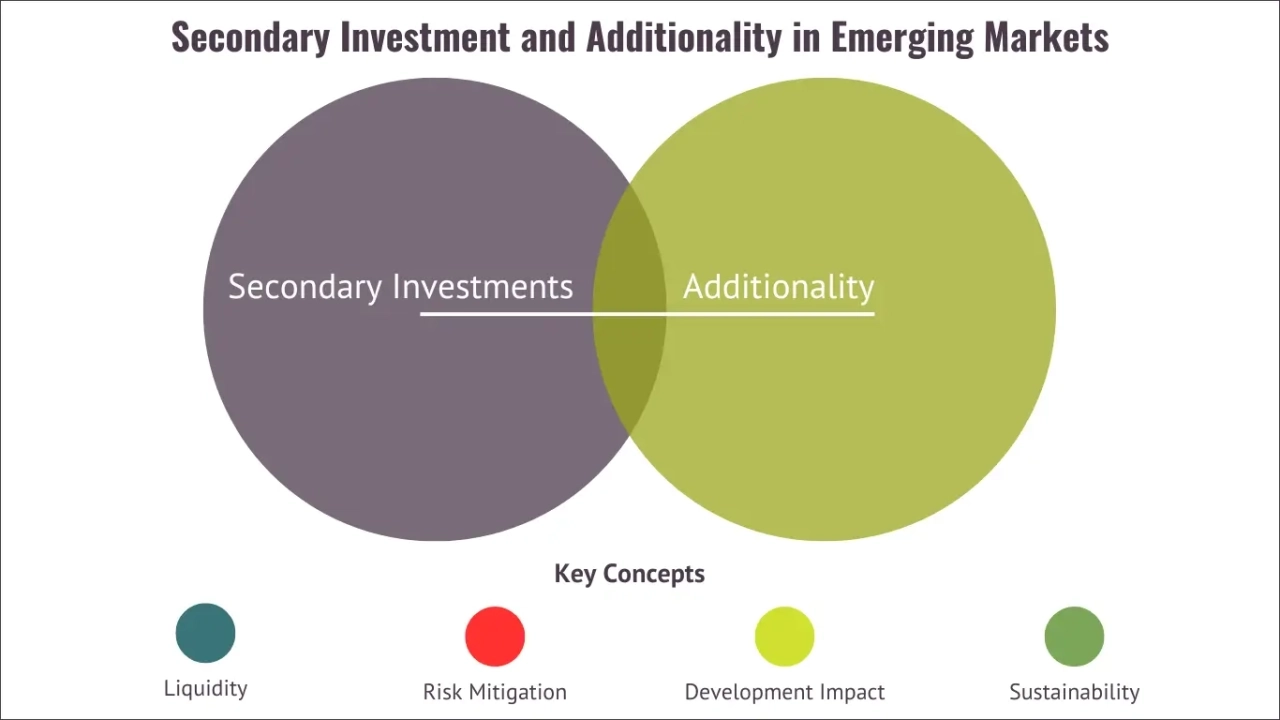

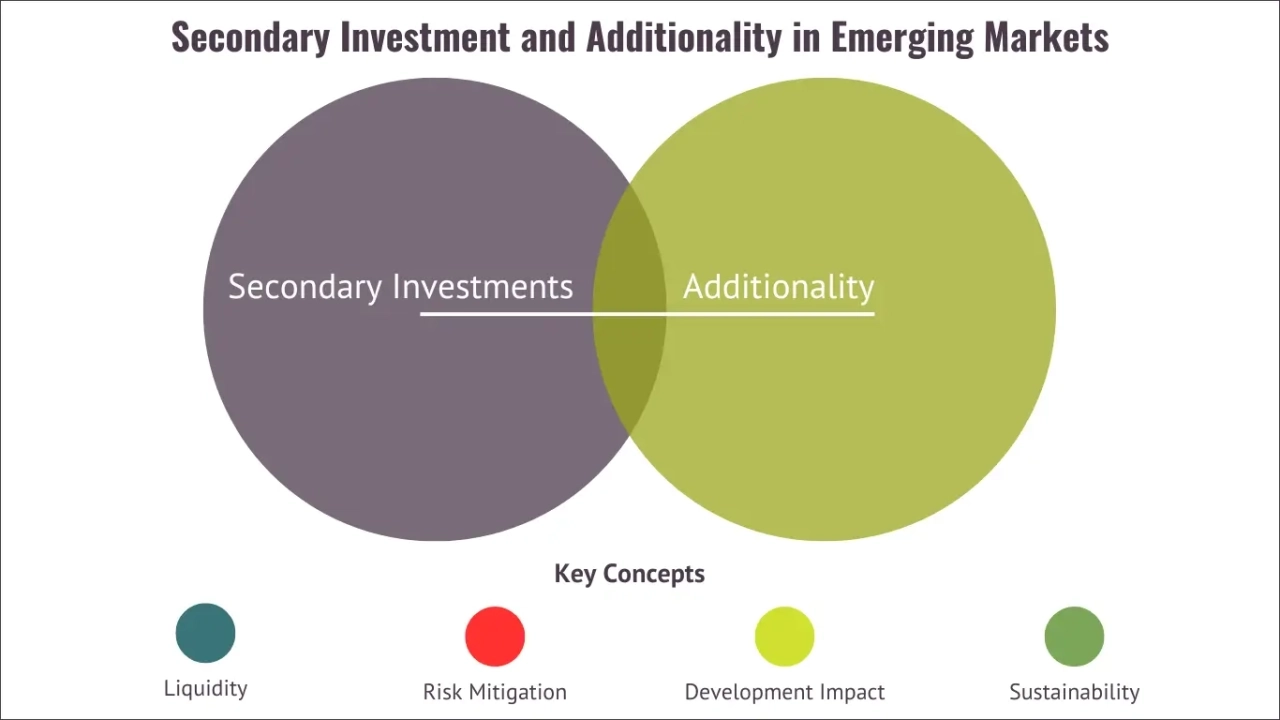

Investing in emerging markets requires a nuanced approach that goes beyond mere financial calculations. It involves recognizing unique opportunities and addressing specific challenges. At Enabling Qapital, we place great emphasis on the potential of secondary private equity (PE) investments and the concept of additionality to foster sustainable development and economic growth. Let us explore how these two approaches work in tandem to create meaningful impact.

The Strategic Advantage of Secondary Investments

Secondary PE direct investments involve the acquisition of existing stakes in private companies. This process offers a solution for primary investors seeking to divest.

The significance of this approach, particularly in emerging markets, is multifaceted:

- Enhanced Liquidity: Secondary investments provide much-needed liquidity to investors, facilitating exits and enhancing investors trust in the market. This, in turn, can attract more investments and it is especially crucial in emerging markets where exits are one of the main risks for PE impact investors.

- Improved Market Efficiency: Secondary investments facilitate the reallocation of capital to investors capable of adding greater value, thereby enhancing overall market efficiency.

- Refined Risk Management: By investing in companies that have successfully passed their inception phase, secondary investors can conduct more thorough risk assessments. This is particularly valuable in markets characterized by uncertainty.

- Optimized Return Potential: Secondary investors have the opportunity to acquire stakes at discount to NAV, presenting significant upside potential, especially in underdeveloped markets.

