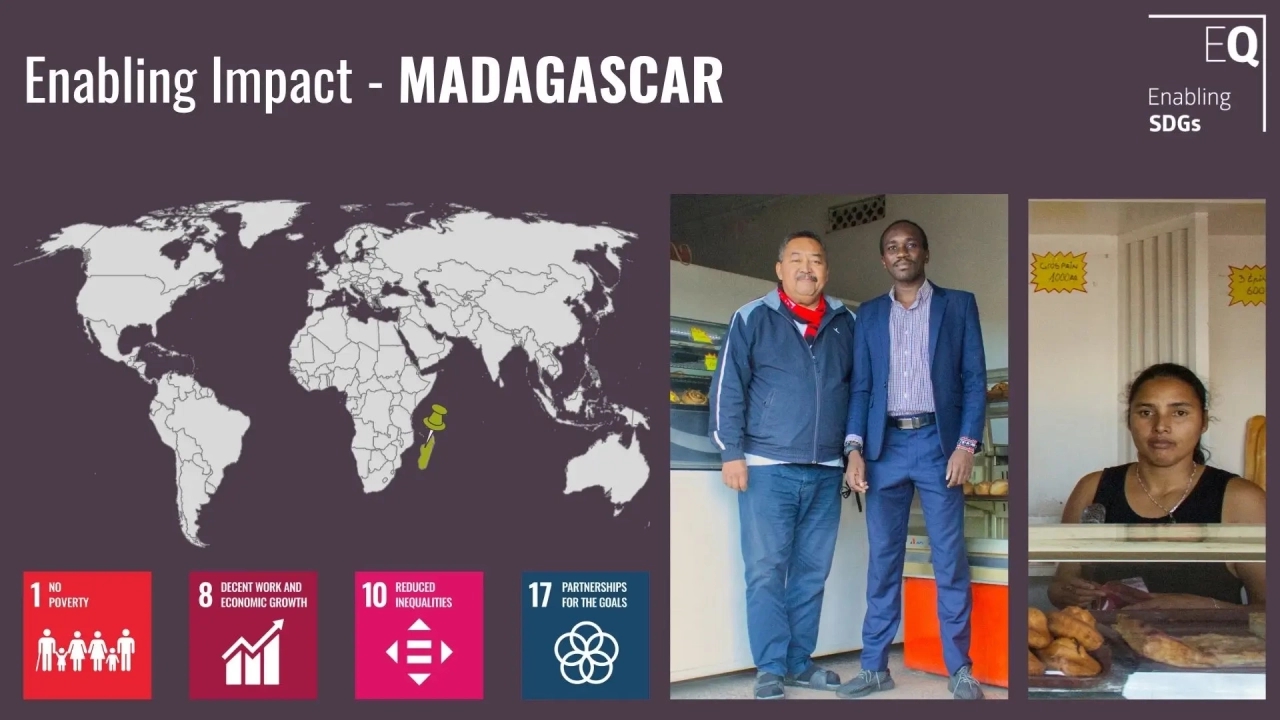

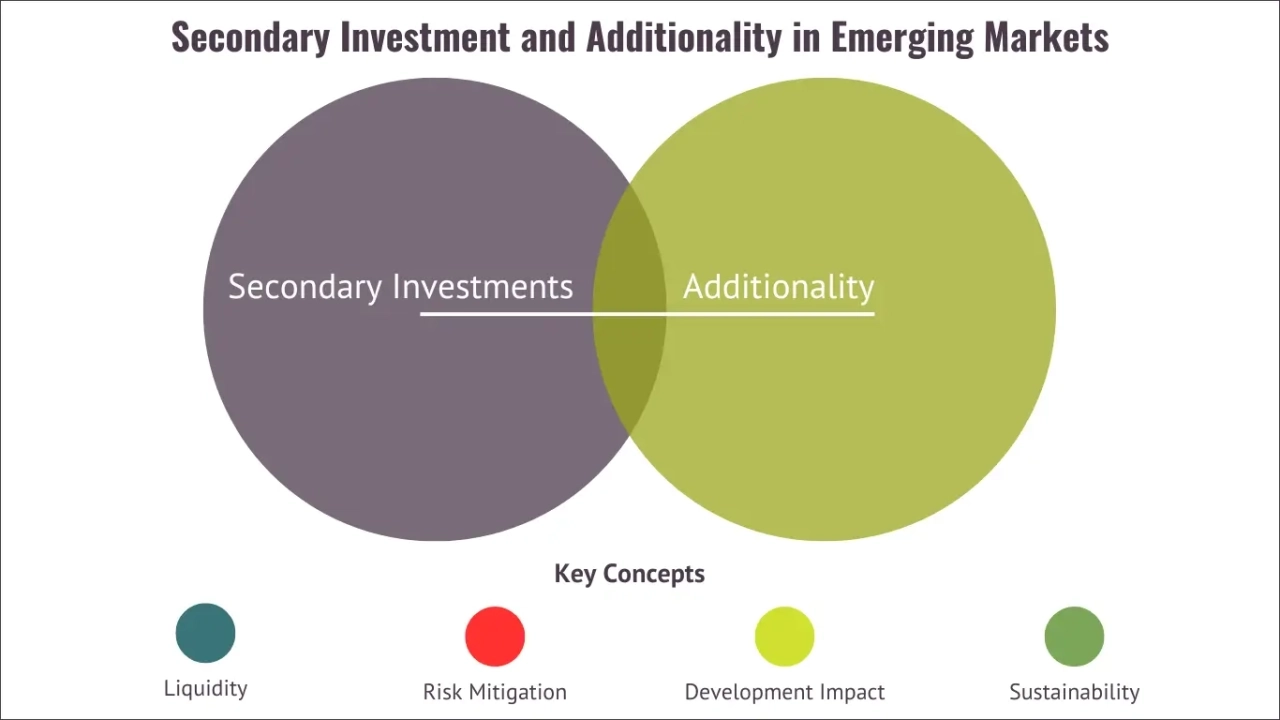

Zurich, February 2026: Enabling Qapital marks the first anniversary of the EQ Emerging Markets Sustainable Bond Fund Strategy, a milestone that underscores the commitment to sustainable finance, robust risk management, and innovative portfolio construction with investments from Swiss and Finnish Institutional Investors as well as Family Offices.

Enabling Qapital AG

Mühlebachstrasse 164

8008 Zurich

Switzerland

Enabling Qapital AG

Branch Geneva

Rue Hugo-De-Senger 7

1205 Geneva

Switzerland

Enabling Qapital Kenya Ltd

Merchant Square Block B

2nd Floor, Riverside Drive

Nairobi

Kenya

Enabling Microfinance AG

Industriering 20,

9491 Ruggell

Liechtenstein

Enabling Qapital Luxembourg S.A.

7, rue Robert Stümper,

2557 Luxembourg

Luxembourg