Emerging Market Debt (EMD) is no longer just a high-yield play, it’s becoming a cornerstone of sustainable finance. As investors seek both impact and performance, integrating Environmental, Social, and Governance (ESG) factors into EMD strategies is essential. Within the European Union’s Sustainable Finance Disclosure Regulation (SFDR), Article 9 sets the benchmark for what qualifies as a truly sustainable investment. But applying these standards in emerging markets presents unique challenges and opportunities.

Article 9: From Label to Framework

Under SFDR Article 9, financial products must have a sustainable investment objective. This means that each investment must contribute to environmental or social goals, avoid significant harm to others, and be made in entities with sound governance practices. MSCI’s 2021 study “The SFDR’s Articles 8 and 9: The Funds Behind the Labels” highlights how fund managers are interpreting and disclosing the DNSH principle, noting that only a limited number of funds have adopted Article 9 classification, and many apply controversy screening to bridge gaps in disclosure [1].

For EMD portfolios, this translates into rigorous ESG screening, impact measurement, and transparent reporting at both the issuer and portfolio levels. The regulation also mandates disclosure of Principal Adverse Impact (PAI) indicators, such as greenhouse gas emissions, biodiversity risks, and social controversies, even for sovereign and quasi-sovereign issuers [2].

Adapting ESG Integration to Emerging Markets

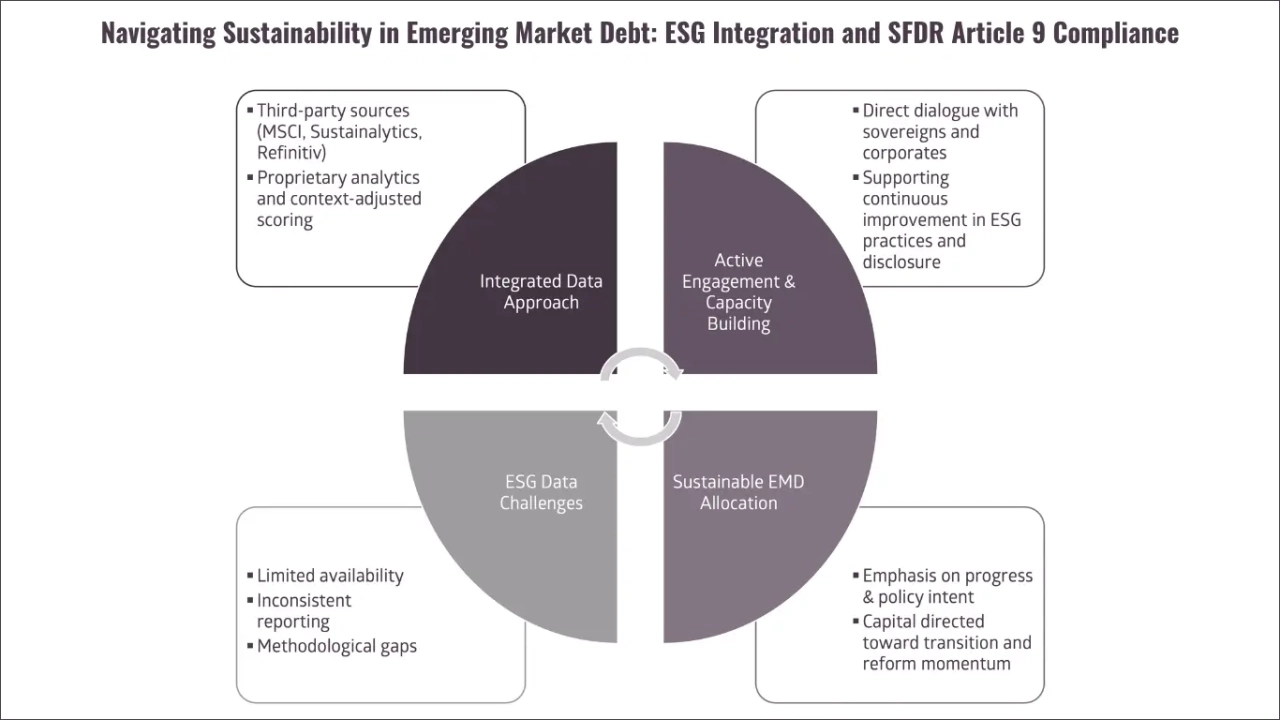

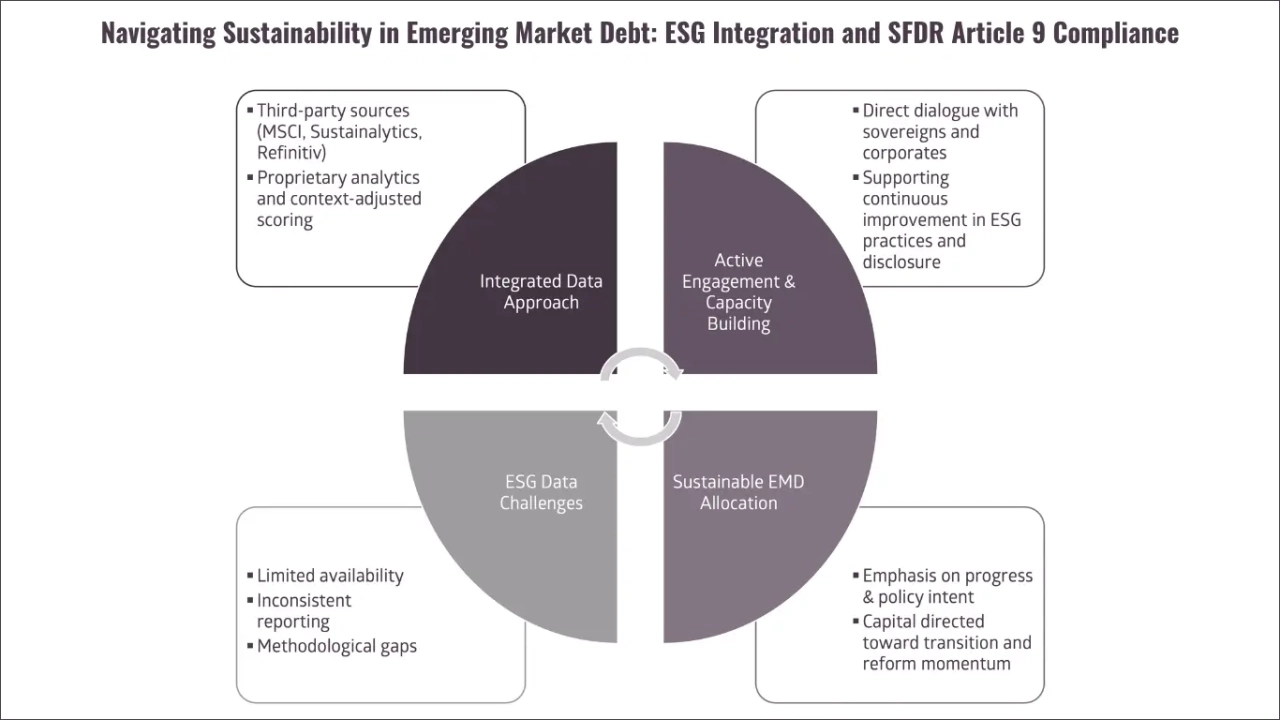

Data quality remains a critical challenge. ESG information for many EM sovereigns and corporates is limited or inconsistent. To address this, leading investors are developing proprietary frameworks that combine third-party data (MSCI, Sustainalytics, Refinitiv) with internal analytics and context-adjusted scoring. Such models recognize that developing countries may face structural barriers (for example, lower renewable-energy penetration or weaker social infrastructure) but can still show strong policy momentum and improvement trajectories. This nuanced approach ensures that ESG integration does not penalize countries for their absolute performances but instead reflects their progress and intent [3].

Active Engagement and Capacity Building