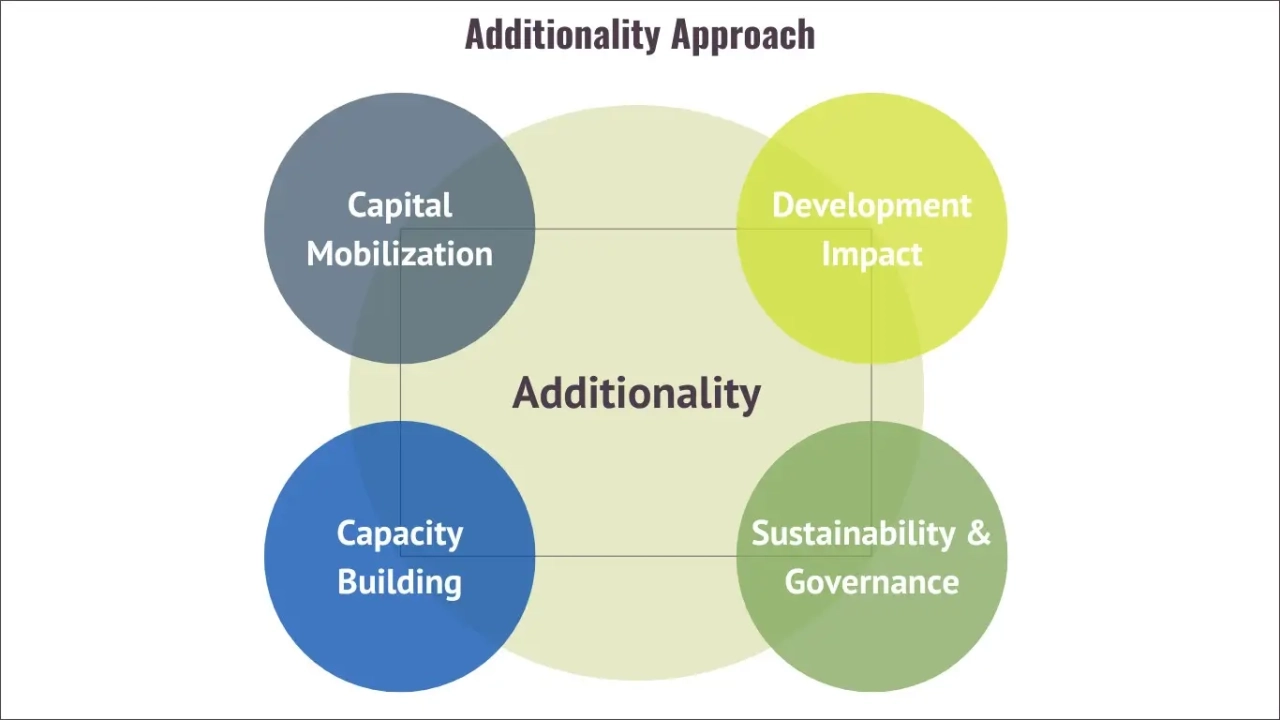

The Additionality Approach: Generating Tangible Impact

Additionality, in the context of PE investments in emerging markets, extends beyond profit generation. It focuses on creating sustainable, positive change that would not occur otherwise.

