NewGas: Fueling Ghana's clean cooking transition one cylinder at a time.

NewGas Cylinder Bottling Ltd is helping transform how people cook in Ghana. The company is playing a critical role in making clean cooking gas more affordable and safer for families as part of the Government of Ghana’s goal of reaching 3 million households by 2030. With solid funding and government support in changing cooking habits, NewGas is helping to cut emissions, create jobs, and improve health outcomes across the country.

Table of Contents

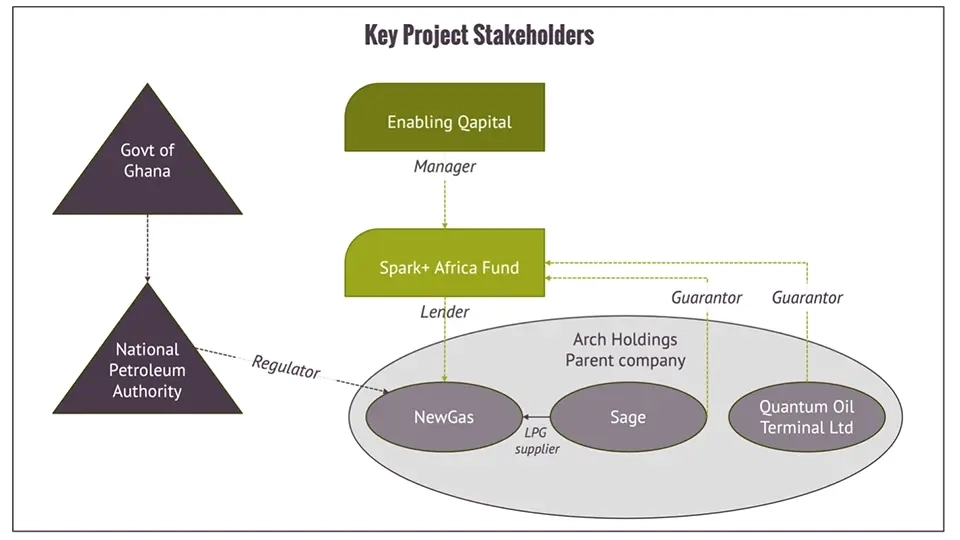

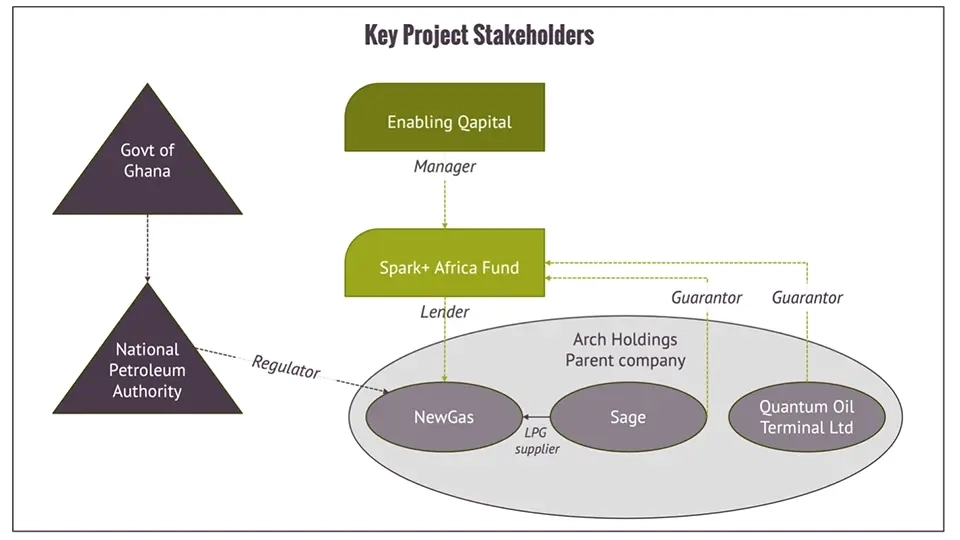

In May 2025, Spark+ Africa Fund (“Spark+” or the “Fund”), managed by Enabling Qapital (“EQ”), provided a $7.5 million loan to NewGas Cylinder Bottling Ltd (“NewGas”), as part of a consortium which provided the company a total of $18.2 million in financing.

This transaction is a first-of-its-kind in Ghana’s Liquefied Petroleum Gas (“LPG”) sector and an example of how Spark+ is financing the transition to clean, modern energy for cooking across sub-Saharan Africa.

