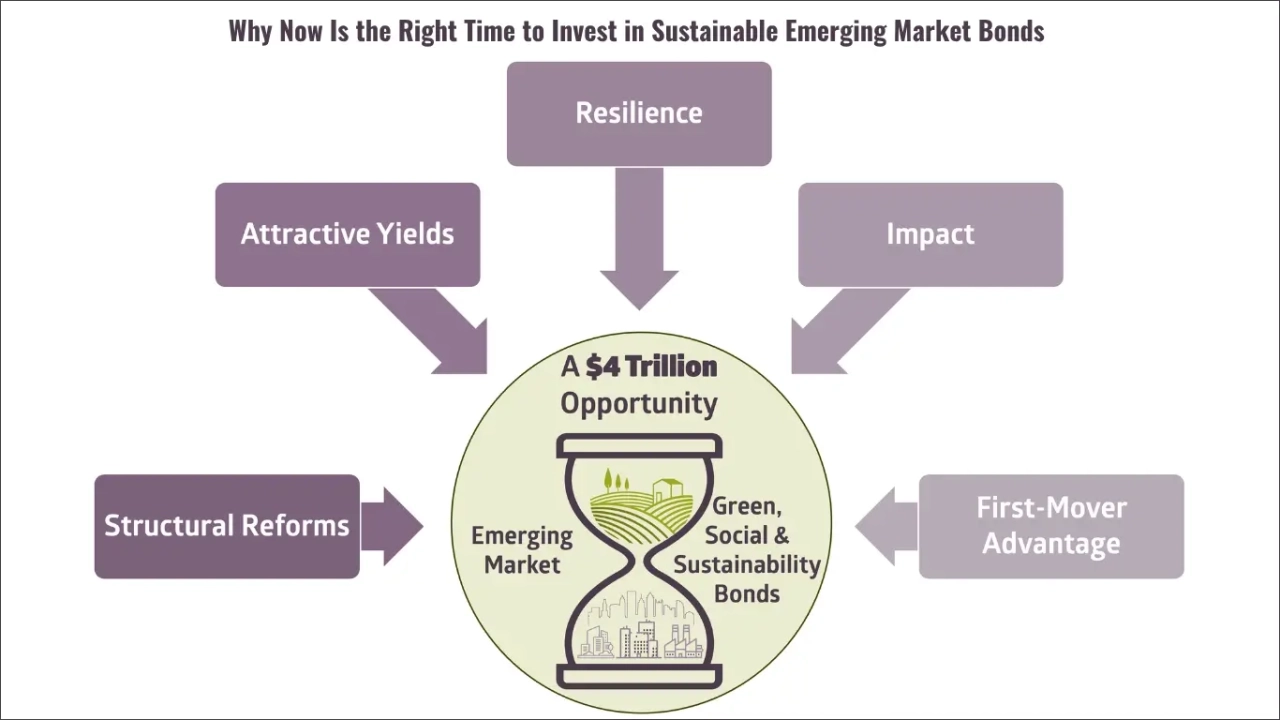

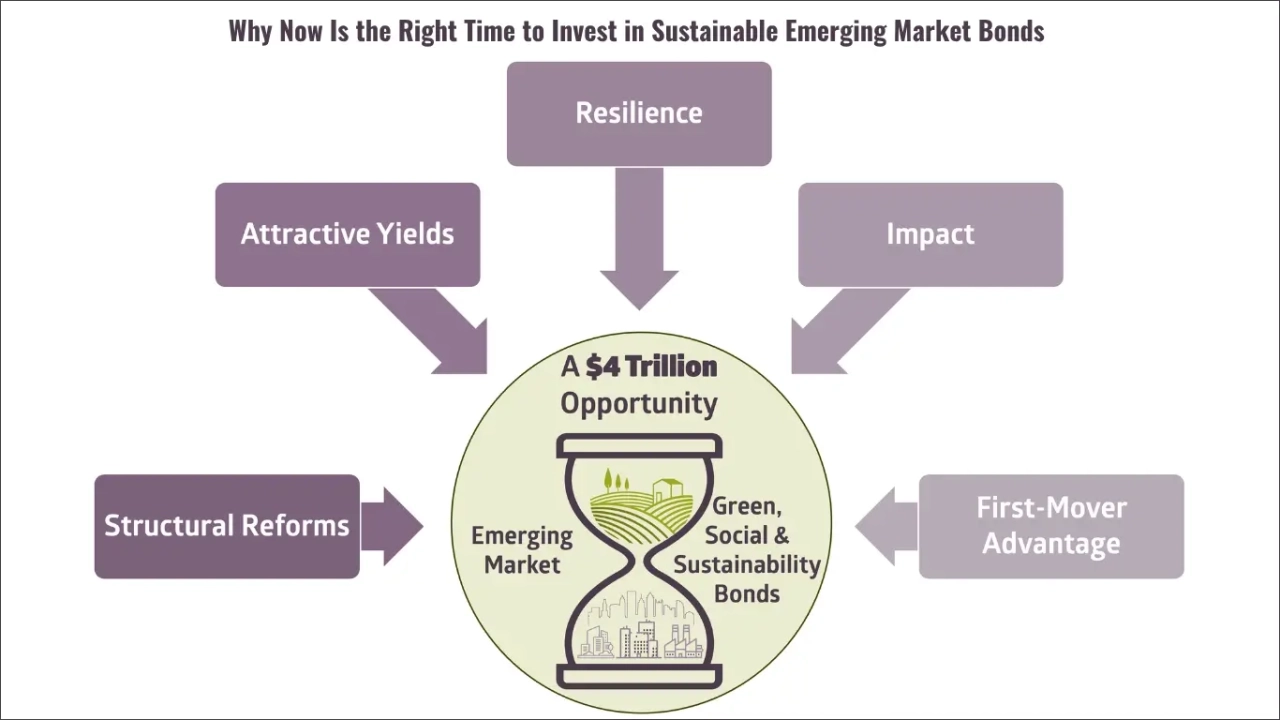

As global markets recalibrate in response to climate urgency, geopolitical shifts, and evolving investor expectations, Sustainable Emerging Market Bonds are emerging as a strategic asset class combining resilience, impact, and return. Here’s why now is a timely inflection point.

