Enabling Qapital, an impact asset manager dedicated to financial inclusion and access to energy, recently held a webinar on Advancing Gender-Lens Finance with our portfolio companies. The session highlighted how financial institutions can move beyond traditional approaches to create lasting economic inclusion and participation.

Advancing Gender-Lens Finance: Enabling Qapital’s Webinar Insights

The webinar emphasized the decline in women’s participation in both loan and employment cycles, underscoring the gender biases that must be addressed to reverse this trend. Portfolio companies were also briefed on the adaptation of updated 2X criteria, whose compliance or commitment to comply will help tackle key gender-lens investing challenges.

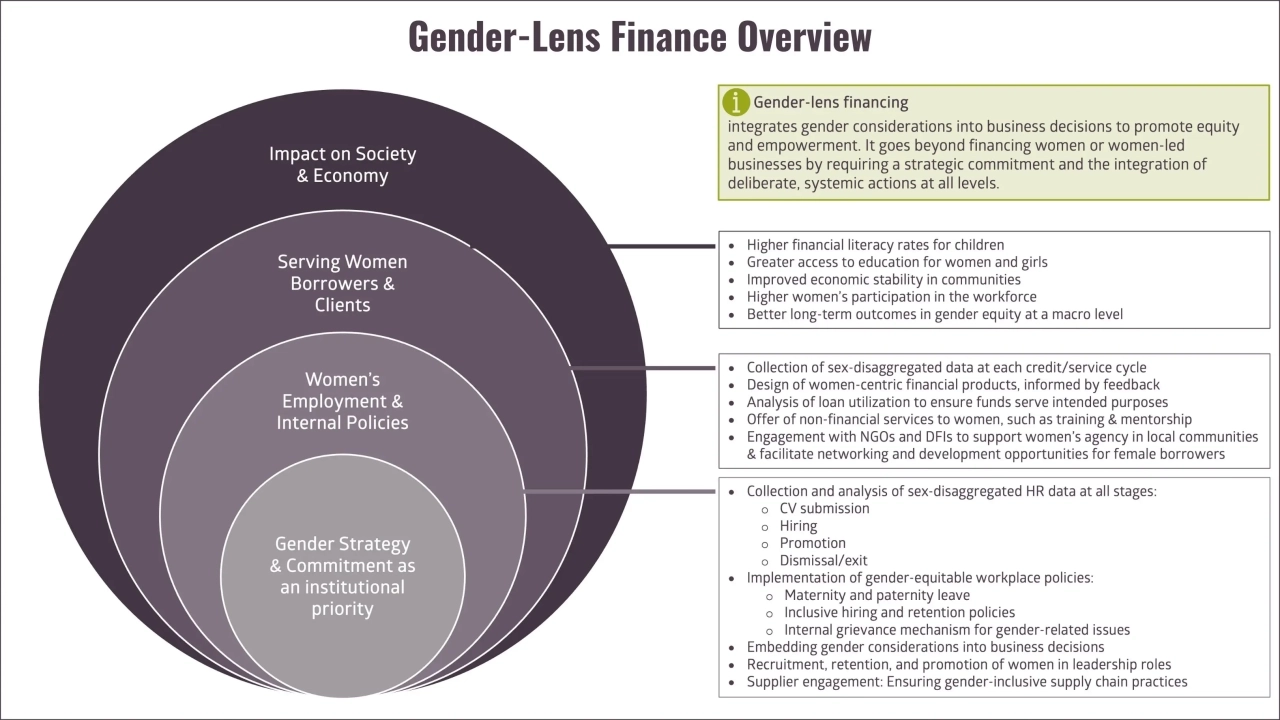

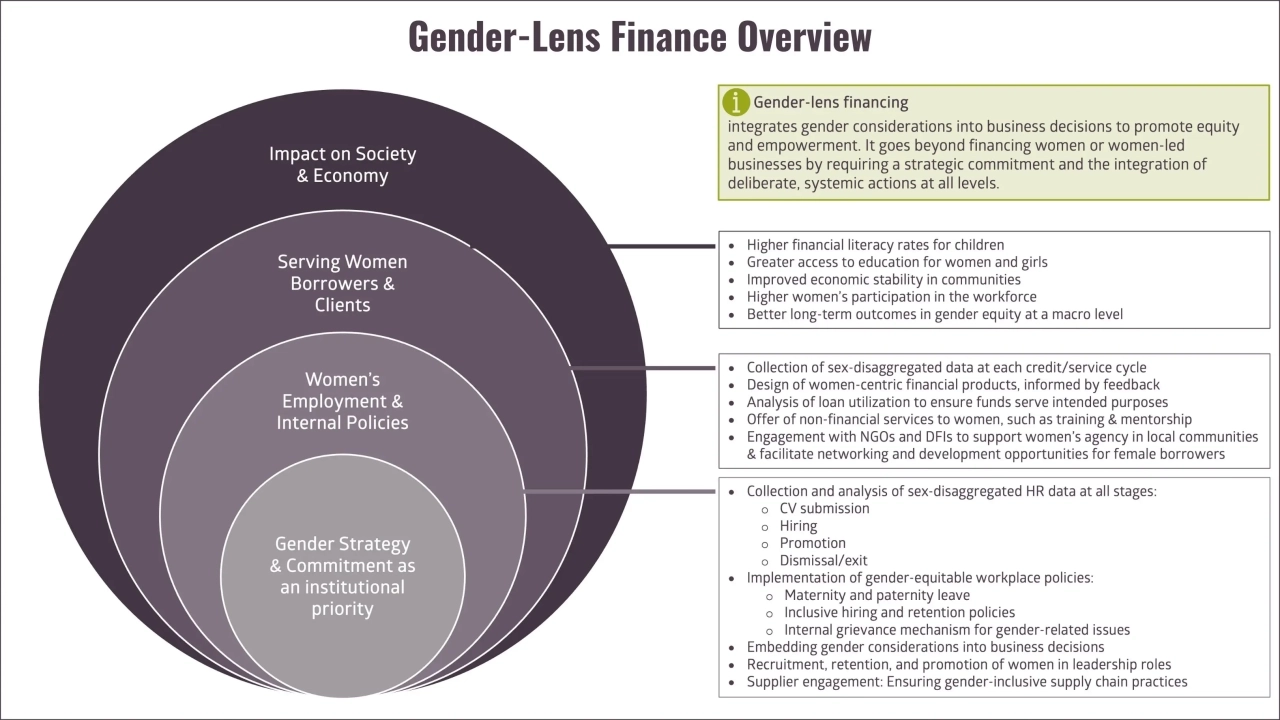

Understanding Gender-Lens Finance

Gender-lens finance goes beyond merely extending loans to women. It takes a holistic approach, considering not only how funds are used but also the broader environment that enables women to thrive.

This includes increasing women's representation in financial institutions, implementing supportive workplace policies such as maternity and paternity leave, and creating grievance mechanisms to address workplace challenges. When designed thoughtfully, gender-lens finance can reshape financial systems - empowering women not just as participants but as leaders driving meaningful change.