1. The Problem: Household reliance on dirty and unsustainable cooking fuels in Ghana

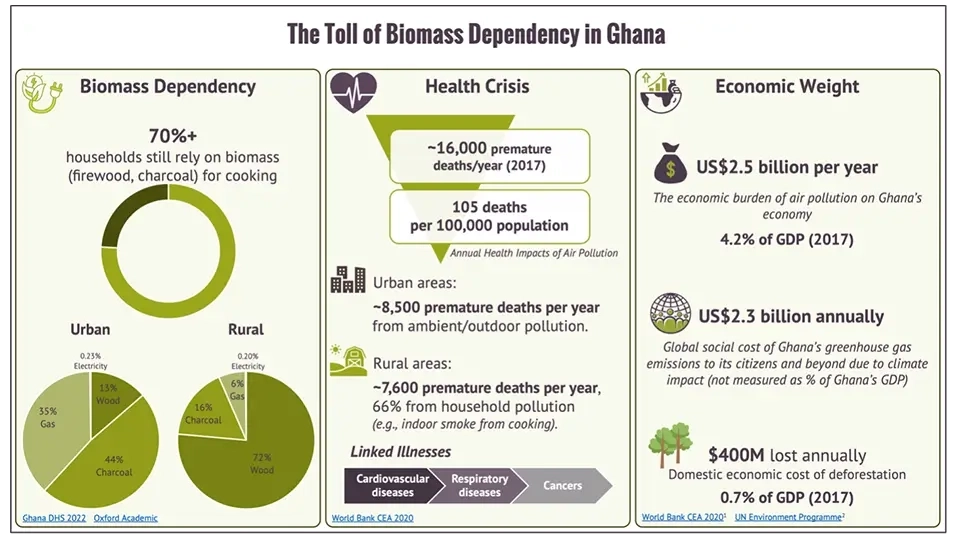

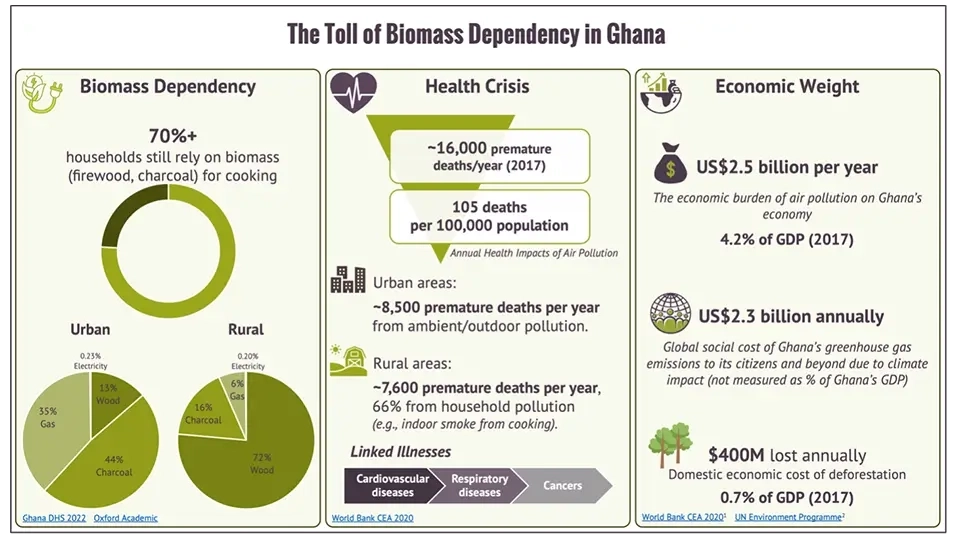

According to the 2022 Ghana Demographic and Health Survey (GDHS), over 70% of Ghanaian households still rely on biomass, mainly firewood and charcoal, for cooking. The disparity is especially sharp between rural and urban areas: access to clean cooking fuels drops to just 12% in rural zones, compared to about 45% in urban centers (Clean Cooking Alliance). Yet even in cities, two in five urban households still list charcoal as their primary cooking fuel (Ghana Consumer Segmentation report).

This is a result of a classic infrastructure and access gap. Traditional biomass dominates not because it's preferred, but because other fuels such as LPG – a cleaner, faster, and more efficient fuel – is either unavailable or unaffordable for much of the population.

While LPG is technologically viable and cost-effective at scale, distribution economics often do not work for low-income families. Households that spend about $200 annually on charcoal often cannot afford the $50 upfront cost of an LPG cylinder. Earlier efforts to expand LPG adoption faltered for exactly this reason: families were asked to buy and maintain their own cylinders. Many could not. And those who could often ended up with dangerous counterfeit cylinders or struggled to find safe and reliable refill stations.

