In today’s evolving macro landscape, investors are increasingly re-evaluating the traditional boundaries between Emerging Market Debt (EMD) and Developed Market Debt (DMD).

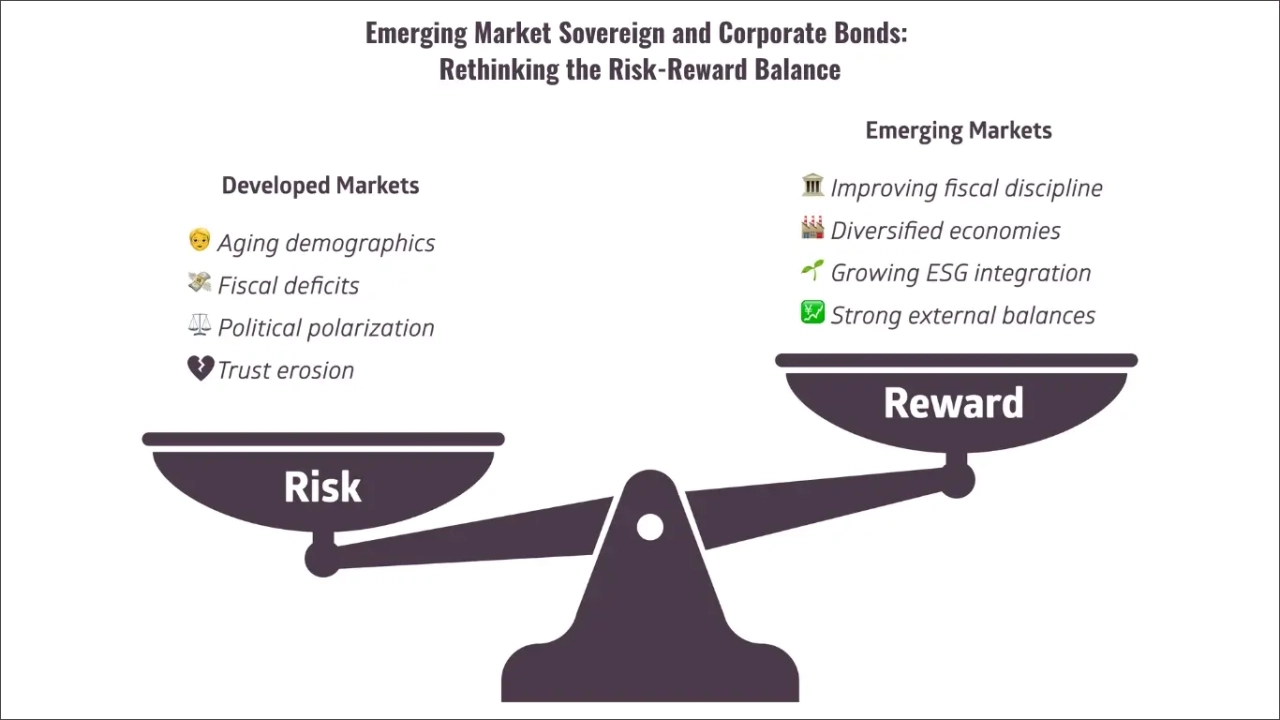

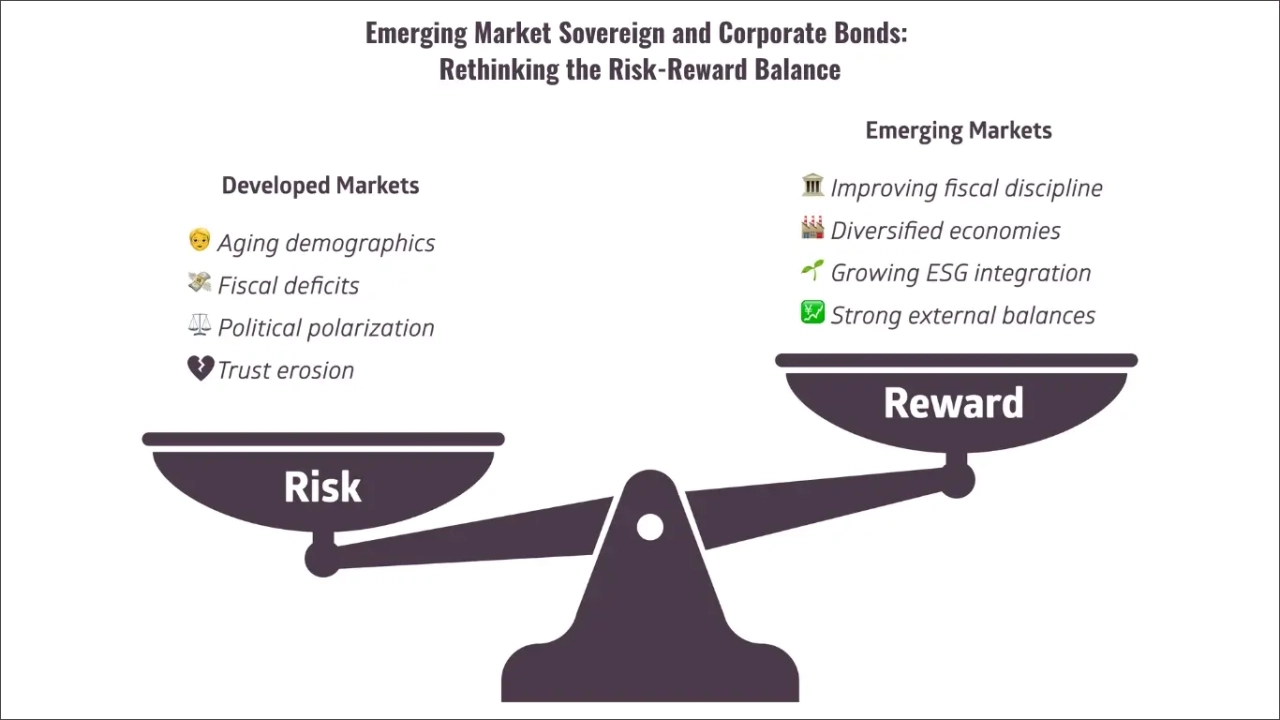

Rethinking the Risk-Reward Balance

While DMD has long been considered the safer option, recent data and structural shifts suggest that EMD may offer a more compelling risk-reward profile than previously assumed.

The Myth of Excessive Risk in Emerging Market Bonds

EMD, particularly in the sovereign and corporate bond space, has historically been viewed as volatile and high-risk. However, this perception is increasingly outdated. Recent analyses by the World Bank and IMF indicate that long-term default rates for EM sovereign and corporate bonds are only marginally higher than those observed in advanced economies [1] [2]. This improving risk profile reflects stronger fiscal management, better institutional frameworks, and growing integration of ESG principles into emerging-market capital markets [3].

Developed Markets Face Their Own Structural Challenges

Developed markets are now grappling with mounting fiscal and structural pressures. Fiscal deficits, aging demographics, and political instability are eroding the traditional safety associated with DMD. According to the IMF World Economic Outlook (April 2025), the average debt-to-GDP ratio in advanced economies stands at approximately 110%, compared with around 74–75% in emerging and middle-income economies [1].

This relative fiscal discipline has underpinned a wave of sovereign credit-rating upgrades in EM, with 14 EM sovereigns upgraded in 2024, the most positive net-upgrade year since 2011 [4]. These trends suggest that many emerging markets are now on a more sustainable fiscal trajectory than their developed peers.

Growth Differentials Drive Performance

From a growth perspective, EM economies continue to outpace developed markets. The IMF reports that emerging and developing economies grew 3.7% in the year to April 2025, compared with 1.4% for advanced economies [1]. Historically, when this growth gap exceeds 2 percentage points, EMD, especially sovereign and corporate bonds, has tended to outperform, reflecting stronger earnings, improving credit fundamentals, and higher local consumption [5].

This growth differential remains a key driver of total-return potential in EMD, particularly in reforming economies or those benefiting from favorable demographics [3] [5].