Gender-Lens Investing: A Growing Recognition

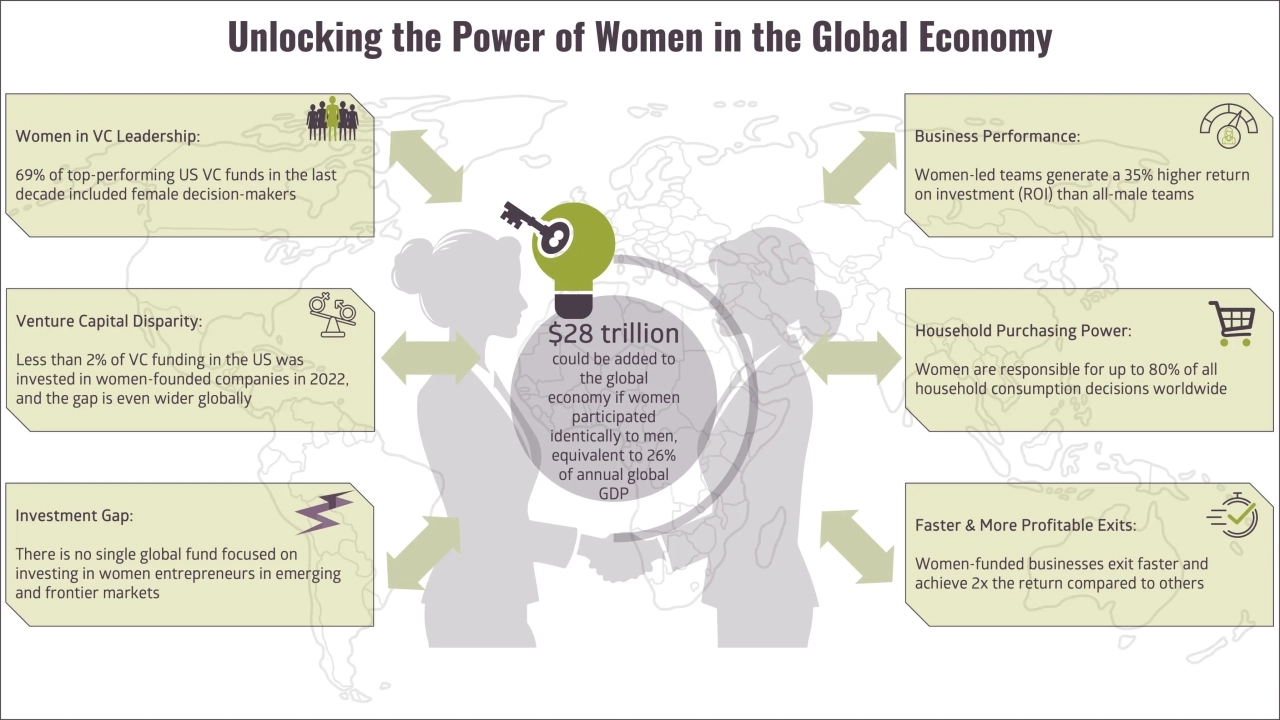

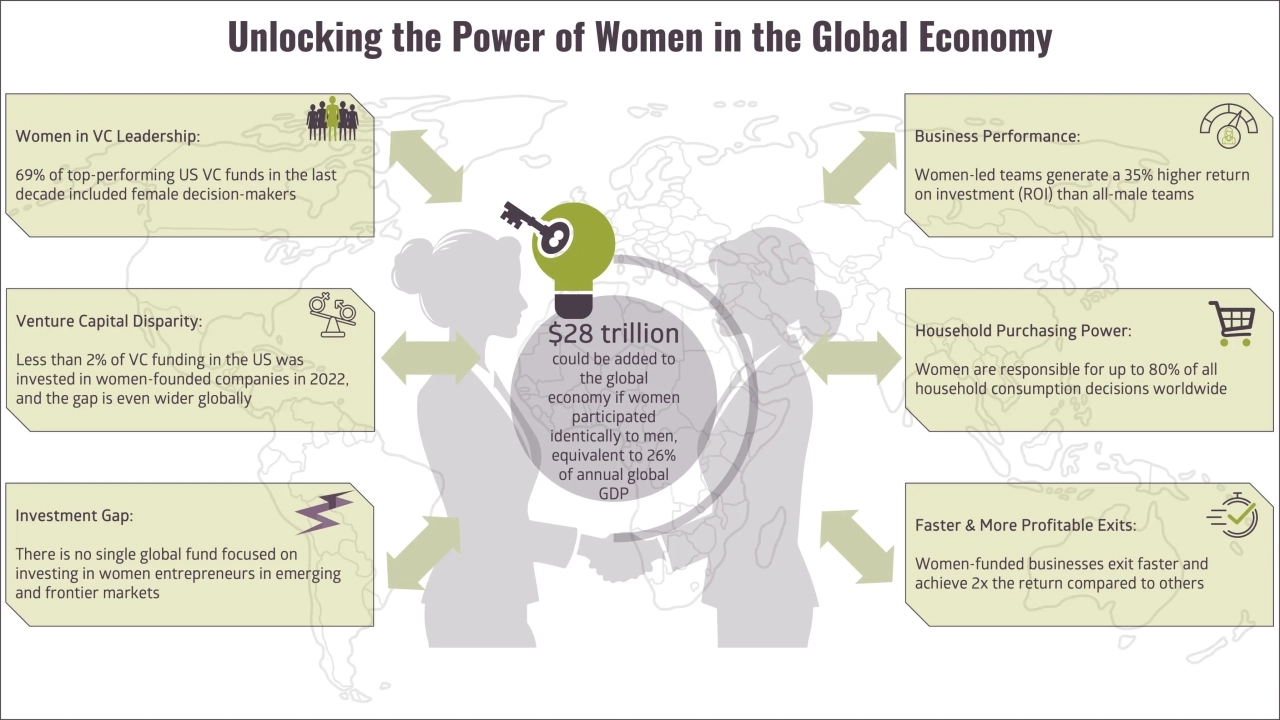

Advancing gender equity represents one of the most significant opportunities for global economic growth. Research suggests that if women participated in the economy on equal footing with men, it could add as much as $28 trillion - or 26% - to global GDP by 2025, a figure larger than the size of the US economy today. Yet, persistent disparities in access to resources, funding, and opportunities continue to hinder progress.