This bottleneck creates multiple measurable negative impacts on people and the environment.

Health impacts

From a health standpoint, air pollution – both household (HAP) and ambient (AAP) – is Ghana’s top environmental risk to public health. It is linked to ~16,000 premature deaths per year (2017 base year): ~8,800 from HAP and ~7,200 from AAP. The age-standardized air-pollution mortality rate is ~105 per 100,000, with the burden falling most on infants (illness) and the elderly (deaths) (World Bank).

Environmental and economic impacts

From an environmental and economic perspective, the annual cost of air pollution is ~US$2.5 billion (≈4.2% of 2017 GDP), and Ghana’s greenhouse gas emissions impose an additional ~US$2.31 billion/year in global damages (World Bank).

Social impacts

And there are social costs as well. Hours are lost daily gathering wood or buying charcoal. Reliance on solid fuels imposes especially heavy time burdens on women. In Ghana, evidence shows women spend about 1.7 hours per trip fetching fuelwood, time that crowds out education and income-generating activities, while they already shoulder a disproportionate share of unpaid domestic work overall (IAEIW, Counting Women’s Work).

Why prior initiatives struggled

Well-intentioned initiatives to address these impacts have struggled. The Rural LPG Promotion (RLP) Program, launched in 2013, distributed cylinders and stoves, but by 2017, only ~8% of households were still using LPG due to refill cost barriers and poor infrastructure (ACS Publications, ResearchGate).

Individual failures reflect broader structural issues: fragmented policy, limited financing, low public awareness, and lack of last-mile distribution. But they also point to a clear opportunity. If LPG can be made as convenient and affordable as traditional fuels, the market will respond.

And while solving Ghana’s clean cooking problem is a public health imperative, it is also a scalable investment opportunity. The key lies in financing the infrastructure that removes the access barrier, particularly where there is robust support from government regulators who enable market growth by implementing innovations such as the Cylinder Recirculation Model (“CRM”), which aims to lower upfront costs, improve safety, and simplify distribution.