The SFDR framework also encourages investor engagement. Many asset managers actively engage with sovereign debt management offices, central banks and corporates to improve sustainability practices and disclosures, implement monitoring systems, and align with regulatory expectations such as the ICMA Green Bond Principles and UN SDGs [4]. This hands-on approach not only strengthens ESG compliance but also builds local capacity for sustainable development. According to the UN PRI, 66% of signatories investing in fixed income now engage with at least one type of issuer on ESG issues, highlighting a growing shift toward more responsible investing in emerging market bonds [5].

Momentum and Market Signaling

Despite the complexity, the momentum is clear. Article 9 funds are gaining traction, with sustainable fund assets climbing to EUR 6.4 trillion by mid-2025 [5]. While fund flows have fluctuated, the regulatory push has led to a wave of reclassifications and new launches. Investors are increasingly demanding transparency, and Article 9 compliance offers a credible signal of sustainability alignment.

Why It Matters for Emerging Market Debt

In the context of EMD, SFDR Article 9 is more than a label, it provides a governance framework for responsible allocation of capital to high-impact regions. By embedding robust ESG criteria, it helps channel funding towards economies that are both reforming and transitioning, ensuring that sustainability claims are backed by data, governance, and intent. As emerging markets continue to evolve, aligning with SFDR standards will be key to unlocking their full potential in the global sustainable finance ecosystem.

Sources:

- https://www.msci.com/documents/10199/a5471d75-de16-c7ab-a6e0-d12c81fcb1a1

- https://www.esma.europa.eu/sites/default/files/2025-09/JC_2025_26_Report_on_PAI_disclosures_under_Article_18_SFDR.pdf

- https://www.ifc.org/content/dam/ifc/doc/mgrt/ifc-esg-guidebook.pdf

- https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/

- https://assets.contentstack.io/v3/assets/blt9415ea4cc4157833/bltdb931b89f7bc073c/SFDR_Article_8_and_Article_9_Funds_Q2_2025.pdf?utm_campaign=&utm_content=_32731&utm_id=&utm_medium=email&utm |

- https://www.unpri.org/download?ac=4449 | https://www.unpri.org/fixed-income/esg-engagement-for-fixed-income-investors/2922.article?