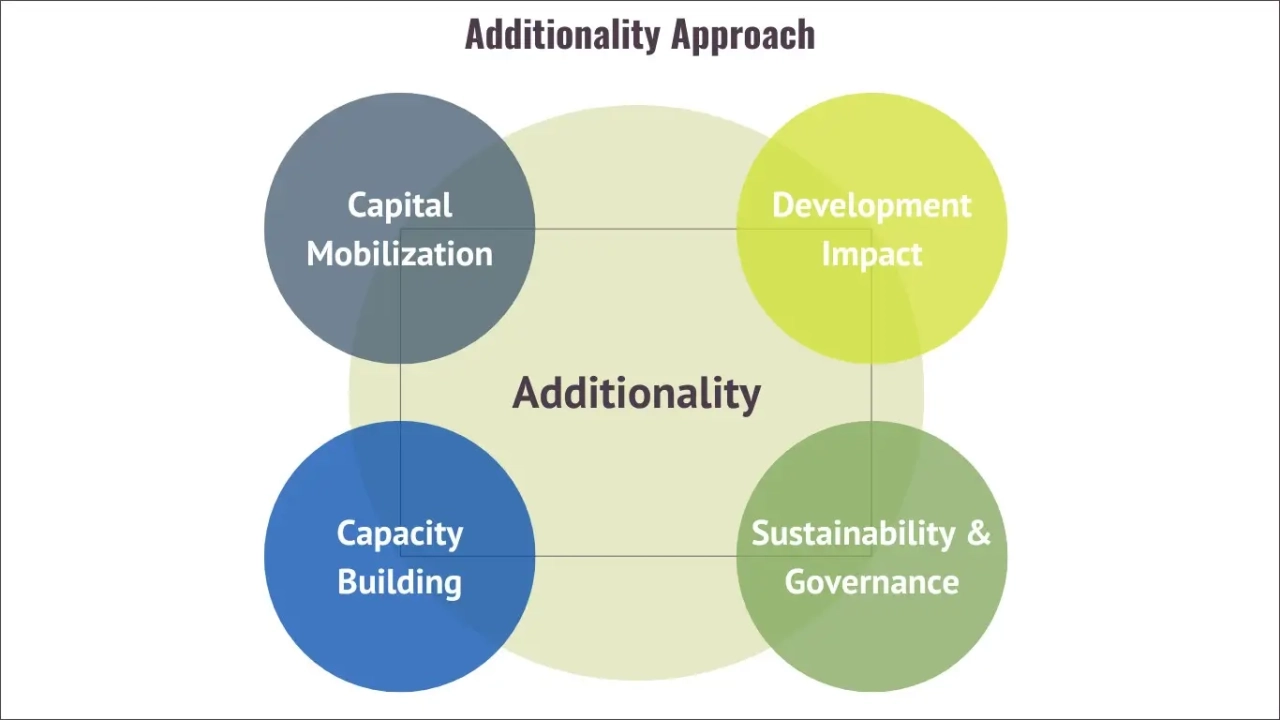

Our perspective on additionality encompasses:

- Capital Mobilization: direct focus towards regions and sectors that are often overlooked, channelling capital to stimulate growth in areas of greatest need.

- Development Catalyst: investments create jobs, improve infrastructure, and enhance essential services, contributing to broader economic development.

- Capacity Building: Through the transfer of knowledge, technology, and best practices, local businesses in strengthen their operations, fostering a more robust economic environment.

- Sustainability and Governance Advocacy: prioritize investments that promote sound environmental, social, and governance (ESG) practices, ensuring the impact is sustainable over the long term.