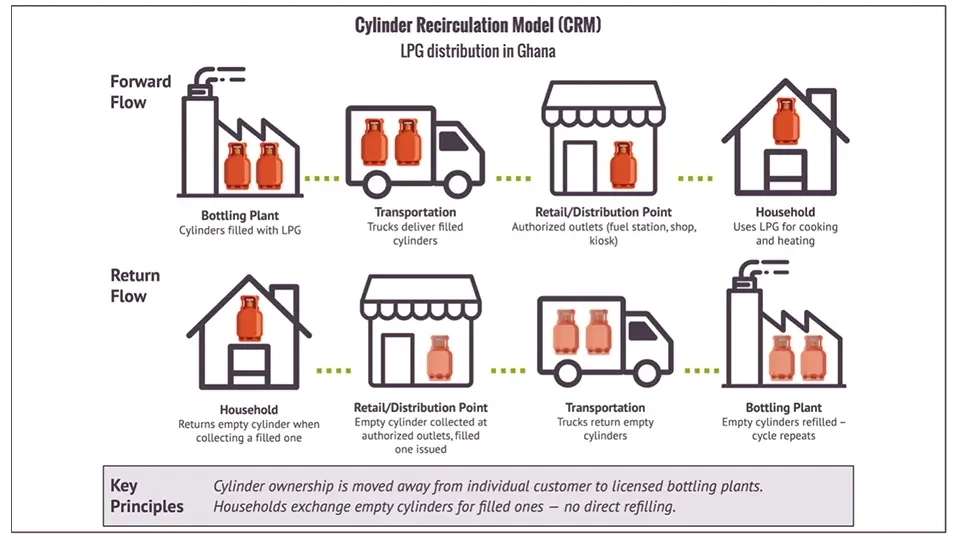

2. The Cylinder Recirculation Model (CRM): Increasing the accessibility of LPG

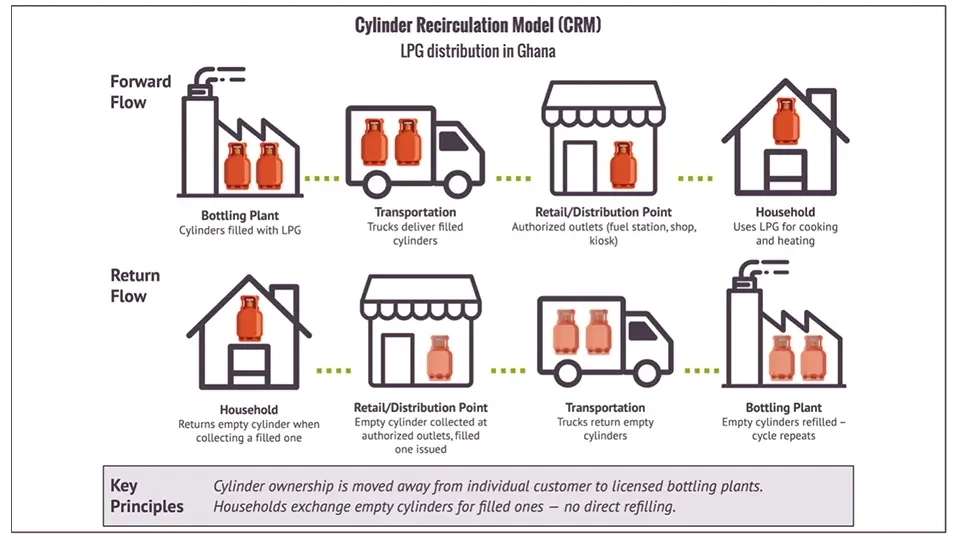

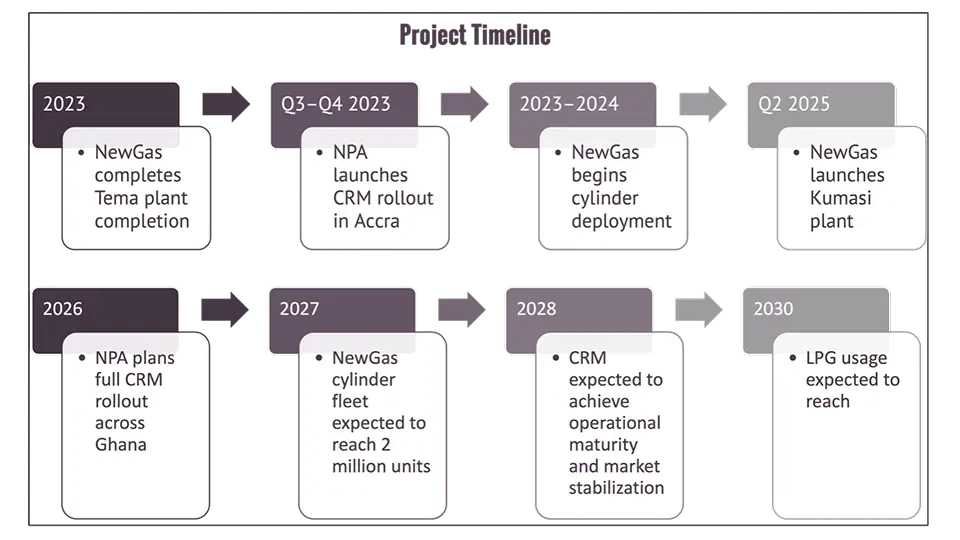

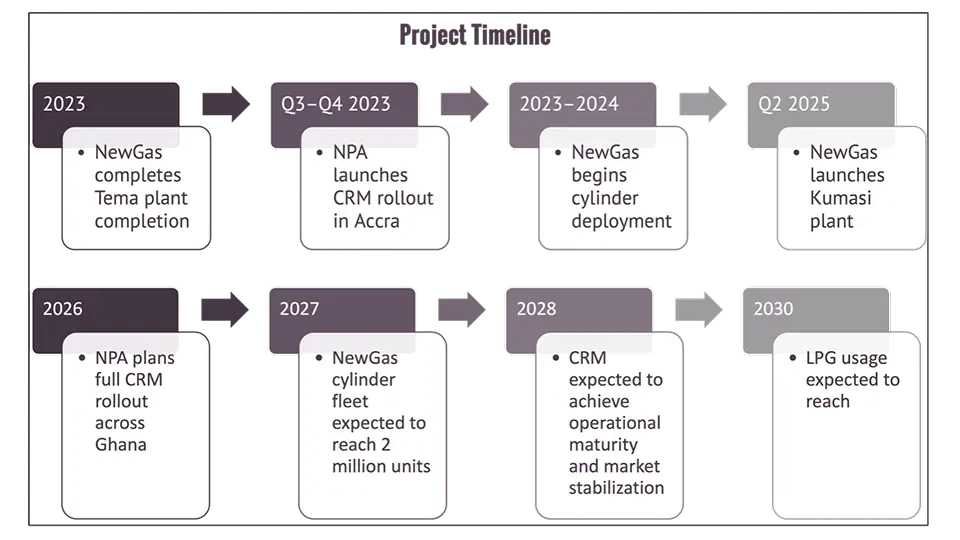

In 2017, the Ghanaian government officially announced the CRM and launched a national LPG cylinder exchange system. However, it took several years until its wider rollout began starting in 2023 and continuing into 2025.

