In the ever-evolving landscape of private equity (PE), secondary investments have emerged as a significant strategy, particularly in emerging markets (EM) and developing countries. These markets present a unique combination of high growth potential and challenging conditions, making secondary PE investments an attractive option for investors looking to balance risk and return. However, the path to successful secondary investments in these regions is not just about financial performance; it is also about responsible exit strategies that ensure sustainable impact. This article explores the dynamics of secondary PE investments in emerging and developing countries, outlines the importance of responsible exits, and connects these concepts to additionality.

Secondary PE direct investments refer to the purchase of existing shares in companies from current investors. This approach provides liquidity to these investors who are looking to divest due to reaching the end of the envisaged investment period.

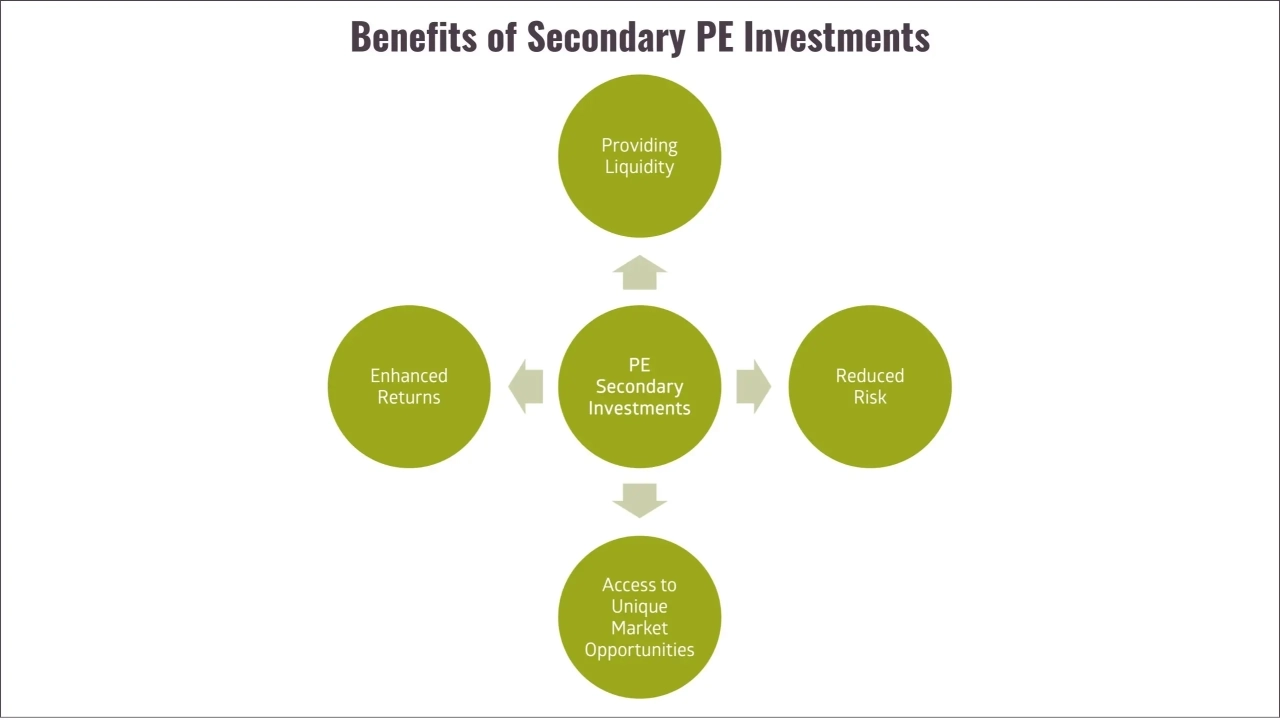

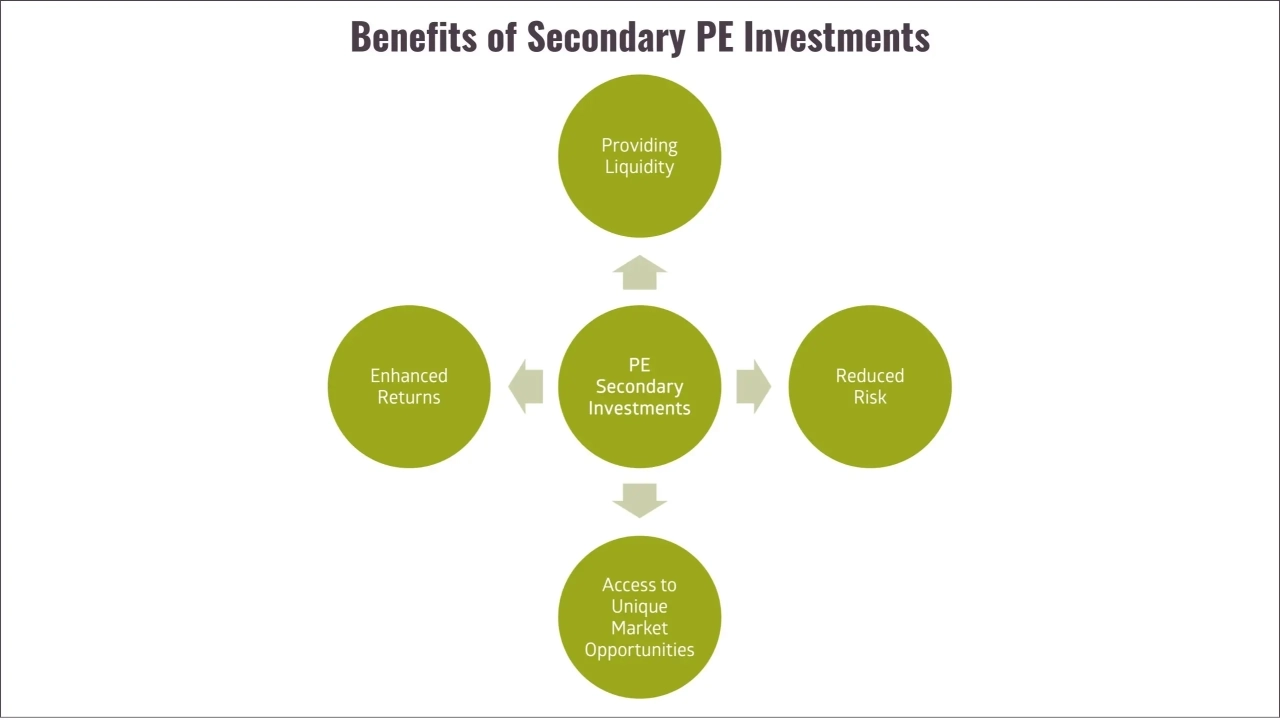

Secondary investors, in turn, gain access to established companies with track records, thereby reducing some of the inherent risks associated with private equity. In the context of emerging markets and developing countries, secondary PE direct investments offer several advantages:

- Liquidity Provision: Secondary investments provide a critical exit route for investors who need liquidity, thus ensuring continuous capital flow into emerging markets.

- Risk Mitigation: By investing in established companies, secondary investors can better assess risks, such as business model and business development, market volatility and environment, regulatory changes, ESG risk and geopolitical risks.

- Access to Growth Markets: Emerging and developing markets often exhibit high growth rates due to demographic trends, urbanization, and economic reforms, making them attractive for PE investors.

