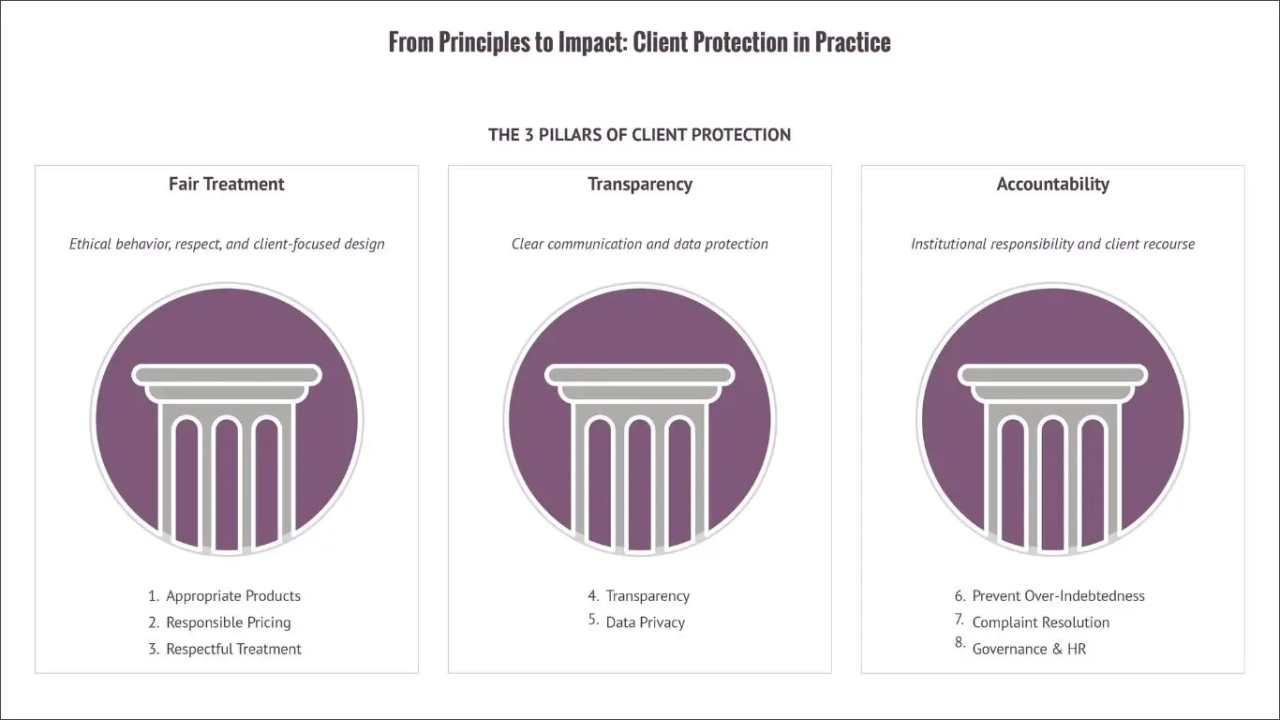

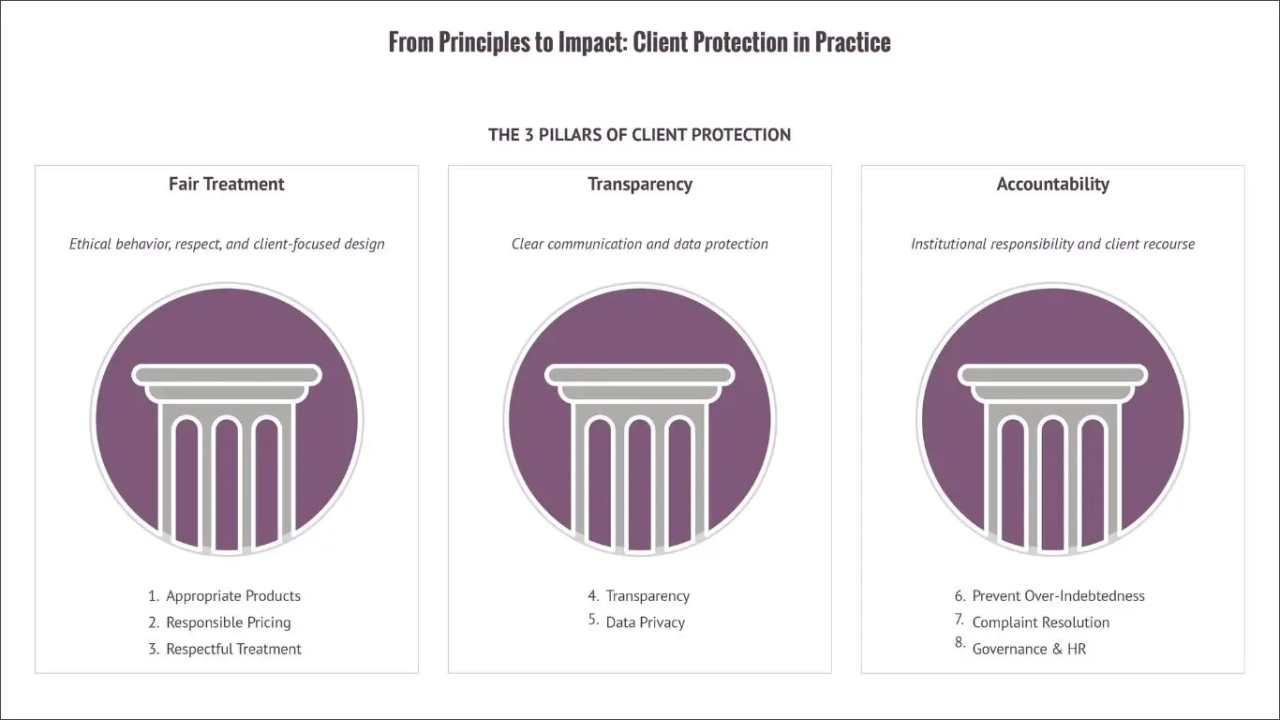

The Client Protection Principles (CPPs) filled a critical gap in responsible finance by providing a practical framework developed by practitioners for real-world implementation. These principles help financial institutions establish systems for fair treatment, transparency, and accountability in their operations.

Why Consumer Protection Matters

The CPPs were originally created by the Smart Campaign, a global initiative launched in 2009 to embed strong client protection practices into the microfinance and financial inclusion sectors. The Smart Campaign developed the CPPs and led efforts to certify financial institutions that met those standards. This campaign helped turn responsible lending from a theory into a measurable, certifiable practice.

Learning and Adapting

The CPPs were developed with practical applicability in mind and have evolved to address emerging risks. Version 2.0 incorporated best practices for loan refinancing, reflecting the framework's responsiveness to market developments.

A separate set of principles was drafted for digital financial services, but it never resulted in a certification standard, largely due to limited buy-in from fintechs. This highlights the ongoing challenge of ensuring consumer protection keeps pace with technological innovation.

Real-World Results

Originally managed by the Smart Campaign, the CPPs are now overseen by CERISE+SPTF, two organizations that merged their efforts to promote responsible inclusive finance. CERISE, a French non-profit organization, specializes in social impact measurement tools, while SPTF (Social Performance Task Force) is a global community of financial inclusion stakeholders focused on improving the social and environmental performance of financial service providers.

During the Smart Campaign's tenure, over 135 financial institutions across more than 40 countries were certified for meeting CPP standards. While that number may appear modest, the value was in demonstrating practical implementation, which encouraged some regulators to adopt elements of the CPPs into formal regulation.

Implementation Quality