Under CRM, cylinders are owned and managed by licensed bottling plants, rather than consumers. These bottling plants are responsible for cylinder quality. Current LPG users are permitted to exchange their current cylinders for them to be refurbished or discarded. New LPG users can choose from a range of cylinder sizes depending on their needs and ability to pay a deposit on the cylinder. After this initial step, customers exchange empty cylinders for filled ones at designated outlets, typically existing fuel stations or standalone exchange points, paying only for the gas inside. All cylinders meet safety standards, eliminating fire risks from mini refilling stations in highly populated areas.

How CRM addresses market barriers

- Lowering barriers to market entry for new LPG customers by offering smaller cylinder sizes and more affordable upfront deposits;

- Standardizing cylinder safety through professional management;

- Utilizing existing retail infrastructure; and

- Establishing recurring revenues for operators, creating a sustainable business model.

By 2030, Ghana aims to boost household LPG adoption from 30% to 50%, bringing clean cooking solutions to an additional 3 million families. While CRM represents a significant step forward in improving safety and accessibility, it does not fully eliminate affordability challenges. For many households, even the deposit for a cylinder remains a hurdle, underscoring the need for complementary interventions such as targeted subsidies, financing schemes, or donor-supported programs to ensure inclusive access.

3. Investee Profile: NewGas Cylinder Bottling Ltd.

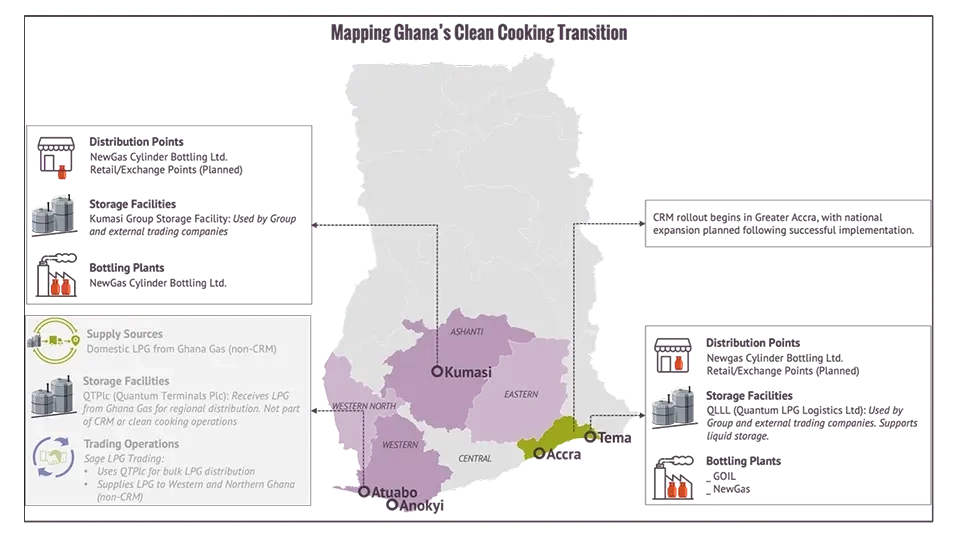

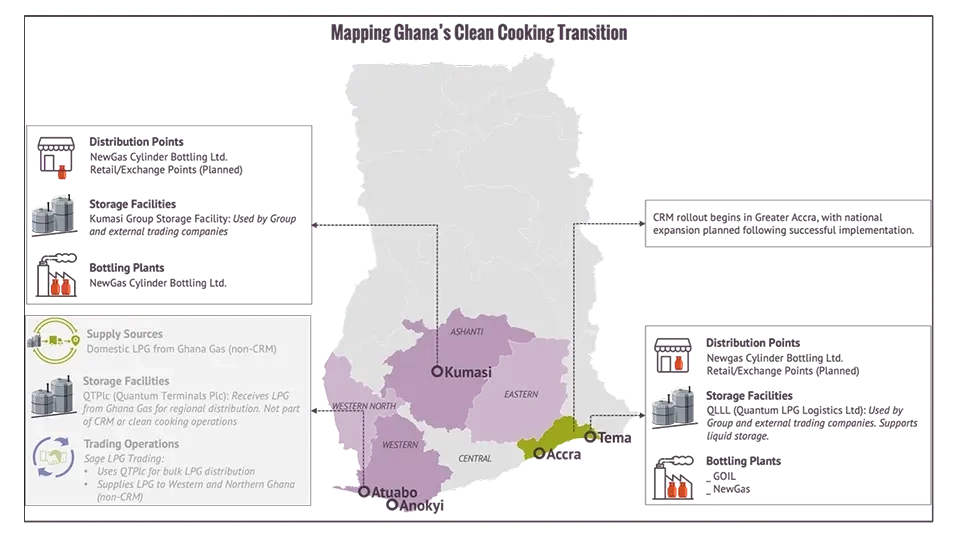

NewGas is a wholly-owned subsidiary of Arch Holdings (“Arch”), a Ghanaian conglomerate with deep expertise and established operations in energy logistics and fuel trading via various subsidiaries including Sage Petroleum (“Sage”) and Quantum Oil Terminals Limited (“QOTL”). This gave NewGas immediate access to LPG fuel supply, storage infrastructure, and distribution relationships across Ghana's regions.

Backed by Arch, NewGas became a first mover in the market and one of the first two refilling companies licensed to operate under the CRM framework. The company secured land in the industrial area of Tema to construct a bottling facility, and Arch committed $4.8 million of equity toward construction costs.

The company’s management identified retail partners and mapped deployment priorities based on market demand data. Most importantly, they had as deep an understanding as any other player in the market of the operational complexities involved in managing hundreds of thousands of cylinders across a national network.

NewGas’ new business model offered predictable cash flows: unlike traditional LPG sales that generate one-time revenue, they would earn recurring income each time customers exchanged cylinders. And in turn, higher cylinder deployment rates should result in more frequent exchanges and stronger financial performance.

