Recent Central Bank language as well as early economic indicators are clearly pointing towards a state of global interest rates remaining higher for longer, somewhat in opposition to previous market consensus and futures forward pricing. I joined a recent session where our portfolio management has shared its views on what that means for the microfinance industry and its return perspectives as a whole.

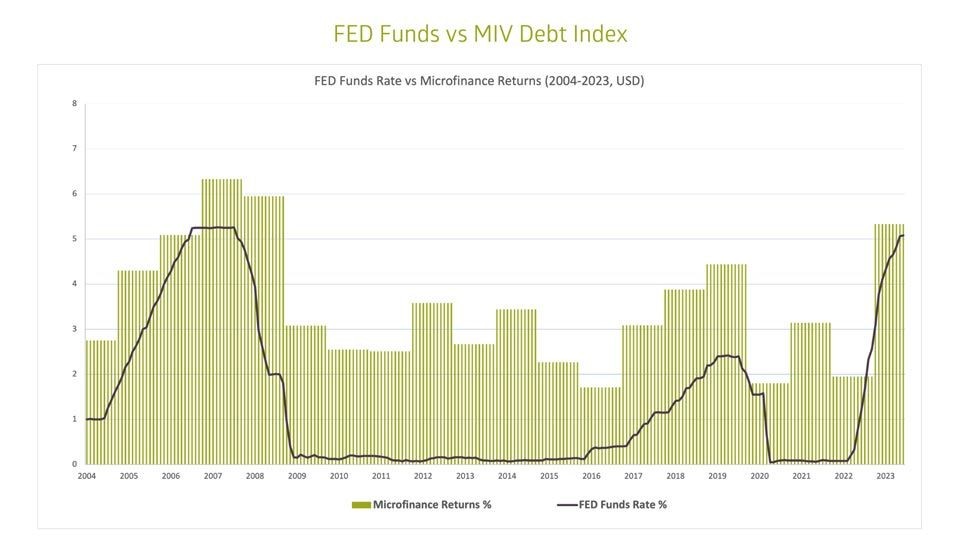

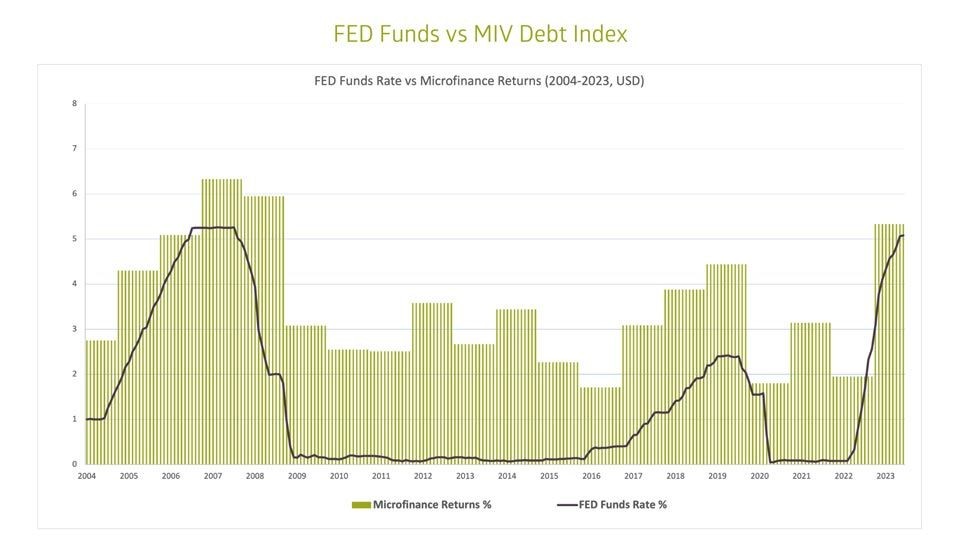

In short, microfinance institutions continue to demonstrate good resilience and very low correlation to global credit and equity markets. As a result, the Microfinance Investment Vehicle (MIV) Debt Index, an industry index and benchmark for microfinance as an asset class, demonstrates consistent and stable returns above the risk free rate, albeit lagging slightly in times of rates hike cycles. We find that microfinance on average keeps up with rates increases within 2y. This makes microfinance an interesting risk-adjusted asset class for the foreseeable future.

What is microfinance?

Microfinance is the provision of access to capital and financial services in low-income economies. It can be offered both to businesses and individuals in the form of credit, savings, remittances, payment services, insurance and other basic financial products. According to Precedence Research, the global microfinance market was USD 226.37 billion in 2022 and is expected to hit around USD 646.25 billion by 2032.

What is the Microfinance Investment Vehicle (MIV) Debt Index?

The MIV Debt Index is an industry index which has been tracking 7 microfinance funds on a monthly basis and since 2004. It is a good proxy and performance indicator for microfinance fund managers and investors globally. In the chart below, we are plotting the yearly average returns of the MIV index in USD vs the prevailing FED fund rate. Clearly the Microfinance returns are lagging the FED rates with an average delay of 2y, particularly during rate hike cycles, but will on average adjust to these new risk-free interest rates with an average premium of around 215bps over a cycle. This credit spread in comparison with low realized defaults does indeed screen very favorably to both traditional IG and HY credit.

What does this mean for microfinance?

Across the previous rates cycles, the MIV Debt Index demonstrates stable returns, low volatility, and low correlation to traditional global markets. Returns generally remain above the risk-free rate, albeit lagging slightly during periods of rapid Fed increases. This makes microfinance an interesting industry to keep an eye on in the coming months as it is likely rates hike have peaked, default rates remain stable, and microfinance delivers an attractive risk/return/quality/volatility mix in comparison to global markets.

Reach out if you’d like to learn more about microfinance, impact investing, or what we are doing at Enabling Qapital!

If you’re looking for stability, impact, and a unique investment opportunity, the world of microfinance might just be your next frontier.