#MovingMoneytoMeaning & together scaling the #Impact

#MovingMoneytoMeaning & together scaling the #Impact

This is the core of Microfinance! Moving Money to Meaning!

We continue our #EnablingSDGs series. In this video our Investment Analyst Abdul Rehman Ijaz from #Karachi explains how #EQ is contributing towards the #SDG2 – zero hunger.

Muhammad Saleh is the owner of a small staple food store in Karachi, Pakistan. A few years ago he was introduced to the possibilities of expanding his business through a visit from a Loan Officer of the Microfinance Institution (MFI) ASA Pakistan.

WE ARE VERY HAPPY TO ANNOUNCE OUR PARTNERSHIP WITHGSB CAPITAL NBFI LLC FROM MONGOLIA!

Welcome to number four of our EnablingSDGs series. Managing Partner and Co-Founder Remo Oswald elaborates on how EQ is contributing to reach SDG4 – Quality Education

We are delighted do present Roger Müllers Interview at Swisspreneur.

We present you the third episode of our #EnablingSDGs series.

Today we want to share the inspiring story from Maryam, one of the many impressive MicroEntrepreneurs in Pakistan.

FARIDA ABDULHAFIZOVA explains how Enabling Qapital is contributing towards the SDG5 – Gender Equality and Women Empowermen.

Global Parametrics and Enabling Qapital launch the Climate Resilience Enhanced Debt product with Chamroeun Microfinance Plc. in Cambodia

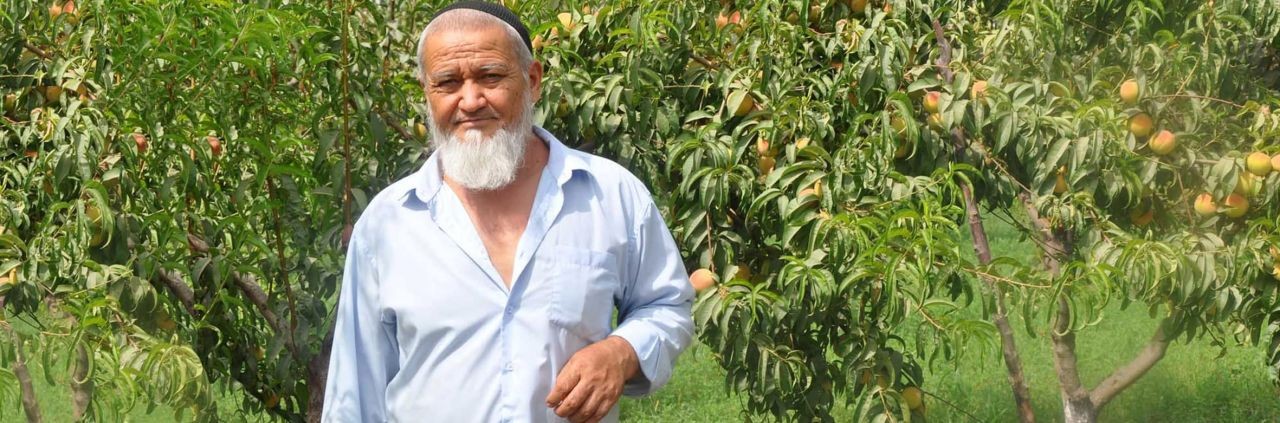

Rustam Buriev started his farming business many years ago.

In 2013 he applied for his first loan at Finca Tajikistan, with the purpose to help finance the expansion of his garden.

The enlargement was much needed for him to be able to grow more fruits, rice and wheat.

Subsequently he managed to grow his business and payback the loan amount.

Rustam decided to apply for a second loan and even a third one, which enabled him to also purchase livestock and thereby grow his farm further.

Roger R. Müller, Managing Partner and Co-Founder of Enabling Qapital AG, explains our contribution to the Sustainable Development Goal Number 1 – no poverty.

The company Freshpro, which was established in 2016 initially delivered fresh products from different localities to urban areas in Nairobi. In 2018, they transitioned to dairy processing by setting up a bigger facility in Githunguri (Kiambu County, Kenya). The company began operations in 2019 and expanded its presence shortly afterwards to four cities: Keringet, Chogoria, Embu and Njoro.

Interesting read! Clean Cooking Alliance released their Industry Snapshot & our Spark+ Africa Fund is nicely portrayed.

We invite you to celebrate #earthday2021 together with our Investment Officer from #Ecuador, Carolina Ordoñez and the whole EQ Team!

Why Enabling Qapital?

Because of its commitment to creating and supporting companies and institutions that empower the poor and provide environmental and financial solutions to some of the world’s problems.

Why Enabling Qapital?

I believe in impact finance but not all financing is in the best interest of the client. I am glad to be part of an organization that values client impact and is willing to say no when the client’s interests are not served.

MRS LUCIA RICO SUCCESS STORY

Growing up with her two siblings in the town of Trento in the rural province of Agusan del Sur in the south of the Philippines, Mrs. Lucia always dreamt of running her own business. She started her business with a tiny stall to sell her handmade baskets and figures made from rattan palms. After struggling with bankruptcy in 2015, she moved her business and began to look for capital. This was only the start of a long and hard journey for this microentrepreneur to fulfill her dreams and be independent.

In the beginning, Muhammad Shoiab’s mobile textile business generated only a very little revenue. It was so little that he was not able to send his children to school. Nonetheless, Muhammad believed in himself and his business and decided to apply for a loan at ASA Pakistan limited.

Why is it that Microfinance funds remain comparably stable throughout international crisis or economic downturns? Where does the low correlation with the financial markets come from?

Why Enabling Qapital?

I was excited to be part of something new with a group of talented individuals with a renowned name in the impact investing industry. We all share a common goal as we plan to implement innovative initiatives that can help the most vulnerable people in the world.

Why Enabling Qapital?

As I have been part of the impactinvesting community for over 10 years, I can say that EQ is truly delivering microfinance in its purest form and therefore enabling real social impact. I am truly excited working with such highly qualified and especially dedicated team.

Enabling KyrgyzRepublic - Roundtable (in Russian): Friday, February 26 | 10:00 am (GMT+6)

#ENABLINGINSIGHTS >>Remo Oswald, Managing Partner informiert Sie über die wichtigsten Mikrofinanz Insights in Zeiten einer globalen Krise.

We are very happy to announce our partnership with Microserfin. Microserfin is a leading microfinance institution in Panama, looking after low-income entrepreneurs and is fully owned by the Fundación Microfinanzas BBVA.

Enabling cleancooking with Spark+, our new mandate in cooperation with Clean Cooking Alliance.

OUR PARTNER-MFI SUMAC

In 2020 Enabling Qapital provided USD 1.5mn to Sumac, a microfinance bank based in Kenya. The bank specializes in providing finance to both individuals and companies in the MSME segment by offering a variety of financial services. They have a large clientele within the agribusiness sector, who can profit from the Kilimo Biashara (agribusiness) loans. Through those, Sumac can disburse loans of up to ~USD 3,000 within 48 hours. Sumac also offers customers the Kawi loan product, targeting the provision of clean energy solutions to its customers.

Why Enabling Qapital/Woodman?

An inspiring group of people doing inspiring work – who wouldn’t want to work for company like that?

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

7, rue Robert Stümper,

2557 Luxembourg

Luxembourg

Mühlebachstrasse 164

8008 Zurich

Switzerland

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Industriering 20,

9491 Ruggell

Liechtenstein

16, rue Robert Stümper,

2557 Luxembourg

Luxembourg

© 2025 Enabling Qapital Ltd - Privacy Statement - Disclaimer and Terms & Conditions - Contact - Design Magiris