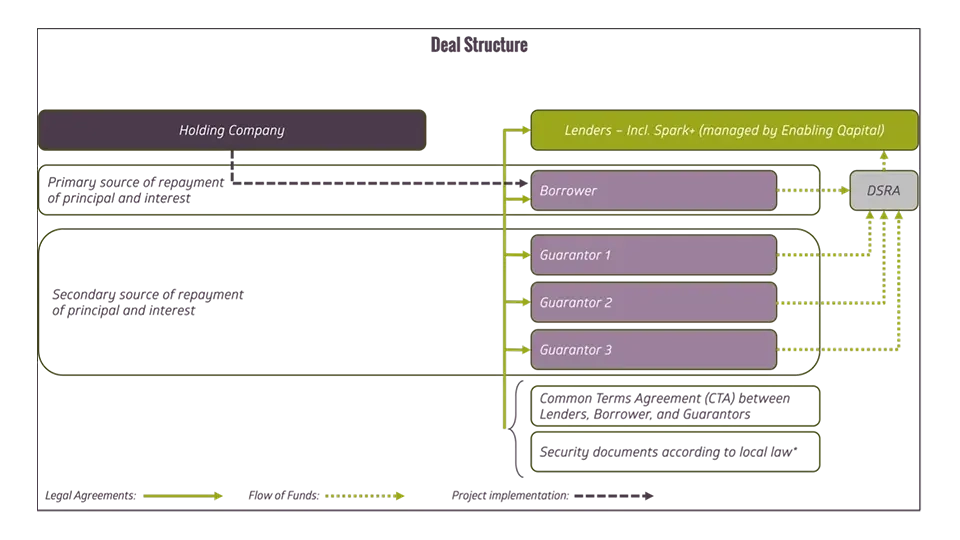

4. Transaction Structure: Leveraging Arch assets to enhance bankability

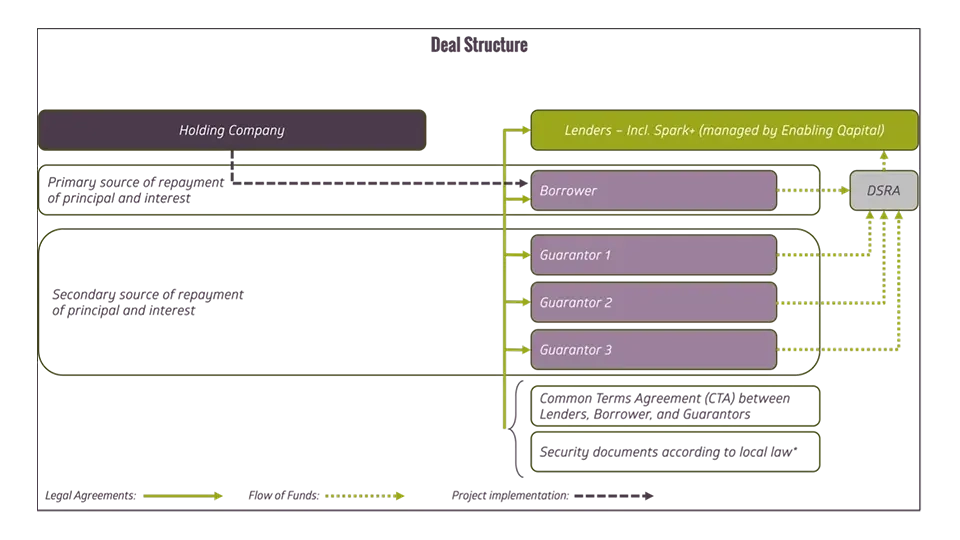

As a result of the LPG market transition, including the rollout of the CRM, the Spark+ team was pleased to engage with Arch management to carefully design a loan structure which was well-suited to the company’s needs, while offering the Fund substantial risk mitigation.

To support NewGas’ expansion, including through the completion of the cylinder refilling plant and purchase of more than 200,000 cylinders, Spark+ provided a medium-term/4 year facility including a one-year grace period on principal amortization.

To reduce risk to the Lender, Spark+ secured the loan with several layers of protection. These included a legal claim over all of NewGas’ assets and a claim on cash flows generated by other Arch subsidiaries until NewGas proves its financial sustainability on a standalone basis. Additionally, Spark+ has a claim on an infrastructure asset held by QOTL.

The structure of Spark+’s loan to NewGas, alongside the $11.2 million co-lending facility and Arch’s equity contribution, reflects the investment team’s experience in designing highly customized investments in innovative energy companies in developing markets which balance ambitious corporate growth while mitigating key risks.

5. Business Plan Execution: Inevitable risks coupled with positive impacts

While NewGas benefits from strong regulatory alignment and secured capital, execution risks remain as it works to build both a sustainable business and achieve its positive social and environmental impact targets.

Regulatory enforcement risk

A successful market transition from the consumer-owned cylinder model to full implementation of the CRM, and in turn the success of players like NewGas who service the CRM, is reliant on effective and sustained regulatory enforcement by the National Petroleum Authority (NPA), the relevant regulator responsible for the market. To this end, NewGas is in active engagement with NPA and supports campaigns which sensitize the industry and the public to this new market model.

Scaling and project execution risk

There is also the need for scale. NewGas has ambitious plans to complete a second phase of this project and construct a similar plant in Ghana’s second largest city Kumasi. On-budget completion of these facilities will be critical to NewGas establishing itself at scale and improving financial viability. As a result, the company is phasing its financing plan and ensuring robust project management to deliver according to agreed budgets and timelines.

Distribution network dependency

Notwithstanding the current and projected growth of its own operations and infrastructure, NewGas cannot achieve success in a vacuum. Given that they own and refill cylinders that will in turn be circulated to consumers, NewGas relies on a robust and well-functioning network of distribution channels to reach end-users.

This timeline aligns with the NPA’s national CRM rollout and Ghana’s clean cooking targets.