Although certification quality can vary depending on the diligence of the certifying body, it generally represents progress toward responsible practices. Institutions may not follow every detail perfectly, but certification creates a culture of intention and effort toward consumer protection.

How We Assess CPP Compliance

We integrate CPP checks throughout our investment process:

Team Training

All investment staff of Enabling Qapital are required to complete internal training on CPPs to ensure consistent understanding across the team.

Loan File Review

Our due diligence includes validation of key client protection features, such as transparency of loan agreements and quality of underwriting practices. The loan file review requires investment staff to dig into loan details to better understand underwriting standards and repayment history, and also affords an opportunity to meet with branch staff and loan officers in order to have an in-depth review of the implementation of the client protection principles.

ESG Rating

CPPs are embedded in our ESG rating tool, with assessments based on:

- A self-assessment questionnaire submitted by the financial institution

- On-the-ground verification by investment team members via the loan file review and cross-checking the implementation of policies and procedures

Additional Due Diligence Measures

In addition to CPP-focused assessments, EQ’s due diligence process includes broader checks to evaluate institutional risk and integrity. These include:

- Local Legal Review: Inquiry into ongoing or past legal issues that could potentially highlight areas of concern or that require further investigation

- HR policies: Review of employment practices and internal grievance mechanisms

- Audit reports: Examination of external audit findings for financial or governance red flags

- UNGCP compliance: Monitoring adherence to the UN Global Compact Principles on a self-reported basis

The Path Forward

The CPPs represent our commitment to ensuring that financial inclusion delivers genuine value to end clients and avoids significant harm, with the ultimate goal of protecting them. By maintaining rigorous CPP assessments throughout our investment process, we work to build a financial ecosystem where growth and consumer protection advance together.

Our ongoing commitment to these standards reflects our belief that sustainable impact requires consistent attention to consumer welfare.