A $4 Trillion Opportunity in the Real Economy

With the sustainable development gap now surging at an alarming $4 trillion per year, nearly double the level estimated in 2015 [1][2], emerging economies must increasingly tap capital markets to bridge the infrastructure, healthcare, education, and climate resilience divide.

This creates compelling opportunities in their bond markets, particularly through green, social, and sustainability bonds. Despite trade tensions making headlines, many developing nations are pursuing structural reforms and fiscal discipline, offering yields that often exceed those in developed markets [3].

Attractive Yield and Improving Credit Quality

Emerging Market (EM) Green, Social, and Sustainability bonds offer attractive yields relative to developed-market sustainable bonds, reflecting the sovereign and corporate risk premiums inherent to these markets. In 2024, global sustainable bond issuance exceeded $1 trillion, with green bonds comprising 57.7% of the total, underscoring strong investor demand [4][5].

EM corporate Green, Social, and Sustainability bonds have demonstrated robust risk-adjusted returns. The J.P. Morgan CEMBI Broad Diversified Index delivered one of the strongest Sharpe ratios in fixed income as of February 14, 2025, based on annualized weekly returns, highlighting the resilience of EM corporate debt. [3]

Credit fundamentals are improving: many EM issuers show disciplined leverage, narrowing deficits, and structural reforms. Sovereign debt metrics further support the investment case: the IMF’s World Economic Outlook (April 2025) reports average general government gross debt of 73.6% of GDP in emerging and developing economies, versus 110.1% for advanced economies. The latest IMF Fiscal Monitor confirms similar trends, with EM and middle-income economies averaging ~74.8% of GDP, below advanced peers [6].

Together, these factors indicate that EM sustainable debt can provide both attractive yields and manageable risk, making Sustainable Emerging Market Bonds a compelling choice for income-seeking investors looking to diversify beyond traditional fixed income, while supporting sustainable development [2][5].

Resilience Amid Global Headwinds

Despite political headwinds and regulatory complexity, the sustainable bond market is holding firm. Moody’s forecasts another $1 trillion in global sustainable bond issuance in 2025, with green bonds expected to dominate [7][8].

Emerging markets are increasingly stepping up: sovereign issuers are pioneering innovative instruments such as Indonesia’s green sukuk [9], while others are expanding frameworks to include social and sustainability bonds.

EM sustainable bonds have also shown resilience in credit metrics. Default rates among EM investment-grade issuers remain low, and market liquidity has held up well despite regional political volatility [3][8].

Impact Where It Matters Most

Emerging markets are disproportionately affected by climate change, infrastructure gaps, and social inequality. Sustainable Emerging Market Bonds allow investors to deploy capital where it can make the greatest difference, supporting transitions in energy, infrastructure, and social systems [1][2].

From financing nature-positive transitions to decarbonizing heavy industry, Sustainable Emerging Market Bonds are helping reshape economies. Private finance for nature alone grew from $9.4 billion in 2020 to over $100 billion by 2024 [2].

Specific examples include renewable energy expansion, resilient water systems, and social infrastructure projects that directly support sustainable development goals [5][9].

First-Mover Advantage in a Maturing Market

While sustainable finance is becoming mainstream, Sustainable Emerging Market Bonds remain underrepresented. Only about 60 of 170 sovereign issuers have tapped the sustainable bond market [3]. This creates a first-mover advantage for investors who act now, capturing returns while helping define the standards of tomorrow [10].

EM sustainable bond issuance is expected to continue growing at a double-digit rate, offering investors the chance to capture returns while helping shape emerging market ESG standards [8][10].

Final Thoughts

Investing in Sustainable Emerging Market Bonds is not just about aligning with ESG goals, it’s about strategic positioning in a rapidly evolving financial landscape. These instruments are Article 9-eligible under SFDR, combining measurable sustainability impact with robust investment-grade analysis [10].

Offering a rare convergence of yield, resilience, and impact, they represent a smart choice for forward-looking investors in 2025 and beyond.

Sources

- https://news.un.org/en/story/2025/04/1162671

- https://unctad.org/publication/sdg-investment-trends-monitor-issue-4

- https://www.jpmorgan.com/insights/global-research/outlook/mid-year-outlook

- https://www.ice.com/insights/sustainable-bond-report-2024?utm

- https://www.ifc.org/content/dam/ifc/doc/2025/emerging-market-green-bonds-2024.pdf

- https://www.imf.org/en/Publications/WEO/Issues/2025/04/22/world-economic-outlook-april-2025

- https://www.moodys.com/web/en/us/insights/credit-risk/outlooks/esg-sustainable-finance-2025.html

- https://www.environmental-finance.com/content/the-green-bond-hub/2025-a-tough-challenge-for-the-sustainable-bond-market.html

- https://files.acquia.undp.org/public/migration/id/INS-UNDP-Indonesia-Sustainable-Development-Financing.pdf

- https://www.weforum.org/stories/2025/09/sustainable-finance-in-2025-why-investors-can-t-afford-to-look-away/