gender strategy focused on inclusive hiring, work-life balance, career progression, pay equity and leadership development. At EQ, diversity and inclusion are not just policies – they are the foundation of our success.

Some companies take a transactional approach to employment – offering competitive pay but minimal extras.

Why does EQ go beyond that?

Because we’re not just building a company – we’re building a mission-driven organization. A purely transactional approach might work in other industries, but in impact investing, passion and engagement are critical.

A strong culture attracts and retains top talent. Our Employee Assistance Program (EAP/SAP) provides confidential mental health support, and our structured mentorship and leadership training ensure career growth. Beyond financial incentives, we offer a comprehensive benefits package, including flexible work arrangements, paid study leave, travel compensation, and wellness programs.

Ultimately, our success as a company is tied to the well-being and performance of our people. When employees feel valued and supported, they go the extra mile – not because they have to, but because they believe in what they do.

What’s next for EQ’s people strategy?

We’re continuously evolving. In 2025, we plan to:

- Expand our scholarship and training programs.

- Introduce quarterly refresher training on ESG, investment strategies, and HR policies.

- Strengthen our leadership and sustainability training for managers.

- Continue developing team-building initiatives.

At EQ, investing in our people isn’t just the right thing to do – it’s essential to our mission. Because we don’t just “move money to meaning” – we move careers to purpose.

64 team members (up from 13 in 2020) – Our team has grown in experience and efficiency, delivering stronger results with minimal expansion. Throughout this journey, we have maintained a 40% female representation – a milestone we take pride in, especially as we hire globally, including in countries where opportunities for women remain limited. However, we recognize there is still room for improvement in some departments and we remain committed to fostering greater gender balance across all areas of our organization.

21 languages spoken (up from 10 in 2020) – Our team speaks more languages than ever, enhancing our local expertise and deepening our connection to the markets where we invest.

Investing in our people – Five of our team members sponsored between 2023 and 2024 pursued Master’s degrees, Diplomas, and professional certifications such as Chartered Financial Analyst and Chartered Alternative Investment Analyst.

Beyond business-focused training, we are committed to holistic development, offering learning opportunities that support personal well-being and workplace culture. Recent training highlights include:

- Mental health awareness

- Nutrition and healthy eating habits

- Emotional intelligence

- Sexual harassment awareness and prevention

- Work-life balance and burnout prevention

- Personal safety and travel awareness

Empowering Growth Through Education: The EQ Scholarship Program

- At EQ, we believe that investing in our people is just as important as investing in the businesses we support. Through the EQ Scholarship Program, we provide financial support and flexible study arrangements for team members pursuing advanced degrees and professional certifications.

- From full tuition coverage to study leave options, our program empowers employees to expand their expertise while continuing to contribute to our mission.

- One of our scholarship recipients, Begoña Leiva, recently completed her Master’s in Financial Management at EAE Business School in Madrid. With EQ’s full sponsorship and a flexible work arrangement, she was able to gain specialized knowledge, deepen her financial analysis skills, and enhance her impact within our investment origination team.

- As we continue to grow, we remain committed to fostering talent, promoting lifelong learning, and ensuring our team members have the tools to excel – both professionally and personally.

Strengthening Team Connections

In June 2024, we brought our entire team to Switzerland for a five-day company retreat – a rare opportunity to gather in person, strengthen collaboration, and align on EQ’s future.

The retreat focused on both business efficiency and team engagement:

-

Strategic Review:

We assessed and refined our business processes to enhance efficiency and risk management. -

Training & Development:

Employees participated in fraud management workshops and sustainability-focused learning sessions. -

Sustainability Challenge:

Since sustainability is a shared responsibility at EQ, we designed an interactive competition, inspired by the Shark Tank format. Teams pitched innovative sustainability projects, and the winning idea – the introduction of a Welcome Kit for new hires – is now being implemented. This Kit is designed to immerse new team members in EQ’s culture and sustainability values through engaging videos and a small onboarding budget for personal sustainability initiatives.

Committed to INDUSTRY STANDARDS

At EQ, we believe that industry standards play a crucial role in driving transparency, accountability, and meaningful impact.

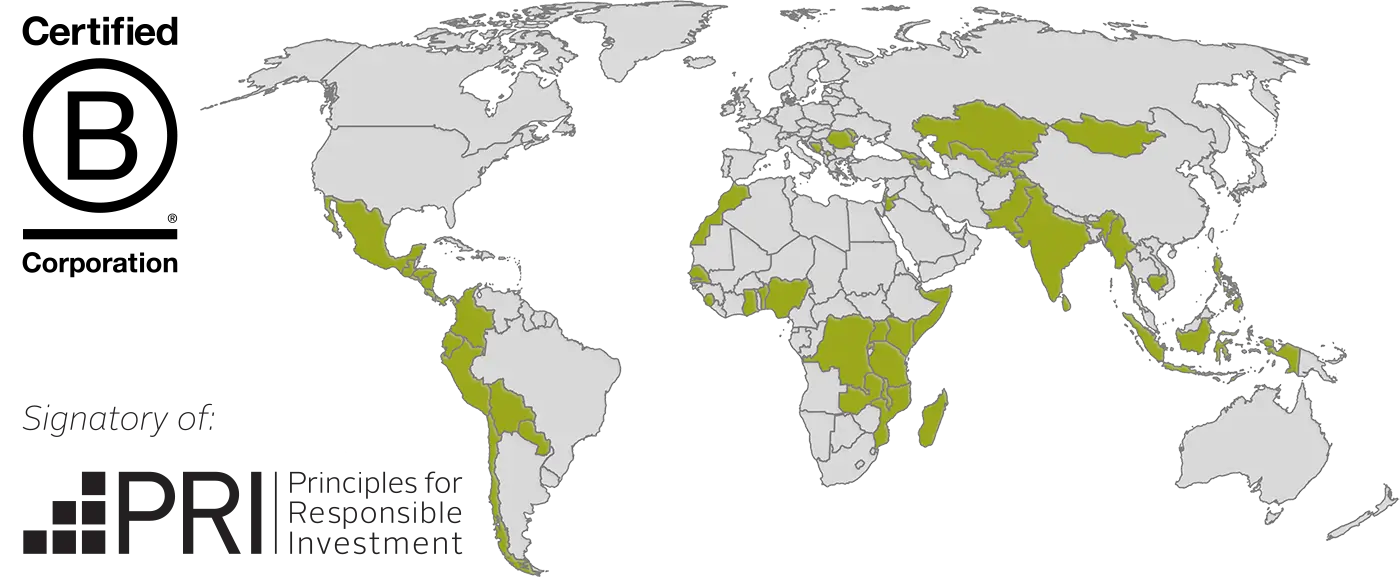

As a global impact asset manager, we align with recognized frameworks and certifications that help us strengthen our internal practices, investment processes, and sustainability commitments. Below are the key standards and initiatives we follow.

Continuously Raising the Bar

We uphold the values and rigorous standards of the B Corp movement. With our current certification expiring in September 2025, we have successfully submitted our updated impact assessment as part of the renewal process.

As EQ continues to grow, so do the expectations placed upon us. Due to our expanded operations, we now fall under a stricter standard, requiring even greater diligence in both internal practices and investment decisions. We view this as a valuable opportunity for growth – allowing us to identify areas for improvement, strengthen our impact, and refine our responsible investment practices.

Our dedication to sustainability remains steadfast, and we will continue to raise the bar for impact-driven asset management.

Transparency in Responsible Investment

We uphold the values and rigorous standards of the B Corp movement. With our current certification expiring in September 2025, we have successfully submitted our updated impact assessment as part of the renewal process.

This global initiative promotes the integration of ESG factors into investment decisions. As a signatory, we align with the UN PRI’s mission to foster a more responsible and sustainable financial system.

While we are currently in the optional reporting year, we have chosen to actively contribute to the reporting process. We believe that transparency is key to driving impact, and early participation allows us to refine our ESG integration practices ahead of the mandatory reporting phase.

STÉPHANIE TAUBER-GOMEZ

Deputy CEO – B Lab Switzerland

As Deputy CEO of B Lab Switzerland, I am proud to recognize Enabling Qapital as one of the first Swiss impact asset managers to achieve B Corp certification in 2022. EQ has demonstrated that finance can drive equitable and sustainable progress, proving that responsible investment goes beyond returns – it’s about creating long-term value for people and the planet.

The B Corp community continues to grow, and we are constantly raising the bar – challenging both certified and aspiring organizations to push boundaries and lead positive change. It is inspiring to see that EQ embraces this journey, undeterred by challenges, and remains committed to continuous improvement alongside the B Corp community.

We embrace the 2X Challenge movement and recognize the importance of advancing gender-smart investing.

As we refine our investment approach, we strive to align with the 2X criteria and actively contribute to gender equity within our portfolio.

EQ is a member of the Swiss Sustainable Finance (SSF) network, a platform that promotes sustainability in Switzerland’s financial sector.

Through this membership, we stay connected with leading sustainability initiatives and contribute to shaping the future of responsible finance.

We align our ESG and impact metrics with IRIS+ indicators, supporting industry-wide comparability and benchmarking of ESG data. We believe that standardized ESG disclosure, transparency, and data alignment contribute to better information flow, ultimately enabling stronger ESG integration at all levels – from investors to financial institutions.

We have been recognized as an ImpactAssets 50 2025 fund manager, a leading industry benchmark for impact investing. This recognition highlights fund managers who are shaping the future of impact investing with innovative strategies and measurable social and environmental outcomes. The IA 50 selection process is rigorous, combining quantitative analysis with expert qualitative review to identify fund managers that demonstrate both financial strength and a deep commitment to impact.

Being included reflects our dedication to aligning capital with purpose, ensuring investments drive meaningful change while maintaining strong financial performance.

FARIDA ABDULHAFIZOVA

Head of Sustainability Department![]()

In a rapidly evolving sustainability landscape, established standards offer valuable benchmarks to assess progress and ensure credibility. We intentionally select frameworks that reflect different dimensions of our operations. As a young company, we initially focused on broad frameworks to guide the development of our internal practices, investment processes, and impact measurement. We are now deepening our focus on strategic themes such as the 2X Challenge.

Looking Ahead

At EQ, we see these standards not just as compliance requirements but as tools to enhance our impact, improve decision-making, and contribute to a more transparent and responsible financial ecosystem. As we continue to grow, we remain committed to strengthening our ESG integration, gender lens investing, and sustainability leadership.

Dedicated to IMPACTFUL INITIATIVES

As part of EQ’s internal ESG strategy, we believe that our responsibility extends beyond managing funds – it includes how we use our own resources to create long-term impact. That’s why a portion of EQ’s revenues is directed to the Enabling Microfinance Foundation (“Foundation”), a non-profit entity that supports sustainability-focused projects in the communities where we work.

Enhancing lives through the Enabling Microfinance Foundation

The EMF Microfinance Fund (“EMF”) was founded in 2008 and has since been closely linked to the charitable, non-profit Enabling Microfinance Foundation (“Foundation”). The regulated foundation is governed by an independent committee, which carefully evaluates and selects initiatives for funding. This rigorous selection process ensures that the supported initiatives align with EMF’s mission to drive significant positive change in the communities they serve. As part of our ongoing commitment to social responsibility, EQ allocates a substantial amount to support the foundation.

Current ongoing projects include the following

Supporting Women Smallholder Farmers in Zambia Through Digital Finance

One of the initiatives supported through the Enabling Microfinance Foundation is the project called “Rural Digital Finance Ecosystem Empowering Women Small-Scale Farmers” implemented by Access Bank Zambia. This project builds on Access Bank’s existing mobile wallet platform, eTumba, to provide digital financial services to small-scale farming communities, with a strong focus on women. The project addresses the critical lack of access to financial services in rural Zambia, where only 27% of farmers and fishermen are financially included, according to the Finscope 2015 report.

To overcome the challenges of high transaction costs in rural areas, the initiative aims to launch a rural agent network of 100 agents (60% of whom will be women) to create a trusted digital finance ecosystem to rural smallholder farmers. This ecosystem will enable over 26,000 smallholder farmers, 62% of which are women to access digital loans, make payments, and receive financial literacy training. By enhancing trust and usability of digital finance services, this project empowers women farmers to increase their investment capacity, mitigate risks, and achieve financial independence.