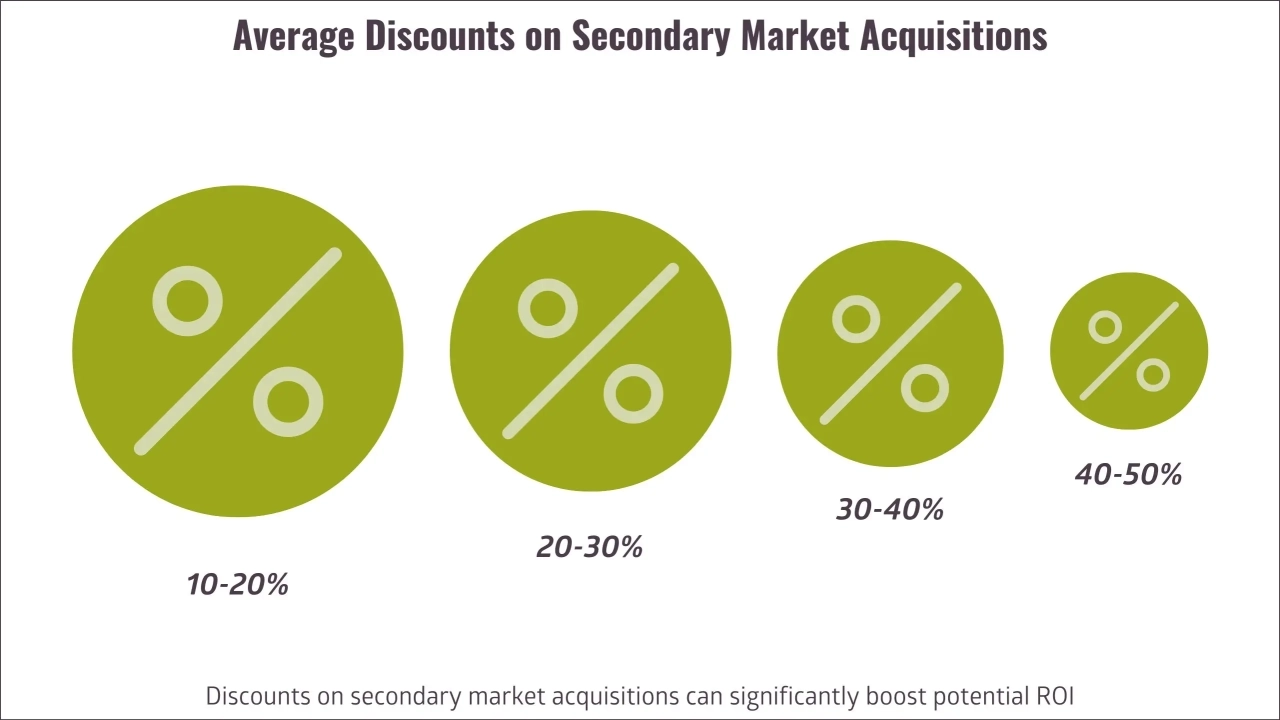

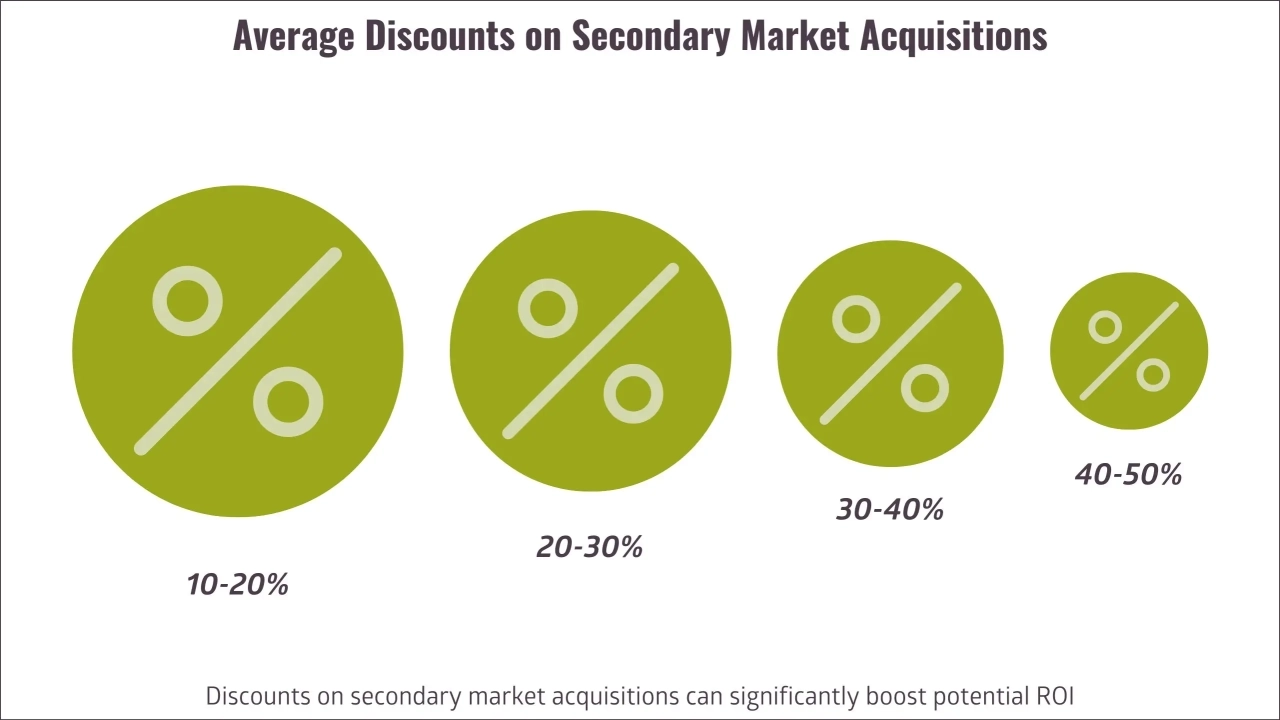

- “Skip over” the J-curve Secondary investments can be acquired at a discount to NAV and compared to primary investments, potentially lead to higher returns.

The Role of Secondary PE Investments in Emerging Markets

Emerging markets and developing countries present a unique opportunity for private equity investors. These regions are characterized by growing consumer markets, increased industrialization, and rapid urbanization, which create substantial demand for capital. However, they also come with significant risks, including political instability, regulatory uncertainties, and less developed financial infrastructures. Secondary PE investments help bridge these gaps by:

- Providing Capital: Secondary investments inject necessary capital into markets where access to financing might be limited, thus supporting business growth and development.

- Fostering Economic Development: By investing in sectors such as infrastructure, healthcare, education, and financial services, secondary PE investments contribute to broader economic development goals.

- Enhancing Market Efficiency: Secondary investors often bring operational expertise and governance improvements, helping to build more robust and efficient market practices.