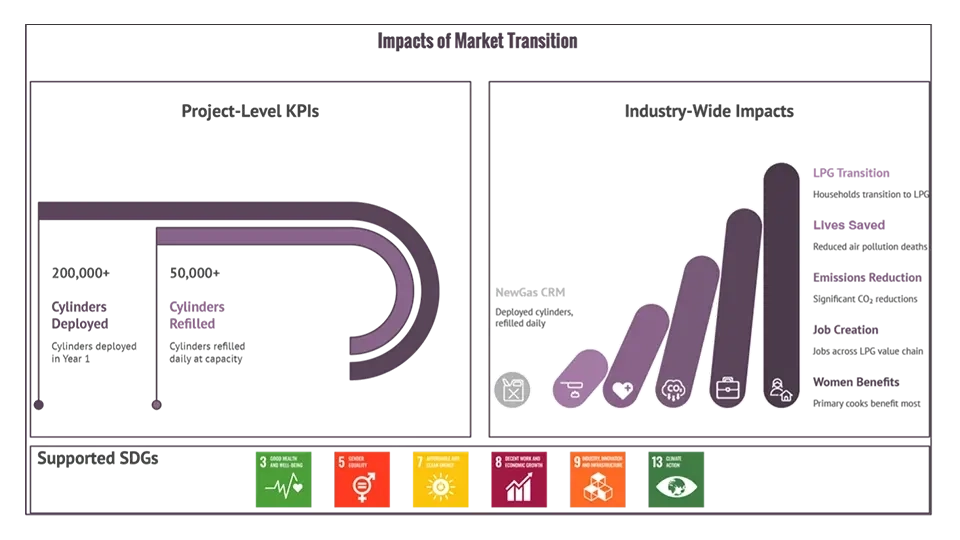

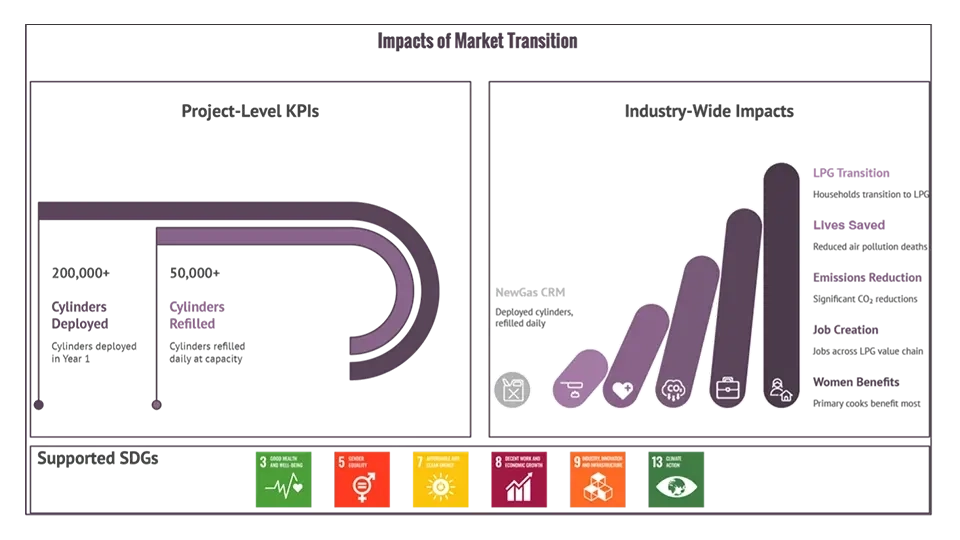

Projected outcomes and impacts (assuming successful execution)

- 200,000+ cylinders deployed in the next year alone, with national scale-up underway.

- 50,000+ cylinders refilled daily (at full capacity), enabling distribution across Ghana.

Industry-wide targets and impacts

- 3 million households transitioned to LPG by 2030.

- 30,000 fewer annual premature deaths due to HAP.

- Significant CO2 emissions reductions, due to reduced wood and charcoal usage.

- Benefits for women in particular, given that they are often responsible for cooking.

- Job creation across the LPG fuel value chain.

Various of these ultimate impact indicators, as well as E&S-related risks associated with business plan execution, are actively measured, monitored, and tracked by NewGas and reported to investors and lenders such as Spark+.

6. Looking Forward: Ghana LPG market growth with NewGas as a market leader

NewGas has already established itself as Ghana’s leading cylinder refilling provider under the CRM. The first phase of its Tema plant operates two carousels with a daily output of over 25,000 cylinders. The second phase will double this capacity to 51,000, positioning NewGas to play a meaningful role in the national LPG transition of 3 million households by 2030.

Careful, large-scale expansion of its own infrastructure, including additional bottling plants and distribution channels will be critical. As a cylinder refilling provider and not a direct retailer, NewGas’ success also depends on the development of a robust distributor network. There must be careful synchronization of plant expansion, cylinder procurement, and distribution capacity to meet the NPA’s 2030 target of 50% LPG penetration nationwide.

NewGas operates within an improved regulatory framework, with a clear growth timeline and recent financing obtained. The company has demonstrated operational competence and holds a first-mover advantage in the mandated CRM market model. However key risks relate to execution – the company’s ability to maintain pace with the NPA’s rollout schedule and to respond to emerging competition. Success will depend on sustaining high operational standards while scaling infrastructure to achieve national coverage.

The recently disbursed $7.5 million loan from Spark+ addresses the company’s immediate capital needs and is an important first step towards NewGas achieving its growth plans. The market opportunity is not speculative, it is anchored in government policy and regulatory mandates, offering a uniquely structured and clear path to scale.

Of course, the path from policy and plans to results and impact, is never easy. But with the right partners, including capital providers like Spark+, NewGas, together with its affiliated companies under Arch Group, has the best chance possible to achieve its goals and serve its ultimate customer base, the citizens of Ghana who deserve clean and convenient energy solutions to be both accessible and affordable.

Interested in partnering with us to scale clean cooking energy access across Africa? Find out more at www.sparkafricafund.com.