Protecting Smallholder Farmers in Bangladesh with Climate Insurance

Another impactful project funded by the Enabling Microfinance Foundation is the “Loans with Climate Protection Cover” initiative by The Association for Peoples Development Stream (APDS) and DESHA Bangladesh. This project aims to protect farmer borrowers from APDS and DESHA – 65% of whom are women collectively – from the adverse effects of climate change by bundling parametric climate insurance with their loans. Initially piloted with 500 dairy farmers with heat stress insurance coverage in Haluaghat, the project will be scaled to more districts to include protection against a range of climate-related risks such as excessive rainfall, droughts, and high winds.

Upon completion, the project is expected to empower over 24,000 smallholder farmers across four locations in Bangladesh by integrating climate insurance into their credit products. This protection will not only help farmers pursue commercial farming with greater confidence but also reduce default rates, enhance the financial stability of microfinance institutions (MFIs), and encourage broader adoption of climate insurance solutions across the sector.

Access to finance and business mentoring for young, disadvantaged micro-entrepreneurs

The Enabling Microfinance Foundation supported a project in Albania to enhance access to finance for young, disadvantaged micro-entrepreneurs aged 18–35. In partnership with three local MFIs – Agro & Social Fund, BESA, and NOA – the project helped adapt or develop tailored loan products by easing collateral requirements, offering flexible conditions, and lowering interest rates. Combined with financial literacy and business mentoring, these efforts enabled 4,408 young entrepreneurs (30% women) to access nearly USD 13.5 million in loans, with an average loan size of approximately USD 2,700.

In parallel, MFIs received capacity-building support through 21 workshops reaching 349 loan officers (59% women), encouraging them to see youth entrepreneurs as a viable and promising client segment. By project close, over 1,600 entrepreneurs with existing businesses reported increased incomes, while many others were able to launch their own small enterprises. The initiative not only empowered young people to grow their businesses but also strengthened the ability of MFIs to serve this underserved segment sustainably.

Investing for POSITIVE CHANGE

Overview of our Investment Scope

At EQ, we facilitate the flow of capital to emerging markets. “Moving Money to Meaning” reflects our belief in the power of finance to support sustainable development and long-term progress. Our investment scope is guided by a clear intention: to address challenges in emerging markets that can be tackled through targeted financial solutions. Each of our products is grounded in a Theory of Change and supported by measurable indicators, allowing us to track progress and remain accountable to our mission.

In recent years, we’ve expanded and diversified our investment offerings to better respond to the evolving needs of our partners and investors. By targeting areas where capital is most needed, we focus on high-impact opportunities that address today’s most pressing challenges.

One example is our bond product, which allows us to channel capital toward new sectors and segments – provided the issuers meet our ESG criteria and align with our investment principles. This reflects our ongoing effort to balance innovation and investments with a clear sustainability mandate. We begin this section with a closer look at our bond strategy and the types of companies and sectors it enables us to support.

Our core investment activity remains rooted in financial inclusion. Through senior and subordinated loans, we support financial institutions of various sizes and legal structures – ranging from microfinance institutions to small and mid-sized banks. These institutions play a critical role in expanding access to financial services for underserved individuals and businesses. While the idea of financial inclusion is not new, it remains highly relevant in today’s world, where inequality and economic uncertainty continue to affect the most vulnerable. In the following chapter, we present our perspective on financial inclusion – what it means today, why it matters, and how our investments aim to strengthen it.

We continue to invest in the clean cooking sector. These investments aim to address several interlinked challenges – from improving health outcomes for women and children through cleaner cooking solutions, to supporting local job creation and contributing to the development of a carbon credit market in Africa to enable companies to benefit from the climate adaptation finance. We dedicate a separate chapter to the role of carbon credits in clean cooking, where we give an example of our support.

Supporting LIQUIDITY & SUSTAINABILITY

Emerging Markets Sustainable Bond Strategy in a UCITS Framework

Overview of the emerging markets sustainable bond universe – why it matters

The emerging markets bond universe comprises debt issued by governments, supranationals and corporations in rapidly growing, developing economies. Despite a growing correlation with developed markets, emerging markets bonds still offer valuable diversification benefits. As these markets mature, improved credit ratings can push bond prices higher, enhancing investor returns. However, political and regulatory uncertainties can introduce volatility, demanding careful monitoring from both policymakers and investors. Overall, they are crucial because they enable global capital to flow into high-growth regions, shaping future economic and investment landscapes.

Given the significant opportunities emerging markets bonds offer, it’s important to recognize the growing scale of these markets. According to recent BIS (Bank for International Settlement) data, the total stock of EM debt securities (sovereign and corporate) stands at approximately USD 28-29 trillion as of early 2023. J.P. Morgan’s EMBI Global Diversified Index shows roughly USD 450-460 billion in USD-denominated EM sovereign bonds. The local currency segment remains dominant, with outstanding EM government bonds exceeding USD 10-11 trillion per IIF (Institute of International Finance) estimates. Though sources and classifications differ, these figures highlight the growing scale and importance of emerging bond markets for global finance and economic development.

Overall, the emerging markets bond universe is a significant segment of global fixed-income investing – its dynamics can affect everything from investment portfolio performance to global economic stability. Understanding its opportunities and risks is crucial for anyone participating in international markets.

Purpose of a Sustainable Emerging Markets Bond Fund

An SFDR Article 9 Emerging Markets Sustainable Bond Fund, especially in a UCITS (Undertakings for Collective Investment in Transferable Securities) structure, increases liquidity for emerging-market investments by offering a carefully composed portfolio of bonds issued by institutions active in or supporting emerging markets, alongside bonds issued by the governments of these countries.Such bond products adhere to high transparency standards set by SFDR Article 9, reassuring investors about measurable social or environmental outcomes.

Such transparency fosters greater confidence in impact investing. By helping develop a robust public bond market, they complement private debt strategies and attract scalable capital. Ultimately, this balanced approach supports both large-scale infrastructure financing and smaller, innovative ventures, advancing inclusive and sustainable economic development.

Overall, an Emerging Markets Sustainable Bond Fund within a UCITS, SFDR Article 9 context strikes a balance between the liquidity and transparency needs of investors and social and environmental impact goals driving sustainable finance. By bolstering public-market participation in emerging economies, this type of strategy catalyzes capital flows that ultimately accelerate the transition to a more inclusive and sustainable global economy.

EQ’s Approach to Sustainable Risk Screening

As part of our UCITS SFDR Article 9 Emerging Markets Sustainable Bond Strategy launched earlier this year, EQ employs a diligent approach to sustainable risk screening. Given the limited availability of reliable, standardized information on publicly listed fixed-income instruments in emerging markets, we address this gap by selecting bonds with the most comprehensive data. We have also developed a robust sustainable screening process that combines publicly available information with our proprietary assessment framework.

To fulfill its investment objective, EQ’s Article 9 Emerging Markets Sustainable Bond Product employs an investment strategy aiming to reduce sustainable risks, address Principal Adverse Indicators (PAIs), and measure issuers’ contributions to sustainability goals. This strategy relies on a disciplined, comprehensive Sustainability Framework.

SFDR Article 9 Classification

EQ’s impact investing approach for the Emerging Markets Sustainable Bond Product targets liquid asset classes aligned with SDGs 5, 8, 9, 10, and 13, measuring performance with four indicators: Freedom House, SDG Alignment, CO₂ Intensity, and ESG Score. The Bond Product meets SFDR Article 9 requirements, reflecting the highest level of sustainability ambition and our commitment to measurable, intentional, and transparent impact.

Why SFDR Article 9 Matters

SFDR Article 9 classification matters because it holds funds to the highest bar for disclosure and impact. It reassures investors that the fund’s primary purpose is to achieve sustainable outcomes, rather than simply incorporating ESG factors into an otherwise conventional strategy.

SFDR Article 9 compliance assures investors that the product is fundamentally designed around a core sustainability objective. It requires rigorous tracking of outcomes, rather than focusing solely on risk management, thus setting a higher standard of accountability and transparency. This higher level of assurance can attract a broader range of investors and, consequently, provide greater liquidity in the bond market.

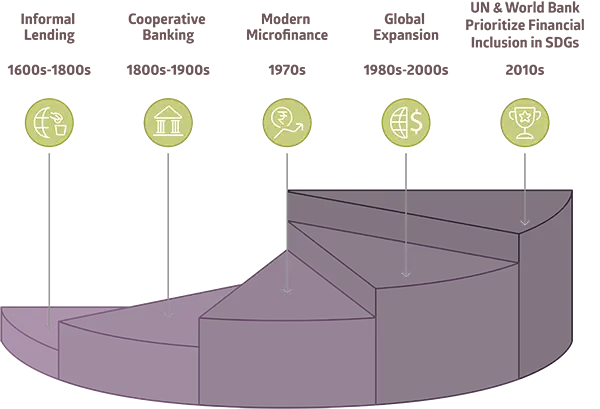

Evolving from Microfinance to FINANCIAL INCLUSION

From Milestones to What’s Next

The Evolution of Microfinance

Microfinance has deep historical roots, from informal lending systems to the cooperative banking movements of the 19th century.

The modern era of microfinance began in the 1970s, pioneered by institutions like Grameen Bank, proving that small, collateral-free loans could empower the economically underserved.

By the 1980s and 1990s, microfinance institutions (MFIs) expanded globally, demonstrating financial access as a tool for poverty alleviation. The early 2000s brought increased recognition, with the UN’s and World Bank making financial inclusion key goal of the Sustainable Development Goals (SDGs), as well as governments starting to adopt national financial inclusion strategies.

From Microfinance to Financial Inclusion

As the sector evolved, it became clear that in addition to credit, there was a growing demand for other financial services such as savings, insurance, payments, and digital financial services. This broader scope of services has come to define the concept of financial inclusion. The rise of mobile banking (e.g., M-Pesa), fintech innovation, and impact investing has redefined access to finance, enabling millions to participate in the financial system. Today, financial inclusion remains central to global development goals, ensuring individuals and businesses – regardless of income – can participate in and

benefit from the financial system. However, this does not mean the mission is complete. In 2024, we reassessed financial inclusion’s impact and remaining gaps using the latest Global Findex data.

The Global Financial Inclusion Landscape

The financial inclusion landscape has transformed over the past decade. According to the latest Findex survey available:

- Global account ownership increased from 51% in 2011 to 74% (2021 data).

- Despite progress, 1.4 billion adults worldwide remain unbanked.

- In high-income countries, only 4% of adults remain unbanked, while in developing countries, approximately one-third of adults still lack access to formal financial systems.

![]()

In EQ’s target markets, financial exclusion is even more severe, with about 50% of the adult population lacking financial accounts.

Why Are People Still Unbanked?

Globally, the primary barriers to financial inclusion are:

- Insufficient funds (most commonly cited reason)

- Documentation challenges

- High costs and distance from financial institutions

- Lack of trust in financial services

Financial Inclusion Disparities: Who Is Left Behind?

The gap varies across gender, income, and education levels:

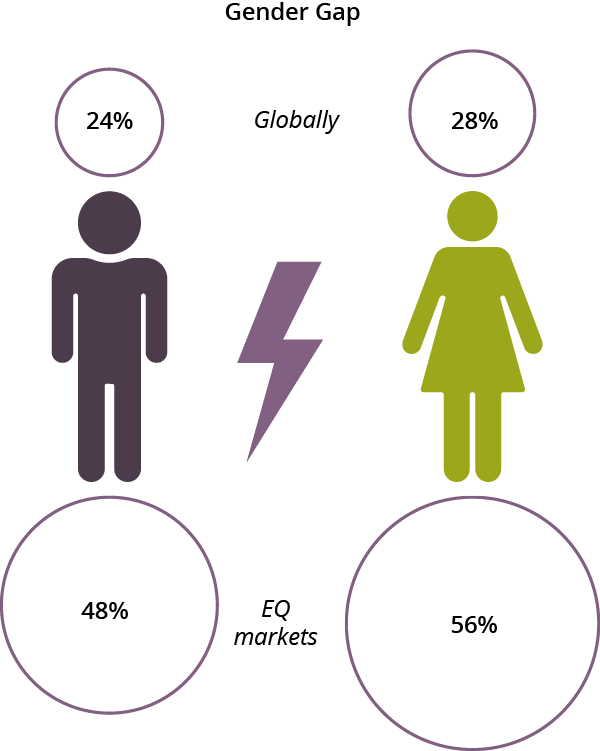

- Gender gap: Globally, 24% of men are unbanked, compared to 28% of women. This gender gap exceeds 16% in at least ten countries within EQ’s coverage.