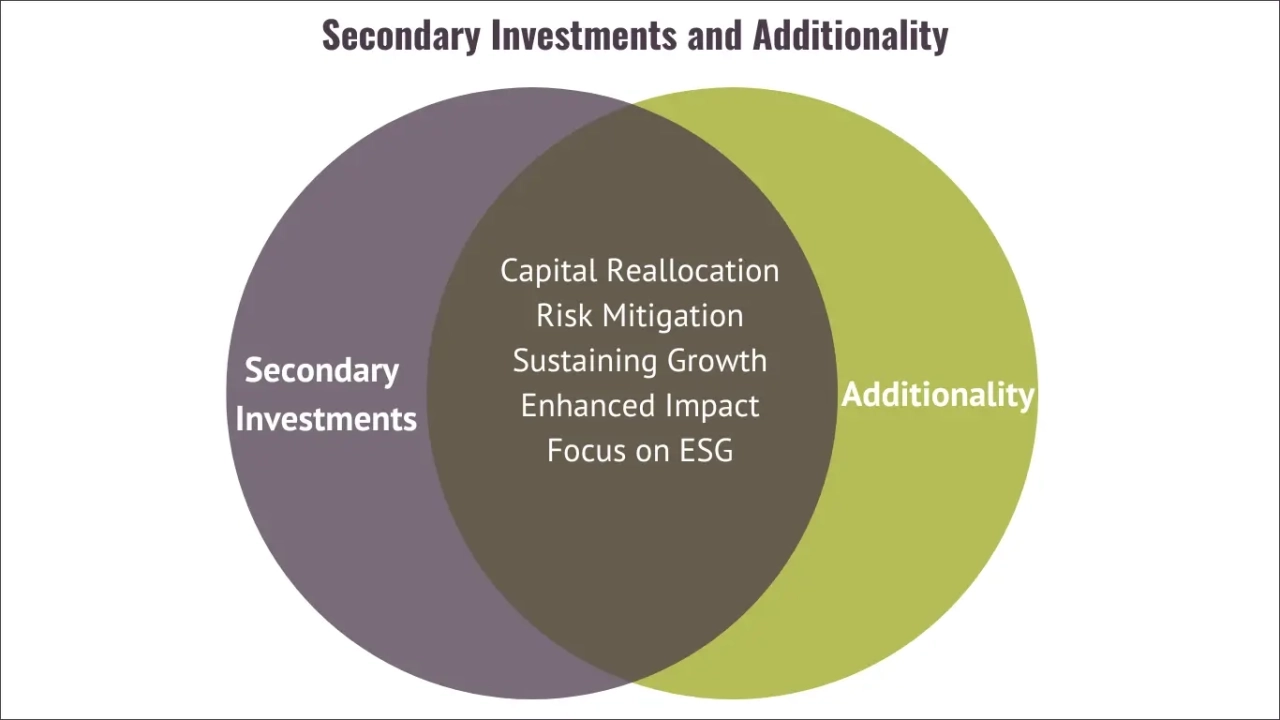

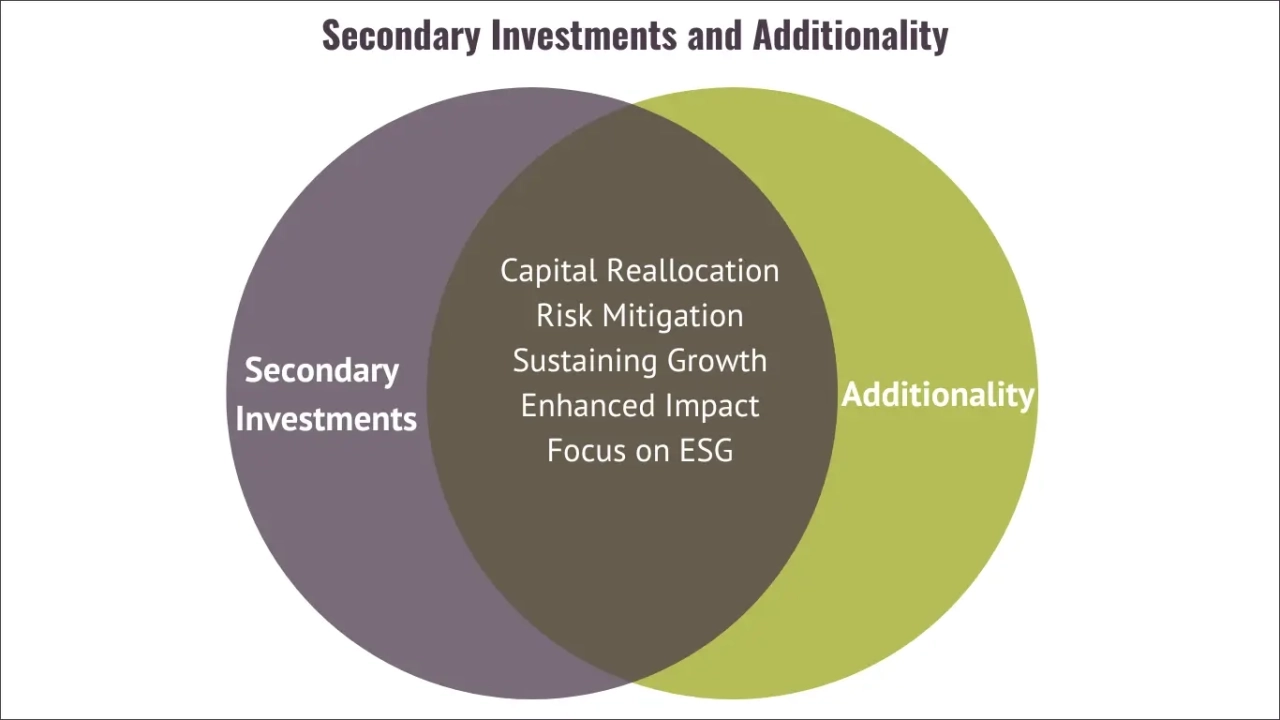

The Synergy of Secondary Investments and Additionality

The intersection of these two approaches creates a powerful synergy:

- Capital Reallocation for Growth: When primary investors exit through secondary investments, they free up capital for reinvestment into new ventures, fuelling ongoing economic development.