Yield Dynamics Strengthen the Case for EMD

Yield remains one of EMD’s most compelling advantages. As of August 2025, U.S. Treasury yields had declined to approximately 4.23%, while resilient EM economies were offering real yields well above long-term averages [4][5].

Growth Drivers and Diversification Benefits

Diversification remains another key advantage. The EM bond universe spans nearly 100 countries, offering exposure to diverse policy cycles, commodity bases, and structural reforms [2]. The IMF (2025) notes that correlations among EM regions have moderated even during global shocks, enabling more resilient cross-country allocation [1]. With both local-currency and hard-currency segments responding differently to monetary and fiscal regimes, EMD offers investors a balance of income stability and growth exposure, making it a powerful complement to traditional developed-market fixed income holdings [3][5].

Managing Challenges

Naturally, EMD is not without risks. Currency volatility, geopolitical tensions, and trade disruptions, such as the re-imposition of U.S. tariffs, can affect returns [4]. However, many EMs are now less exposed to these shocks, owing to rising intra-EM trade, improved external balances, and larger local-currency investor bases. Additionally, liquidity enhancements, greater transparency, and the growth of sustainability-linked instruments are helping to further strengthen market resilience [5].

Conclusion: A Strategic Allocation for 2025 and Beyond

The balance between Emerging and Developed Market Debt is shifting. With improving fundamentals, attractive real yields, and robust diversification benefits, EMD, focused on sovereign and corporate bonds, is increasingly viewed not as speculative but as a strategic allocation within global fixed-income portfolios [3][5].

For investors seeking both financial performance and sustainable impact, Emerging Market Debt offers a compelling long-term proposition, aligning portfolio returns with the broader goals of resilient growth and inclusive development [1][2].

References

- [1] https://www.imf.org/en/Publications/WEO

- [2] https://www.worldbank.org/en/research

- [3] https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/can-emerging-markets-equities-outshine-developed-markets-in-2025/

- [4] https://www.reuters.com/markets/currencies/

- [5] https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/can-emerging-markets-equities-outshine-developed-markets-in-2025/