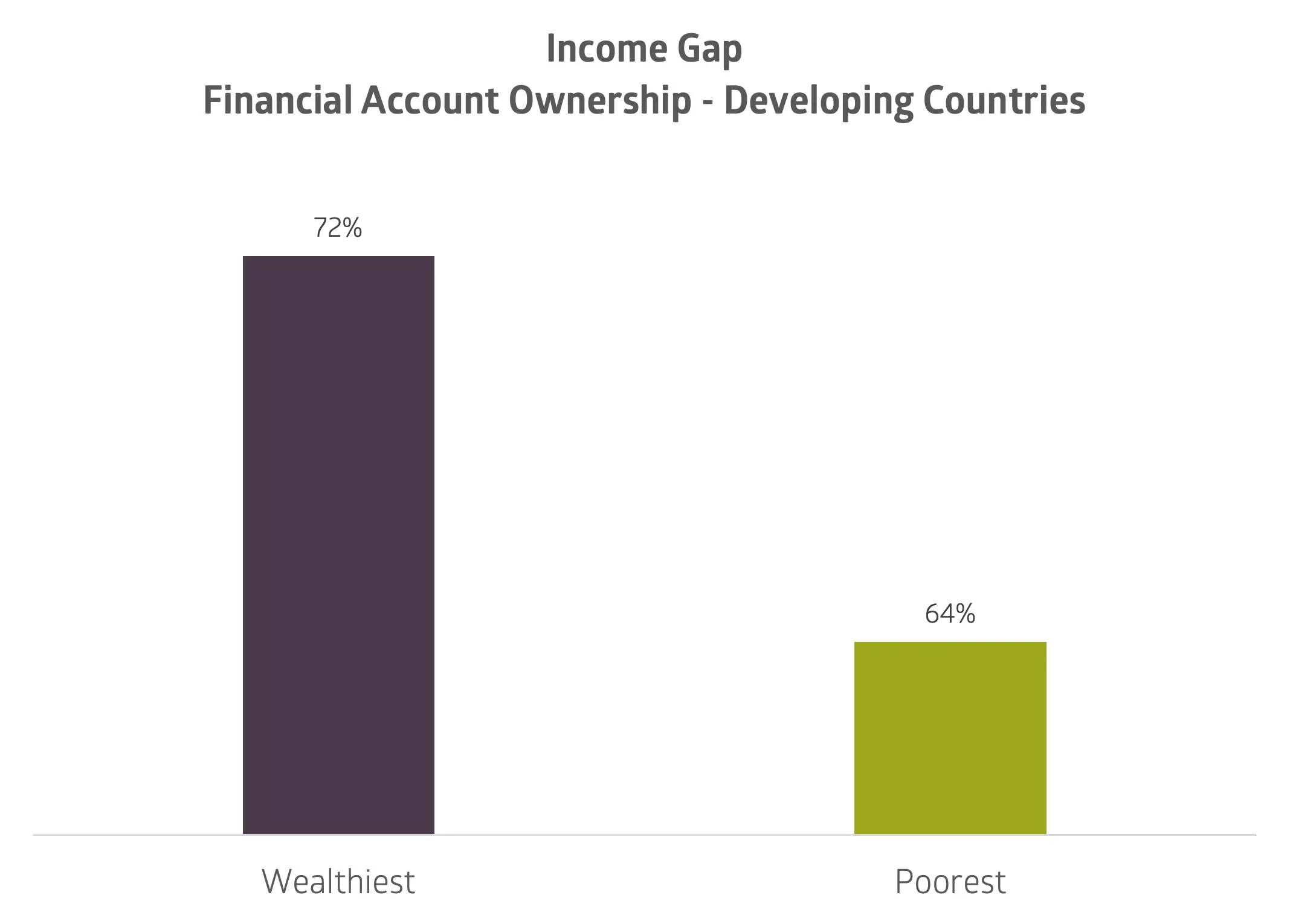

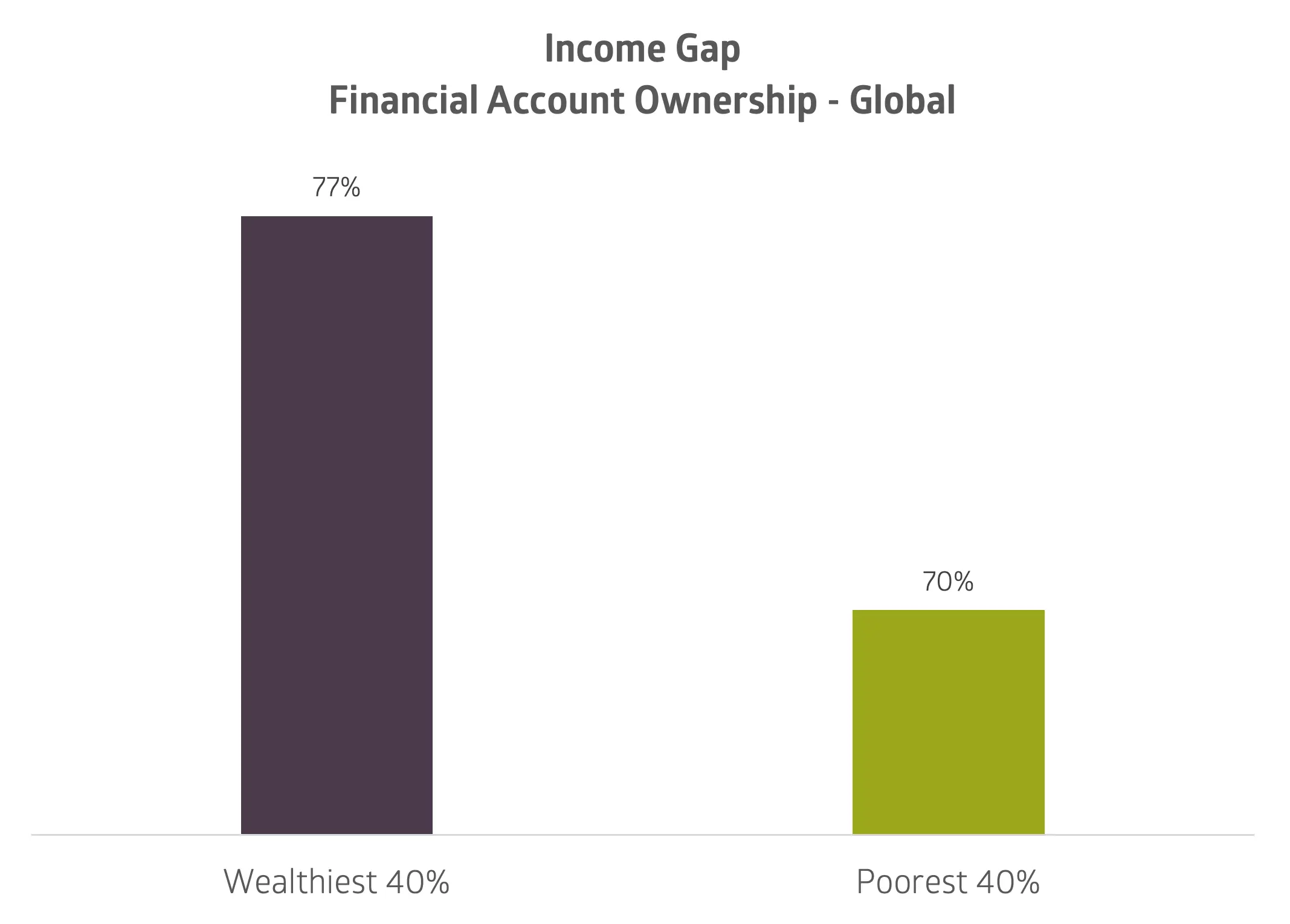

- Income gap: Among the wealthiest 40%, 77% have financial accounts, compared to 70% of the poorest 40%. In developing countries, the gap is wider: 72% of the richest have access vs. 64% of the poorest.

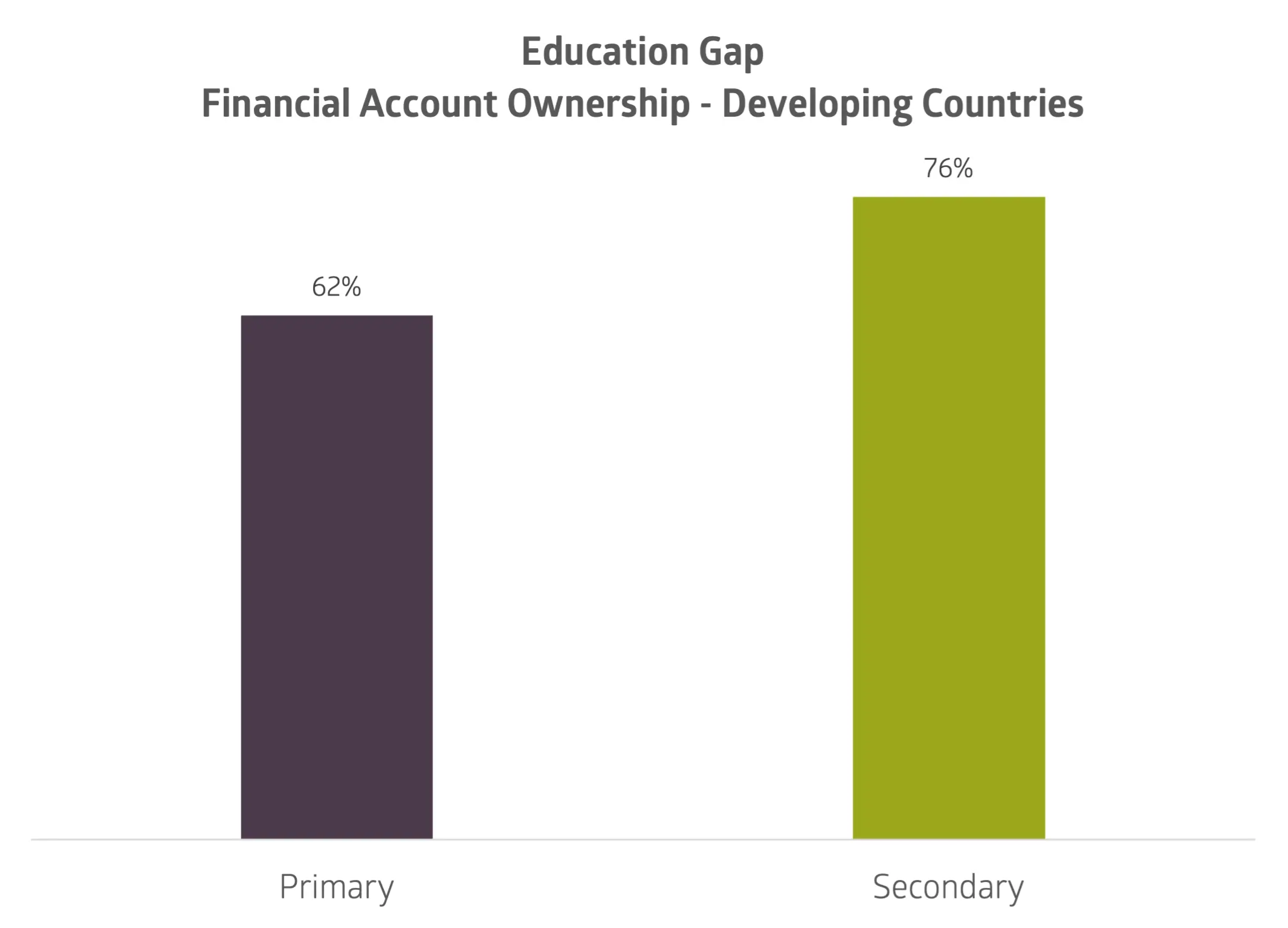

- Education gap: In developing countries, 62% of those with only primary education have accounts, while 76% of those with secondary education do. Globally, the difference is even starker: 64% (primary) vs. 82% (secondary education).

