Why is it that Microfinance funds remain comparably stable throughout international crisis or economic downturns? Where does the low correlation with the financial markets come from?

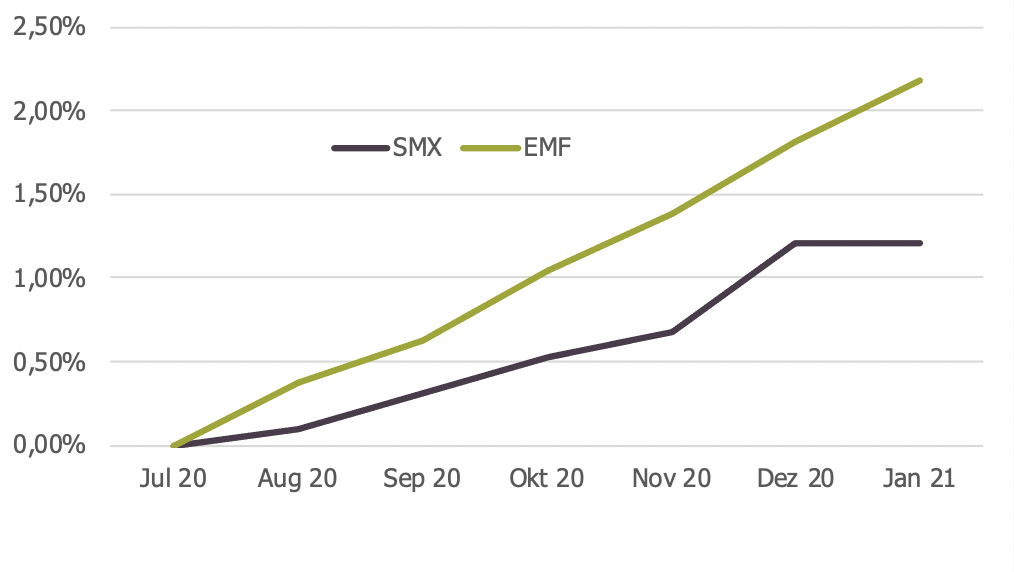

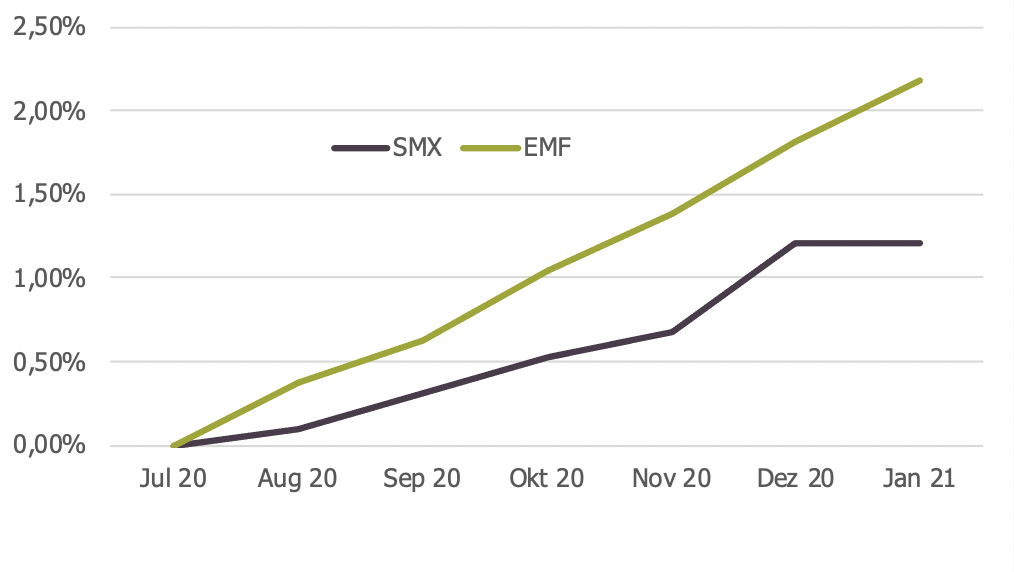

Historically, the global financial markets have outperformed Microfinance investments financially on a long-term basis. Still, the major global finance indices are and will stay more volatile and subject to frequent ups and downs. This is also visible when looking at two indices over the course of the last years: The MSCI World and the SMV, an index by Symbiotics S.A. which represents 7 USD Microfinance funds.

As you can see in the graph below, the recession in 2008, 2011, 2015 and most recently in 2019 are clearly visible through negative outbreaks in the MSCI World. The SMX, on the other hand seems unbothered by the global recessions and its growth remains stable over the years.

With a Microfinance investment in your portfolio, the potential losses during a crisis can be minimized through ongoing stable returns from your Microfinance position. Thus, in our opinion a good way to optimize the return of your portfolio would be to include a position in Microfinance that provides a stable return even through a global financial crisis. But why are Microfinance investments more stable and where does the comparably low correlation come from?

An important quality of Microfinance investments is their independence from global financial markets. This is due to the nature of Microfinance activities, which are typically targeted at rural communities, which due to the remoteness or higher cost of doing business, have limited or no access to financial services. Another fact to consider is that most Microfinance loans are used to finance activities in the local markets that provide basic products or services, for example agriculture. Demand for this type of product or service are not as strongly affected by swings in the global economy. The final beneficiaries of the Microfinance investment chain are relying on small but relatively stable businesses, which is also reflected by their steady repayment rates.

When it comes to political risk, one might think that because of the relative unstable political environment in many target countries, there is a higher political risk involved. However, it is important to remember that many microfinance activities support businesses at the bottom of the pyramid and thus are generally outside of the political arena. Additionally, Microfinance Investors also adhere to strict diversification strategies across continents and countries. Furthermore, Microfinance provides capital to small businesses, which helps support the economic growth of a country. As a result, Microfinance is generally supported by regulatory authorities as a good way to channel money into the local economy.

The pre-Investment Due Diligence process in Microfinance is typically very detailed. This is extremely important, as Microfinance Institutions provide services to marginalized populations that do not have assets to pledge as collateral, thus in the event of default, there is no safety net on which to fall back on. Thus, it is extremely important to conduct an in-depth review of the institutions and their underwriting so as to reduce the risks of credit default.

In combination those factors make investments in Microfinance Investment Funds extremely crisis-proof. This might surprise some people, as Microfinance is often perceived as riskier due to its focus on developing economies, politically unstable nations, and low-income clients.

Through their high social impact on the rural and female population, Microfinance funds are a great way to enhance your portfolio with a stable and social beneficial investment or to further enhance your ESG portfolio with a low-volatility asset that remains stable when the rest of the world is shaking.