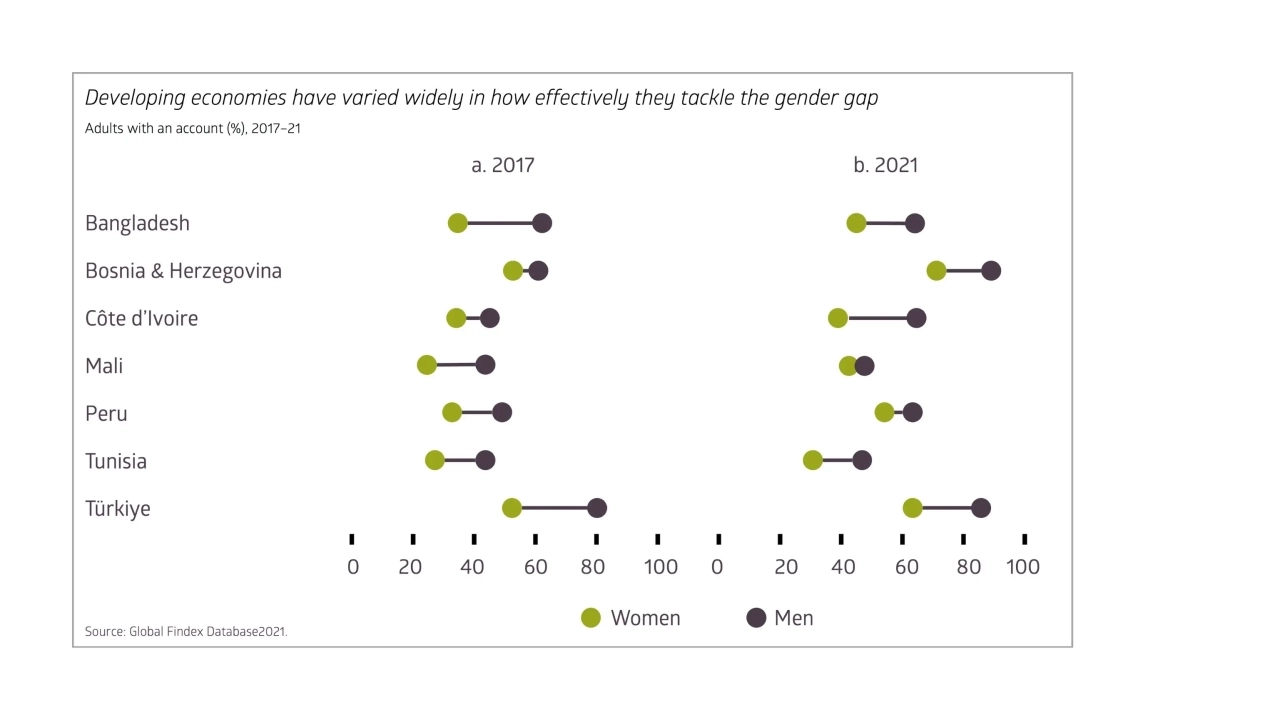

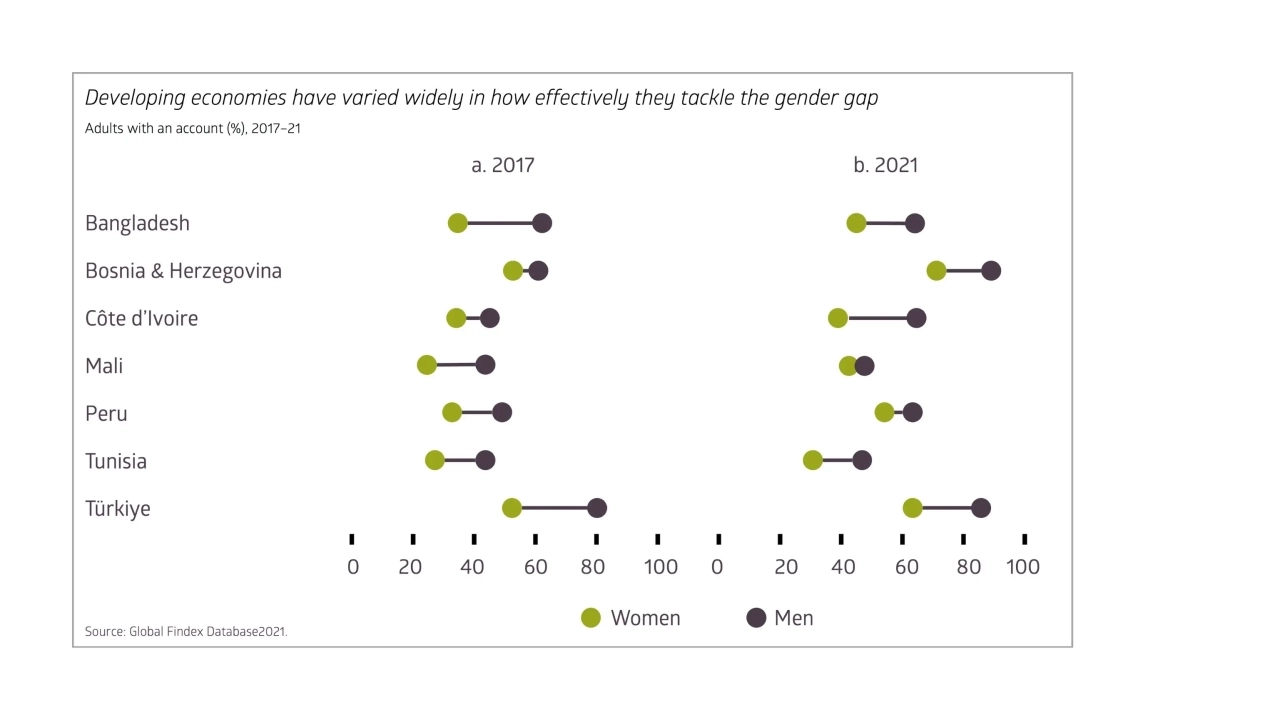

These challenges are particularly stark in emerging markets, where gender gaps in financial inclusion remain pronounced. According to the World Bank’s Global Findex 2021, 68% of women have access to an account compared to 74% of men, and although this gap has narrowed, it reflects systemic barriers that constrain women’s economic participation. Women-owned and women-led businesses also struggle to access financing, despite generating strong social, environmental, and economic returns.