The Persistent Credit Gap

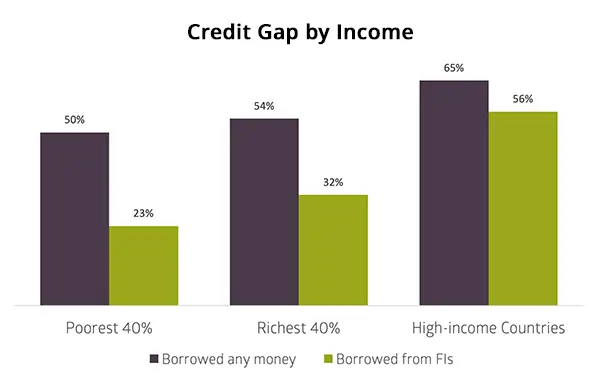

While account ownership has improved, access to formal credit remains limited:

- 53% of adults borrowed money in the past year, but only 28% of them used a financial institution.

- Women: 51% borrowed money, but only 27% used formal financial institutions.

- Poorest 40%: 50% borrowed, but just 23% used formal credit.

- Richest 40%: 54% borrowed, and 32% used formal institutions.

- High-income countries: 65% borrowed, with 56% using formal financial institutions.

Savings and Financial Resilience: Room for Improvement

While savings are crucial for financial security, formal savings mechanisms remain underutilized:

- Only 49% of adults save money in any form.

- 29% use formal financial institutions for savings.

- Globally, 68% of adults find it difficult or impossible to access emergency funds within 30 days – a figure that climbs to 80% among the poorest 40%.

The MSME Finance Gap: A Barrier to Economic Growth

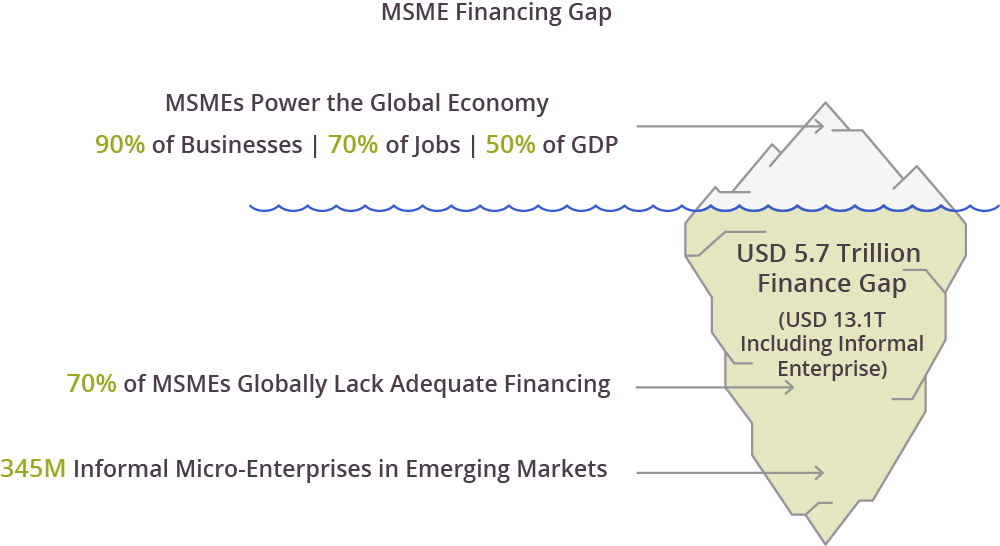

Financial inclusion is equally critical for micro, small, and medium enterprises (MSMEs), which account for 90% of businesses, over 70% of employment, and 50% of GDP worldwide, according to IFC. However, the MSME finance gap continues to widen:

Catalyzing Financial Inclusion Across Markets:

At EQ, our impact footprint has grown dramatically since 2020. We’ve expanded from 40 portfolio companies in 23 countries to 156 companies across the financial inclusion and clean cooking sectors in over 50 countries, increasing microentrepreneur reach more than tenfold to 443,191. Our focus on underserved populations has strengthened, with rural borrowers growing from 46% to 51% and women entrepreneurs from 50% to 63%. This growth demonstrates our commitment to integrating strong financial returns with measurable social impact in financial inclusion markets worldwide.

The Inclusion Challenge: Why EQ’s Work Matters More Than Ever

Despite progress in financial inclusion, significant gaps remain, disproportionately affecting underserved populations and small businesses. According to the latest Global Findex database 2021, 26% of adults globally remain unbanked. That’s 1.4 billion adults, with women and lower-income individuals facing the greatest barriers. Even among those with accounts, many remain underbanked, with up to half in some regions lacking access to essential financial services like credit, savings, and insurance. While digital financial solutions have expanded, challenges such as financial literacy, infrastructure, and affordability continue to hinder full participation in the formal financial system.

For micro, small, and medium-sized enterprises (MSMEs), access to finance remains a critical constraint, with the gap widening to +27% despite increased lending. Between 2015 and 2019, the MSME finance gap grew by over USD 1 trillion, reaching USD 5.7 trillion – a pace that outstripped global economic growth. While financing supply expanded, it has not kept up with demand, leaving many viable businesses without the capital needed to scale. As a share of global GDP, the gap has widened to 19% rather than narrowed, highlighting the need for more inclusive financial solutions to support small business growth and economic resilience.

Recognizing these challenges, EQ is constantly launching new strategic initiatives aimed at accelerating financial inclusion and closing the remaining gaps. By driving innovation, expanding financial access, and strengthening financial literacy, we aim to build a more inclusive and resilient financial ecosystem for individuals and businesses worldwide.

REACHING The Unreached

The institutions we support, the end borrowers they serve

Portfolio Breakdown: scaling inclusion

Persistent gaps in access to financial services remain a global challenge with far-reaching economic implications. As outlined in the previous section, national averages often mask significant disparities across population groups. This is at the heart of what it means to be unbanked. But exclusion can also be partial – described as being underbanked – where individuals may have some access to financial services but still rely heavily on informal or alternative providers.

Even in one of the world’s most developed financial markets – New York City – nearly 10% of households are unbanked, and over 20% are underbanked, relying on services such as check cashers or payday lenders to meet basic financial needs (NYC Department of Consumer and Worker Protection, 2021).

Being underbanked may mean having a savings account but no access to credit or qualifying for a mortgage backed by collateral while lacking the financing needed for education or working capital. These realities highlight the multidimensional nature of financial exclusion and the importance of targeted, context-specific investment strategies. EQ addresses this complexity by investing in financial institutions across a range of legal structures, asset sizes, and levels of maturity – ensuring that underserved populations are reached through adaptable, scalable, and inclusive delivery models.

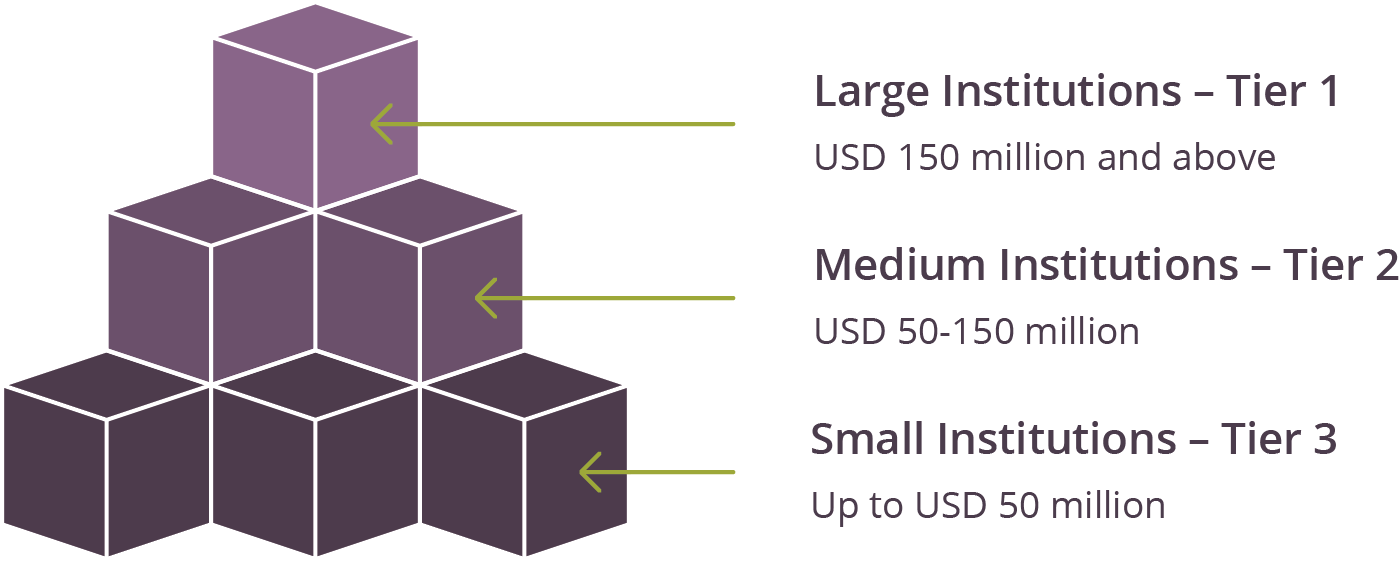

As of December 2024, for our financial inclusion investment mandate, we are working with 145 financial institutions across a wide range of geographies, legal structures, and operational capacities. To support strategic portfolio management and ensure outreach across the financial inclusion spectrum, we classify our investees into three tiers based on total asset size:

This tier-based classification reflects our belief that institutions of all sizes play a vital and complementary role in building a more inclusive financial ecosystem. Each tier contributes differently to addressing the barriers, disparities, and use-case gaps outlined in the previous chapter.

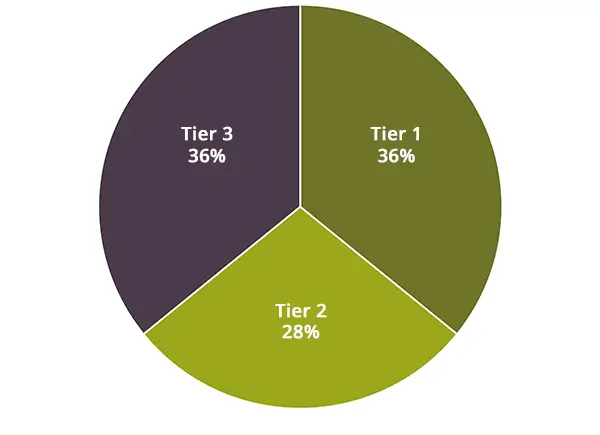

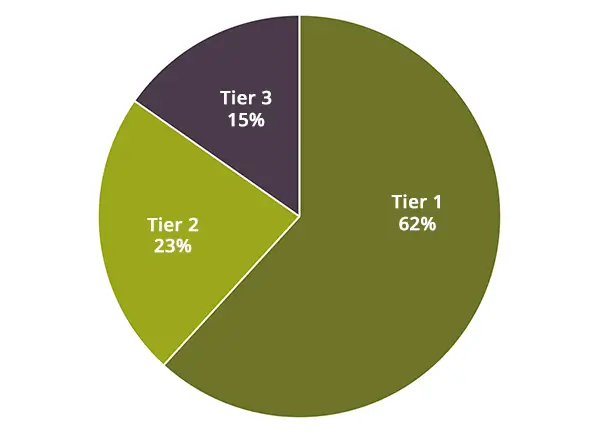

Investment Breakdown by Tier

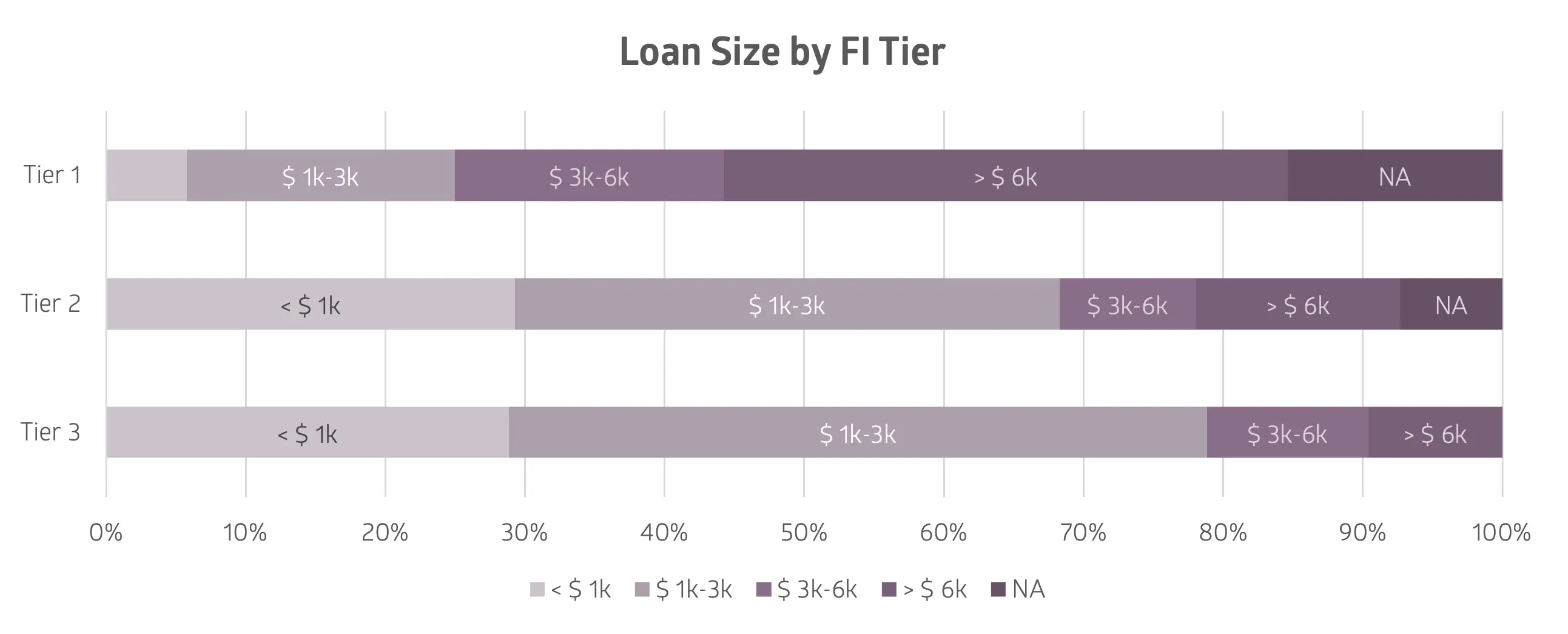

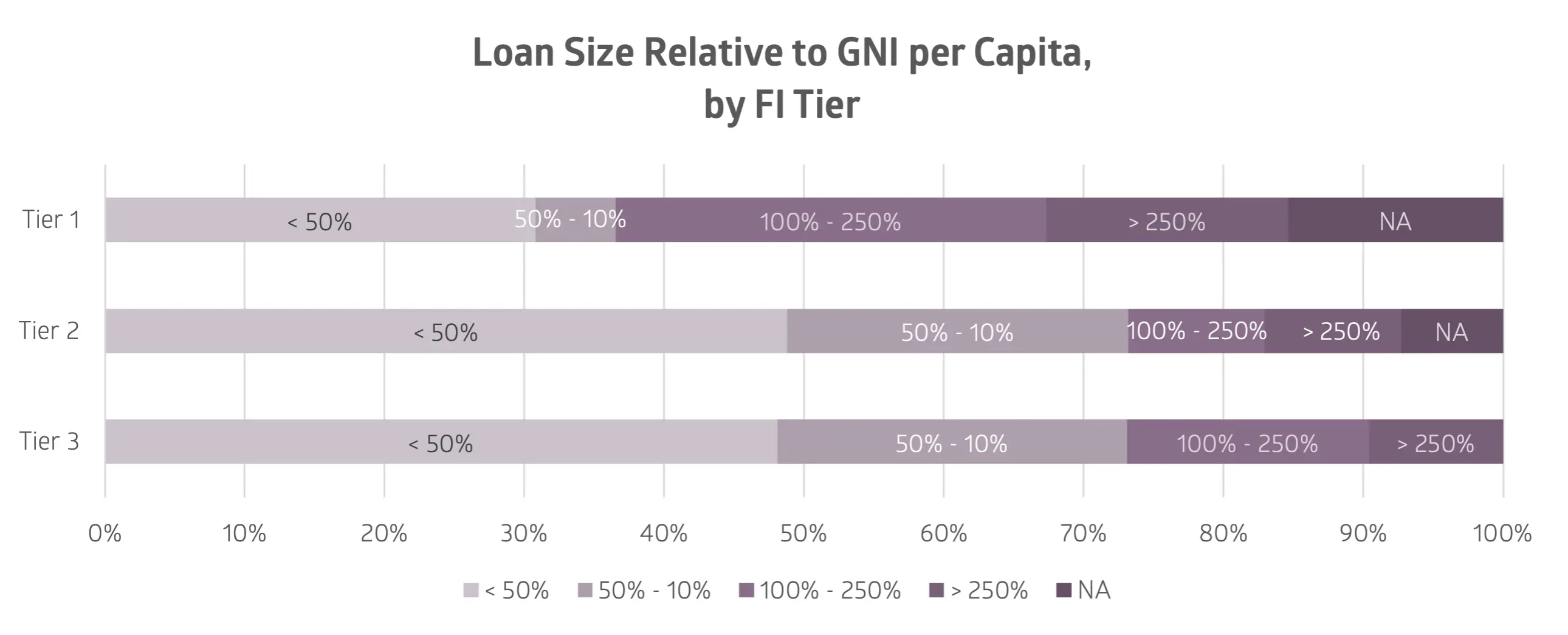

Our portfolio is well balanced in terms of institutional diversity: 36% of investee companies fall under Tier 3, 28% under Tier 2 and 36% under Tier 1. However, when measured by loan volume, smaller institutions (Tier 3) collectively hold 15% of the outstanding loans, medium institutions (Tier 2) hold 23% and large (Tier 1) institutions hold 62% of the outstanding volume.

Tier Distribution

Number of Companies

Outstanding Loans

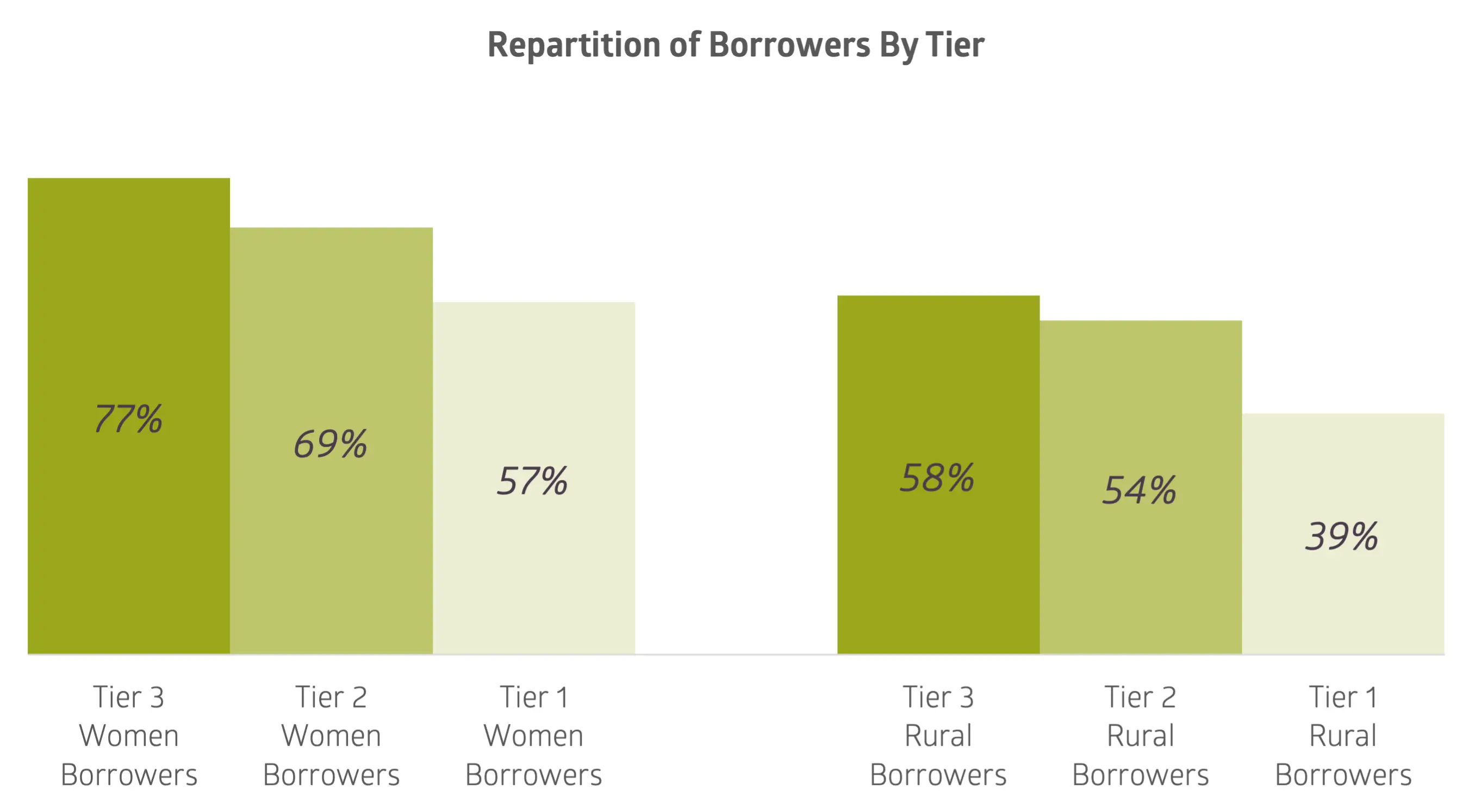

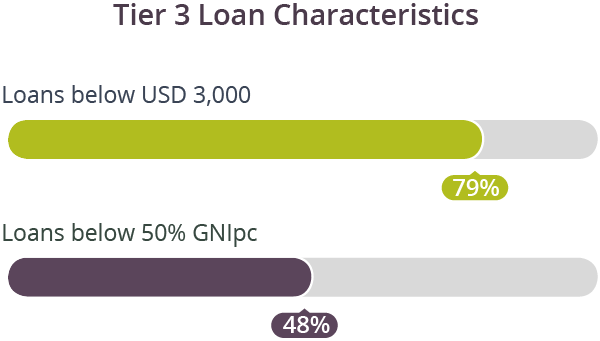

Tier 3 – Reaching the last mile

Tier 3 (smaller) institutions typically operate in hard-to-reach areas and serve clients often excluded from formal financial systems. The portfolio-wide share of women borrowers and rural borrowers in Tier 3 institutions is 77% and 58%, significantly higher than in Tier 1 institutions: 57% and 39% respectively.

With lean operations and limited digitization, these institutions rely on strong community trust and proximity to clients. They may have further to go in terms of formal governance or ESG policy, but they excel at tailoring services – such as smaller loan sizes and flexible repayment terms – for

remote and low-income populations. Many fill market gaps by opening branches in regions where larger banks won’t go, offering an essential gateway to the financial system.

Over 79% of Tier 3 institutions report average loan sizes below USD 3,000, and for 48%, the average is under half of the GNI per capita (GNIpc) – underscoring their focus on reaching lower-income borrowers and the base of the pyramid.

Tier 2 – The Missing Middle

Tier 2 institutions are the most diverse group in our portfolio. Depending on the country context, they range from growing MFIs to well-established, regulated entities – even banks. They are often large enough to scale, yet small enough to maintain close relationships with micro and small entrepreneurs.

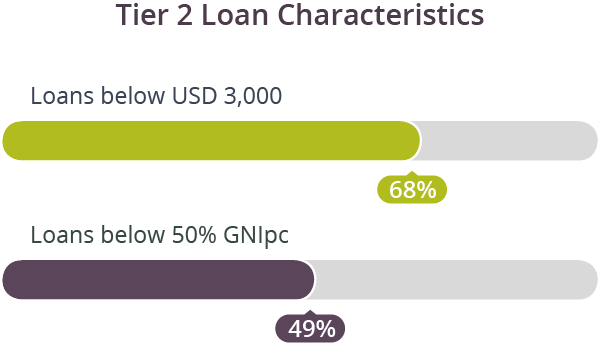

While adopting more formal systems, many Tier 2 institutions continue to serve underserved clients: over half report average loan sizes below USD 3,000, and 49% stay under 50% of the GNIpc – showing a sustained commitment to inclusive lending.

Tier 1 – Scaling Inclusive Finance

Tier 1 institutions are the most mature and typically operate at a national scale. They benefit from diversified funding sources, robust risk management, and well-established operational systems. While they tend to focus more on small and medium enterprises – including women-led SMEs – their outreach to rural and underserved borrowers is often lower.

Despite this, Tier 1 institutions are essential to financial inclusion. They offer a wide range of services beyond credit – such as savings, payments, and insurance – and often maintain micro-lending products as part of a broader offering. Our funding ensures these products remain viable and can be scaled to reach more clients.

Compared to other tiers, Tier 1 institutions provide a higher share of larger loans: over 20% report average outstanding loan sizes over USD 9,000, and 48% of them reported loans exceed 100% of GNIPC, indicating a stronger focus on established businesses and higher-income clients. This highlights their role in enabling business growth and job creation, while still contributing to inclusion through specific outreach programs.

Going THE EXTRA MILE

Q&A with Chuck Olson

Co-Founder of EQ

As a member of the Executive Management Team and Co-Founder of EQ, Chuck Olson oversees the due diligence process and the disbursement of loans to financial institutions. During the following Q&A, Chuck shares how financial inclusion continues to present meaningful investment opportunities – and how EQ navigates risks while shaping the future of inclusive finance.

Insights on Growth, Resilience, and Responsible Market Building

From an investment standpoint, why does EQ go the extra mile to support smaller financial institutions? Wouldn’t it be easier just to work with the big banks?

Working with smaller institutions is our sweet spot, as these are the institutions where we believe we can add the most value – financially and strategically. They tend to be more agile, more open to adopting best practices, and more responsive to client needs. We don’t just provide capital – we help shape how these institutions grow, strengthen governance, and scale sustainably.

They’re also often more transparent and cooperative during our due diligence. For example, in our underwriting process, we conduct transaction testing – where we analyze real loan data and spend time onsite reviewing actual files. Smaller institutions typically share their full loan database, which we cross-check against internal reports. We visit selected branches, examine loan files from both new and repeat clients, and assess the borrower journey, including credit history and the clarity of loan terms. This gives us a grounded understanding of how loans are appraised and how the institution interacts with clients.

When it comes to managing distressed loans, recovery is often more feasible with smaller institutions. They don’t have large deposit bases or complex liabilities, and they’re usually more open to guidance on restructuring. Larger institutions, by contrast, often have other instruments and regulatory constraints that make recoveries more bureaucratic and less flexible.

At the same time, many small and mid-sized partners are better capitalized and more conservatively provisioned than their larger competitors, as the theory there is that the larger banks more effectively measure risk, which is likely true, but puts large banks more on the edge if a risk not correctly measured, comes into effect. Of course, we try to always assess and price the risk carefully. But by supporting these players, we strengthen not just the institution – but the broader financial market.

The microfinance sector has been around for decades and went through many cycles. Is there still room for meaningful growth?

Without a doubt. Microfinance markets are far from saturated. Over 1.4 billion adults globally remain unbanked, most of them in emerging markets. Even among those with a bank account, many are still underbanked – lacking access to affordable credit, flexible savings tools, or the financial products they need to manage everyday risks and opportunities.

There’s also significant room for growth among clients who are already served by microfinance. As their businesses expand – or even just to keep operations steady in an inflationary environment – their financing needs increase. Yet traditional banks are often inaccessible or uninterested in this segment.

Take the example of a small shopkeeper. Last year, they might have needed USD 100 to stock basic inventory. This year, due to inflation, they need USD 120 just to stay afloat. Microfinance helps bridge that gap. As borrowers move from survival to growth, the institutions that serve them must also scale and evolve. That’s where the sector’s potential lies – not only in expanding outreach, but in deepening the quality, size, and relevance of financial access over time.

The high interest rates environment that we have since in the last couple of years had a big impact on many sectors.

How did the FIs cope with the high interest rates?

FIs have demonstrated strong resilience over several market cycles. Even during the last years and despite higher funding costs and tighter global liquidity, many institutions managed to adapt well. A key reason for this resilience lies in the institutional strength they’ve built over time. Years of collaboration with international lenders have helped FIs improve their systems, governance, and credibility – enabling them to access new funding sources such as local bank loans, client savings, and even local bond markets. These options would have seemed out of reach for many institutions just 15 years ago.

Repayment rates have also remained strong across many portfolios – an indication that even in a high-interest environment, borrowers continue to prioritize microfinance loans because they meet urgent, real needs. For microfinance institutions, their proximity to clients, flexible loan structures, and deep understanding of their markets have all contributed to maintaining portfolio quality.

But resilience does not mean self-sufficiency. FIs still need committed, long-term partners to navigate uncertainty. Our capital enables them to continue lending to underserved clients at responsible terms, even as market conditions become more challenging. It also supports strategic investments – whether in risk management, staff capacity, or operational systems – that might otherwise be delayed. This is precisely where EQ’s role becomes most meaningful: providing stability, flexibility, and partnership when it’s needed most.

Microfinance institutions are sometimes criticized for charging high interest rates. Is that concern justified?

It’s a fair concern, but one that needs context. Microfinance interest rates may appear high compared to commercial bank rates, but they reflect the true cost of serving borrowers without formal income, collateral, or access to infrastructure – particularly in remote or underserved areas.

Importantly, microfinance offers a far safer and more transparent alternative to the informal lending options that many borrowers would otherwise rely on. In markets where formal financial services are absent or limited, people often turn to unregulated payday lenders, where rates are significantly higher, terms are unclear, and collection practices can be aggressive. In contrast, responsible microfinance is designed to be transparent, affordable, and client-centered.

What’s often overlooked in the debate about pricing is the borrower’s perspective – and their right to timely financial resources.

Take the example of a smallholder farmer preparing for planting season. While some governments offer subsidized agricultural loans, these are often distributed through state banks with lengthy appraisal processes. As a result, funding may arrive too late in the season. Meanwhile, the farmer needs immediate capital to buy seeds, prepare the land, and start planting. Microfinance institutions step in to fill that gap. In many cases, the farmer applies for both: a microloan to begin planting, and a subsidized loan in parallel. Once the government funding is approved, they repay the MFI. It’s a practical and complementary solution.

It’s also worth noting that repayment rates across the sector remain strong. This shows that borrowers understand and manage their obligations – because the financing they receive is relevant, timely, and valuable. Responsible microfinance meets real needs, and borrowers repay when the product is delivered transparently and ethically.

And that transparency is essential. Clients must be able to review terms clearly, compare offers, and make informed choices. That’s what drives healthy competition – and ultimately, better pricing. When interest rates are capped artificially, lenders often introduce hidden fees or product distortions that undermine transparency and true affordability, or even worse, stop lending to potentially higher-risk sectors, forcing borrowers looking for smaller sums to turn to the informal sector.

That’s why EQ’s diversification strategy is so important. By supporting a wide range of institutions, we promote market choice, strengthen accountability, and encourage efficient pricing models. Our capital doesn’t just support borrowers – it helps shape a more inclusive and sustainable financial ecosystem.

Typical FI loans have a maximum duration of three years. Still, EQ has worked with many FIs for years – reflecting our strong commitment to collaboration. What does EQ look for in a long-term partner?

We look for a dual commitment: to impact and to performance. Whether it’s a small rural MFI or a regional bank, we seek partners that understand their clients and want to grow responsibly. If there’s a willingness to innovate, improve, and stay client-centric, that’s where our investment can be most catalytic.

Geographical Essentials

- Country: Uzbekistan

- Capital: Tashkent

- Population: 36.8 million (0.45% of the global population, ranked 43rd)

- Urban Population: 48.1%

- Median Age: 27 years

- GNI per Capita: USD 2,700 (2023)

- Official Language: Uzbek

- Currency: Uzbekistani Som (UZS)

Financial Institution Spotlight:

- Name: Vodiy Taraqqiyot Mikromoliya Tashkiloti LLC

- Established: 2014

- Mission: to provide accessible microfinance solutions to support economic growth and financial inclusion in the Fergana region.

- Target client: Rural Residents

- Branches: 16

- Number of borrowers: 26,416

- % of Rural Borrowers: 89.2%

- % of Women Borrowers: 23.2%

- Gross Loan Portfolio: USD 48.4million

- Average Loan size: USD 1,794

Baking Success

In Chust district of Namangan region, Sherali Gafurov has been building a bakery business since 2018. What started as a modest operation producing 1,200 bread loaves daily has now grown to an impressive 3,000 pieces per day, serving the local market and creating employment in his rural community.

Sherali’s growth trajectory accelerated when he became a client of Vodiy Taraqqiyot Mikromoliya (VTK) in 2021. His first loan of approximately USD 2,900 provided essential working capital to strengthen his operations. Building on this foundation, Sherali secured a second loan of USD 4,100 in 2024 specifically to purchase an additional oven – a strategic investment in expanding production capacity. When asked why he chose VTK, Sherali said he was familiar with them and didn’t know of other lenders.

Perhaps the most significant impact of Sherali’s growing business extends beyond the numbers. With his expansion, he has created three new jobs in his community, specifically hiring local housewives who now earn USD 300 monthly each. These employment opportunities provide stable income to families in Chust, demonstrating how access to appropriate financing can create a ripple effect of economic empowerment.

Sherali’s story reflects the broader mission of VTM, currently the fourth-largest microfinance organization in Uzbekistan.

With 88% of its 26,000+ active clients based in rural areas, VTM’s footprint across 16 branches throughout Uzbekistan demonstrates its commitment to serving communities that often lack access to traditional banking services.

Through its USD 50 million loan portfolio and team of over 300 employees, VTM continues to support entrepreneurs like Sherali who are building businesses, creating jobs, and strengthening local economies across rural Uzbekistan.

Sherali’s bakery business contributes to several key UN Sustainable Development Goals:

By creating sustainable income for himself and providing employment to three local women, Sherali’s business directly contributes to poverty reduction in rural Uzbekistan.

Sherali’s business provides women with economic opportunities and income independence, supporting greater gender equality in a rural setting.

The bakery’s growth from 1,200 to 3,000 bread loaves daily represents significant business expansion. This economic activity, supported by strategic microfinance, demonstrates how local enterprises can drive sustainable economic development and create quality employment opportunities..

The strategic investment in additional production equipment (a new oven) through microfinance shows how access to capital enables small businesses to build productive capacity and upgrade their infrastructure...

VTK’s focus on serving rural areas (88% of clients) helps address the urban-rural divide in financial services access, reducing geographical inequalities in economic opportunity.

Geographical Essentials

- Country: Uzbekistan

- Capital: Tashkent

- Population: 36.8 million (0.45% of the global population, ranked 43rd)

- Urban Population: 48.1%

- Median Age: 27 years

- GNI per Capita: USD 2,700 (2023)

- Official Language: Uzbek

- Currency: Uzbekistani Som (UZS)

Financial Institution Spotlight:

- Name: Fortuna Biznes Mikromoliya Tashkiloti LLC

- Established: 2016

- Mission: to offer high-quality financial services to rural residents, aiming to meet customer needs to the maximum and serve as their best financial partner.

- Target client: Rural Residents

- Branches: 22

- Number of borrowers: 45,725

- % of Rural Borrowers: 83.1%

- % of Women Borrowers: 22.4%

- Gross Loan Portfolio: USD 82.9 million

- Average Loan size: USD 1,731

Crafting a legacy

In the historic city of Margilan in Uzbekistan’s Fergana Valley, Abdubannobjon Madrakhimov has been perfecting his carpentry craft since 2010. From his workshop on Akhmad Yassaviy Street, he creates handcrafted tables, chairs, and both kitchen and bedroom furniture that blend functionality with traditional craftsmanship. While his skills were wellestablished, Abdubannobjon’s vision for growth required financial support to reach its full potential.

When Abdubannobjon sought to expand his carpentry business in 2022, he turned to Fortuna Biznes Mikromoliya Tashkiloti LLC. The microfinance institution’s proximity to his home, efficient loan processing, and cash disbursement options made it an ideal financial partner. What began as a modest request for business capital has blossomed into a transformative financial relationship spanning multiple loans over three years.

Abdubannobjon’s growth journey with Fortuna showcases how targeted microfinance can propel small businesses forward:

- March 2022: First loan of USD 2,700 for purchasing local construction materials

- January 2023: Second loan of USD 5,000 for acquiring specialized handicraft tools

- July 2024: Third loan of USD 4,700 for woodworking materials and supplies

- February 2025: Fourth loan of USD 4,600 for additional woodworking resources

In total, Fortuna has extended USD 17,000 in microloans to support Abdubannobjon’s furniture business, with two loans already successfully repaid and an outstanding balance of approximately USD 8,300.

From Family Workshop to Employment Creator

One of the most significant transformations in Abdubannobjon’s business has been its evolution from a family-operated workshop to a small enterprise creating economic opportunities for others. Initially relying solely on family members, his business expansion has enabled him to create two additional permanent jobs, hiring neighbors as employees and providing them with steady monthly incomes of USD 400 each.

Today, Abdubannobjon’s furniture workshop generates a monthly turnover of approximately USD 8,000, with 30% representing his income (USD 2,400). After paying his two employees (USD 800), he maintains a monthly profit of $1,600. His continued access to financing enables him to invest in business growth and improve his family’s living conditions, demonstrating how appropriate financial support fosters sustainable livelihoods.

Sustainable Development Impact

Abdubannobjon’s journey with Fortuna highlights the multifaceted impact of financial inclusion – particularly through expanded access to finance – in advancing several United Nations Sustainable Development Goals:

By establishing a sustainable business with steady profits, Abdubannobjon has created economic security for his family.

His workshop provides employment for two community members.

The loans have enabled investment in better tools and materials, improving production quality and efficiency..

Abdubannobjon’s access to finance through Fortuna helps address economic disparities and promote inclusive growth.

The impact of Abdubannobjon’s story is multiplied across Uzbekistan through Fortuna’s extensive operations.

As the country’s third-largest microfinance organization, Fortuna maintains a gross loan portfolio of over USD 82 million and employs more than 440 staff members across 22 branches throughout the Republic of Uzbekistan. With over 45,000 active clients – 80% located in rural areas – Fortuna demonstrates why microfinance remains vitally important today: it provides access to capital in underserved communities, transforms skilled individuals into job creators, and builds sustainable local economies where traditional banking often fails to reach.

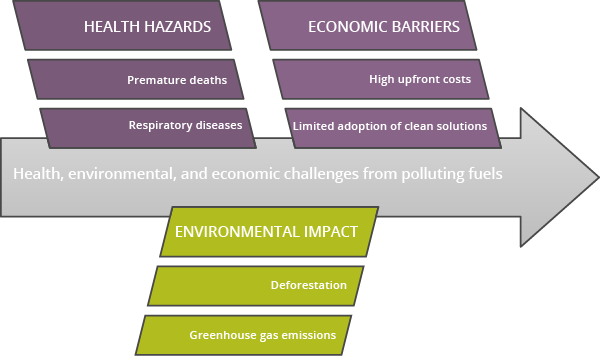

Addressing the Clean Cooking Challenge

Access to clean cooking remains a critical issue in Ghana, where 4.5 million households rely on polluting fuels such as firewood and charcoal.

These traditional cooking methods pose severe health risks, contributing to respiratory diseases and premature deaths, especially among women and children.

Additionally, the widespread use of biomass fuels accelerates deforestation, biodiversity loss, and greenhouse gas emissions, exacerbating climate change.

Despite the strong demand for cleaner alternatives, the high upfront cost of clean cooking solutions has hindered adoption, underscoring the need for innovative financing mechanisms.

The Role of Carbon Finance in Scaling Clean Cooking Solutions

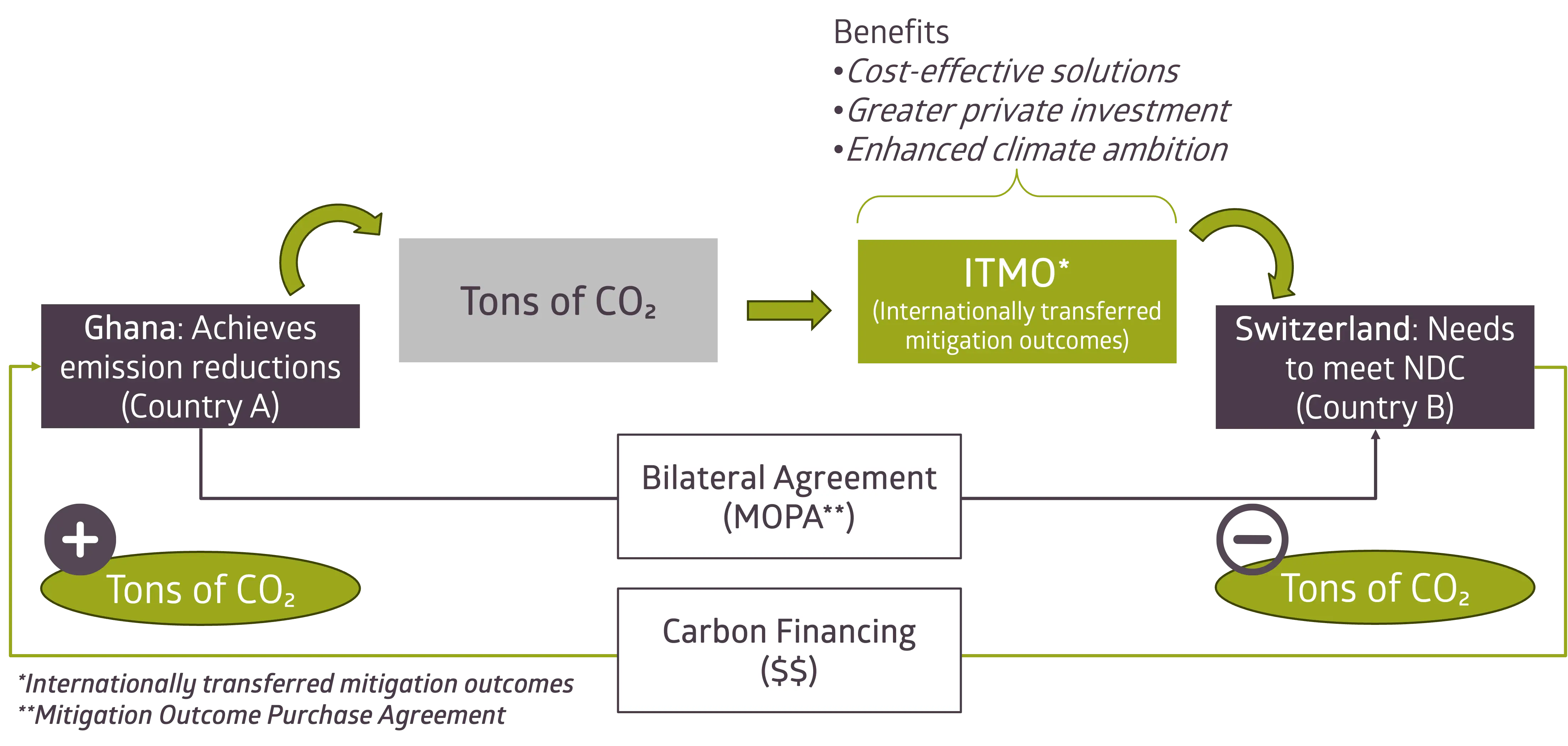

Lowering cookstove costs while driving climate action through carbon credits – verified emission reductions that can be traded to help entities meet their climate targets.

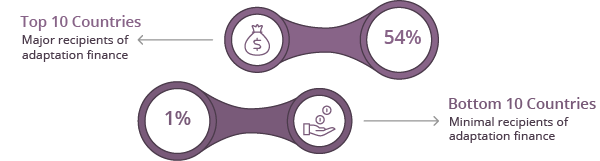

Article 6.2 Transaction

Beyond affordability, carbon finance also plays a vital role in addressing the unequal distribution of climate adaptation funding. In Africa, for example, finance flows are heavily concentrated: according to the Global Center on Adaptation, 54% of adaptation finance goes to just 10 countries, while the bottom 10 recipients receive only 1% (www.gca.org).

However, this inequality is part of a broader trend – public multilateral and bilateral adaptation finance to developing countries overall declined by 15% to USD $21 billion in 2021 (www.unep.org).

By integrating carbon finance mechanisms, projects such as the Envirofit Cookstove Initiative in Ghana ensure long-term financial sustainability while delivering significant environmental, economic and social benefits.

The EFI Cookstove Project: A Scalable, High-Impact Solution

Project Overview

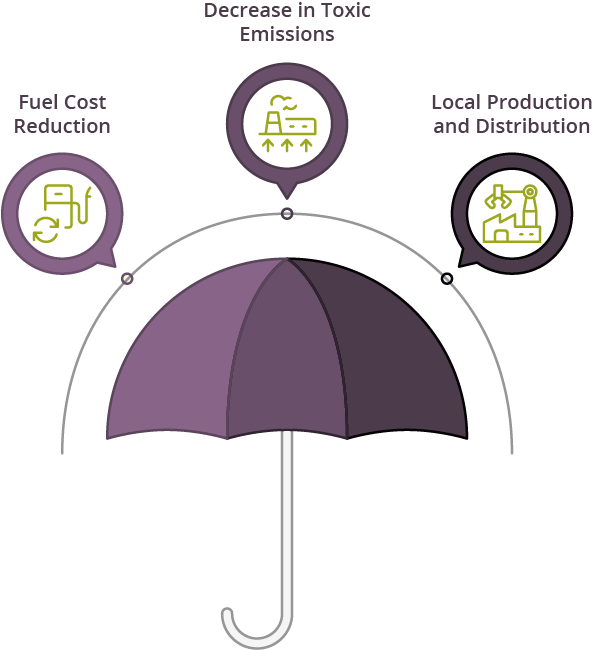

The Envirofit International (“Envirofit”) Ghana Cookstove Project aims to distribute 180,000 high-efficiency cookstoves across rural and semi-rural Ghana. These stoves offer significant benefits:

- 60% reduction in fuel costs for households.

- 80% decrease in toxic emissions, improving indoor air quality.

- Local production and distribution, generating jobs and strengthening supply chains.

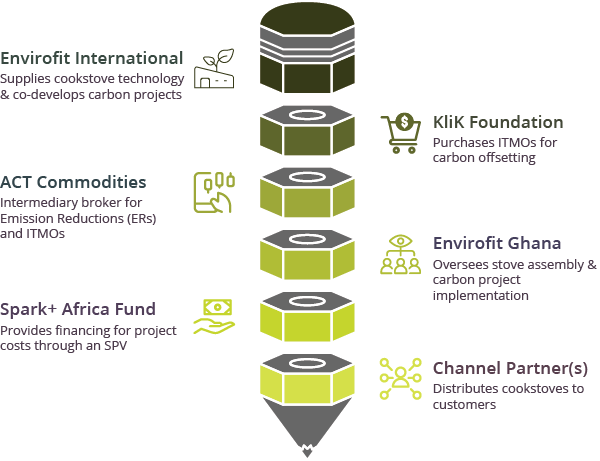

How the project works

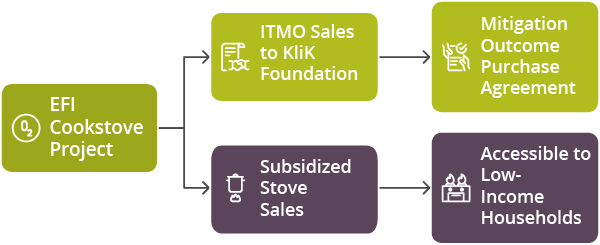

To scale the distribution of clean cookstoves, Envirofit approached EQ for USD 4 million in financing from Spark+ Africa Fund (“Spark+”), a clean cooking-focused fund it manages. With EQ’s support, Envirofit successfully entered into a carbon transaction aligned with the stringent requirements of Article 6 of the Paris Agreement, ensuring financial sustainability through the sale of Internationally Transferred Mitigation Outcomes (ITMOs).