Responsible Exit Strategies: A Crucial Consideration

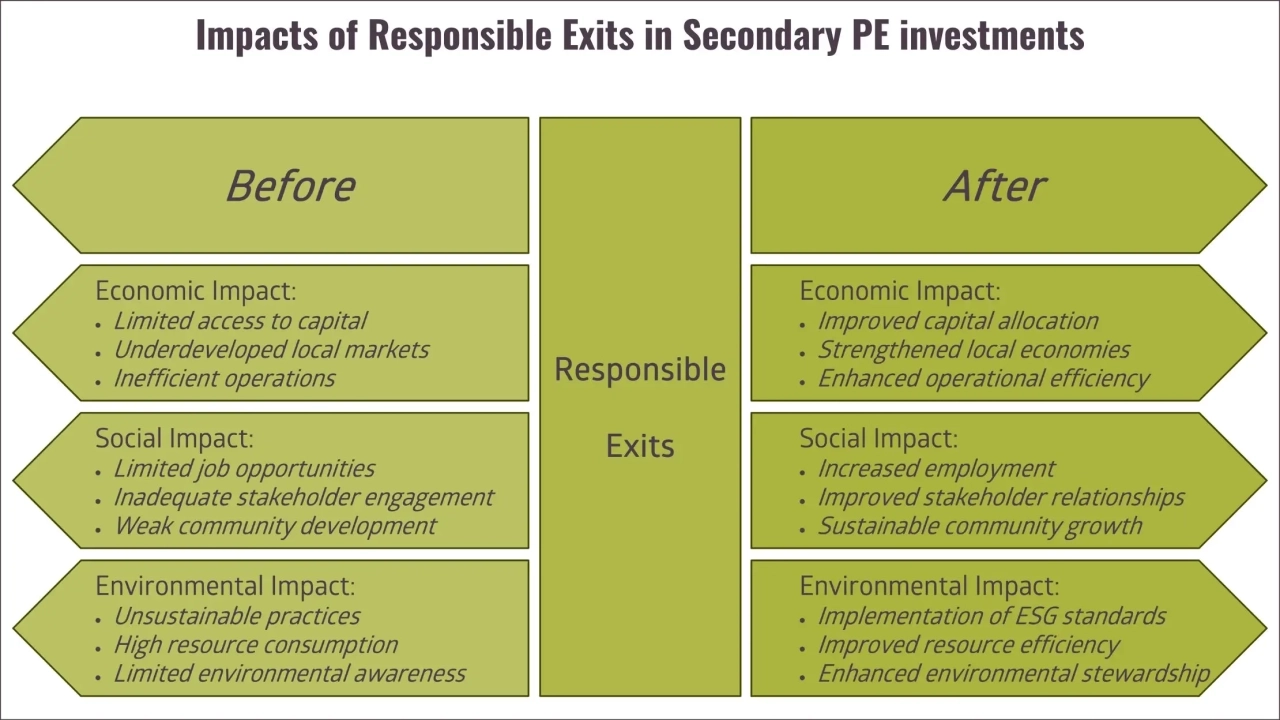

While secondary PE investments offer numerous benefits, achieving a responsible exit is paramount.

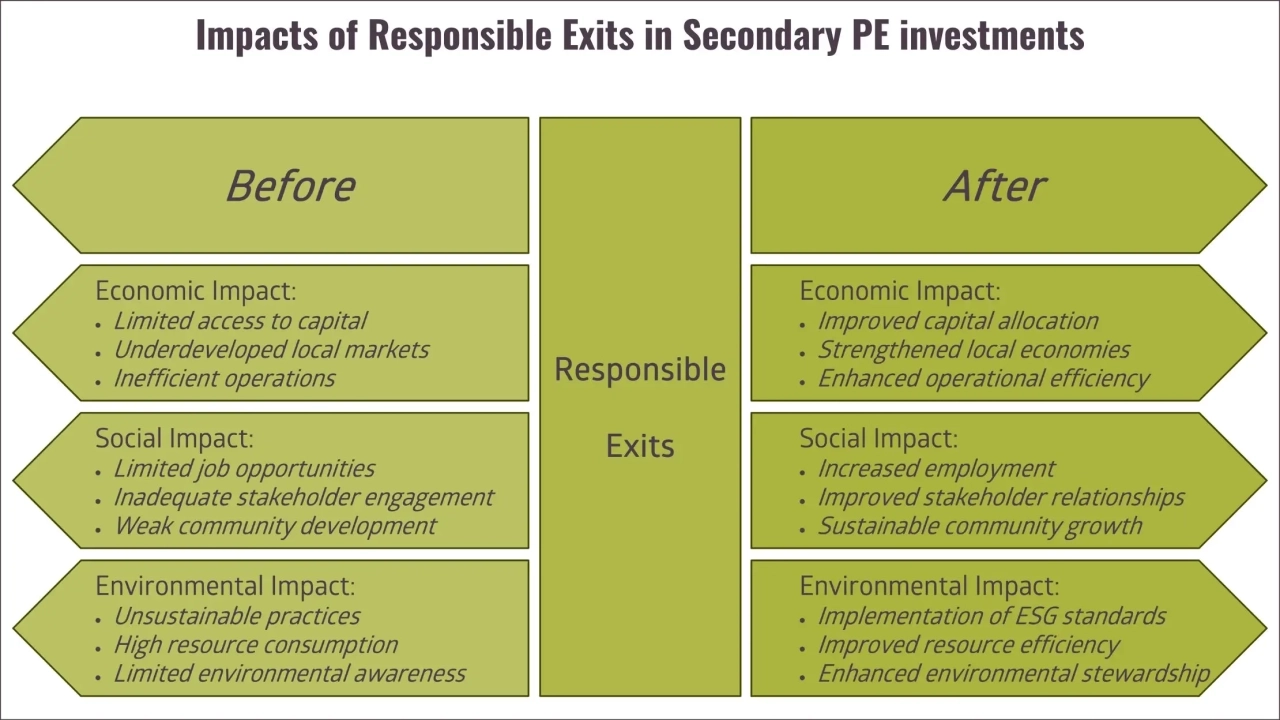

Responsible exits ensure that the positive impacts generated during the investment are sustained and that the stakeholders, including employees, customers, and communities, are not adversely affected. Responsible exit strategies in secondary PE investments in emerging markets can include:

- Sustainability Focus: Investors should prioritize exits that promote sustainability. This could mean selling to buyers committed to maintaining environmental, social, and governance (ESG) standards or ensuring that the companies continue to operate sustainably post-exit.

- Local Market Development: Exiting to local buyers can help develop domestic markets by retaining capital and expertise within the country. This approach supports the growth of local businesses and enhances economic resilience.

- Long-term Partnerships: Establishing long-term partnerships with strategic buyers who share a commitment to the region's development can lead to more responsible exits. These partners are likely to invest further in the company's growth and its impact on the community.

- Stakeholder Engagement: Engaging with stakeholders throughout the investment period and during the exit process ensures that the needs and concerns of all parties are considered. This can lead to more balanced and responsible outcomes.

Connecting Responsible Exits to Additionality

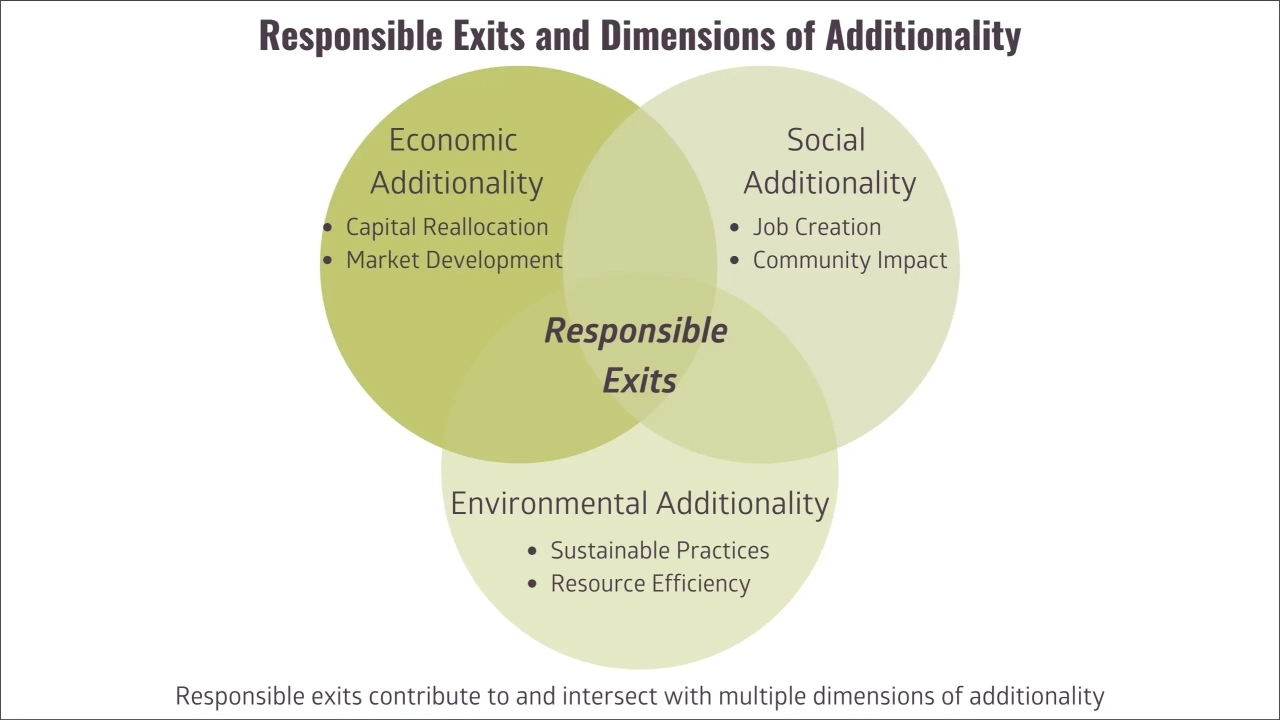

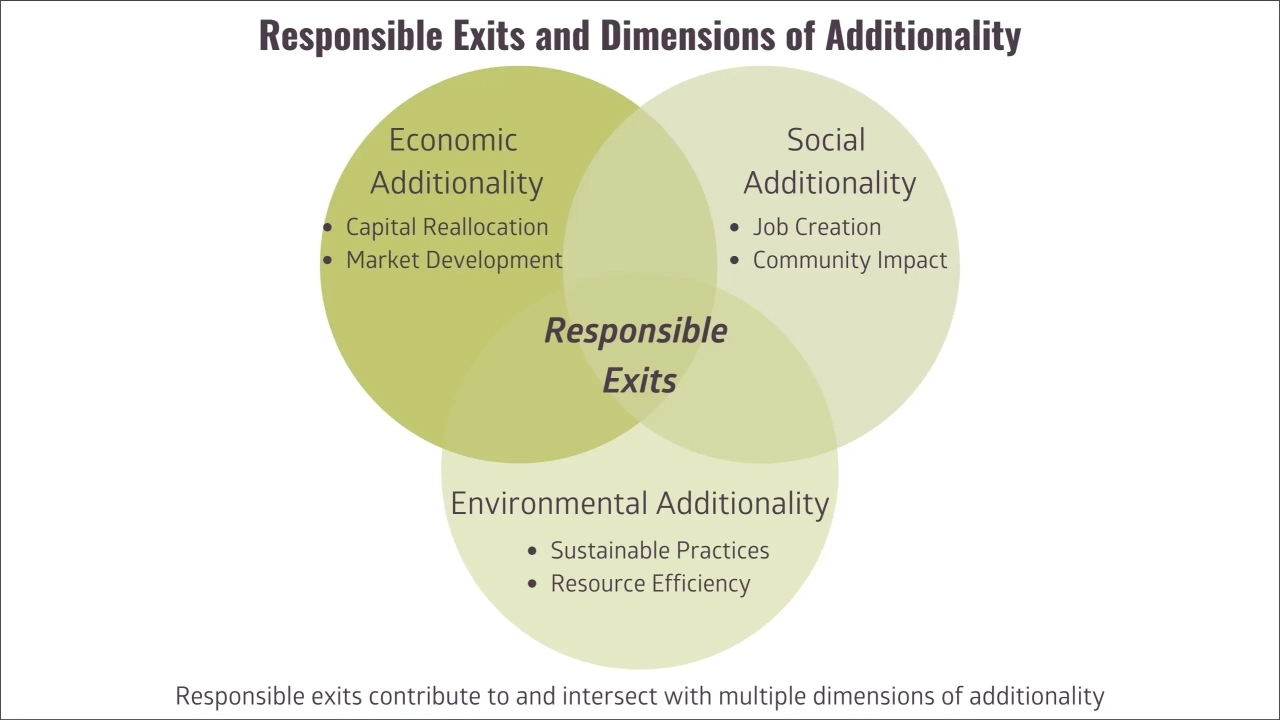

Responsible exits are directly linked to the concept of additionality. By ensuring that investments leave a lasting positive impact, secondary PE investors contribute to additionality in several ways:

- Capital Reallocation for Continued Growth: By facilitating responsible exits, investors free up capital that can be reinvested in other impactful ventures, promoting continued economic development.

- Sustained Development Impact: Exits focused on sustainability ensure that the development impact—such as job creation, improved infrastructure, or enhanced social services—continues post-exit.

- Strengthening Local Economies: Exiting to local buyers or fostering local market partnerships builds stronger, more resilient economies, aligning with additionality goals.

Examples of Responsible Exits

- Renewable Energy Projects: In regions with abundant natural resources, secondary PE investments in renewable energy projects, such as solar or wind farms, can be exited responsibly by selling to infrastructure funds or utilities with a commitment to green energy.

- Healthcare and Education: Investments in healthcare and education can have lasting positive impacts. Exiting to non-profits or socially responsible businesses ensures that these services continue to benefit the local population.

- Financial Services: Secondary investments in financial institutions can be exited responsibly by ensuring that acquirers continue to provide access to finance for underserved populations, thus promoting financial inclusion.

Conclusion

Secondary PE investments in emerging and developing countries offer significant opportunities for investors looking to achieve high returns while contributing to economic development. However, the path to success is not only about capital gains; it is also about responsible exits that sustain positive impacts and contribute to long-term sustainability. By prioritizing ESG considerations, engaging with stakeholders, and fostering local market development, secondary PE investors can achieve responsible exits that benefit both their portfolios and the communities they invest in. This approach not only enhances the reputation of private equity in these markets but also ensures that the benefits of investment are shared widely and equitably.

Next Steps

If you are an investor or stakeholder interested in learning more about how secondary PE investments can deliver responsible and sustainable returns, or if you wish to explore potential partnerships, contact us.