- Enhancing Market Confidence: Successful exits contribute to reducing perceived risks in emerging markets, attracting additional investment and increasing capital flows.

- Sustainable Growth Support: Secondary investors bring fresh perspectives and strategic insights, aiding companies in scaling and sustaining growth, aligning perfectly with additionality goals.

- Impact-Focused Investment: investments that offer clear development impacts, ensuring our capital drives both social and economic benefits.

- ESG Advancement: Secondary investors often possess the experience and resources to implement stronger ESG criteria, improving governance and operational standards, and contributing to sustainable development goals.

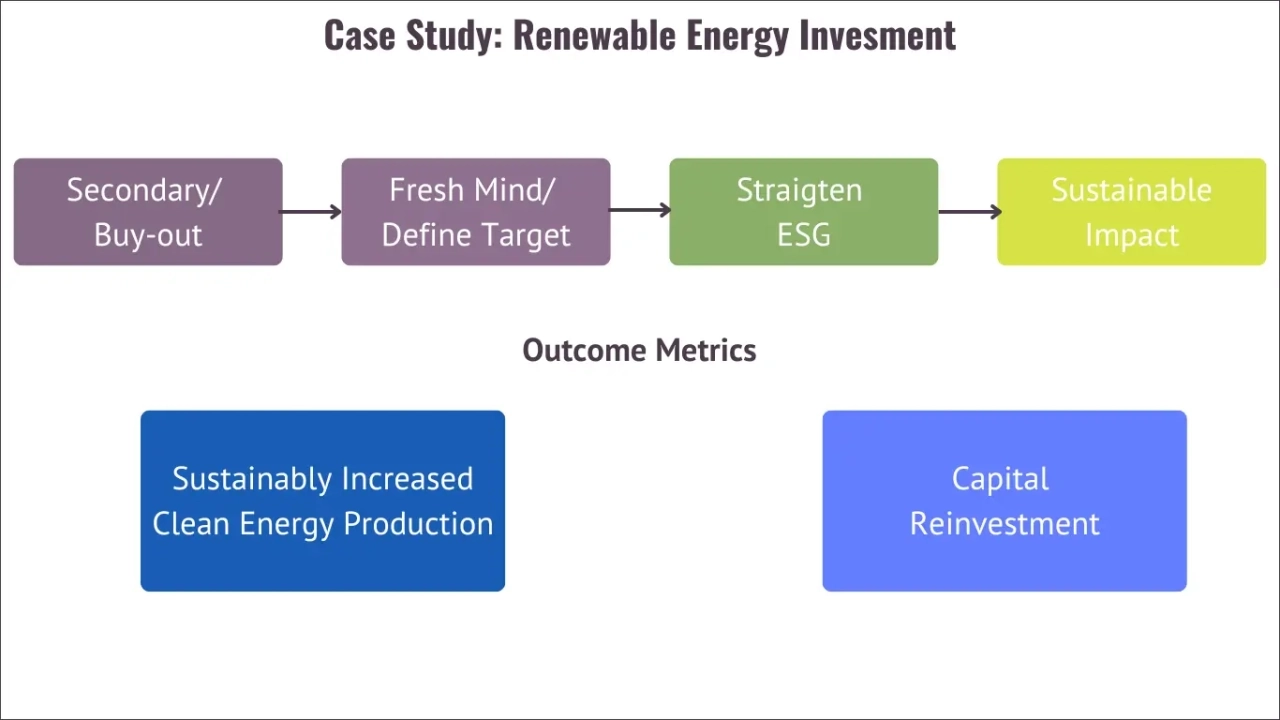

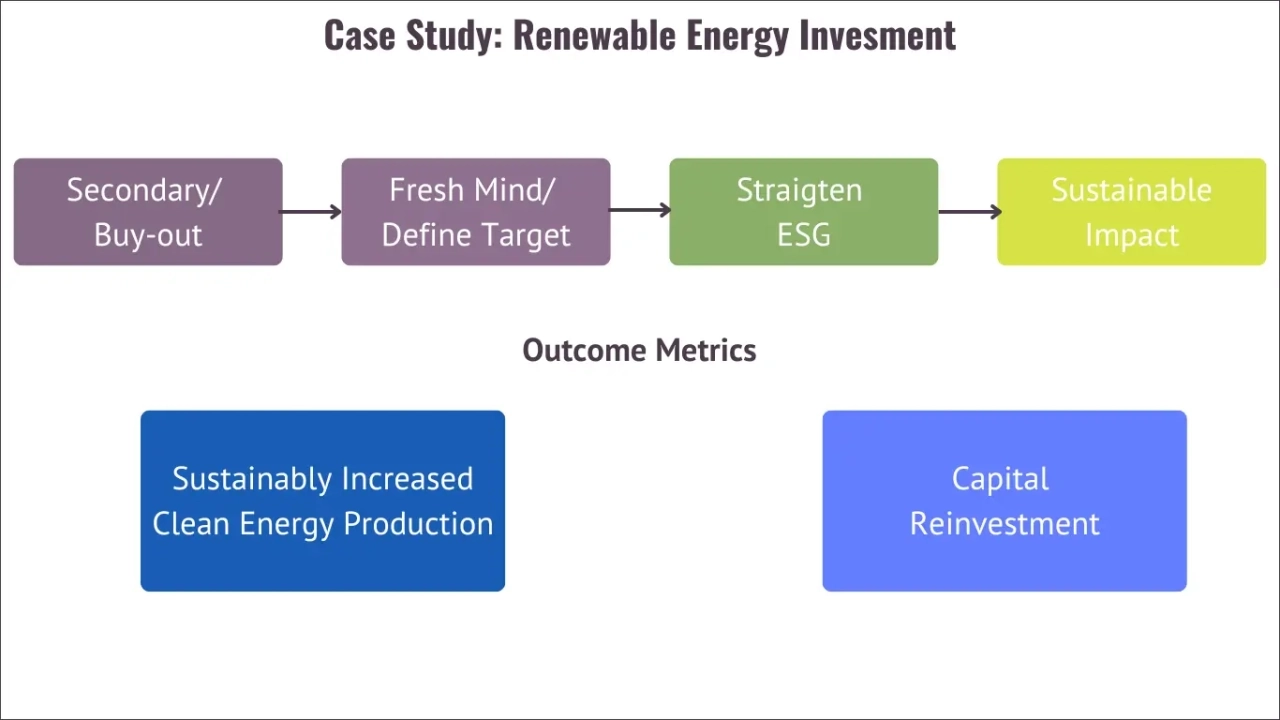

Practical Application: Investing in Renewable Energy

Consider a scenario involving a renewable energy company in an emerging market poised for expansion but requiring additional capital and expertise. A secondary investor acquires stakes from existing investors seeking liquidity. With additional fresh capital as a primary top up from the secondary investor, and strategic guidance as value added, the company enhances its clean energy production, supports environmental objectives, and generates employment in the local community. The existing investors, now able to reinvest, direct their capital into new ventures, further stimulating growth in the sector. The outcome is enhanced capacity, sustainable development, job creation, and improved governance - all resulting from the synergy between secondary investments and additionality.

Why Enabling Qapital?

At Enabling Qapital, we’re more than just investors; we’re partners in progress. Our expertise in secondary private equity investments allows us to unlock value and promote sustainable development in emerging and developing markets. We’re committed to driving positive change - one investment at a time.