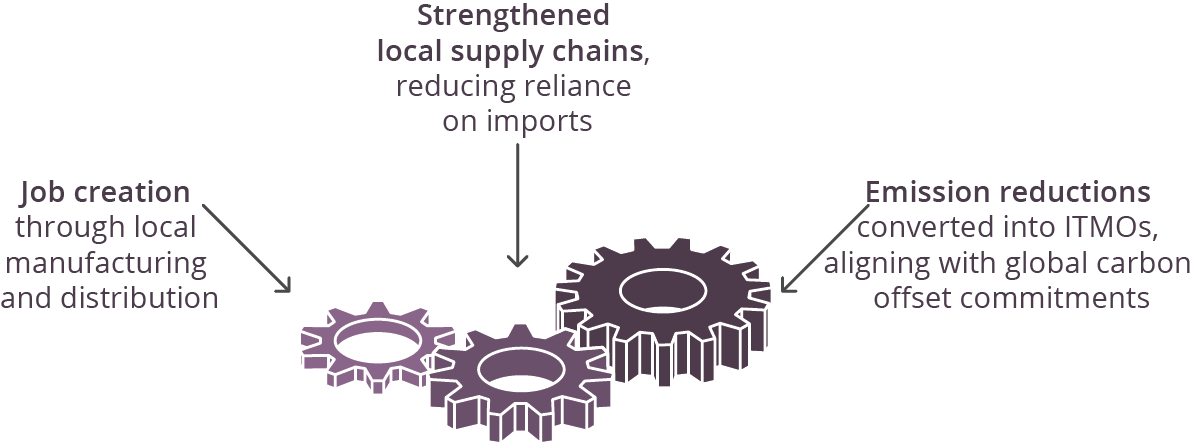

By manufacturing stoves locally, the initiative reduces costs, creates jobs, and ensures long-term scalability. The integration of carbon finance means that emission reductions from cleaner cooking are monetized, making the stoves more affordable while securing financial sustainability for the project.

Key Stakeholders and Financial Model

- Envirofit International: Designs and manufactures the high-efficiency cookstoves.

- ACT Commodities: Manages carbon credit generation and transactions.

- Spark+ Africa Fund (managed by EQ): Provides USD 4M in debt financing to support project implementation.

- KliK Foundation: Purchases carbon credits (ITMOs) generated by the project to offset Switzerland’s automotive fuel emissions.

The project leverages an innovative financial structure, ensuring long-term sustainability through two key revenue streams:

- ITMO sales to the KliK Foundation via a Mitigation Outcome Purchase Agreement (MOPA).

- Subsidized stove sales, making the technology accessible to low-income households.

To enhance accountability, the project incorporates performance-based financing and high-frequency monitoring using advanced sensor-based methodologies.

Enabling Qapital’s Contribution: Financing Climate Solutions

Spark+ Africa Fund, managed by EQ, plays a pivotal role in advancing climate finance solutions by providing impact-driven debt financing. In Ghana, Spark+ funding has directly supported the deployment of 60,000 clean cookstoves, ensuring job creation, emissions reductions and strenghtened local supply chains.

By financing scalable, market-driven solutions, EQ enables the transition to cleaner energy, demonstrating how private capital can effectively mobilize climate finance for high-impact projects.

Impact and Future Outlook

Environmental and Social Impact

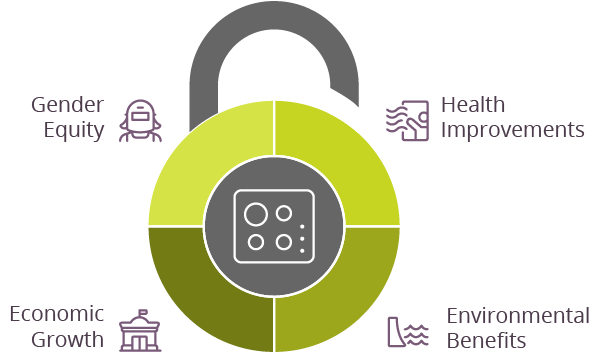

The Envirofit Ghana Cookstove Project is delivering measurable improvements across multiple dimensions:

- Health: Improved indoor air quality reduces respiratory illnesses.

- Environment: Lower carbon emissions and reduced deforestation.

- Economic Growth: Local job creation in stove production, distribution, and maintenance.

- Gender Equity: Reducing cooking time and fuel collection burden, benefiting women.

Scalability and Replicability

The project serves as a model for clean cooking and carbon finance initiatives, with potential for further expansion beyond the initial 60,000 stoves.

Key factors supporting scalability include:

- Proven demand: 95% interest from surveyed households.

- Supportive policy environment: Ghana’s commitment to ITMO frameworks.

- Strong partnerships and financing mechanisms.

Challenges to address include:

- Initial investment: Sources of capital for projects may be limited given the risks, however capital can be unlocked through fixed price offtakes of ITMOs.

- Supply chain challenges: Projects may rely on importing materials, which could face supply chain issues, import restrictions, or global market fluctuations. This could potentially delay production or increase costs.

- Cultural acceptance and behavior change: Transitioning from traditional cooking methods to high-efficiency stoves may face resistance due to ingrained cultural practices. Overcoming barriers will require targeted awareness campaigns.

- Monitoring and verification: Ensuring accurate measurement of emission reductions across distributed households may be complex. However, projects may rely on innovative technologies like sensor-based usage measurement to track impact and mitigation outcomes.

- Regulatory and policy variability: Shifts in environmental policies or mitigation outcome regulations could affect the project’s financial model and implementation. Maintaining compliance with evolving regulatory frameworks may pose challenges.

- Market competition: Other clean cooking initiatives or technologies entering the market could impact adoption rates. The introduction of subsidized stoves without proper market analysis could distort the market and affect existing initiatives.

Conclusion

The Envirofit Ghana Cookstove Project is a pioneering example of how carbon finance can drive large-scale impact, improving health, economic opportunities, and environmental sustainability. By leveraging Article 6.2 of the Paris Agreement, the initiative ensures financial viability while contributing to global emissions reduction efforts.

The full case study, detailing Enabling Qapital’s role in expanding access to clean cooking solutions, is featured on our website: www.enabling.ch

Investing with A GENDER LENS

EQ’S Portfolio Approach

Financial inclusion has a strong capacity to improve women’s agency by providing them with access to resources, decisionmaking power, and economic independence. At EQ, we strongly believe in this principle, which is why we continue to strengthen the implementation of gender-lens investing within our operations and across our portfolio companies.

Gender-lens investing is an investment approach that intentionally integrates gender considerations into financial decisionmaking to advance gender equity while achieving financial and social returns. It focuses on directing capital toward businesses that empower women, promote gender equity in leadership and workforce participation, and improve access to finance for women.

EQ’s Progress on 2X Challenge

Meeting Internal Criteria and Expanding to Portfolio-Level Implementation

EQ has made significant strides in incorporating gender considerations into its investment processes:

Gender considerations are integrated in the ESG assessments and reporting frameworks of EQ’s investment products.

Gender metrics is aligned with IRIS+ standards.

In 2024, we’ve conducted a comprehensive 2X criteria audit of our portfolio companies in the clean cooking sector.

The findings highlighted common challenges, particularly in emerging markets, including:

- Lack of public commitment to gender targets

- Need for formalization of gender-based violence prevention policies

- Absence of gender-disaggregated metrics

We believe these challenges are addressable through awareness-building initiatives. Going forward, voluntary evaluations will also be extended to portfolio companies receiving investments under our financial inclusion mandate.

Collaboration with Columbia University’s School of International and Public Affairs (SIPA)

Advancing Gender Equity Through Research and Practical Tools

In 2024, EQ partnered with SIPA to conduct research on the barriers women face in recruitment, workforce retention, career mobility, and access to credit and credit lifecycles. These studies, led by Professor Barbara Magnoni, were conducted in Uzbekistan and Cambodia, providing critical insights into gender-specific challenges in financial and employment sectors. To build on these findings, EQ followed up with webinars aimed at engaging portfolio companies, raising awareness, and discussing actionable solutions to promote gender equity.

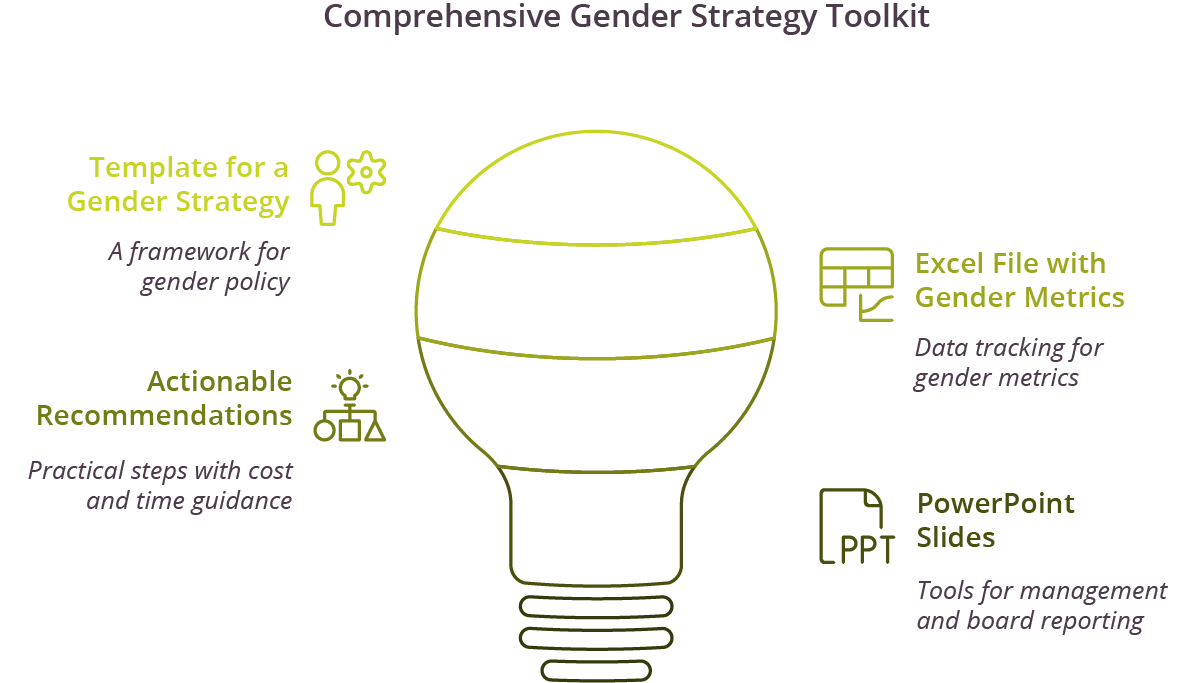

In 2025, we strengthened this collaboration, and SIPA students developed a Gender Toolkit to assist financial institutions in adopting gender-inclusive strategies.

The Gender Toolkit – A Student Perspective:

To introduce the toolkit, we invited SIPA students to share their experience.

Barbara Magnoni

President of EA Consultants and Adjunct Professor at the School of International and Public Affairs at Columbia University

Maxwell Ryan Lawson

Master of International Affairs (MIA), Economic and Political Development/International Organizations and UN

Aanchal Chittalipi

Master of Public Administration (MPA), Economic and Political Development/Data Analytics and Quantitative Analysis

Neema Mariam Kihwelo

Master of Public Administration (MPA), Development Practice

Alessia Villani

Master of Public Administration (MPA), Economic and Political Development/Europe Specialization

Shria Ramanathan

Master of Public Administration (MPA), Economic and Political Development/Gender and Public Policy

Jennifer Liu

Master of International Affairs (MIA), Economic and Political Development/Technology, Media, and Communications

Swathi Pottabathini

Master of Public Administration (MPA), Development Practice

Neema Mariam Kihwelo

SIPA Student

Working with EQ was a unique experience that allowed us to bridge theory with practice. Developing the Gender Toolkit gave us the opportunity to apply our academic knowledge in a practical setting and explore the complexities of gender equity in financial institutions. Throughout this process, we aimed to emphasize that gender equity is not the same as gender equality – while gender equality focuses on achieving equal outcomes, gender equity recognizes that different circumstances may require different approaches to ensure fairness. This distinction guided our approach, ensuring that the toolkit offers tailored, practical solutions that help financial institutions address gender gaps effectively and sustainably.

“To support financial institutions interested in adopting a gender strategy, we, as students, have developed the following resources for the Gender Toolkit:

- A template gender strategy

- An Excel file with common gender metrics

- Actionable recommendations with guidance on their cost and time commitment

- PowerPoint slides for management and board reporting