Investors are increasingly recognizing the importance of gender-lens investing as a strategy that drives both financial returns and lasting social impact. The GIIN 2024 Impact Investor Survey reports that 50% of respondents now incorporate gender considerations into their investments. Of these, 27% have fully integrated gender-lens investing, while 23% have made specific gender-focused investments.

The growing adoption of gender-lens investing has driven the expansion of specialized products like gender bonds and equity funds. Publicly traded gender-lens equity funds alone have reached $4.8 billion in assets, with gender-lens fixed-income products managing an additional $8 billion. Despite this progress, challenges remain - 92% of gender investors cite fragmented impact measurement frameworks as a significant barrier, while 31% struggle to find suitable exit options for their investments.

Tailored Financial Inclusion for Women’s Success

Microfinance has long been a game-changer in expanding access to financial services for those excluded from traditional banking - especially women. These targeted lending programs unlock opportunities for entrepreneurship and economic participation in underserved communities.

However, achieving true success requires careful design. Financial products must address women’s specific needs and circumstances, ensuring they lead to genuine empowerment rather than simply increased debt. Programs that actively evaluate their impact—focusing on financial independence and broader social improvements—are most effective in driving meaningful outcomes.

Case Studies:

- A study in Africa found that combining awareness, capacity building, and advisory services with financing led to 26% of women engaging in entrepreneurial activity. Women using tailored loan products reported higher confidence levels, leading to a 60% increase in savings over six months.

- Research in Nepal’s urban slums found that when given access to no-fee mobile savings accounts, 84% of female-headed households opened an account, leading to a 50% increase in monetary assets and a 16% rise in total assets over a year (Prina, 2013).

- A 20-year panel study in Bangladesh demonstrated that microfinance borrowing - particularly by women - significantly improved household income, asset accumulation, and poverty reduction. A 10% increase in female borrowing was linked to a 5 percentage-point drop in extreme poverty.

Moving Forward: Strategies for Impact

To make gender-lens finance a cornerstone of global economic development, we need to take intentional steps:

Shifting the Narrative:

Shifting the Narrative:

Move beyond narrow financial metrics to focus on long-term social inclusion, ensuring the language reflects these deeper goals.

Enhancing Access to Capital:

Enhancing Access to Capital:

Design financial products tailored to women’s needs, ensuring affordability and flexibility to support entrepreneurship and long-term stability.

Promoting Representation in Leadership:

Promoting Representation in Leadership:

Encourage the inclusion of underrepresented genders in leadership roles within MFIs and financial institutions, fostering an environment that values diverse perspectives and experiences.

Leveraging Innovation:

Leveraging Innovation:

Utilize digital solutions, fintech advancements, and ESG integration to expand the reach and effectiveness of gender-lens financing in underserved regions.

These strategies provide a broad framework, with more in-depth insights on HR and credit to follow in a dedicated series of articles.

Emerging markets offer both challenges and opportunities. The GIIN report found that 42% of gender investors focus on these regions, yet they account for only 18% of total impact assets under management (AUM). In these markets, Latin America and the Caribbean lead with the largest share of gender-focused investments (29% of impact AUM), followed by South Asia (24%) and Sub-Saharan Africa (21%). However, investments in developed markets still dominate, with 66% of AUM concentrated there.

Conclusion

Advancing gender-lens finance isn’t just an investment strategy—it’s a commitment to fostering a fairer, more inclusive world. By integrating gender into financial decision-making, we can build systems that empower women, strengthen communities, and unlock untapped potential across economies.

Shifting the Narrative:

Shifting the Narrative: Enhancing Access to Capital:

Enhancing Access to Capital: Promoting Representation in Leadership:

Promoting Representation in Leadership: Leveraging Innovation:

Leveraging Innovation: